Summary:

- Wide moat 3M recently soared 5%, reporting strong guidance and cash flow.

- Total litigation costs should come in at around $1.5 billion per year.

- A dividend cut is probable.

- Analysts claim 3M is ‘uninvestable’, but the market’s fear has discounted returns of 11% per annum.

Scott Olson

Headwinds, But Still A Buy

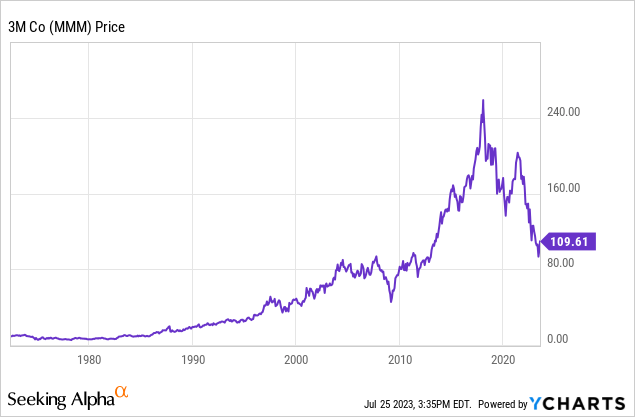

3M Company (NYSE:MMM) recently reported earnings, and the stock soared 5% on strong guidance. Investors have exited in a multiyear selloff, with analysts exclaiming:

The stock is currently uninvestable.”

It is well known that 3M Company has huge potential lawsuits hanging over its head. The company recently agreed to pay a $12.5 billion ($10.3 billion present value) liability over 13 years. These types of lawsuits are generally paid out over several years or even over decades if they are large enough. Therefore, it is rare for them to bankrupt a company. After all, that’s not the goal; the claimants want to get paid.

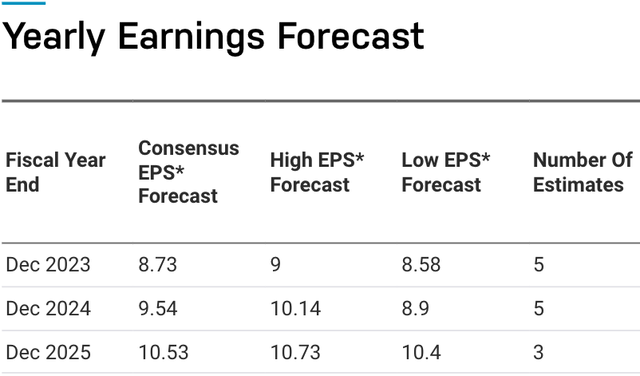

Morningstar estimates the cost of litigation at “$20 billion for total PFAS liabilities (inclusive of the settlement), and nearly $4 billion in Combat Arms liabilities.” RBC Capital came out with a similar estimate of $20 to $25 billion in PFAS liabilities. The market is well aware of these risks, and analysts still have 3M earning substantial profits over the next three years:

3M Analyst EPS Estimates (Nasdaq)

This gives 3M a forward PE of 12, 11, and 10 in 2023, 2024, and 2025. That’s a great price for a business of 3M’s quality, and you only get values like this when there’s trouble and uncertainty.

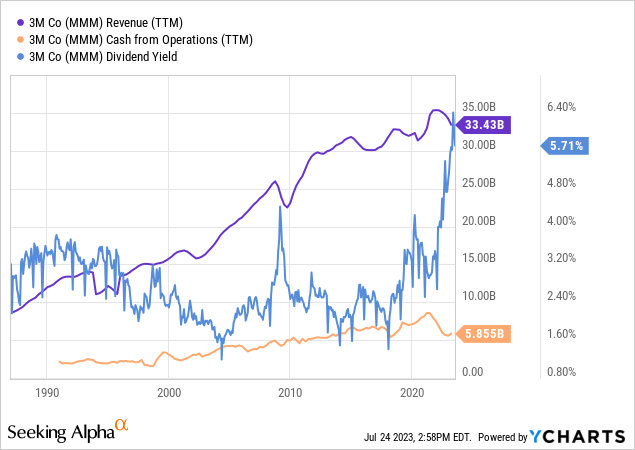

Now, investors should understand that 3M is going to substantially miss 2023 GAAP EPS estimates because it has taken a huge non-cash charge of $14.19 per share for the “impact of public water systems settlement.” I think a more important metric than EPS will be 3M’s cash from operating activities, which remains intact at $2.78 billion over the past 6 months.

The company has a long track record of growth and is now sporting a record-high dividend yield, stretching beyond the 4.5% reached in the Great Financial Crisis:

I think the road ahead is murky but have a “Buy” on 3M at prospective returns of 11% per annum.

The Business, The Moat

3M has four key competitive advantages, giving it a wide moat against the competition:

- Brand Power – 3M has several widely recognized consumer brands such as Scotch-Brite, Post-it, Nexcare, Scotch tape, and others. These brands command a premium price and premium margins over the generic competition.

- R&D Spend – 3M is able to outspend its competitors on innovation because of its size.

- Supply Chain – 3M has a global distribution system that is very difficult to replicate.

- Patents – The company has tons of patents and reported that, “Over the past five years, our scientists have earned an average of 3,500 patents per year.”

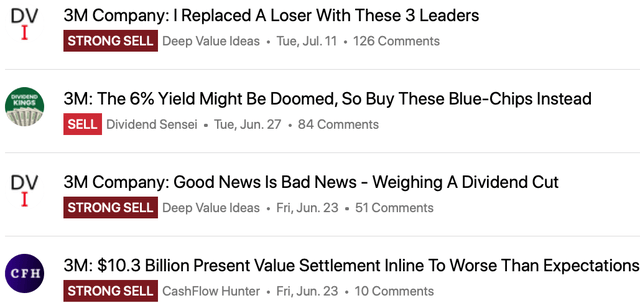

3M is a very diversified business:

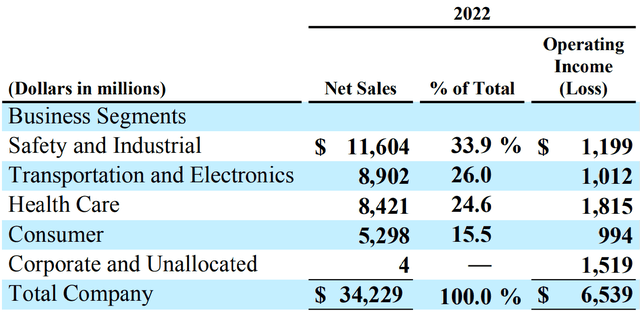

Business Segments (Q2 Company Presentation) 3M Business Segments (2022 Annual Report)

The company’s transportation and electronics segment saw a huge year-over-year decline in 2022 as the global economy cooled and automotive part shortages took hold. 3M is arguably under-earning with inflation pressures and global demand issues that may prove temporary.

Here’s a look at segment sales for Q2, 2023:

Segments Sales (Q2 Financial Statements)

I see transportation making a huge comeback later this year and electronics coming back in 2024 or 2025. In this segment, the company wants to tap into global growth trends like electric vehicles.

Management is now attacking costs, trimming down excessive management layers, corporate offices, and in-house computing. This should all be a positive, boosting earnings and cash flow when demand returns.

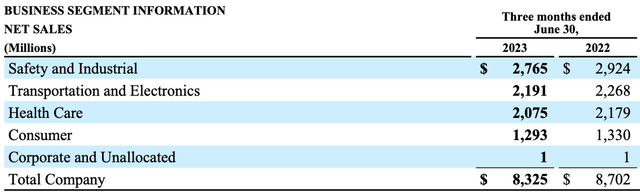

Also, the company is looking to spin off its Health Care business:

Health Care Spin Off (Q2 Company Presentation)

I need to see more about the valuation of this spin off and the liabilities it will carry before commenting on it.

The Valuation And The Dividend

3M is projecting approximately $6.1 billion of adjusted cash from operating activities for 2023. That would translate to approximately $4.3 billion of free cash flow. The company has averaged $5.4 billion of free cash flow over the past three years. This covers 3M’s $3.3 billion of TTM dividends paid, but not by a comfortable margin. The days of dividend growth are likely over.

Here’s my estimate of 3M’s normalized earnings, factoring in $26 billion of estimated litigation costs over 25 years. I think this will likely be front-end loaded given the existing $12.5 billion over 13 years:

| 3-Year Average Free Cash Flow | $5.4 billion |

| Less: Litigation Costs | ($1.5 billion) |

| Normalized Earnings | $3.9 billion |

| Divided By: Diluted Shares Outstanding | 0.553 billion |

| Normalized EPS | $7.05 |

Given my outlook on normalized earnings, 3M’s dividend payout looks stretched and could be cut. In fact, that’s my base-case scenario.

Below, I value the company as a whole, assuming a dividend cut. My 2033 price target is $208 per share, implying returns of 11% per annum with dividends reinvested:

| Normalized EPS | $7.05 |

| Reduced Dividend | $4.20 |

| Compound Annual Growth Rate | 6% |

| Year 10 EPS | $12.60 |

| Terminal Multiple | 16.5x |

| Year 10 Share Price | $208 |

| Annualized Returns (Dividends Reinvested) | 11% |

Note: This is a base-case estimate. The compound annual growth rate is for dividends and earnings.

Risks

You can read about 3M’s risk factors in its annual report, but let me sum up a few of the key ones.

- 3M operates in over 70 countries around the globe and is thus at risk of geopolitical conflicts, as we saw with the Russia/Ukraine war.

- Also, 3M has more liabilities on its balance sheet now and will need to maintain appropriate levels of cash flow to meet its obligations. Moody’s recently assigned 3M a credit rating of A2 (Signaling a strong, investment-grade financial position).

- There’s also the risk that litigation comes in higher than I expect, which would increase risk and lower expected returns.

The Bottom Line

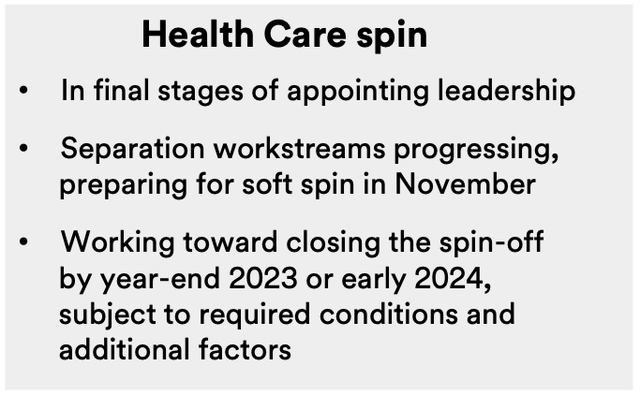

I differ from other Seeking Alpha analysts on 3M:

Analyst Articles (Seeking Alpha)

I think the risks are well understood and that the market has discounted decent returns from here due to the fear surrounding these risks. While I have not yet owned 3M, I would hang in there if I was an existing shareholder. 3M has a strong financial position and a strong moat. It could face a dividend cut, and investors should stay tuned to S.A. to navigate the potential spin-off of the Health Care business prudently. All risks accounted for, I expect total returns of 11% per annum from here. My rating: “Buy.”

Until next time, happy investing!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.