Summary:

- We’re upgrading Microsoft Corporation to a hold post Q4 2023 earnings; we believe Microsoft is well positioned to outperform, driven by Azure and generative A.I., but see softer cloud/enterprise spending in H2 2023.

- We expect the cloud slowdown to continue into H2 ’23 due to macro weakness; Azure and other cloud services reported lackluster revenue growth, dropping 1% sequentially this quarter.

- We’re now more constructive on Microsoft monetizing generative A.I. into revenue growth, but we don’t see the company achieving meaningful A.I. revenue growth in 2H23.

- Management stated nothing short of a capital spending binge on generative A.I. investments in FY24; we think investors will see revenue later than expenses.

- We recommend investors stay on the sidelines of the stock in the near term, as we expect the company to be impacted by macro weakness as customers continue to trim budgets.

lcva2/iStock Editorial via Getty Images

Microsoft Corporation (NASDAQ:MSFT) is down roughly 5% today after reporting fiscal Q4 2023 earnings results yesterday, experiencing its worst day since January; we’re upgrading the stock to a hold. Consistent with our expectations in April, we’re seeing a correction in cloud/enterprise spending play out as customers continue to tighten budgets due to macro headwinds. We might’ve been early with our forecast, but we weren’t wrong; Microsoft reported Azure and other services revenue growth of 26% Y/Y during the quarter, declining 1% sequentially from 27% Y/Y growth last quarter. We expect Azure’s revenue slowdown to continue into the next quarter as the macro weakness persists due to inflationary pressures and higher interest rates.

Our concerns regarding Microsoft’s slowing Azure and other cloud services’ growth were further confirmed by management’s somewhat guarded comments on whether Azure revenue growth had “bottomed” on the earnings call. Microsoft still derives the bulk of its revenue from its Intelligent Cloud segment, which includes Azure and other cloud services and accounts for 42.7% of total revenue this quarter Azure and other cloud services.

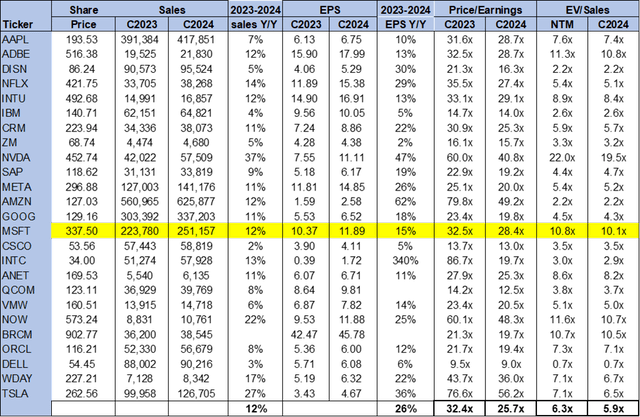

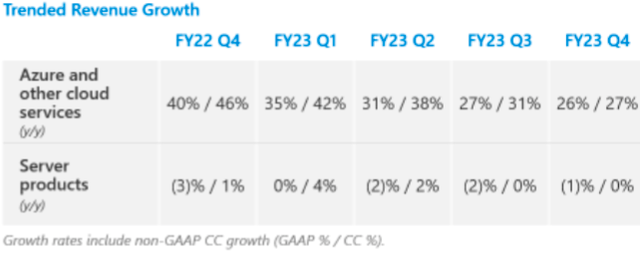

The following chart outlines Microsoft’s Intelligent Cloud growth trend up to 4Q23.

Microsoft 4Q23 earnings presentation

Azure growth has slowed sequentially every quarter since 3Q22 and remains a signal of the macro weakness pressuring companies to trim capital expenses amid rising interest rates. We’re seeing the impact of slower cloud/enterprise spend on Seagate Technology Holdings (STX), which is scheduled to announce earnings later today. Additionally, the Fed just raised interest rates by 0.25 percentage points to a range of 5.25% to 5.5%, marking a 22-year high.

We think the higher interest rate environment will weigh on cloud spending in the second half of the year as companies tighten IT budgets; we expect to see the impact of the current macro headwinds play out on Amazon’s (AMZN) cloud earnings as well, scheduled for next month. We think Azure revenue growth will continue to slow through 2H23 and recommend investors hold the stock due to near-term uncertainty.

Near-term pain for long-term gain

Shifting to A.I., we’re more constructive now on Microsoft’s ability to monetize generative A.I. into revenue growth, but we still don’t expect investors will see meaningful A.I. revenue growth this year. Our belief is that Microsoft is now undergoing a phase of “increased capital spend [that] will drive higher COGS growth than in FY ’23.” We think investors will see revenue later than expense. The A.I. stock rally triggered by OpenAI’s ChatGPT situated Microsoft at the heart of the A.I. boom; however, we believe now that earnings are under more scrutiny as investors track how A.I. revenues will materialize. Our expectations that Microsoft’s A.I. capabilities will take time to materialize into meaningful A.I. revenue growth are playing out.

We think the company’s on the right track partnering with Meta Platforms (META) to support Llama on Azure and Windows, as well as OpenAI, and in its announcement of pricing for a new Copilot subscription service adding A.I. to Office products. We’re constructive on Microsoft’s position to outperform in the mid to long run, but don’t see the stock outperforming meaningfully in the near term due to macro weakness.

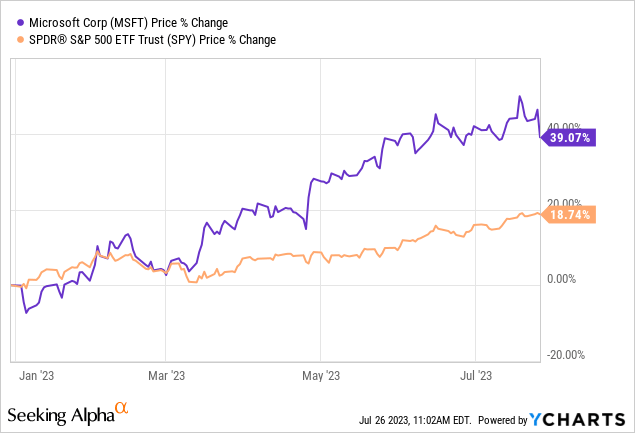

The stock is up 39% YTD, outperforming the S&P 500 (SP500) by around 19%. We see short-term uncertainties pressuring the company and hence recommend investors stay on the sidelines in 2H23.

The following graph outlines MSFT’s stock performance YTD against the S&P 500.

YCharts

Valuation

Microsoft is trading well above the peer group at premium multiples; the company hit a record market cap of $2.59T and is now closer to a $2.49T market cap. While we believe Microsoft currently leads the A.I. race in the software/hardware space, we think the stock is too overvalued to provide attractive entry points at current levels, especially considering we won’t see A.I. revenue growth in 2H23. On a P/E basis, the stock is trading at 28.4x C2024 EPS $11.89 compared to the peer group average of 25.7x. The stock is trading at 10.1x EV/C2024 Sales versus the peer group average of 5.9x.

The following chart outlines Microsoft’s valuation against the large-cap peer group.

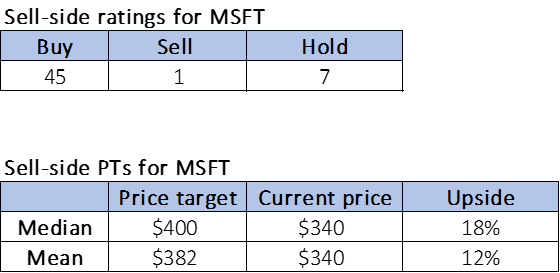

Word on Wall Street

Wall Street is overwhelmingly bullish on the stock. Of the 53 analysts covering the stock, 45 are buy-rated, seven hold-rated, and the remaining is sell-rated. The stock price is trading at $340 per share. The median sell-side price target is $400, while the mean is $382, with a potential upside of 12-18%.

The following charts outline Microsoft’s sell-side ratings and price targets.

TSP

What to do with MSFT stock

We’re moving Microsoft to a hold post-4Q23 earning results. We continue to believe the company leads the A.I. race among software/hardware peers as it creeps closer to the $3T market cap mark; however, we see near-term headwinds due to softer cloud/enterprise spending resulting from the higher interest rate environment and expect this to weigh on Azure revenue growth this year. We also think the company won’t deliver meaningful A.I. revenue growth in 2H23, and see generative A.I. driving outperformance in 2024, not earlier. We recommend investors stay on the sidelines for the macro weakness to play out before exploring favorable entry points into the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.