Summary:

- We remain sell-rated on Tesla, Inc. stock post Q2 earnings as our investment thesis of contracting margins continues to play out.

- We expect the company to continue to be under pressure in 2H23 due to the price cut strategy, factory shutdown that’ll slow production, and macro headwinds.

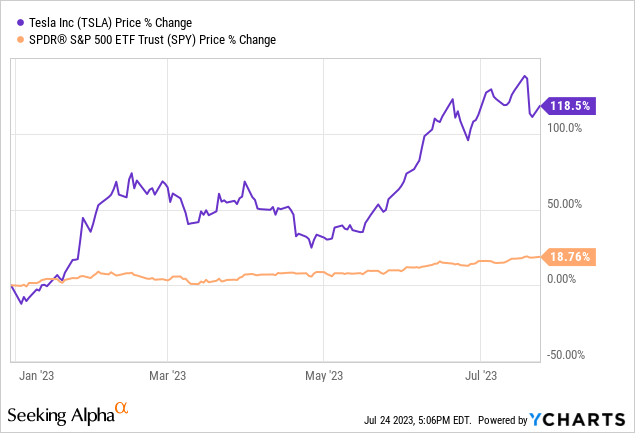

- The stock is up over 110% YTD but has begun giving back gains following Tesla’s Q2 2023 earnings results that reported a single-digit % operating margin at 9.6%.

- We continue to be bullish on Tesla stock mid-to-long term prospects, but we expect downside ahead as Musk continues to pursue the price cut strategy in a high interest rate environment.

- We see short-term uncertainties due to macro weakness and don’t expect Tesla’s Cybertruck or Robotaxi to offset macro headwinds in 2H23.

Дмитрий Ларичев

We maintain our sell rating on Tesla, Inc. (NASDAQ:TSLA) shares post Q2 2023 earnings last week. Consistent with our expectations, the company’s margins have paid the price for CEO Elon Musk’s attempts to stimulate demand via the price-cut strategy. We now expect financial outperformance to moderate, as management outlined intentions to continue tinkering with the prices of electric vehicles (“EVs”) in 2H23 and cited production slowdowns next quarter due to factory shutdowns for improvements and upgrades.

Musk noted on the earnings call, “We expect that Q3 production will be a little bit down because we’ve got summer shutdowns to — for a lot of factory upgrades.” The earnings call was also disappointing for more reasons than one; little information was given about the precise delivery of the long-awaited Cybertruck or in regards to the autonomous Robotaxi developments. We do expect both to perform well once released and enjoy major adoption. Still, we don’t think this will happen over the next quarter and see a higher risk profile for Tesla’s financial performance during this period. We think the price cuts, if assumed further in 2H23, will be concerning amid the high-interest rate environment and with the Fed’s Jerome Powell predicting further interest rate hikes.

Despite the increasing competition in the EV market and S&P Global’s forecast of Tesla’s EV market share shrinking to less than 20% by 2025, we continue to believe Tesla is positioned to outperform in the mid-to-long run but expect the stock’s outperformance to moderate in 2H23 due to macro weakness and shrinking margins. We think the Q2 2023 earnings call highlighted new short-term uncertainties that’ll also weigh on the stock aside from the weakening margins, specifically delays in Cybertruck, production slowdowns, and lackluster details on Robotaxi. The stock is up roughly 119% YTD, outperforming the S&P 500 by 100%.

We might’ve been early with our sell rating in our article linked above, “Tesla Stock: Get Off The High Risk Way,” but we don’t believe we were wrong. We recommend investors count their profits at current levels and exit the stock now to revisit once the macro weakness and correction cycle have played out more fully.

The following graph outlines Tesla’s YTD performance against the S&P 500 (SPY).

YCharts

Q2 2023 & What’s Next?

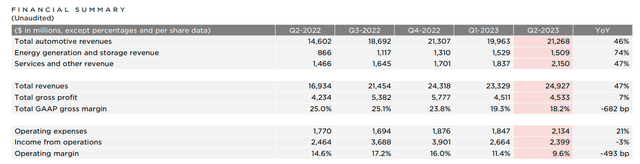

The stock dropped roughly 11% after reporting earnings last week; the company reported revenue of $24.93B, up 47.3% Y/Y, and Non-GAAP EPS of $0.91, beating top and bottom line estimates. Our main concern for Tesla is the company’s declining margins after the aggressive price cut strategy; the operating margin came in at 9.6% this quarter, and the gross margin at 18.2%, both trailing the lowest margins over the past half-decade. Tesla’s operating margin was 11.4% last quarter and 16% in 4Q22. Granted, cutting prices has begun to stimulate demand and put more Tesla vehicles on the road, evidently from the uptick in Services and Other revenue this quarter, rising 47% Y/Y to $2.15B. However, given the macro situation and higher interest rate environment, we don’t think this is a sustainable growth path.

The following chart outlines a financial summary for 2Q23.

The strategy, in our opinion, will lengthen Tesla’s dominance over the EV market as it finds footing in its A.I. investments with Dojo training computers and Robotaxi, but we believe this will come at the expense of the stock price’s near-term performance. It’s also worth noting that while margins are under pressure, Tesla is actively increasing R&D spending on its A.I. investments; R&D rose to $943M from $771M in 1Q23 compared to “R&D expenses increased $482 million, or 19%, in the year ended December 31, 2022.” The increased R&D spending does well to back Tesla’s goal to be at “the cutting edge of AI development.” Still, combining the uptick in R&D, price cuts, and shrinking margins, we expect the company’s financial outperformance to moderate next quarter.

The Cybertruck has been promoted since 2019 and has since faced delays, while Robotaxi was discussed as early as 2016, with Musk tweeting, “In ~2 years, summon should work anywhere connected by land & not blocked by borders, e.g., you’re in LA, and the car is in NY.” This goes to say that investors should be cautious not to get too excited about Tesla’s next big thing too early; the stock is currently overpriced and facing near-term uncertainties due to the macro environment. We continue to be bullish on the EV leader in the mid-to-long run but don’t see any near-term catalysts driving revenue growth or easing margin contraction in 2H23.

Valuation

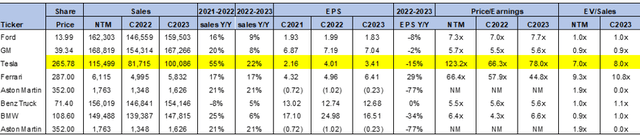

Tesla is relatively expensive; our sell rating is not based on the stock’s overvalued nature, as the company is the dominant EV player and the higher valuation factors in future earnings. We think, however, that the valuation is trading well above the peer group at unjustified premium multiples for the short-term risk factors pressuring financial performance. On a P/E basis, the stock is trading at 78.0x C2023 EPS $3.41 compared to the peer group average of 24.7x. The stock is trading at 8.0x EV/C2023 Sales versus the peer group average of 7.6x. We recommend investors wait for more favorable entry points to revisit the stock once the bottom has been formed.

The following chart outlines Tesla’s valuation against the peer group.

Word on Wall Street

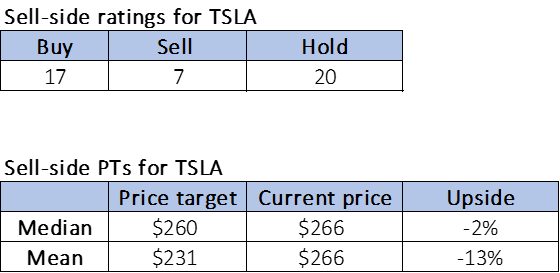

Wall Street shares our bearish sentiment on the stock but leans more toward a hold than a sell. Of the 44 analysts covering the stock, 17 are buy-rated, 20 are hold-rated, and the remaining are sell-rated. We think the increased number of bearish ratings over the past quarter highlights that analysts are beginning to track the higher risk profile of Tesla’s deteriorating margins. The stock is currently priced at $266 per share. The median sell-side price target is $260, while the mean is $230, with a potential downside of 2-13%.

The following chart outlines Tesla’s sell-side ratings and price targets.

TSP

What to do with Tesla stock

We reiterate our sell rating on Tesla, Inc. stock after the company announced Q2 2023 earnings results that confirmed our concerns over deteriorating margins in the near term and a higher-risk profile as price adjustments continue into 2H23. We think the macro environment of higher-interest rates and pressuring inflation won’t work in the company’s favor in the short term; however, while we do expect Tesla’s investments in A.I. development will yield attractive results in 2024, we don’t see Tesla revenue being meaningfully boosted by A.I. revenue in the near-term. We continue to recommend investors exit the stock at current levels after a YTD surge of over 100% and revisit the stock once more attractive entry points appear.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, the best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2-week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2-week free trial, so we hope to see you in our group soon.