Summary:

- Despite a challenging earnings year for many tech companies, Visa’s earnings have continued to grow and the company trades for 24.4x year-ahead earnings, reflecting its consistent growth.

- Visa benefits from the widespread use of its credit card payment system and from the resulting network effect.

- Adoption of contactless payments has boosted transaction volume and Visa’s expansion into developing markets like Thailand, Croatia, and Latin America is expected to drive further growth.

- Visa stock is a great example of growth at a reasonable price.

Alphotographic/iStock via Getty Images

This year, many tech companies have soared to fresh heights despite earnings being substantially down from 2021. In these cases, their runaway “growth” was nothing but a fleeting cyclical boom driven by the pandemic. But don’t tell that to managements competing to see who can say the word AI the most in their quarterly conference call. Even earnings calls for grocery stores are now full of AI mentions to arguably try to cover for weak underlying business performance. Visa (NYSE:V), on the other hand, is expected to grow EPS by 15% Y/Y for 2023 and 13% for 2024, and their earnings were never down in 2022 to begin with. Visa currently trades for 24.4x year-ahead earnings, which is surprisingly low for the amount of growth the company has had in the past and is projected for in the future.

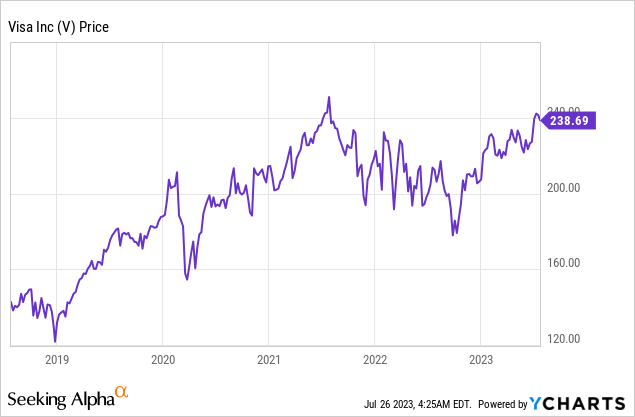

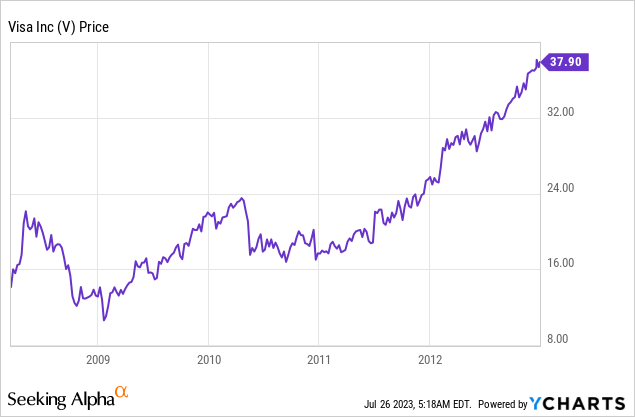

Visa Stock Is A Long-Time Winner

Since coming public in 2008, Visa stock has returned 20% per year. While that will be a tough act to follow, there are plenty of reasons to expect Visa to return more than the market at large.

- For one, Visa is nicely plugged into nominal GDP growth. What this means is that as long as they don’t screw up running the company, Visa’s earnings will automatically increase in line with nominal GDP or better. Since nominal GDP growth is now largely inflation, that’s another way of saying Visa does well in an inflationary environment.

- Visa has a textbook network effect. Why do consumers use Visa? Because merchants accept it. Why do merchants accept Visa? Because consumers expect it. Perhaps an innovative fintech could come along and disrupt everything, but the system of credit card payments through Visa and Mastercard (MA) is convenient for consumers and businesses alike (even if a bit expensive for the latter). There’s big money up for grabs if anyone can successfully disrupt the payment infrastructure in the US or other large economies. But as is so often the case in tech, Visa or Mastercard can simply buy out emerging competitors that look like they might be able to threaten them, so long as the government doesn’t block the deals.

- Contactless payments– perhaps the quietest innovation of all time. Contactless cards had been around for a few years in the US, but adoption really ramped up after the pandemic. I think I first saw someone in line at a grocery store tap their card to pay sometime in 2020 or 2021, I asked them about it and they showed me. Since then, I don’t think I’ve ever swiped or inserted a credit card unless the contactless payment wasn’t working. It’s very useful and a huge win for Visa as they’re often paid per transaction. Contactless payments have largely displaced ticket terminals on public transportation, which is both a huge volume and amount of transactions. That’s a huge win for Visa.

A Look At The Numbers

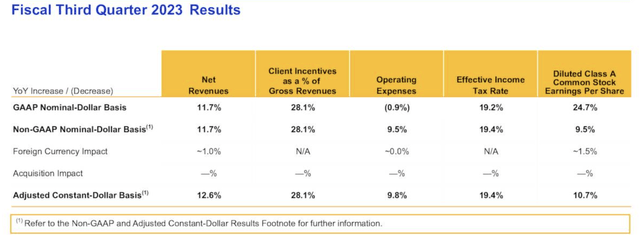

Here are Visa’s results for their Fiscal 2023 Q3, from the company’s latest investor presentation. Visa reported $2.16 in non-GAAP earnings for the quarter and $2.00 in GAAP earnings. And if you’re wondering, Visa’s management said the word AI 4 times on the quarterly conference call, which probably did not beat the bookies’ over/under line.

Visa’s revenue breakdown:

Visa Revenue Growth (Visa Q3 FY 2023 Investor Presentation)

Adjusting for the stronger dollar, Visa’s revenue is up 12.6% Y/Y. That’s great. When you account for the stronger dollar, Visa’s revenue is up 11.7%. That’s still great, considering the S&P 500 (SPY) is earning less this year than it did last year.

Earnings are solid as well, up 10.7% for the year on a constant currency basis and 24.7% on a GAAP basis. Visa’s roughly $0.16 difference in GAAP and non-GAAP EPS comes from litigation expenses. This is the long-running lawsuit in question if you’d like to learn more.

Visa’s conference call highlighted new initiatives in Thailand, Croatia, and Latin America, showing that the company is plugged into not only nominal GDP growth in mature markets like the US, but also in fast-growing developing markets. Visa announced in June that they were acquiring Pismo, a Brazilian payments provider, for $1 billion. Finally, the company guided for 10% revenue growth in its current quarter as well.

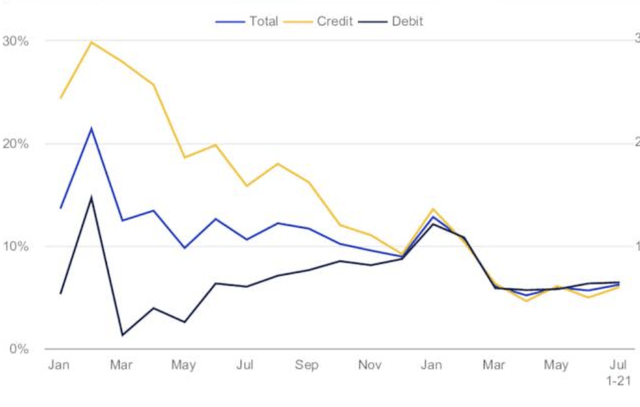

Y/Y payment growth, January 2022 to July 2023

Visa Y/Y Revenue Growth (Visa Q3 FY 2023 Investor Presentation)

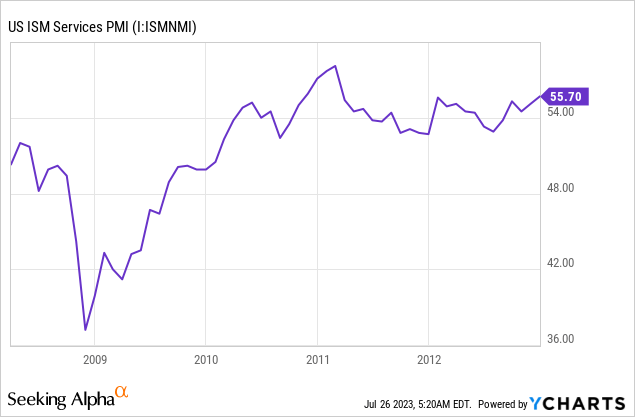

Visa isn’t immune to the business cycle and payment growth is slowing in line with the broader economy. However, Visa does benefit from services spending being less sensitive to interest rates than spending on housing or cars, for example. Services spending in 2008 for example held up reasonably well until things totally collapsed in the fall of 2008.

Visa’s stock was similar–the company was able to recover its bear market decline by mid-2009.

This cycle may not play out exactly like the last one, especially if the resumption of student loans has an outsized impact on services spending. But there are plenty of reasons to think that credit card spending in particular may be more resilient than overall economic activity. In any case, Visa’s business should be among the last to fall in a recession and among the first to rebound.

If you’re wondering whether Visa or Mastercard is a better buy, MA trades for a higher valuation and has historically grown faster. Visa trades for 24.4x 2024 earnings with 13% expected growth, while Mastercard trades for 28x earnings with 19% expected growth. The businesses are very similar, so I prefer Visa for the cheaper PE and less room for disappointment if the economy slows.

Bottom Line

At 24.4x 2024 earnings, Visa isn’t the cheapest stock you can buy, but I think that the long-range analyst estimates are directionally correct. It’s worth buying some Visa now and adding on any correction back to the $200 range. I wouldn’t bet big, but I appreciate the near-immunity to inflation that the company has. While the value in the stock market overall is thin, investors will more than likely be happy with a long-term investment in Visa. V stock is a good example of growth at a reasonable price. What do you think? Share your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.