Summary:

- AT&T has an industry structure problem in which it is at a strategic disadvantage.

- Both customers and suppliers are getting the better end of deals with AT&T.

- I see the tower companies as the best play in the space.

DarrenTownsend

We all grow up wanting to believe that good deeds get rewarded. If you build something useful that creates genuine value for the world, that should be rewarded. Business, unfortunately, does not always work that way.

The entity which creates the value is seldom the entity which captures the value. In this article we will dig into how AT&T (NYSE:T), along with peer telcos, will struggle financially even as it creates tremendous amounts of value. The industry vertical is positioned in such a way that AT&T’s suppliers and customers capture the lion’s share of the surplus, with T merely getting enough scraps to get by.

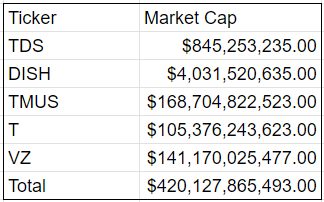

Huge value – none of it captured

Allow me to present a quick comparison. The entire market cap of the cellular service providers is about $420 billion. There are the big 3, AT&T, Verizon (VZ), and T-Mobile (TMUS), along with DISH Network (DISH) which the FCC is stuffing into the equation and various tiny regional players represented here by TDS.

2MC

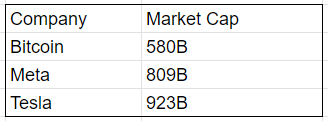

That is an absurdly tiny market cap. It is dwarfed by individual companies that don’t do nearly as much.

2MC

The telcos have built millions of strand miles of cable across the entire U.S. and are responsible for providing communications capabilities to hundreds of millions of people. If these companies disappeared, we would be sent into the stone age and yet their market cap is just over $400B.

If the $580B Bitcoin disappeared, nothing would change. I think some guy famously bought a pizza with 2 bitcoin and for a few months you could buy a bucket of KFC chicken using crypto, but really if Bitcoin was gone the world would be fine.

The same could be said for META. People would simply find a new way to waste time on the internet.

So how is it that these things which provide very little actual value to the world are worth multiples of the telcos which provide so much value to the world?

There are 2 reasons market caps can deviate significantly from value creation.

- Mispricing

- Failure of the value creator to capture the value

AT&T falls into the second category.

This can be discerned by examining the unit economics, in which T’s suppliers and its customers each get an enormous surplus.

Consumer surplus

Consumer surplus in economics measures the difference between how much a good or service is worth to the consumer and how much they pay for it.

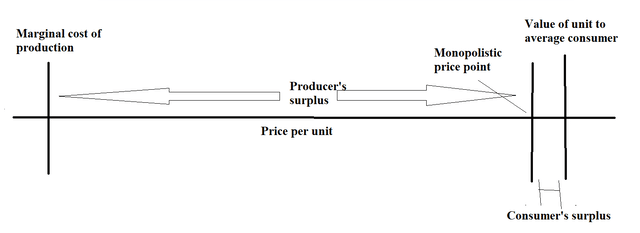

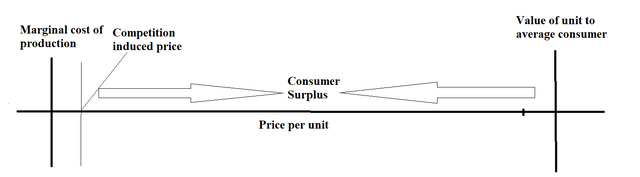

In a monopoly, the producer captures nearly all of the surplus as pricing is set to the profit maximizing level which would be the level at which the product of units sold and margin per unit is maximized. Think of it as a slider bar where there is a finite level of surplus and that extra value is divided between the parties of the transaction.

Telcos are far from a monopoly.

In fact, the Federal Communications Commission, or FCC, enforces that there be ample competition among providers. When T-Mobile (TMUS) bought Sprint, it was only allowed to go through with a plan in place to ensure there was a 4th major carrier.

The merger was contingent upon divestiture of assets to DISH and an agreement that DISH would build out its network to a minimum size.

This government enforced high level of competition maintains constant price wars between the telcos as they skirmish for market share. Given how low switching costs are, customers can simply go with whatever provider gives them the best deal. As a result of the perpetually high competition, the surplus diagram looks more like this:

Cellular service is essential. Most of us need it for our jobs and if given no cheaper route, I suspect most would be willing to pay close to $1000 per month for it.

Yet, a cell phone plan costs somewhere around $20-$70 a month depending on location, amount of data and other terms.

Customers are winning, with service providers left with razor-thin margins. Matters are made worse by the fact that telcos are getting squeezed on the other end as well.

Suppliers eating AT&T’s lunch

Apple phones are routinely subsidized by AT&T and the other providers as a means to lock in customers to longer contracts. While I think Apple is clearly getting the better end of that deal, I want to focus on a different supplier relationship in which I have more expertise: Tower REITs.

The unit economics on tower deals is extremely in favor of tower REITs and once again this is a result of the level of competition present in the telco space.

Decades ago, the coverage wars started in which each cell service provider was trying to capture market share by having the best network. You may recall the commercials where they show their coverage maps and feature the “can you hear me now?” guy.

AT&T and its peers were entirely capable of building their own tower infrastructure and in some instances, they did own their own towers. However, building a nationwide network of 20,000+ towers is remarkably capital intensive. Funding the entirety of that project themselves would have slowed their coverage expansion and they would have fallen behind their competition.

The tower REITs figured out how to pit the cell providers against each other. They could provide cell towers at no upfront cost in exchange for annual rent.

Real estate works on cap rates which are essentially rental rates of return on assets. Build a cell tower for $100,000 get $8,000 in annual rent and that’s an 8% return on invested capital. In today’s interest rate environment, an 8% cap rate would be fairly typical.

That would be an okay deal for both parties. The real estate owner would get a high enough return to generate a spread over their cost of capital and AT&T would get to use a tower without any upfront investment.

Well, the tower REITs aren’t getting just an okay deal. They are getting that rental stream from AT&T, Verizon and T-Mobile all on the same tower.

So rather than that $100,000 tower generating $8,000 of revenue it is getting $24K. These are cap rates that are just unheard of in any other real estate sector.

It all comes down to strategic positioning.

Cell towers are monopolistic in nature. Due to interference of signals, cell towers must be built a certain radius apart. As such, each individual cell tower has somewhat monopolistic coverage in that particular area.

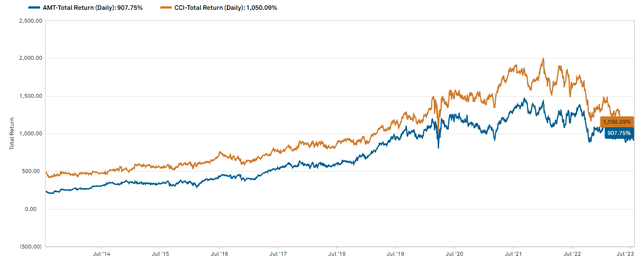

Service providers could either have holes in their coverage map or they could pay up and give the REITs the lion’s share of the surplus. They universally chose the latter which resulted in this.

S&P Global Market Intelligence

American Tower (AMT) and Crown Castle (CCI) returned 907% and 1050% over the last 10 years, respectively.

Round 2 of buildout FOMO

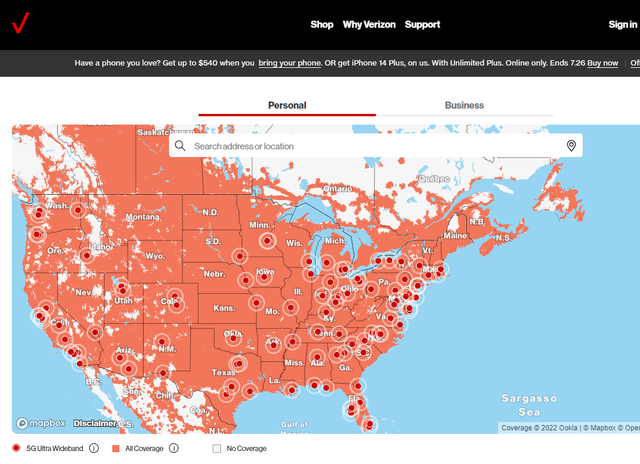

In the constant push to capture market share from one another, the cell service providers are now racing to get superior 5G coverage. Verizon’s website now looks like this.

That is rather reminiscent of all those commercials comparing 3G and 4G maps.

Yet again, the tower REITs position to take advantage of the excessive competition among the providers by offering to build out their 5G networks in exchange for rental payments.

The verdict is still out as to how far the providers want to take their 5G networks. Perhaps the demand isn’t quite here yet, as 4G seems to fulfill all critical functions.

Beyond all the profitability challenges inherent in AT&T’s poor strategic positioning, it seems to also be the victim of public ill-will.

Misplaced Animus

By my calculations, AT&T has overwhelmingly been a force for good, at least in the economic sense. While they have failed to capture the value they created, that value nevertheless accrued to the benefit of Americans in that we all get amazing cell coverage at very cheap pricing.

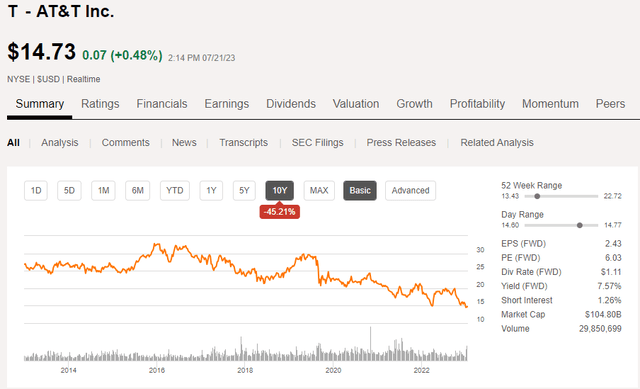

Rather than being rewarded for its industry, AT&T is the target of a now widely disseminated hit piece by the Wall Street Journal about the lead sheathing on some of its 100-year-old conduits. That article knocked another chunk off of T’s already struggling market price.

This has left AT&T extremely cheap at 6X earnings with a 7.57% dividend yield.

As a value investor, I began looking rather seriously at AT&T as a potential investment after the lead poisoning public relations drop. It is indeed quite a value, but unfortunately its problems are permanent in nature.

The space will always be high competition, and I don’t see any reason customers and suppliers would stop capturing the majority of the value AT&T creates.

I see the tower REITs as a much better way to play the space. It is better to be on the advantaged side, as they will get to raise AT&T’s rent a few percent a year for the foreseeable future. At present valuation, I view Crown Castle as the most opportunistic of the group.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

So far, Portfolio Income Solutions subscribers consist largely of investment professionals, whether current or retired. That’s great, I love having an educated readership as they ask questions that challenge me to dig deeper. At the same time, I believe financial information should be available to all and that financial education is foundational to success in life. As such, I have launched REIT University, a new branch within Portfolio Income Solutions and am offering a large discount to those who want to learn. It contains a crash course in fundamental investment and goes deep into REIT specific analysis.

Grab a free trial and start learning today!