Summary:

- Adobe’s shares have seen significant appreciation right before and after its latest earnings report. Since EPS and revenue results were in-line, it appears to be due to forward-looking bullishness.

- This is sensible due to the company having already delivered generative AI capabilities into the market, with the goal of continuing to do so, creating a potential tailwind ahead.

- My conviction in this materializing is increased due to the quality of execution we are seeing by Adobe thus far. The firm is integrating generative AI into existing customer workflows.

- The early customer interest that Adobe has seen, along with its proper execution, and its relatively-cheap historical valuation, all lead me to conclude that ADBE stock is a buy.

Michael Vi/iStock Editorial via Getty Images

Overview

Adobe (NASDAQ:ADBE) shares have had an interesting trajectory throughout this year. While trading below the NASDAQ Composite’s price return throughout most of the first half, its shares saw significant appreciation in the run up to its latest earnings report. These gains have persisted, and another round of buying appears to have taken hold here in late July. The stock nonetheless continue to trade cheaper than its all-time high of $670.

The latest earnings report that appears to have catalyzed Adobe’s price gains was good but not particularly outstanding as to performance against consensus EPS and revenues. This indicates that investors may have found something else to like with Adobe’s business. While the elephant in the room here is evidently the Figma acquisition, Q2’s earnings report did not solidify anything around this.

Rather, it seems that successfully bringing artificial intelligence capabilities to market is the likely driver of optimism here. Adobe appears to be a credible AI player just as the technology is coming out of the gate. This has been made evident by demonstrations around Adobe’s new AI features in Photoshop as well as the technology it has in general, which it has named Firefly. Firefly has been stated to be a more generalized tool – a ‘family of creative generative AI models’.

This is well and good, demonstrating a clear value proposition for Adobe’s user base. While the exact financial impact of generative AI for the company’s business is as yet unclear, it is evident that the company is delivering real value to its customers through this technology. Customers have already used the tool hundreds of millions of times as of the last quarter. This is certainly more than can be said for most companies in the market at present, and I consider it a fair reason for its future prospects to have been repriced higher by the market.

Of course, the question is now whether the market is getting ahead of itself. This will warrant a review of Adobe’s financial trajectory as well as its valuation to see if this may be the case. This should give us a clearer view on where things are headed for the next few quarters.

Select Financials

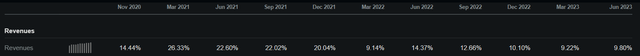

Revenues have grown consistently y/y, albeit now entering the high single-digits as of the last two quarters. For a company doing close to $5B a quarter in top line I still consider that to be the healthy. It also doesn’t seem that these figures are set to decline any further, with the latest quarter’s y/y revenue growth already a bit higher than the low point of Q1 ’23.

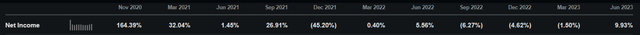

The profitability picture here is more murky. Far from being as consistent as the firm’s revenue growth, we can see that net income actually decreased y/y for 3 out of the last 4 quarters. This could indicate difficulties in terms of maintaining margins.

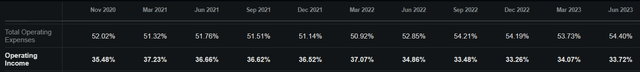

Looking over at operating margin, however, this does not appear to be the case – at least not in the most recent periods. Last quarter’s operating margin of 33.72% was well in line with what the company has been putting up over the last year. The caveat here, as I see it, is that operating margins appear to be holding steady at a somewhat lower level structurally. While 2021 saw Adobe posting operating margins in excess of 35%, this hasn’t happened for 5 quarters running and likely won’t. This drop-off in operating margin seems to account for the hits to net income over recent periods.

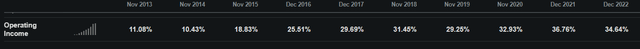

Current margins are nonetheless quite good relative to historical norms; over the last decade, this figure has fluctuated significantly for Adobe. Given the changing economics of software over this period I would expect the current levels to persist, namely 32% or higher operating margin for Adobe.

The company’s balance sheet also remains sound, with $6.6B in cash on hand and roughly double the amount of assets versus liabilities outstanding.

This brief financial review indicates that Adobe is maintaining its recent trendline as to performance. Essentially, its financials have yet to reflect any benefits from generative AI. They are statistically right where we would expect them to be had the firm not released Firefly. Additionally, it appears to have faced a very slight decline in margins over the last two years. This allows us to contextualize current appreciation as forward-looking as opposed to being reflective of changing fundamentals.

Risks and Valuation

As mentioned above, it is clear that Adobe stock is trading higher in advance of any changes to its actual financial performance. This means that this stock is trading on momentum and future growth prospects at the moment. The core risk that gets created here is then that investors’ expectations aren’t met, or simply not met soon enough, and that the stock gets sold off as a result. We can see how expensive Adobe is relative to its own trading history by considering its historical multiple.

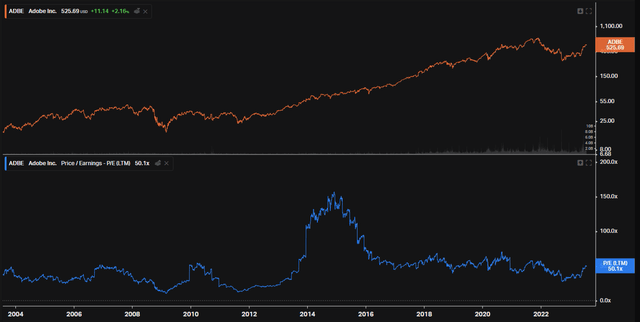

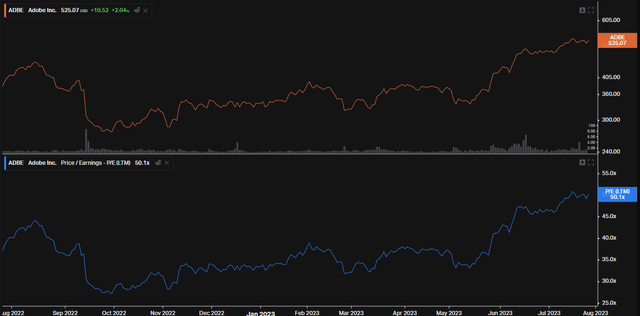

Looking at Adobe’s P/E ratio over its trading history, we can surmise that it is not actually particularly expensive at the moment. We can see that its current trailing P/E multiple of 50.2x is nowhere near all-time highs and indeed quite close to where it has traded over most of the last 7 years.

On a more granular timeframe, however, the story is different. Adobe stock is trading more expensively than it has been at any point over the last year. This makes sense given that the stock is appreciating in advance of fundamental improvements.

This provides me with additional conviction that the stock is trading on the basis of momentum and a positive reassessment of its future growth expectations.

Future Growth Prospects

The fact of the matter here is that Adobe’s future growth profile is credibly set to improve. The company has generative AI in its products and these tools are being used by customers at this very moment. Given the material productivity enhancements that visual design professionals can gain from Firefly in Photoshop, I believe that this can act as a positive force for Adobe’s top line.

While Photoshop may be leading the pack in terms of delivering generative AI value to the market, it is far from the only card in Adobe’s hand. As mentioned, the Firefly technology is actually a set of large language models designed for each of the various creative use cases that Adobe enables through its software suite. The company is bringing this technology into its Document Cloud (Adobe Acrobat) as well, with a more nascent offering called ‘Liquid Mode’ that allows PDF’s to be readily resized and ported to different-sized screens. It has also brought Firefly into its content management system offering, enabling a higher level of analytics for customers that use it to manage customer workflows. All of this bodes well for Adobe.

Conclusion

While it has been made clear that Adobe’s financial statements have yet to benefit from its AI rollout, I think we are still in the first inning here and find myself optimistic for the future. This is because of the stellar execution that we are seeing from Adobe. The innovations that Adobe is bringing to market are tailored to existing customer workflows and are thus much more readily commercializable. Adobe is not trying to reinvent the wheel or create the best AI system around. Rather, they are tactically inserting AI capabilities into products that customers already use. The significant early uptake, as well as the simple logic of this, again bode well for the firm.

All of this leads me to conclude that Adobe is a large company that is genuinely on its front foot when it comes to delivering AI-enabled software. While I would reiterate the risk of the company not being able to drive marginal revenues or profits through this in the near-term, I certainly think that it can do so over the medium term (1-3 years). This is again due to the firm already delivering products with real value to its customers. When we consider that the valuation here is still not expensive relative to historical norms, it presents a clear bull case for the stock. On this basis I am calling Adobe a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.