Summary:

- Next Wednesday, August 2, 2023, after the bell, PayPal Holdings, Inc., one of the largest fintech companies, is expected to publish its financial report for the second quarter of 2023.

- On June 20, 2023, it was announced that the company entered into a multi-year agreement with KKR.

- PayPal’s actual revenue has beaten analyst consensus estimates in eight of the last nine quarters, suggesting that Wall Street is underestimating its business growth potential.

- We initiate our coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

PeopleImages

On Wednesday, August 2, 2023, PayPal Holdings, Inc. (NASDAQ:PYPL), one of the largest fintech companies, publishes its financial report for the second quarter of 2023. The company continues to revolutionize the way to send and receive money digitally, ultimately improving the quality of life for millions of customers. Moreover, PayPal’s various tools expand financial opportunities for entrepreneurs, allowing them to securely accept payments and work with clients in different parts of the world without opening multiple bank accounts.

On June 20, 2023, it was announced that the company entered into a multi-year agreement with KKR. Under the terms of the deal, KKR is acquiring up to €40 billion of buy now, pay later (“BNPL”) loan receivables from PayPal in certain European countries. This transaction not only reduces PayPal’s financial risks but will also bring it about $1.8 billion in proceeds. The company will use part of the proceeds from this deal to replenish the share buyback program, which certainly helps to support the company’s share price growth.

The company’s portfolio comprises world-famous brands such as Paidy, Xoom, Braintree, Venmo, Hyperwallet, and Braintree. Moreover, the company continues to work to expand its geography and increase the number of customers of its Zettle point-of-sale terminal, designed to simplify the acceptance of payments for small and medium-sized businesses (“SMBs”). But the company does not stop at the progress achieved and, thanks to numerous partnership agreements, continues to explore new areas, including cryptocurrencies.

PayPal allows customers to buy, sell, and hold cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin, which, given their growing popularity, will not only increase the investment attractiveness of the company as the Fed cuts the interest rate, but also increase the company’s share in the digital payments market.

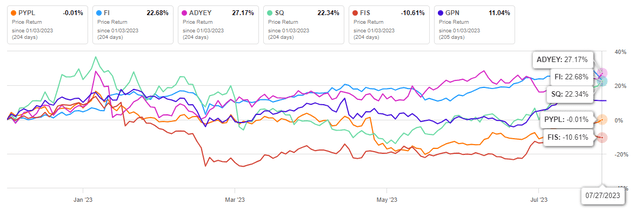

But despite the growth in net profit and revenue of the company from year to year, since the beginning of 2023, the share price of PayPal showed a decrease of about 0.01%. It underperformed such competitors in the financial sector as Fiserv (FI), Block (SQ), and Global Payments (GPN).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

The financial position of PayPal Holdings and its prospects

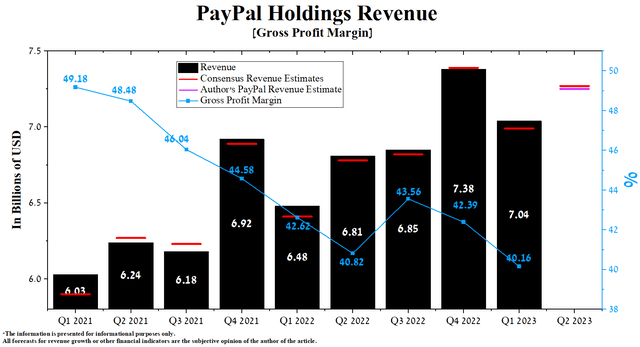

PayPal’s revenue for the first three months of 2023 was $7.04 billion, down 4.6% from the previous quarter and up 8.6% from the first quarter of 2022. However, PayPal’s actual revenue has beaten analyst consensus estimates in eight of the last nine quarters, suggesting that Wall Street is underestimating its business growth potential.

We believe that despite the persistence of high central bank interest rates, which are affecting the slow recovery in international e-commerce and consumer spending, Dan Schulman is doing an excellent job of managing the impact of these complexities on the company.

Author’s elaboration, based on Seeking Alpha

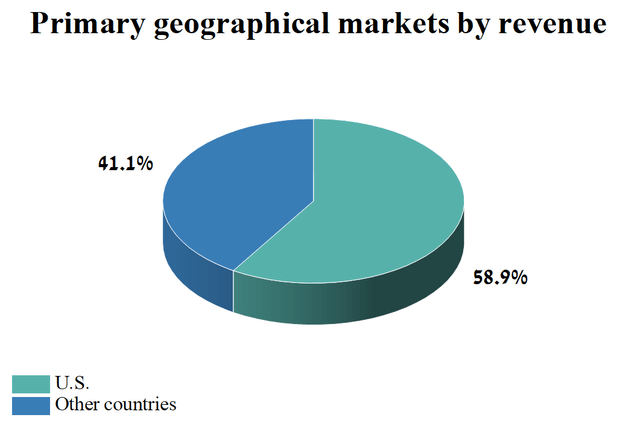

At the same time, the U.S. remains the primary market for PayPal Holdings, bringing about 58.9% of the company’s total revenue for the 1st quarter of 2023.

Author’s elaboration, based on 10-Q

According to Seeking Alpha, PayPal’s Q2 2023 revenue is expected to be $7.25-$7.33 billion, up 4% from analysts’ expectations for the first three months of 2023. At the same time, following our model, the company’s total revenue will be slightly below the median value of this range and will amount to $7.25 billion.

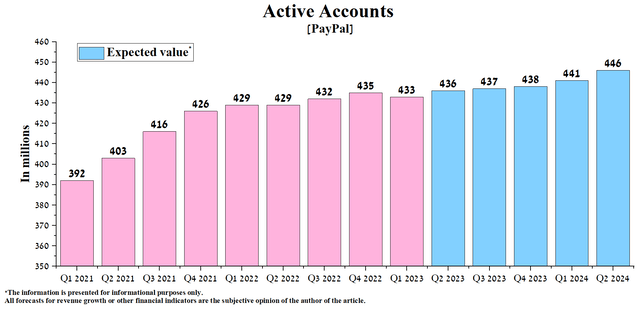

Year-on-year and quarterly revenue growth will be provided by an increase in the number of Braintree’s customers, a continuing trend towards an increase in the number of payment transactions made on the PayPal payment platform, and an increase in the volume of processing card transactions. With improved U.S. and European macroeconomic indicators in recent months, we expect active accounts to rise from 433 million to 436 million by the end of Q2 2023.

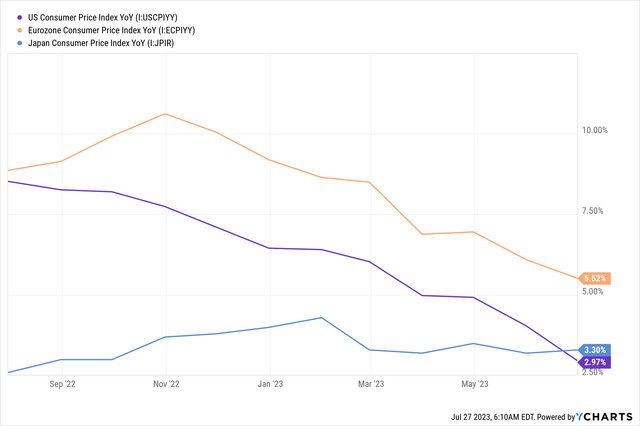

According to our model, this figure will reach 446 million active accounts by the end of Q2 2024, thanks to the start of a cycle of interest rate cuts by central banks early next year. Despite the fears of many economists that the Fed’s tight monetary policy could quickly lead to a recession, this did not happen. Furthermore, the inflation rates in the United States, the European Union, and Japan are steadily decreasing, inspiring confidence in the acceleration of the growth rate of household incomes.

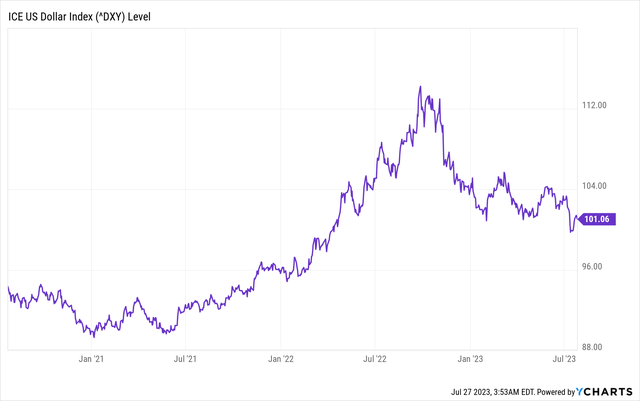

On the other hand, we are slightly less optimistic about PayPal’s Q2 2023 revenue than Wall Street analysts’ forecasts due to the strong dollar’s negative impact on fee revenue from foreign exchange.

On July 26, the Fed’s Open Market Committee raised the interest rate by 25 basis points to 5.25-5.5%. As a result, we expect an increase in demand for the dollar due to the growth of foreign investment in the US economy.

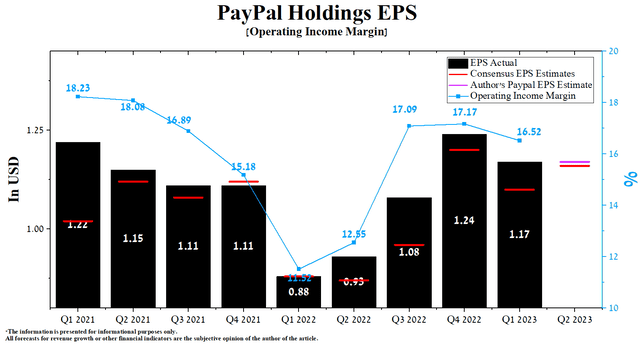

PayPal’s Q1 2023 operating income margin was 16.52%, up significantly year-over-year and above its median of 15.91% between January 1, 2021, and the end of March 2023. At the same time, we forecast that by 2023 the company’s operating income margin will remain stable and reach 17.1%. While by 2024, this figure will rise to 18%, thanks to lower interest rates and Venmo, a P2P payment app that continues to gain popularity quickly.

The company’s earnings per share (EPS) for the first three months of 2023 was $1.17, down 5.6% quarter-on-quarter, and just as importantly, it beat analyst consensus estimates in eight of the last nine quarters. According to Seeking Alpha, PayPal’s Q2 EPS is expected to be $1.13-$1.19, up 5.5% from the consensus estimate for Q1 2023. While we believe this is slightly underestimated, our model puts PayPal’s EPS at $1.17.

Meanwhile, PayPal’s Non-GAAP P/E [TTM] of 16.61x is 78.46% higher than the sector average and 58.67% lower than the average over the past five years. On the other hand, Non-GAAP P/E [FWD] is 14.86x, which indicates that the company is undervalued amidst the ongoing economic recovery in China and India.

Author’s elaboration, based on Seeking Alpha

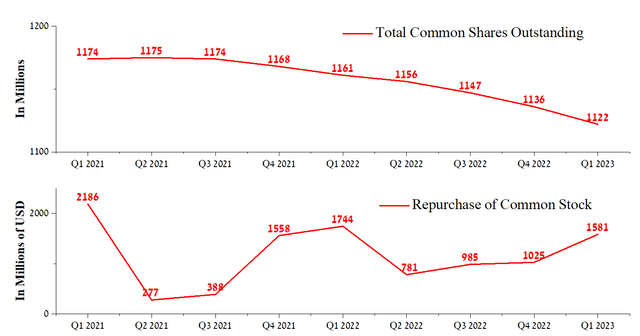

In recent quarters, the company has continued to please investors by continuing to beat the consensus EPS and one of the reasons for this trend to continue is the share repurchase program. In the first three months of 2023, PayPal bought back about $1.58 billion of its shares. At the same time, at the end of the first quarter of 2023, the remaining authorization to buy back PayPal shares amounted to $14.4 billion. We estimate that this will play a significant role in supporting the company’s share price during a tense period when its management actively searches for a new CEO to replace Dan Schulman, who is retiring at the end of 2023.

Author’s elaboration, based on Seeking Alpha

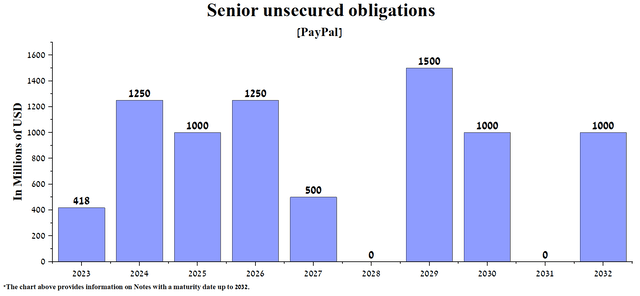

At the end of Q1 2023, the company had a well-diversified portfolio of fixed-rate notes, allowing Dan Schulman to launch new devices and platforms actively.

Author’s elaboration, based on 10-Q

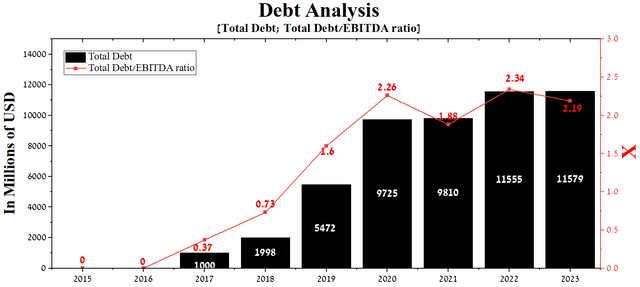

At the end of March 2023, PayPal’s total debt was about $11.58 billion, an increase of $1.77 billion from 2021. On the other hand, the growth of the company’s EBITDA year-on-year did not significantly impact the decrease in the total debt/EBITDA ratio, which amounted to 2.19x.

Author’s elaboration, based on Seeking Alpha

Given the stable cash flow, the introduction of initiatives to reduce operating costs, the notes’ maturity dates, and their effective interest rate, we do not expect PayPal to have problems with its redemption, and it will continue to be one of the leaders in the global digital payment market.

Conclusion

Next Wednesday, August 2, 2023, after the bell, PayPal Holdings, one of the largest fintech companies, will publish its financial report for the second quarter of 2023.

Despite Dan Schulman’s retirement from the post of CEO of the company at the end of this year, under his leadership, PayPal continues to release new products to the market, allowing it to maintain the pace of growth in the number of payment transactions made on numerous payment platforms. On the other hand, changes in management and growing uncertainty about the new CEO and his strategy for the company’s development increases the nervousness among investors.

On June 20, 2023, it was announced that the company entered into a multi-year agreement with KKR. At the same time, part of the proceeds received under this deal will be used to replenish the share repurchase program, which will certainly reduce the impact of short sellers on the price of the company’s shares.

We believe that some of PayPal Holdings, Inc.’s most challenging times from the beginning of 2022 to the first quarter of 2023 are in its history, and its financial position will continue to improve. The recovery of the e-commerce industry, the gradual expansion of the use of cryptocurrencies in everyday life, the launch of payment solutions for businesses, and the improvement of macroeconomic data. These factors are just a few investment theses that make PayPal an attractive asset for long-term investors.

We initiate our coverage of PayPal Holdings with an “outperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.