Summary:

- Q2 earnings beat expectations by $.44 driven largely by cost cuts, particularly in the supply chain.

- Full year earnings guidance was only raised by $.10, which implies weak guide for the back half of the year.

- Organic revenue growth still flat to negative in all segments and geographies with particular weakness in electronics.

- Environmental and earplug liabilities still determine the company’s fate.

syahrir maulana/iStock via Getty Images

3M’s Second Quarter Update:

3M (NYSE:MMM) reported a second quarter that beat low expectations for both the top line and bottom line excluding a $10.3 billion pre-tax charge on proposed municipal water utility settlement. Total sales declined 4.7% on an adjusted basis from the same quarter last year and organic revenues declined 2.5%. That organic drop was less severe than the consensus estimated 4.5% drop. Much of the “less bad” sales appears to have come from automotive and aerospace, which mostly improved the Transportation and Electronics segments. However, that segment still experience negative organic revenue growth as did all other segments except for the “growth” segment Healthcare, which grew organic sale a whopping 0.1% and negative overall sales growth of 4.8%.

| Organic Sales Growth | Total Sales Change | |

| Safety and Industrial | -4.6% | -5.5% |

| Transportation and Industrial | -2.4% | -4.7% |

| Healthcare | 0.1% | -4.8% |

| Consumer | -2.2% | -2.7% |

| Total | -2.5% | -4.7% |

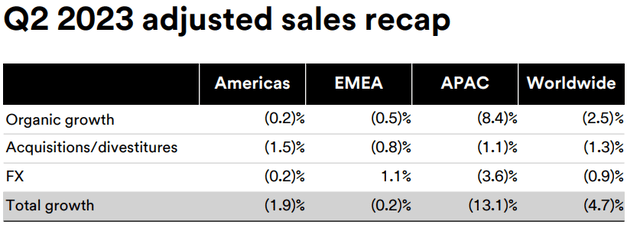

I’ll also note that revenue weakness was global. Literally every geography had negative organic growth as well as total sales.

Q2 2023 Geographic Sales Picture (3M Q2 Presentation)

Much of the beat appears to stem from cost cuts the company announced earlier, specifically the $900 million announced in April. The tax rate also appears quite low, although a clean number there is obfuscated by the settlement charge.

Interestingly, while the company beat earnings estimates by $.44 for the q, they only raised guidance for the year $.10 from $8.50-9.00 to $8.60-9.10. That implies at least a weak Q3 if not a weak Q3 and Q4. Organic sales growth guidance is still expected to be negative 3% to flat and total sales are guided to -5% to -1%.

It’s nearly impossible to maintain margin in the face of lower volumes and 3M is no exception. Operating margins declined 230 basis points from 21.6% to 19.3% company-wide and all segment margins declining except for Safety and Industrial which grew marginally.

| Q2 2023 Margin | Q2 2022 Margin | |

| Safety and Industrial | 22.2% | 21.5% |

| Transportation and Industrial | 19.8% | 23.4% |

| Healthcare | 19.8% | 22.6% |

| Consumer | 18.2% | 18.6% |

| Total | 19.3% | 21.6% |

Liabilities Still Looming:

As I have said since I first wrote negatively on this company “3M: Catalysts for Potential Bankruptcy”, this story is about the massive legal liabilities the company faces rather than its moribund revenue and earnings. While the $10–12.5 billion proposed settlement with the multi-district water utility litigants puts some certainty and a manageable timeline to a piece of the company’s PFAS costs, there are still plenty of large liabilities overhanging, including personal injury and property damages suits, lawsuits by state Attorney Generals and the EPA, which remains the biggest hammer.

Most immediate is the cost for the military earplugs, which could be announced almost any day now. The catalyst for that settlement should be the appellate decision whether or not to confirm a lower court’s dismissal of the company’s petition to file bankruptcy for the earplug subsidiary.

Another potential negative will be hearing how many water utilities opt of the multi-district settlement. I believe there are quite a few larger utilities that can afford to keep fighting the company on their own for bigger payments for clean-up costs.

Valuation:

As I have argued before, I don’t find this company’s valuation compelling even without these overhanging liabilities. I showed above that revenue are declining across all segments and geographies. What type of multiple is a declining revenue, standalone industrial company supposed to garner? Using the high end of the eps guide of $9.10, it’s at 12x earnings. That doesn’t strike me as particularly cheap.

I continue to believe this company is mostly owned for its dividend, which is barely being covered here and will not be covered if the company spins off its no growth healthcare business and as the settlement payments start flowing through. If/when that dividend gets cut, the stock has a long way to fall even excluding further legal liabilities from earplugs or PFAS. I believe bankruptcy is a legitimate risk at some point, which would imply a $0 price target. At the very least I believe the stock should not trade better than 10x earnings implying a price around $90.

Risks:

As with any short sale, the downside is unlimited as the stock has no theoretical price cap. That said, given 3M only has about 2% of the float sold short and it is not a volatile stock (100 day historical volatility is only 28 as of July 25), it should never act like a GameStop (GME) or Carvana (CVNA). Short sellers should actually get paid a small rebate for shorting this stock. The amount depends on your brokerage, but it should cover most of the dividends you have to pay out. If one wanted to cover their downside of being short the stock, an October $115-$125 call spread for about $1.60 would expose you to the first $5 move higher but then cover your risk to where the stock started the year. For investors who want defined downside, longer dated out of the money puts are not particularly expensive given the low volatility. One could buy $100 strike January 2024 expiry puts for about $3.75 (at the time of this writing).

Conclusion:

My view has not changed on this company. I think it’s a low risk short that is a potential bankruptcy situation as the company’s liabilities mount.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

My new investment group, Catalyst Hedge Investing, is live. The launch has been terrific. The chat board is live and active as is the best ideas portfolio. There are still generous introductory prices for early subscribers that will continue for the life of your subscription. Come join the fun!