Summary:

- Tesla, Inc. is forecasting a business slowdown in Q3 attributable to maintenance, as we see demand slowing.

- The company produced 920k vehicles in the first 2 quarters but is guiding for 1.8 million vehicles for the year, implying a decline in production.

- The company doesn’t have a path to justifying its valuation of more than $900 billion, making it a poor investment.

Дмитрий Ларичев

Tesla, Inc. (NASDAQ:TSLA) dipped after hours as the company reported Q2 earnings, and it’s remained lower since then. The company shared for the first time the margin-crush impact of its price decreases. As we’ll see throughout this article, the company’s financials and free cash flow (“FCF”) are likely to remain weak, as its moonshots don’t profit and it struggles to drive future returns.

Tesla Financial Performance

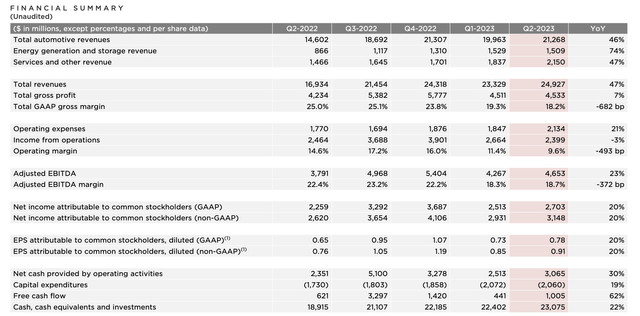

Tesla announced its Q2 earnings and financial performance, showing the impact of decreased prices.

The company saw $21.3 billion in automotive revenues, up roughly 6% QoQ but still down from the company’s 4Q 2022 pricing peak. The company saw roughly flat energy generation and storage revenue and a slight bump in service revenue. The company walked away with total revenues up ~7% QoQ and 3% from its peak.

The company’s headline number was 47% YoY increase, but we expect this to be the last quarter where the company pushes such growth numbers with next quarter being more towards neutral. The impact of margins is seen in the company’s financials, where despite revenue being higher than its peak, EBITDA margins dropped by 3.5%.

The company’s FCF was $1 billion, giving the company a FCF yield of <0.5% and its growth in cash is even smaller. That’s despite the company’s capex decreasing quarter over quarter. We expect the company’s numbers for the next quarter to be worse.

Tesla Vehicle Production and Margins

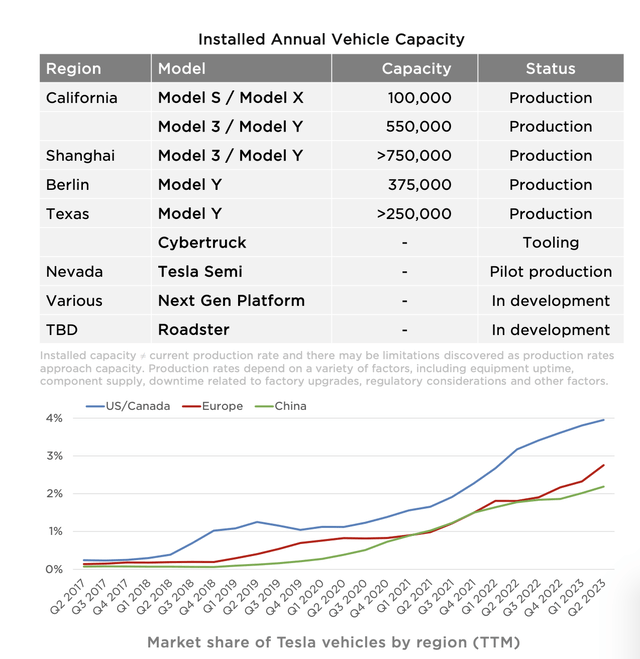

The company has worked to continue increasing its vehicle production, but at the end of the day demand and margins matter.

The company’s factories have total capacity for almost 2 million vehicles / day. That doesn’t count continued tooling for the Cybertruck, which has finally started to be produced, or pilot production currently going on for the Tesla semi. The company has managed to grow its U.S./Canada market share to 4% while Europe and China market shares are 2-3%.

However, there’s a few caveats that we want to highlight here. The first is that in markets with additional competition, the company’s market share gain has been slower. This is true in China, where the company’s market share has dropped below Europe, and we expect it to remain low. Even in the U.S. its rate of market share growth versus COVID-19 has slowed down.

That has combined with the company’s margin decline. YoY GAAP gross margins have dropped almost 7% and operating margins have dropped almost 5%. That weakness in margins has removed a lot of the company’s benefits from revenue growth and will hurt future returns.

Tesla Energy

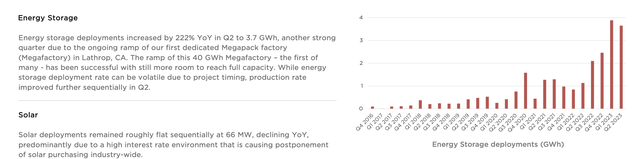

At the same time, the company’s energy business has continued to struggle substantially.

The company’s $1.51 billion in energy sector revenue, was down QoQ, although it was up admirably YoY. As we’ve said before, given the competition and margins in the industry the company’s solar business is meaningless. It declined YoY and high interest rates aren’t helping. The company doesn’t have a path, in our view, to ever have a reasonable solar business.

The company’s energy storage business did decline slightly QoQ, but it was up strongly YoY. The company is building and ramping up a dedicated 40 GWh mega-factory, which will continue to help the company, but we expect this will continue to be a lower margin use of battery packs. Regardless, the real issue is the company’s revenue for energy storage is much weaker.

It doesn’t have a long-term growth rate plan to accommodate that.

Tesla Hypothetical Moonshots

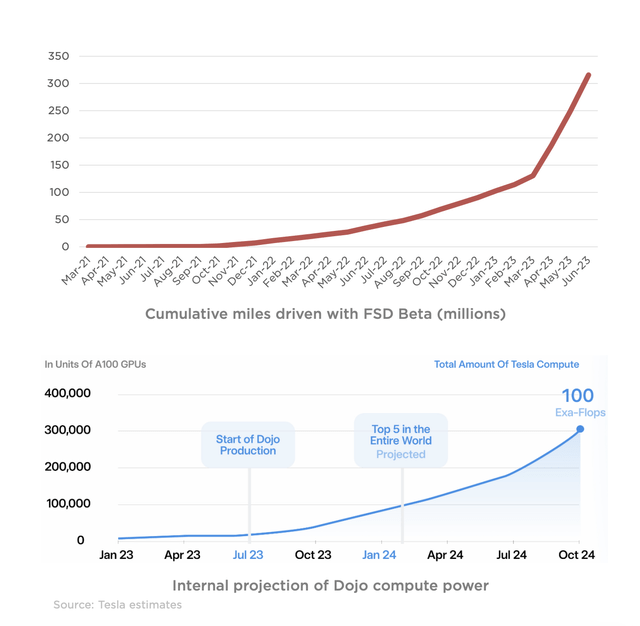

The caveat to our thesis is Tesla’s hypothetical moonshots and whether they can pan out.

The company has continued to rapidly build up its full self-driving (“FSD”) beta miles and associated compute power. The company’s cumulative driven miles that it’s targeted is 325 million miles. It’s build up enough compute to be equivalent to ~15 thousand units of A100 GPUs, and it has a plan to ramp to 20x that over the next 1.5 years. We think that that’s a difficult expensive target.

However, the question is, can the company solve full-self driving. If it can, its SW will fly off of the shelves with an incredibly high margin. If it can’t, the company will see the lawsuits it’s already facing over the potential of FSD continue to grow. Given that the company faces steep competition here and continuously misses its investments, along with regulatory challenges, we expect it to underperform.

Thesis Risk

The largest risk to our thesis is an unexpected black swan event. Tesla in our view is still numerous years away from having a regulator-approved, full self-driving solution. However, that could change tomorrow, and if it does, the company’s valuation could be very interesting given the market opportunity and margins in self-driving. We do feel this situation is very unlikely.

Conclusion

Tesla market capitalization is well over $800 billion, and the company is by far the most expensive company in the car industry. The company is valued as a technology company, but effectively all of its revenue and profits come from its car business. And its car business is starting show some cracks, cracks that its valuation doesn’t allow.

Despite strong production growth in the first half of the year, Tesla growth is expected to slow down for the second half to effectively nothing as the company aims for its 1.8 million vehicle target for the year. Margins are declining dramatically. The company’s profit seems to have peaked and the company’s value is nowhere near its valuation.

Overall, Tesla is a poor investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.