Summary:

- Alphabet reported Q2 results that exceeded expectations, as revenues increased 7.1% (Y/Y), and EPS came in at $1.45, a $0.10 beat.

- With its return to growth, improved profitability, headcount optimization, and impressive AI execution, Alphabet is positioned for its ‘Meta Moment’, and has laid the groundwork for a multiple expansion.

- However, Alphabet is still lagging behind Microsoft with product releases and is unable to take share from Azure.

- Furthermore, the lackluster growth in its core advertising businesses reflects the ad market recovery will take a few more quarters.

- I reiterate Alphabet stock as a Buy and expect to see a multiple expansion in the near term, but I believe there are still areas for major improvement before Alphabet returns to its historical valuation.

Justin Sullivan

Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) just announced Q2 results that beat expectations, as revenues increased 7.1% (Y/Y), and EPS came in at $1.45, a $0.10 beat.

With its return to growth, improved profitability, headcount optimization, and impressive AI execution, Alphabet is positioned for its ‘Meta Moment’, and has laid the groundwork for a multiple expansion.

However, Alphabet is still lagging behind Microsoft (MSFT) with its product releases and is unable to take share from Azure in the cloud. Furthermore, the lackluster growth in its core advertising businesses reflects the ad market recovery will take a few more quarters.

While I reiterate Alphabet as a Buy and expect to see a multiple expansion in the near term, I believe there are still areas for major improvement before Alphabet returns to its historical valuation.

Introduction

In March, I published ‘Alphabet: 3 Lessons Google Should Learn From Meta To Become Strong Buy‘. In the article, I claimed that Alphabet and Meta (META) were in a similar situation in November 2022. Both advertising giants have over-hired into a deteriorating economy, expecting the Covid boom to continue. Their respective leaders in Sundar Pichai and Mark Zuckerberg have directed significant resources into unprofitable long-shot projects and committed the sin of diworsification.

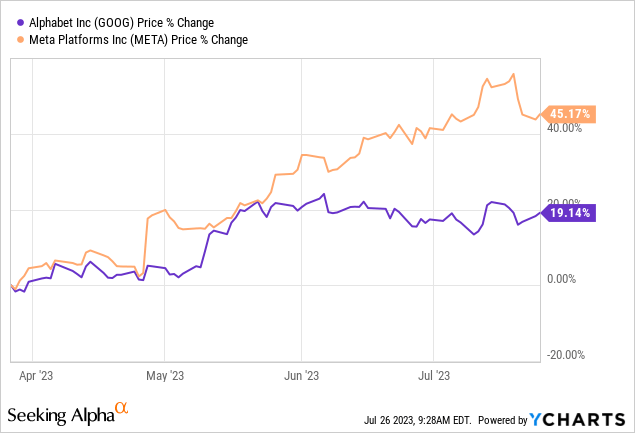

Right around the November lows is when things turned around for Meta. The stock has since surged by more than 3.2x, taking Meta from a single-digit P/E, to now a 24.7 P/E, higher than its 5-year average.

For Alphabet, such a turnaround is yet to have happened. Today, the company trades 14.0% below its historical P/E and has “only” recovered 46% from its November lows, not much better than the Nasdaq 100 index (QQQ).

Since my March article, Meta has returned 45.2%, whereas Alphabet provided decent, but much lower returns with 19.1%. I urge you to read the article, as I provided a full comparison between the companies, discussed their unique moats, and described exactly what investors should focus on with Alphabet.

In the article, I listed three important lessons Alphabet needs to learn from Meta to become a Strong Buy, which I summarized as follows:

Alphabet needs to go more aggressive regarding layoffs and cost-cutting. It needs to provide investors with more clarity and define a detailed path to become a more efficient organization. Additionally, Alphabet should cut unnecessary investments and focus on its core, profitable activities.

Now, focusing on its Q2 results, I think Alphabet’s ‘Meta Moment’ is approaching. Let’s dive in.

Financial Overview, Q2-23

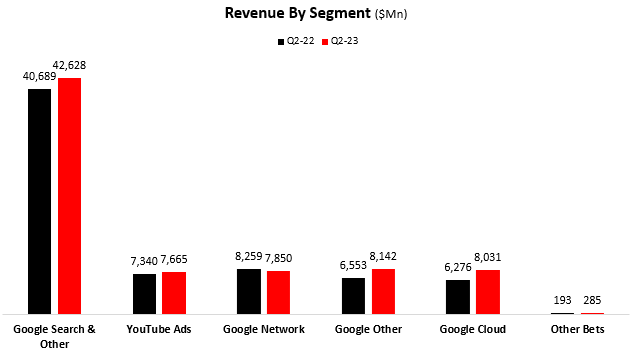

Created by the author using data from Alphabet’s financial reports.

In Q2-23, Google Search & Other grew by 4.8%, led by higher brand and retail advertising activity. YouTube Ads increased by 4.4%, fueled by increased engagement and ad recovery. Google Network decreased by 5.0%, Google Other grew by 24.2%, Other Bets increased by 47.7%, and the star of the show was Google Cloud, with 28.0% growth.

Overall, investors are quite happy with Alphabet’s return to growth in Q2, although it’s important to note that the core ad businesses are still relatively deflated. Furthermore, Google Cloud’s market share gains were primarily over Amazon (AMZN), whereas Microsoft was able to grow at a similar level, but from a much higher baseline with Azure.

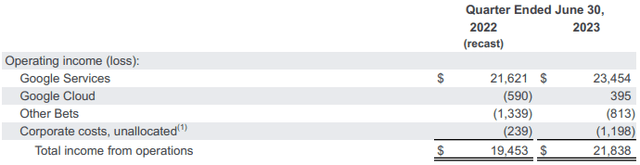

Alphabet Q2-2023 Earnings Release

Looking at operating income, Google Services saw an 8.5% increase, as margins improved by nearly 1 percentage point compared to the prior year period. In Google Cloud, Alphabet has finally turned to profitability, however, it’s mainly due to an accounting change.

It’s important to note that Alphabet is taking almost nearly $1.2B of expenses out of its operating segments into unallocated corporate costs. Typically, those should reflect non-core expenses like litigation, restructuring, etc. In Alphabet’s case, it also includes some of its AI research and development expenses, which in my view, is pretty misleading. For reference, Microsoft doesn’t have a corporate costs segment.

Cloud Performance

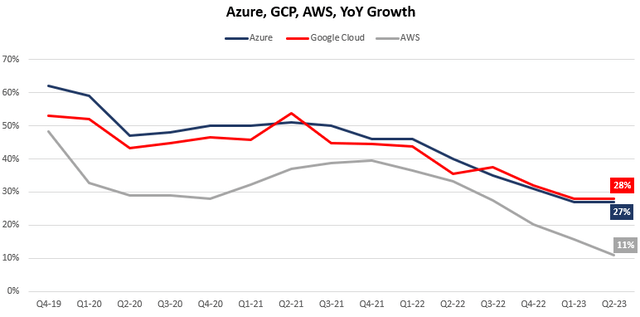

The three main players in cloud infrastructure are Microsoft with Azure, Amazon with AWS, and Google with Google Cloud. As of the end of June 2023, Amazon should still remain the largest in terms of sales at $23.7B, based on its guidance. Google Cloud remained the smallest, with $8.0B, and Azure is estimated to be at around $18.4B.

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q2-23 is Microsoft’s fiscal Q4-23.

As we can see, Google Cloud’s 28% growth in the second quarter is the highest among the three, although it started from a significantly lower baseline. In terms of absolute dollars, Google is still very behind, growing by $553M in Q2, compared to Microsoft’s estimated $3.9B, and Amazon’s expected $2.3B.

While Google Cloud’s growth is impressive, it’s important to remember Alphabet is still very far behind in terms of sales and profitability. In my opinion, Azure’s ability to grow pretty much in line with Google despite the higher baseline reflects who’s the stronger player between the two.

Laying The Groundwork For A Turnaround

In Q2, Alphabet demonstrated an increased focus on efficiency and profitability.

Starting with headcount, the search giant has finally parted ways with nearly 9 million employees. The layoffs contributed to lower capex spending as well, as office expansions were delayed.

While SBC remained high at 7.7% of sales, and margins didn’t reflect the full benefit of the layoffs due to severance costs, it’s clear that Alphabet is on track to become a more efficient organization, and much more efficient than it was just a few quarters ago.

So we have one box checked. The company is actively progressing on the efficiency front. The second item we listed was transparency, and here, I believe there’s still significant room to improve.

I encourage investors to go listen to Alphabet’s earnings call or go over the transcript here. From the moment CFO Ruth Porat says “Turning to our outlook”, she provides zero numbers regarding the company’s future. No growth forecast, no expense forecast, no capex guidance, absolute zero. Now compare that to Microsoft’s guidance, and you’ll get a sense of my problem with the lack of transparency.

I don’t expect Alphabet to give overly detailed guidance, because the company heavily relies on unpredictable revenues, as customers initiate, enhance or reduce advertising campaigns on very short notice. But I think providing an expense target is not too much to ask.

Furthermore, the difference between Microsoft’s detailed, actionable AI announcements compared to Alphabet’s is astounding. We don’t really know how much AI contributes to Alphabet’s topline, and with a good chunk of the expenses allocated to corporate costs, we don’t know how it affects each segment’s bottom line either.

Overall, I believe investors are right to be optimistic about Alphabet’s near term, as its core businesses are not going anywhere anytime soon. Google Cloud is clearly trending in the right direction, and overall margins are improving.

That being said, I believe that in order for the stock to return to historical valuations, investors will need to see better transparency regarding costs and AI execution, higher growth in ads, and continued profitable growth in Google Cloud.

Valuation

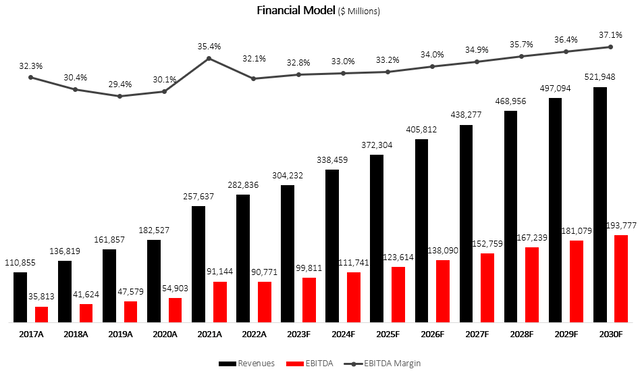

I used a discounted cash flow methodology to evaluate Alphabet’s fair value. I forecast the company will grow revenues at an 8.0% CAGR between 2023-2030, based on recovery in the company’s core operations, continued market share gains in Google Cloud, and growth acceleration in search and YouTube. My projections are pretty much in line with the consensus but are significantly below Alphabet’s past 6-year CAGR of 20.6%.

I project EBITDA margins will increase incrementally up to 37.1% in 2030, due to a combination of higher operating margins and higher depreciation costs. I estimate margins will improve as the company focuses on better efficiency, ad costs decrease, Google Cloud’s profitability improves, and depreciation will increase due to increased investments in infrastructure.

Overall, my assumptions result in EBITDA growth above revenue growth, reflecting operational leverage and recovery in segments that are experiencing temporary headwinds.

Created and calculated by the author based on Alphabet financial reports and the author’s projections

Taking a WACC of 8.3%, I estimate Alphabet’s fair value at $155 per share, which represents an 18.9% upside compared to the market price at the time of writing. This valuation reflects a forward P/E multiple of 23.8 based on my EPS projection for FY24, which is in line with Alphabet’s 5-year average.

Conclusion

In my perspective, Alphabet has the opportunity to become a heartbreaker for many investors, who will look back and question their reasoning for not investing in this juggernaut when it was trading at a 19x P/E.

In my opinion, the company clearly still lags behind better managed Big-Tech names like Microsoft and Apple (AAPL). I find Alphabet’s management somewhat complacent, waiting for the market to recover for the company to return to historical profitability, rather than exploit the downturn to their advantage, and become a stronger company, taking Meta as an example.

That being said, I view the impressive quarter as a step in the right direction, and I believe Alphabet’s ‘Meta Moment’ is approaching. Thus, I reiterate a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.