Summary:

- Southwest Airlines is expected to announce its Q2 2023 earnings on July 27, with industry data showing the airline has maintained a reliable schedule despite significant industry delays and cancellations.

- Despite strong cost management, Southwest’s revenue growth is expected to be tepid due to factors such as the impact of its late 2022 operational meltdown and the lack of long-haul international revenue.

- Southwest’s fleet size and inability to grow its network due to Boeing delivery delays are contributing to the deterioration of the airline’s finances and outlook, despite its strong balance sheet.

Southwest tails at Chicago Midway Airport

chanceb737

Southwest Airlines (NYSE:LUV) is expected to announce its second quarter 2023 earnings before market open on Thursday July 27, rounding out the earnings reports for the big 4 US airlines including American (AAL), Delta (DAL), and United (UAL). Alaska (ALK) had a strong report on Tuesday July 25 joining all of the big 3. While there was reason for concern with each of the airline’s reports, there are several significant factors that should require special attention from airline investors.

Stable Operations

It should first be noted that industry data shows that Southwest has operated a fairly reliable schedule this summer which has been marked by significant industry delays and cancellations, esp. in the Northeast U.S. and most notably at the major New York City airports. Since Southwest is a relatively small player in the NE compared to the big 3, LUV has avoided many of the operational problems that have particularly impacted UAL at Newark, leading for that carrier to reduce the size of its operations. Not only does EWR not operate from Newark but Baltimore, LUV’s most NE major “hub” is typically less involved in the massive delays that are common in other NE airports.

The focus on LUV’s operations this summer is particularly relevant given the massive operational breakdown that occurred at Southwest between Christmas 2022 and New Years. That event cost LUV roughly one billion dollars in lost revenue, higher costs including for customer compensation and reimbursement as well as more aggressive discounting early in 2023 to get passengers back on its aircraft. Although LUV has avoided a repeat, its capacity growth has been more muted than other carriers going into what has been yet another record-breaking travel season. Since low-cost carriers benefit from high growth rates in order to keep unit cost growth down, LUV’s slower growth rate than competitors has led to a slight erosion of the cost gap between Southwest, the low cost airline with the highest unit costs, and the big 3 global carriers.

Tepid Revenue Growth Expected From Southwest Airlines

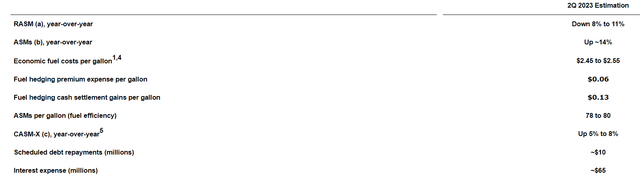

Southwest provided its first look at second quarter 2023 guidance with its 1Q2023 earnings release and released updated guidance on June 1, 2023. In both reports, LUV expected capacity to grow by 14% which is a few percent below the domestic capacity growth that Delta, with the most aggressive domestic expansion so far, reported on their domestic system but above other carriers including Alaska’s 10% available seat mile growth; ALK and LUV both operate without longhaul widebody aircraft with primarily domestic and near international route systems.

LUV guidance 2Q2023 original (Southwest.com)

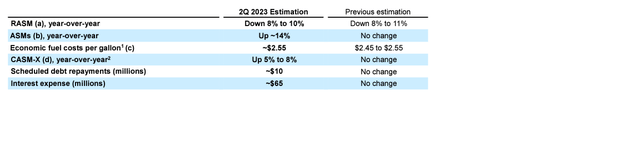

LUV guidance 2Q2023 rev 1Jun2023 (Southwest.com)

ALK reported a 3% decline in domestic RASM (revenue per available seat mile, the airline industry metric for unit revenue) which was roughly in-line with the big 3’s domestic RASM reports. Southwest, however, guided to a much larger 8-11% RASM decline even in its first guidance for 2Q2023 and only marginally trimmed the lower end of that range with its updated guidance. Southwest is likely to significantly underperform the industry on unit revenue production and investors should be tuned in to find the reasons that LUV offers and assess how they might apply to Southwest’s future performance and the industry as a whole.

There are several reasons that could explain LUV’s expected deep RASM drop. Southwest has likely not fully recovered from the impact of its late 2022 operational meltdown which sent some of its most valuable customers looking for more stable operations at other airlines. Although Southwest has some of the best moats in the U.S. airline industry with dominance of many of its largest “hubs,” its network heavily overlays metro areas where United is strong and United is aggressively growing its network and increasing the quality of its onboard product which is certain to involve raids on high-value customers. Southwest has also been forced to take larger Boeing (BA) 737 MAX 8 aircraft rather than its planned MAX 7s which the company has previously stated requires deeper discounting to help fill the larger aircraft. Additional discussion on Southwest’s fleet follows.

LUV full year 2023 guidance as of April 2023 (Southwest.com)

Most significantly, Southwest lacks the longhaul international revenue and the premium revenue opportunities that the big 3 have with their much more complex business models. Many analysts strongly believed that the Americas only low-cost carriers would gain a significant revenue advantage during the pandemic as long haul international traffic was heavily shut down around the world. I argued that such an approach to viewing the industry was painting with too broad of a brush and, in fact, some airlines like Southwest did better than some of its network airline peers during the early years of the pandemic but some other low cost and ultra low-cost carriers never exceeded the financial performance of the global carriers. Now, it is the longhaul international revenue, esp. to/from Europe that is fueling huge revenue growth for the big 3 and their European counterparts that were left standing after many transatlantic low-cost carriers vanished during the pandemic.

Southwest’s egalitarian business model also makes it hard for LUV to participate in the growing focus on premium travel that is helping the big 3, all of which are reporting that the growth of “bleisure” and remote work-related travel is offsetting the part of corporate travel that has not recovered. With no premium cabins and no airport lounges, Southwest is missing out on a significant part of the travel ribbon which is now become a significant asset for legacy carriers rather than the expensive, low margin cost centers that they were often viewed.

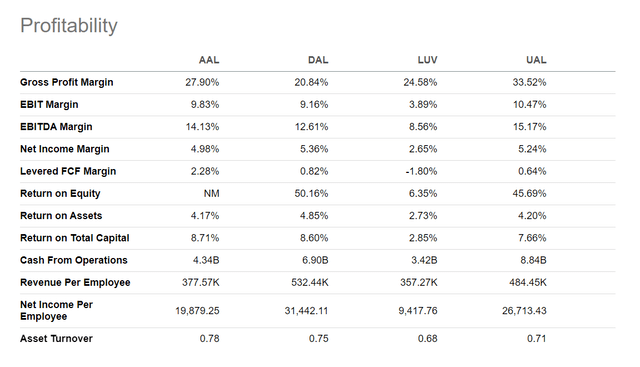

Finally, while Southwest’s loyalty and credit card program revenue as a percentage of total revenue is comparable to some of the legacy carriers, it is much smaller than Delta’s which is significant given that DAL and LUV are considered the two best financially matched carriers in the industry even if they have considerably different business models.

big 4 US airline profitability metrics (Seeking Alpha)

Strong Cost Management Helps…

Southwest has long been one of the best airlines in the world in managing costs and squeezing efficiency out of its operation. Even as its revenue appears to be underperforming its peers, LUV is seeing costs grow at a faster rate than its competitors. Influenced by all of the same general economic factors that are pushing up prices for all Americans, Southwest is paying more for non-fuel services. Since low-cost carriers are dependent on high growth rates to limit cost creep, LUV Is more negatively impacted by higher non-fuel costs because it has not been able to grow as much as it wants.

Labor cost growth is a natural and expected phenomena in the seniority-based airline industry where senior workers, including at LUV, can bring home paychecks on the upper end of the middle-class American workforce. Growth helps minimize the effects of labor cost creep as new workers are brought in at the bottom of payscales. Southwest, like many airlines, either early retired or allowed many employees to take leaves of absence during the pandemic but those workers have been brought back in anticipation of surging demand. Because Southwest’s growth has been more limited than it would like, the impact of those higher cost employees is larger on LUV than on other airlines.

Southwest’s bigger concern is that its labor force is becoming increasingly restless as they watch other airlines and particularly the big 3 global airlines hand out large pay raises to their employees. After fitful attempts by United and American to restart the labor negotiation process post-covid, Delta reached an agreement with its pilots’ union in December that included hefty retroactive payments and large pay increases from the date of signing and for the next four years of the contract. Careful to not upset the balance between its unionized pilots and the rest of its non-union workforce, Delta lifted the pay for its flight attendants and mechanics and other ground staff an. d also affirmed its profit-sharing program which was the most lucrative in the airline industry and one of the largest in the U.S. pre-covid. In addition to missing out on the pay raises that other airline pilots, led by the pilots and some ground staff have received, LUV employees are missing out or seeing greatly reduced levels of profit sharing because of LUV’s reduced profits, in part because of LUV’s operational problems in late 2022.

American and United have agreements in principle with their pilots although the former’s pilots are trying to now match some of the benefits and higher pay levels from the Delta contract and the United AIP. Of the big 4, only Delta has lifted the pay of its flight attendants, adding boarding pay, something no other large U.S. airline has offered. Like pilots, flight attendants have traditionally been paid only for flight hours; as part of its efforts to improve the boarding experience and operate on-time, Delta has been starting boarding earlier, so adding boarding pay incentives flight attendants to help the company’s operations and improve Delta’s customer service reputation. With the shortest average flight length among major jet airlines, it was a given that Southwest’s flight attendants would want boarding pay, a wish that has been echoed by American’s flight attendant union in its negotiations. Southwest and flight attendant union negotiators came to a tentative agreement that lifted pay by double digit percentages and included boarding pay followed by smaller 3% raises during the life of the contract. However, LUV’s flight attendant union executives rejected the deal as insufficient and never sent it to membership for a vote, leading the federal mediator to pause negotiations until January 2024, a technique which federal mediators often use after a proposed agreement is rejected. Since flight attendants are one of the primary touchpoints with airline customers, a deterioration of the relationship between LUV and its flight attendants could adversely impact LUV’s ability to rebuild its customer base in the wake of its operational challenges.

Southwest’s pilots’ union has not even reached an AIP with the company. Not only do LUV pilots want the same percentage increases in their pay that the big 3’s pilots are seeing in their contracts or AIPs but LUV pilots are trying to trying to narrow the widening pay gap between themselves and the big 3’s pilots that have the opportunity to fly widebodies on long international flights. In addition, Southwest’s business model has long thrived on high levels of efficiency, including by its pilots and flight attendants and other airlines are now using larger and more efficient aircraft and fewer regional jets so the efficiency gap between LUV and other airlines is narrowing; both of these factors combined make it harder for LUV to economically match the levels of pay that the big 3 are paying their pilots, a significant switch from just a few years ago when LUV employees including its pilots worked hard but were rewarded as well as or better than other airline employees. Because the demand for pilots is so strong, delays in reaching a deal with its pilots could lead to greater numbers of LUV pilots leaving for the big 3, a growing trend seen at a number of low cost airlines, and greater difficulty in recruiting new pilots.

Southwest’s Fleet

As has been noted several times already in this article, a number of factors are related to Southwest’s inability to grow its network which itself is tied to the size of the fleet. Southwest has been one of Boeing’s most loyal customers ever and was the launch customer for the 737 MAX 7, the smallest member of the Boeing 737 MAX family. Boeing developed the mid-sized MAX 8 first and then soon after developed the MAX 9, both of which were certified and entered service before covid and the eventual foreign carrier accidents involving 2 MAX aircraft. The worldwide grounding of the MAX fleet delayed certification of the MAX 7 and the MAX 10, the largest member of the family, of which United is the largest customer. Boeing expected to deliver the first MAX 7s in 2019 and Southwest has faced repeated delays in receiving its MAX 7s, some of which have been built but cannot be delivered until they are certified. LUV has been converting its MAX 7 orders to larger MAX 8s which has added more seats per flight which has put downward pressure on yields.

LUV has also held onto many of its older 737-700s, the forerunner to the MAX and the backbone of LUV’s fleet, as long as possible but many of those aircraft are now at the physical limits of their life and will have to be retired. LUV now expects to receive its first MAX 7s in late 2023 or early 2024 with passenger service commencing in early 2024. Boeing is also not expected to deliver the number of planned MAX 8s to LUV in 2023 so that LUV will see its fleet shrink by 20 or more aircraft late in 2023 as it is forced to retire older 737s before the next round of MAXs are received. In the midst of a number of revenue and cost-related challenges that Southwest is currently facing, continued Boeing delivery delays are now significantly contributing to the deterioration of Southwest’s finances and outlook.

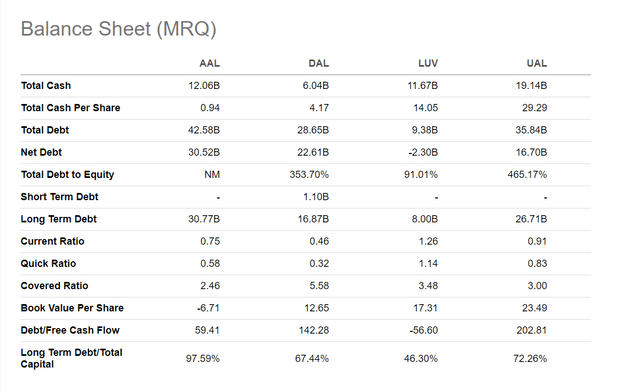

big 4 US airline balance sheet comparison (Seeking Alpha)

Balance Sheet Strength

Southwest’s greatest strength remains its balance sheet which is by far the most pristine in the U.S. airline industry. Southwest was able to pull down credit in the early days of the pandemic and conserved cash well, restarting as much of its operations as possible at every sign of an uptick in travel. Ironically, LUV’s balance sheet fared better during the pandemic but its income statement is now the most challenged in comparison to the big 3 global carriers during the post-covid period. That pristine balance sheet will deteriorate rapidly if LUV’s revenues do not begin to grow as rapidly as other airlines revenues are growing and as fast as LUV’s costs need to grow in order to adapt to the changing environment esp. with respect to airline labor costs.

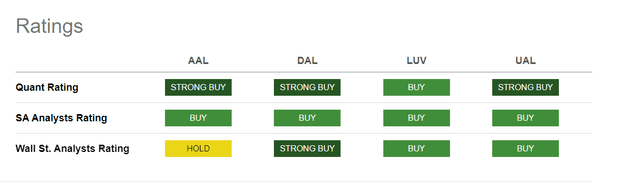

Big 4 US airline ratings 24Jul2023 (Seeking Alpha)

It is absolutely reasonable to recognize that Southwest is facing one of the greatest competitive and strategic challenges in its 52-year history. The big 3 legacy carriers which for years could not dream of producing financial results on par with Southwest which was consistently ranked the most valuable airline in the world by market cap. Although DAL and LUV traded places as the most valuable U.S. airline by market cap in the last decade, DAL is now worth 41% more than LUV. The big 3 are generating margins that meet or exceed LUV levels. It is also clear that some of the moves by LUV’s competitors, while they may not have been designed specifically with Southwest in mind, have a major impact on LUV. Delta’s decision to add boarding pay for its flight attendants will cost LUV more than any other airline given the larger number of flights that LUV operates compared to the big 3 on their own aircraft (not regional jets). United’s aggressive growth and its plans to add amenities is targeted at Southwest customers since UAL and LUV overlap in more metro areas than any other two U.S. airlines. UAL eliminated change fees early in the pandemic but didn’t hesitate to note that it is more competitive with Southwest’s policies than ever before. The aggressive new pilot contracts by the big 3 have to either be matched by low-cost carriers or they will lose pilots even as the global carriers are in much better position to pay for the costly new contracts. Over decades, Southwest has adapted incredibly well to a number of challenges but it has never really faced as many larger and stronger competitors as it now faces.

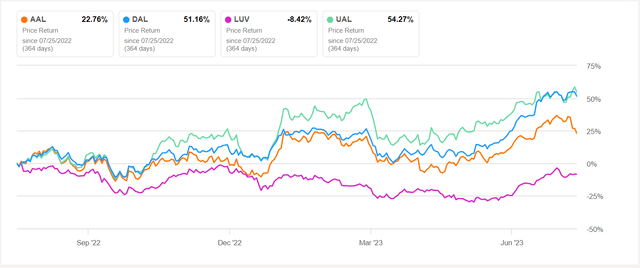

Big 4 US airline one year chart (Seeking Alpha )

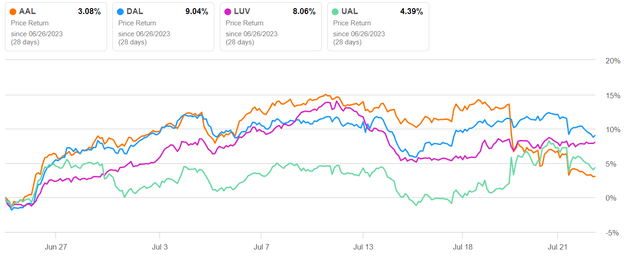

Big 4 US airline one month chart (Seeking Alpha )

It was personally a sad day for me when I sold my shares in Southwest as I saw the change in dynamics in the airline industry play out as international travel recovered and the pendulum moved in favor of the big 3.

Airline Equity Peak?

The most recent earnings season has resulted in a downturn in airline equities despite the strong earnings report from the big 3. ALK’s weak guidance highlights that early readings about weak future average fares might be indicative of a softening of domestic travel. Although a weaker domestic market will affect low cost carriers first, all U.S. airlines get the majority of their revenue from the U.S. Fears of macroeconomic weakness and high inflation might finally be denting the airline industry.

Southwest Airlines management needs to demonstrate that it has a plan to address the changed strategic environment in which it operates and in which it is no longer the king of the hill. Until it does, I cannot be optimistic that LUV stock is the best airline stock even amidst the possibility that the strong YTD performance of AAL, DAL and LUV stock might also have reached its peak.

Accordingly, I have to assign a HOLD to LUV stock for both the near and medium term with expectations of being disappointed by LUV’s 2nd quarter earnings report, guidance for the remainder of the year, and subsequent stock movement.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.