Summary:

- Despite the popular narrative that Microsoft’s ChatGPT-driven Bing would somehow kill Google Search, GOOG generated $2 billion more free cash flow than MSFT in Q2.

- Google is a free cash flow machine – generating $21.8 billion in FCF in Q2, which equates to 29.2% of total revenue.

- That compares to a FCF margin of 18.1% in Q2 of last year. Clearly, GOOG management has gotten the message from investors to become a more efficient enterprise.

- Google Cloud continues to demonstrate strong growth, with Q2 revenue of $8.03 billion, +28% yoy. Gen-AI is a strong tailwind for the Google Cloud segment going forward.

- Meantime, Google is benefiting from the best of both worlds: higher interest income on its massive cash position ($118 billion) and a declining FX headwind from a falling U.S. Dollar.

JHVEPhoto

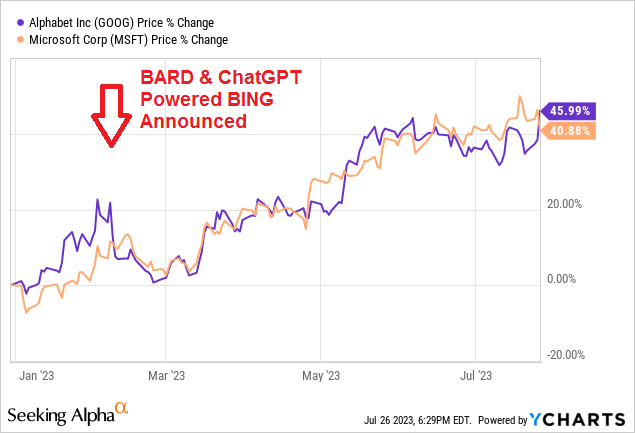

Back in February, Microsoft (MSFT) announced the availability of a new AI powered BING and Edge browser by integrating the same technology underpinning ChatGPT. That was only a day after Google (NASDAQ:GOOG) (GOOGL) had announced its AI chatbot BARD. By observing the popular commentary put forth by financial and technology sector analysts (including some on Seeking Alpha), you would have thought MSFT’s announcement meant the end of Google Search. Indeed, GOOG stock suffered a severe sell-off (see chart below), dropping ~18% over the next two weeks. However, I reminded my followers in comments and discussions that Google had been working on AI for many years and was arguably a leader in the field – if not the leader. I also advised them to buy additional shares in GOOG when it dropped into the low $90s (as I did). That being the case, I was not surprised in the least when Google announced strong Q2 earnings this week and actually generated $2 billion more in quarterly free cash flow as compared to Microsoft. This article will review the two companies’ latest quarterly results and make some observations about the general AI/cloud investment thesis going forward. Meantime, and despite all the headlines MSFT has gotten this year as a result of ChatGPT, Google has actually outperformed Microsoft by 5% year-to-date:

Seeking Alpha YCharts

Note: in the quarterly comparisons below, and in order to reduce confusion, I refer to Microsoft’s calendar Q2 as “Q2” even though it actually corresponds to MSFT’s fiscal Q4 FY23 results.

Investment Thesis

As most of you know, Google is the undisputed leader in search and also operates strong advertising segments on YouTube and Google Networks. In addition, Google Cloud is generally regarded as a rising No. 3 in that space, trailing only Amazon’s (AMZN) Web Service (“AWS”) and Microsoft’s Azure.

However, hidden under the “Other Bets” has been Google’s AI Lab. In December 2020, I highlighted a major medical breakthrough by AI Lab’s Deep Mind when it cracked the code on the “protein-folding problem” (see Google’s Next Stop: $2,100). Deep Mind made the momentous breakthrough using a neural-network based algorithm called Alpha Fold. At the time, the discovery was considered to be a major breakthrough – one that evolutionary biologist Andrei Lupus told Nature was:

… a game changer. This will change medicine. It will change research. It will change bioengineering. It will change everything.

Remember, this was almost three years ago. So, clearly GOOG had strong AI expertise and only a fool would think the company was not leveraging that expertise throughout its operations – including its biggest segment: Search, and its fastest growing segment Google Cloud.

Anecdotally, I have several friends that have played around with ChatGPT, and were, generally, very impressed. However, when I asked them if they were changing the search engine on their browser to BING, every one of them said something along the lines of “no way, I love Google!”

With that as background, let’s take a look at the Q2 results of Google (OK, technically it’s really “Alphabet,” but I’m old-school and will call the company “Google” throughout this article) and Microsoft and draw some conclusions.

Earnings

Google released its Q2 earnings report after the market closed on Tuesday, and it was a humdinger. Highlights on the top line:

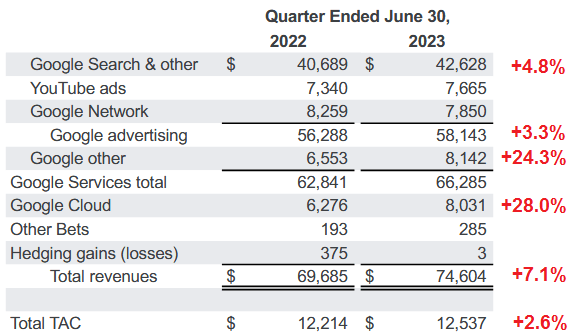

Alphabet

As can be seen in the graphic, Google Search revenue grew 4.8% year-over-year, which may not seem that impressive – but it was much better than expected and demonstrated an actual acceleration of growth. Google “Other” revenue grew a whopping 24.3% year-over-year and was a pleasant surprise for shareholders.

Google Cloud continued its strong momentum by growing revenue 28% yoy, a near doubling of Cloud revenue over just the past two years. On the Q2 conference call, Google CEO Sundar Pichai commented on how integrating AI into Google Cloud is driving that business:

Our AI-optimized infrastructure is a leading platform for training and serving generative AI models. More than 70% of gen AI unicorns are Google Cloud customers, including Cohere, Jasper, Typeface and many more. We provide the widest choice of AI supercomputer options with Google TPUs and advanced NVIDIA (NVDA) GPUs, and recently launched new A3 AI supercomputers powered by Nvidia’s H100. This enables customers like AppLovin to achieve nearly two times better price performance than industry alternatives.

Our new generative AI offerings are expanding our total addressable market and winning new customers. We’re seeing strong demand for the more than 80 models, including third-party and popular open source in our Vertex, Search and Conversational AI platforms with a number of customers growing more than 15x from April to June. Among them, Priceline is improving trip planning capabilities. Carrefour is creating full marketing campaigns in a matter of minutes. And Capgemini is building hundreds of use cases to streamline time-consuming business processes. Our new anti-money laundering AI helps banks like HSBC identify financial crime risk. And our new AI-powered Target and Lead identification suite is being applied at Cerevel to help enable drug discovery.

I apologize for the rather long quote from the conference call, but it’s important for investors to understand the dynamics driving Google’s Gen-AI/Cloud business going forward. Indeed, as the comments above showed, Google is leveraging its AI expertise now.

Meantime, traffic acquisition costs (“TAC”) grew only 2.6% yoy in Q2. TAC refers to payments GOOG makes to affiliates to direct traffic to the company. To put TAC into perspective, GOOG’s Q2 TAC grew only $323 million yoy while top-line total revenue grew by $4.9 billion yoy: Not too shabby.

Overall, top-line revenue of $74.6 billion (+7.1 yoy) beat consensus estimates by $1.84 billion. On the bottom line, GOOG delivered GAAP earnings of $1.44/share – which was a $0.10 beat.

Better still, GOOG’s free cash flow generation in Q2 was very strong: $21.78 billion, or 29.2% of total revenue. That compares to FCF of $12.59 billion in Q2 of last year, which was 18.1% of total revenue. The point is this: Google is becoming a much more efficient company at turning revenue into free cash flow.

Looking further through the report – and as I have been pointing out for years on Seeking Alpha – Google maintains a massive cash hoard. That large cash position enabled GOOG to earn interest income of a whopping $892 million during the quarter – up from $486 million in last year’s Q2. Note that GOOG ended the quarter with $118.3 billion in cash, cash equivalents, and marketable securities. That’s an estimated $9.24/share in cash based on the average of 12.764 million shares outstanding at the end of the quarter (-3.8% yoy). Further, GOOG’s cash position is up $5.4 billion since Dec. 31, 2022, despite spending $29.5 billion in share repurchases so far this year.

Interest Rates: The Best Of Both Worlds

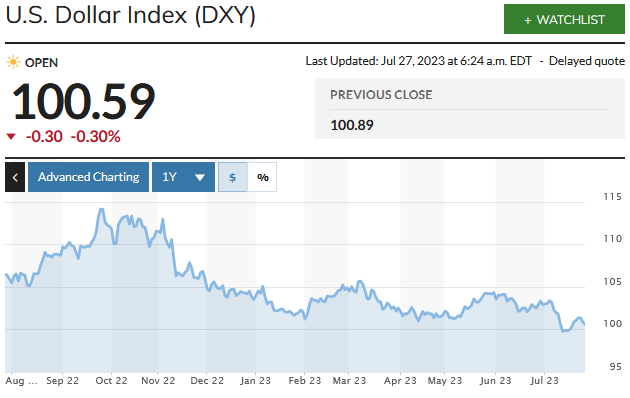

That large cash position means GOOG is actually a beneficiary of rising interest rates – and the Federal Reserve increased the Fed Funds rate by another 0.25% just this week. However, investors should understand that, despite the Fed’s rate increases, the U.S. dollar has actually been on a downward trend since last fall:

MarketWatch

The point here is that from an interest rate standpoint, Google is benefiting from the best of both worlds: Relatively high interest rates enables it to receive strong interest income on its big cash position, while the falling U.S. dollar is removing the severe foreign exchange headwind that it faced for most of last year – an FX headwind that was one big reason for the 2022 bear-market in technology stocks.

Microsoft

Now let’s compare Google’s results to Microsoft’s Q4 FY23 results, highlights of which were:

- Revenue was $56.2 billion, +8.3% yoy and a $710 million beat.

- Diluted EPS was $2.69 (+21% yoy) and a $0.14 beat.

- Azure and other cloud services revenue growth was 26%.

- Overall, “Intelligent Cloud” Segment revenue grew $3.2 billion, or 15% yoy.

Overall, Microsoft’s top and bottom line growth was a bit stronger than Google.

And, like Google, Microsoft also is cash rich and ended the quarter with $111.262 billion in cash, cash equivalents, and marketable securities. That’s an estimated $14.90/share based on the average outstanding shares of 7.467 billion at the end of the quarter. As a result, MSFT also is benefiting from higher interest rates and a decline in the FX headwind that has negatively impacted its top- and bottom-line results last year.

In the Q4 presentation, Microsoft reported it generated $19.8 billion of free cash flow (see slide 5). That was +12% yoy and equated to 35.2% of total revenue. In comparison, Google grew its FCF by 73% yoy and its FCF margin in Q2 was 29.2%.

Microsoft spent $5.7 billion on share repurchases during the quarter. However – and unlike Google – MSFT’s buybacks are barely keeping up with dilution via employee stock grants. I say that because Microsoft’s average outstanding share count only shrank by an estimated 0.5% over the past year while GOOG’s average share count was down by 3.8%.

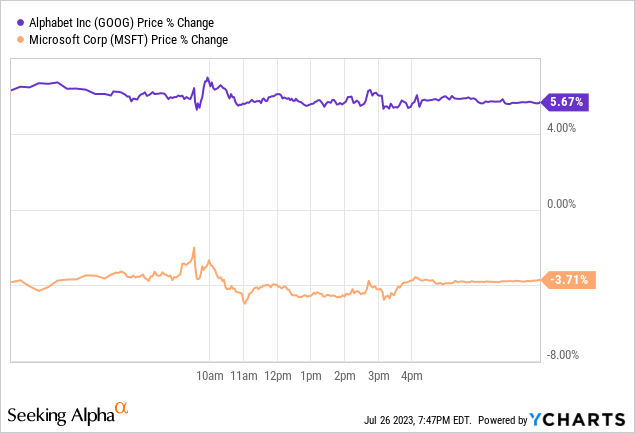

Both companies performed very well during the quarter. However, as mentioned earlier, the popular narrative set expectations very high for Microsoft and quite low for Google. As a result, Microsoft’s results – despite being a beat on both the top and bottom lines – was somewhat of a disappointment as compared to overly optimistic “whisper numbers.” Meantime, Google outperformed expectations and surprised analysts to the upside. That being the case, the stocks moved in opposite directions Wednesday:

Valuation

The following chart compares Google and Microsoft on several valuation metrics:

|

TTM P/E |

Fwd P/E |

Q2 FCF |

Q2 FCF Margin |

Yield | |

| GOOG | 29.5x | 22.9x | $21.8 billion | 29.2% | N/A |

| MSFT | 36.6x | 31.9x | $19.8 billion | 35.2% | 0.78% |

Clearly, Microsoft currently commands a premium valuation as compared to Google and I suppose an extra 6 percentage points of FCF margin is worth a higher valuation. One also could argue that MSFT’s subscription-based model deserves a premium vs. GOOG’s advertising centric business. But is it worth a 20% higher valuation on a TTM basis and a ~30% premium on a forward P/E basis? That’s not as clear to me – especially considering that GOOG’s share repurchase plan is having a much more significant impact on reducing its outstanding share count as compared to Microsoft’s (-3.8% versus -0.5% on a yoy basis). In addition, Google management definitely got the message when it comes to boosting its overall efficiency: FCF margin increased 11 full percentage points (29.2% vs. 18.1% on a yoy basis).

Observations

Going forward, both companies will be beneficiaries of AI: Both in their base businesses and in the growth of their cloud businesses. We haven’t heard from Amazon yet, but one message investors should receive from Google and Microsoft’s Q2 earnings report is that migration to the cloud continues to be robust – and that’s likely to continue for the foreseeable future. I say that because AI is relatively useless without large language models (“LLMs”) and mega data sets to run the AI algorithms on – and all that information will need to reside on the cloud. That being the case, any company wanting to get the full benefits of AI will have to migrate their company’s databases to the cloud. As a result, expect Amazon, Microsoft, and Google to continue strong momentum in their cloud offerings for years to come – and for them to further integrate AI tools into those cloud businesses.

Summary and Conclusions

Both Google and Microsoft delivered strong Q2 results. However, due to a bit of AI/ChatGPT-based over enthusiasm, MSFT’s stock and valuation had run too far too fast and expectations for the quarter were very high. On the other hand, expectations for Google were low, and the company significantly cleared the low bar that had been set for it.

Bottom line: Google is one of the best technology companies on the planet, generates tons of FCF, and is excellently positioned to leverage AI in both its Search and Cloud businesses. Indeed, as shown earlier – Google also is leveraging AI.

GOOG is a Buy and should be considered a core long-term technology holding within a well-diversified portfolio. The same can be said about Microsoft, although – in my opinion – at this time GOOG appears to be the better value.

In addition, the bullish investment thesis in AI/cloud is also applicable to companies like Broadcom (AVGO) and DataDog (DDOG). Broadcom makes the highest performance networking equipment on the planet (i.e. high bandwidth, low latency) that’s required to quickly move huge volumes of data to/from the cloud. Broadcom stock is +61% this year. DataDog specializes in data aggregation, monitoring, and analytics. DDOG stocks is +24.7% since my Buy recommendation in February (see Datadog And 2 Other Sure-Fire Winners In The AI Arms Race).

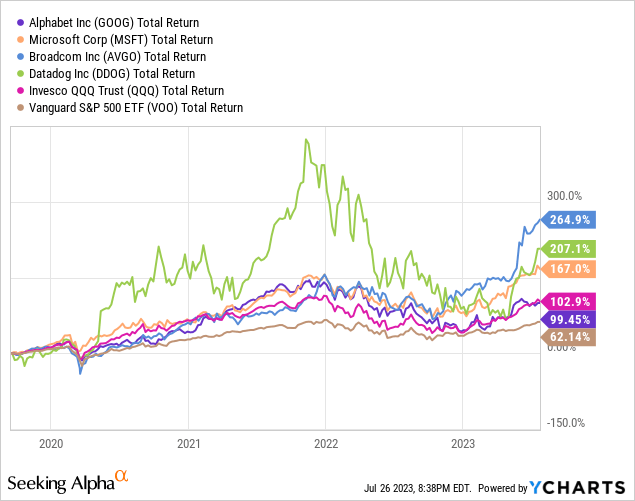

I’ll end with a five-year total returns chart comparing the four companies discussed in this article as compared to the broad market averages as represented by the Invesco Nasdaq-100 Trust (QQQ) and the Vanguard S&P 500 ETF (VOO) and note that – in my opinion – we’re still in the very early innings of both the cloud and AI:

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AVGO, DDOG, VOO, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.