Summary:

- Alphabet’s positive earnings report led to a 5% premarket stock jump.

- While some investor concerns remain, there’s enough good news for optimism.

- Google Cloud’s strong 28% Y/Y growth eases pressure on AI performance.

- Alphabet is focusing on innovation and diversification beyond search with AI and Cloud driving its narrative.

Guillaume

Investment Thesis

Alphabet (NASDAQ:GOOGL)(NASDAQ:GOOG) delivered a positive earnings report that saw its stock jump more than 5% premarket.

I argue that while not every investor worry has been answered in this earnings report, there’s enough good news here for investors to latch onto. Indeed, I ponder over whether the answer of “findability” versus “discoverability” can even be answered in the near-term?

All that being said, I declare that paying around 23x forward EPS for a company that is probably going to grow its EPS at more than 15% CAGR in the next twelve months makes Alphabet one of the best investments in the mega-cap space.

Back from the AI Penalty Box

Before we turn our focus to the topic du jour, AI, I’ll momentarily discuss what was a surprising result for Google Cloud. More specifically, Alphabet’s Google Cloud was up 28% y/y. Beyond doubt, Google Cloud is taking market share away from both AWS (AMZN) and Azure (MSFT).

Even though we haven’t seen Amazon’s quarterly earnings results yet, we have seen Microsoft’s. And Azure hasn’t matched this sort of growth rate this quarter.

Why is this important? Because it takes some of the pressure off the advertising giant to put out strong results in AI. For now, Alphabet can discuss its “turnaround” efforts in AI and reallocation of its engineers, without having to actually put out figures to back up its rhetoric. But by having such a strong performance in the cloud, it can signal to investors that the business prospects are more than just advertising.

Essentially, this allows Alphabet to say, yes we are able to be innovative and diversify away from “just” Search. I say “just” Search, because Alphabet didn’t spend a moment in its press release to remind the investment community that Alphabet’s top products touch 2 billion users daily. Think about this reach for a moment.

Let’s now discuss Alphabet’s AI prospects. The message coming out of both Microsoft and Alphabet is that both companies are intent on ramping up their capex to meet the demand for AI. Incidentally, and possibly not entirely surprising, the biggest end users for AI appear to be coders.

That being said, Alphabet is eager to drive home the message that AI can coexist alongside Search. Here’s a quote from the earnings call that echoed this assertion,

[…] we found that generative AI can connect the dots for people as they explore a topic or project, helping them weigh multiple factors and personal preferences before making a purchase or booking a trip. We see this new experience as another jumping off point for exploring the web, enabling users to go deeper to learn about a topic.

Ultimately, this gets to the core of the bear and bull argument.

Can AI coexist alongside Search? Or put another way, if you can get to your chosen answer quickly do you have any need to “discover” more?

For instance, if you are booking a trip, is there any further need to explore more via blogs to help inform your decision? I don’t have the answer to those big questions. And I don’t think that anyone really does at this juncture.

What I will say is that for now, the market is more than willing to give Alphabet a pass. There were more than enough positives in this quarter for investors not to get too hung up questioning the bigger picture.

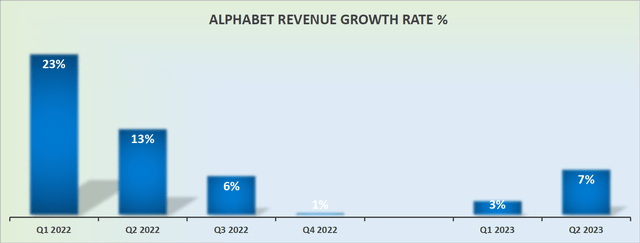

Revenue Growth Rates Reaccelerate

Alphabet’s revenue growth rates in Q2 delivered a nice beat on the revenue line. Naturally, this implies that the rest of H2 2023 will be up against much easier comparables and we could even see Q4 2023 reporting close to 20% CAGR.

Note, this estimate of mine is significantly higher than what analysts presently expect, with analysts expecting around 10% CAGR for Q4 2023. That being said, given the very low bar Alphabet has to cross in Q4 2023, this will leave it well-positioned to enter 2024 in a very different shape than it entered 2023.

In other words, I suspect that 2024 will see Alphabet as a more diversified tech conglomerate, with AI and Cloud driving its narrative rather than it being a Search company with lackluster AI prospects.

Simply put, I believe that the combination of accelerating revenue growth rates and a better narrative in the next few months will see Alphabet rerate higher.

GOOG Stock Valuation – 23x Forward EPS

Alphabet is priced at approximately 23x forward EPS. I don’t believe this is an expensive valuation for what’s on offer. Firstly, on an absolute basis.

The argument that I’ve sought to drive home is that Alphabet’s multiple has been compressed as investors have been too caught up with its lackluster progress in AI. However, I believe while this bigger question hasn’t been entirely solved, Alphabet has clearly taken this message home and is doing all it can to right its ship.

Next, the ultimate question of whether Search and AI can both coexist has not been solved. But there appears to be a narrative where AI “findability” can be the start of the journey and Search can allow for more “discoverability”. Again, I don’t know exactly how this will unfold, but I don’t believe we need to know this answer yet.

Secondly, compared with most other tech players, particularly Apple (AAPL) and Microsoft, Alphabet trades substantially cheaper. That provides this trade with a nice margin of safety.

Finally, I believe that Alphabet can easily grow its EPS line at around 15% CAGR over the next 12 months, and with that insight in mind, paying around 23x forward EPS doesn’t strike me as too expensive. Particularly, if we look out to 2024 when its comparables should become easier.

The Bottom Line

Here I discuss Alphabet’s positive earnings report, which led to a more than 5% premarket stock jump.

While some investor concerns remain unanswered, there is enough good news for investors to be optimistic.

The strong performance of Google Cloud, with a 28% Y/Y increase, alleviates pressure on the company to demonstrate strong results in AI.

This allows Alphabet to focus on innovation and diversification away from just Search.

The company emphasizes that AI can coexist alongside Search and offers generative AI to enhance user experiences. Despite uncertainties regarding AI’s future and its coexistence with Search, the market seems willing to give Alphabet a pass for now.

The report also highlighted accelerating revenue growth rates, making Alphabet well-positioned for 2024 as a more diversified tech conglomerate driven by AI and Cloud, rather than solely a Search company.

At approximately 23x forward EPS, Alphabet’s valuation is considered reasonable, especially compared to other tech players. With an expected 15% CAGR growth in EPS over the next year, the current valuation appears favorable, and the positive narrative may lead to higher rerating in the near future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.