Summary:

- Google’s 50% gain in 2023 is one of the few mega-rallies sanctified by the righteousness of fundamentals.

- GOOG is growing at almost 20% per year and is expected to generate more than $700 billion in free cash flow by 2028.

- It’s expected to repurchase almost $500 billion in stock and end 2028 with more than $500 billion in cash. This is a profit minting machine that won’t quit.

- GOOG is still 16% undervalued and has 55% consensus fundamental justified upside potential by 2025.

- If GOOG grows as expected and returns to fair value by 2029, it could potentially triple in value, and possibly beat the S&P consensus return by 400%.

choness

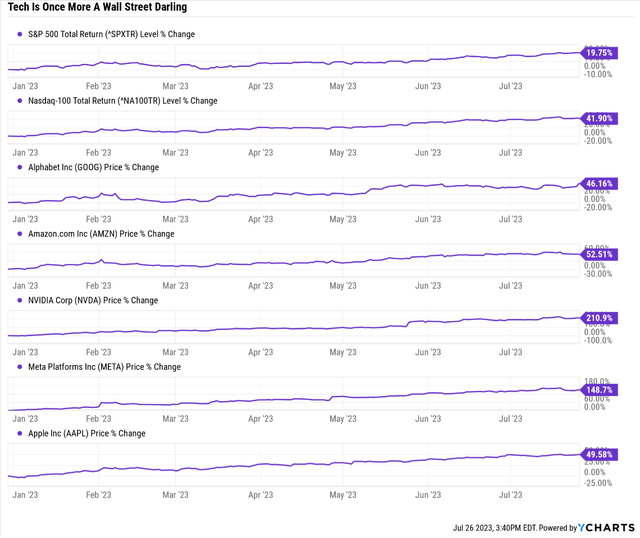

Tech is hot once more. The Magnificent 7 has been red hot in 2023 and helped drive the S&P up 20%.

Ycharts

Most of these gains haven’t been justified by fundamentals, not even close.

A few red-hot tech names have had their gains sanctified by the righteousness of fundamentals.

Let me show you why Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is one of my favorite hyper-growth ultra SWANs.

One that could triple in the next five years and almost quadruple the market’s returns in 18 months. Why?

Because of almost $500 billion worth of expected buybacks through 2028.

And over $500 billion in cash after half a trillion in buybacks by 2028.

And GOOG is expected to generate $700 billion in free cash flow in the next six years, and the rewards for investors could be 5X better than the S&P 500. (see valuation section)

Google has more money than the Vatican (which has $65 billion) and is a red-hot profit machine that’s just getting warmed up.

Wall Street Is Finally Right About Google’s Earnings

Seeking Alpha

The market loved Google’s results even if they were not exactly impressive.

Total second-quarter revenue was $74.6 billion, up 7% from last year. Advertising revenue returned to growth (up more than 3%) after two consecutive quarters of a decline, with improvements in both searches (up 5.6%) which was driven by strength in retail, and YouTube (up 4.4%), partially offset by the ongoing weakness in advertising technology revenue (down 5%). Cloud revenue increased 28%, and other services, which include hardware and Google Play, were up 10%.” – Morningstar

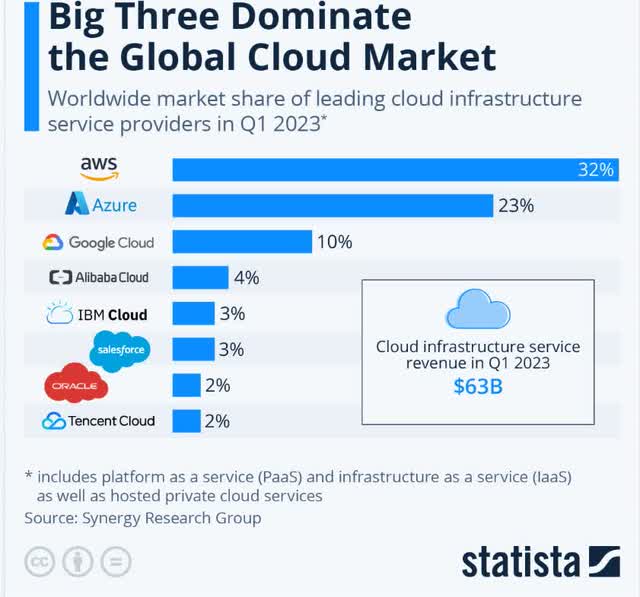

What matters to Google in the long term is the strong growth in the cloud. Remember that cloud is the future of AI and pretty much everything tech.

Most of the value added to the enterprise in the future will be in the cloud.

Statista

GOOG is one of the big three in the cloud, and no one is even close in fourth.

Google Cloud is running $33 billion per year in sales and generating $8.8 billion in annual cash flow.

By 2025 analysts expect Google Cloud to hit $51 billion in sales, but due to high economies of scale, cash flow from the cloud is expected to double to $16 billion.

Today cloud makes up 7% of GOOG’s cash flow, and in 2025 it’s expected to hit 10%.

Cloud sales growth is expected to grow at 21% annually through 2028, as GOOG wins market share, mostly from the lower tier rivals who can’t keep up with the titans.

Google’s sales are growing at 10%, and the cloud is growing twice as fast.

Why am I so bullish on GOOG long term?

Because what it’s doing with AI has the potential to change the very nature of the global economy and even how humans forever live their lives.

- more on this in a separate article

But in the short to medium term, thanks largely to GOOG killing it in the cloud, the growth prospects for one of the world’s best companies keep improving.

Growth, Growth, And More Growth

Short-Term Growth Consensus

| Metric | 2022 Growth | 2023 Growth Consensus | 2024 Growth Consensus |

2025 Consensus |

| Sales | 12% | 12% | 11% | 10% |

| EPS | -19% | 24% | 17% | 16% |

| Operating Cash Flow | 3% | 19% | 17% | 11% |

| Free Cash Flow | -8% | 24% | 23% | 18% |

| EBITDA | 1% | 42% | 14% | 14% |

| EBIT (operating income) | -4% | 20% | 15% | 12% |

(Source: FAST Graphs, FactSet)

After a rough 2022, GOOG is expected to recover nicely and grow at a rate even most growth stocks would envy.

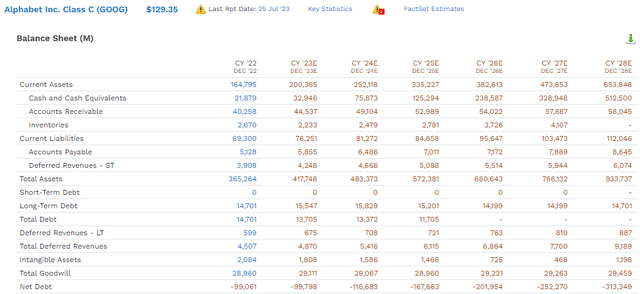

FactSet Research Terminal

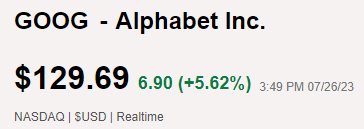

GOOG’s long-term growth consensus has been rising from 14% to 18.2%.

But that’s the long-term earnings growth estimate, the median of 53 analysts. What’s even more impressive about GOOG is how it’s expected to grow all of its fundamentals.

| Year | Sales | Free Cash Flow | EBITDA | EBIT (Operating Income) | Net Income |

| 2022 | $282,836 | $60,010 | $110,132 | $75,483 | $59,972 |

| 2023 | $303,275 | $74,804 | $121,024 | $87,392 | $71,630 |

| 2024 | $337,560 | $89,224 | $137,050 | $102,159 | $82,830 |

| 2025 | $372,796 | $103,210 | $157,663 | $118,106 | $95,210 |

| 2026 | $413,074 | $118,493 | $173,564 | $129,405 | $103,898 |

| 2027 | $444,743 | $149,000 | $191,596 | $134,998 | $115,813 |

| 2028 | $497,230 | $167,819 | $221,772 | $156,718 | $136,835 |

| Annualized Growth 2022-2028 | 9.86% | 17.54% | 12.37% | 12.95% | 13.82% |

| Cumulative 2023-2027 | $2,368,678 | $702,550 | $1,002,669 | $728,778 | $606,216 |

(Source: FAST Graphs, FactSet)

For a company of GOOG’s size to grow free cash flow at almost 20% is extremely impressive.

And guess what GOOG is expected to spend all that cash on?

FactSet Research Terminal

GOOG’s cash pile is expected to hit $513 billion by 2028, $313 billion net of debt.

And remember that in 2028 GOOG is expected to generate $167 billion per year of new free cash flow! GOOG is expected to generate $702 billion in free cash flow through 2028.

That’s so much cash that even with $482 billion in buybacks in the coming years, its cash pile is still expected to increase by 2000%.

FactSet Research Terminal

Let me repeat that. GOOG is expected to spend half a trillion in buybacks AND still end up with $500 billion in cash.

This company is firing on all cylinders, changing the world in many ways you don’t even realize.

- GOOG has saved my life, and I’ll tell you about it in a future article

Red Hot And Still A Strong Buy

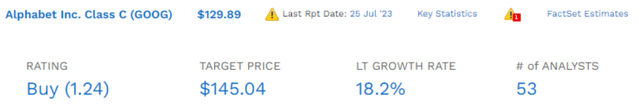

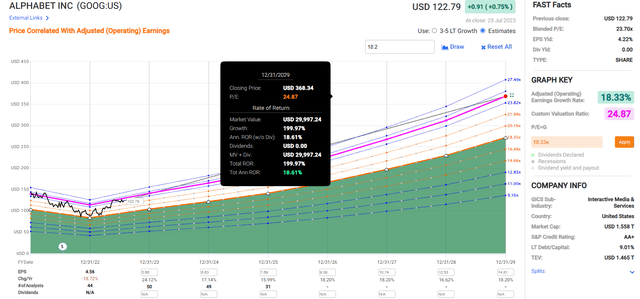

GOOG is up almost 50% this year, but it remains a potentially strong buy.

| Metric | Historical Fair Value Multiples (all years) | 2022 | 2023 | 2024 | 2025 | 2026 | 12-Month Forward Fair Value |

| Earnings | 24.87 | $113.41 | $138.77 | $163.40 | $181.80 | $208.66 | |

| Average | $113.41 | $138.77 | $163.40 | $181.80 | $208.66 | $152.98 | |

| Current Price | $129.15 | ||||||

|

Discount To Fair Value |

-13.88% | 6.94% | 20.96% | 28.96% | 38.10% | 15.58% | |

| Upside To Fair Value | -12.19% | 7.45% | 26.52% | 40.77% | 61.56% | 18.45% | |

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward PE | 12-Month Average Fair Value Forward PE | Current Forward PE |

Current Forward Cash-Adjusted PE |

| $5.58 | $6.57 | $2.36 | $3.79 | $6.15 | 24.9 | 21.0 | 12.2 |

(Source: DK Research Terminal, FactSet)

It trades at just 21X forward earnings, a 16% historical discount. But adjust for its mountain of cash and trading at just 12X earnings.

Right now, private equity is closing deals at about 12X earnings.

Billionaires are getting sweetheart deals at the same valuations that you can buy this AA-rated hyper-growth Ultra SWAN right now.

| Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $138.77 | $163.40 | $152.98 |

| Potentially Good Buy | 5% | $131.84 | $155.23 | $145.33 |

| Potentially Strong Buy | 15% | $117.96 | $138.89 | $130.03 |

| Potentially Very Strong Buy | 25% | $98.88 | $122.55 | $114.73 |

| Potentially Ultra-Value Buy | 35% | $90.20 | $106.21 | $99.44 |

| Currently | $129.59 | 6.62% | 20.69% | 15.29% |

| Upside To Fair Value (Including Dividends) | 7.09% | 26.09% | 18.05% |

(Source: DK Research Terminal, FactSet)

The S&P has a 15% consensus total return forecast through the end of 2025, a 6% annual consensus rate of return.

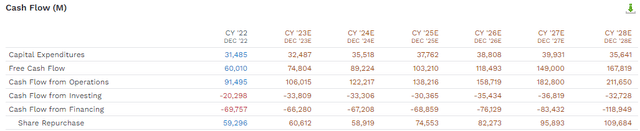

Alphabet 2025 Consensus Total Return Potential

FAST Graphs, FactSet

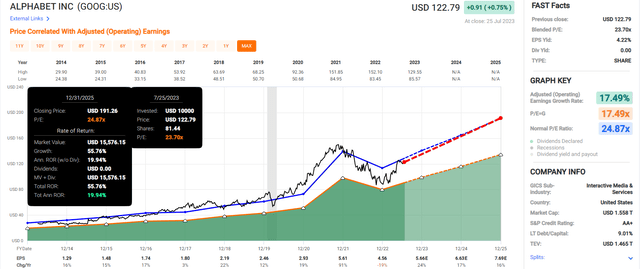

Alphabet 2029 Consensus Total Return Potential

FAST Graphs, FactSet

In the next 18 months, analysts think GOOG can deliver almost 4X the returns of the S&P.

In the next 5.5 years? GOOG might be able to triple, while the S&P is expected to deliver about 40% returns.

- 4X the return potential of the S&P through 2025

- 5X the return potential through the S&P 2029

For anyone comfortable with its risk profile, GOOG is a potentially strong buy.

Risk Profile: Why Google Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

GOOG’s Risk Profile Includes

- political/regulator risk (antitrust threats)

- market share risk (from major rivals like AMZN, whose ads are 4X as effective as GOOG’s)

- disruption risk (web 3.0 potentially will allow everyone to own their data and monetize it, forcing GOOG to pay part of its current profits on data to users)

- M&A execution risk (lots of small bolt-on acquisitions and a lack of large M&A opportunities due to regulatory concerns over antitrust)

- talent retention risk (tightest job market in over 50 years)

- currency risk (as sales become more international)

- cyber-security risk: hackers and ransomware

- AI disruption risk

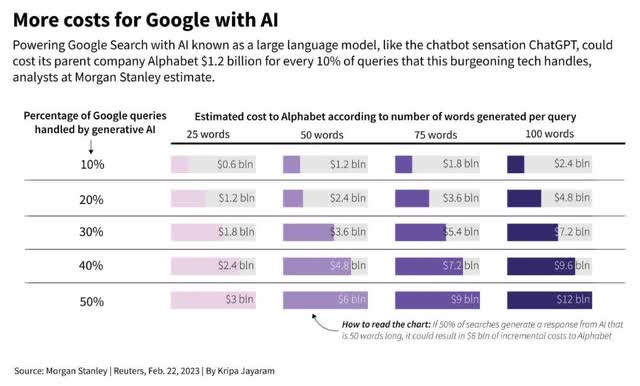

Morgan Stanley

If GOOG’s BARD chatbot were to replace the existing search empire, it would cost the company $24 billion per year.

That’s a 40% hit to the bottom line, created by GOOG doing too good a job with its amazing AI chatbot.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

MSFT Scores 97th Percentile On Global Long-Term Risk Management And GOOG Scores 93rd

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Alphabet | 93 |

Exceptional |

Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

No risk-free companies exist, but GOOG is one of the lowest-risk ways to earn double-digit market-beating returns in the future, according to S&P.

How We Monitor GOOG’s Risk Profile

- 53 analysts

- two credit rating agencies

- 55 experts who collectively know this business better than anyone other than management

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Google Is An Unstoppable Profit Machine, And It’s Still On Sale!

Dividend Kings Automated Investment Decision Tool

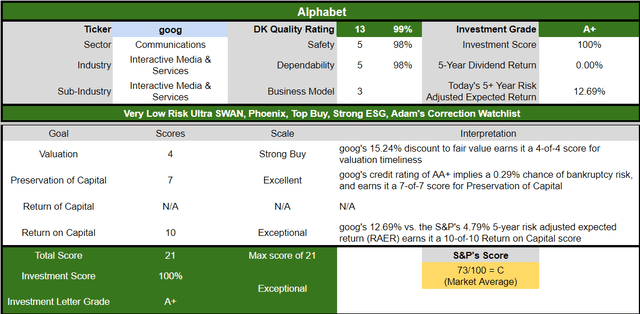

GOOG is one of the few tech titans whose blockbuster returns this year are sanctified by the righteousness of fundamentals.

Its valuation was so low in October of 2022 that even a 50% rally has left its 15% undervalued and capable of 55% gains over the next 18 months.

GOOG can gain more in the next 18 months than delivered in 2023’s red-hot AI tech mania year.

GOOG is so undervalued and growing so quickly thanks to strong execution in the Cloud it could triple in the next 5.5 years, delivering 5X better returns than the S&P 500!

If you want to buy a red-hot momentum Ultra SWAN that still represents sanity in an insane world, GOOG is one of your best choices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.