Summary:

- The DCF model, based on analysts’ expectations, indicates a present fair price of $597 and a future target of $1069.12 when incorporating Figma’s projections.

- The Figma deal’s approval will significantly impact Adobe’s near-term performance, with potential stock value fluctuations based on market sentiment.

- For sustained success, Adobe must defend its market share from smaller competitors through strategic M&As, avoiding excessive debt and margin erosion.

- Macroeconomic risks, like a recession caused by Federal Reserve actions and inflation, may affect Adobe’s revenue due to potential budget cuts by companies.

- Despite uncertainties, a medium to long-term investment approach supports the idea of initiating a position in Adobe due to potential gains and future prospects.

Santiaga

Thesis

In my previous article, I assigned a stock price target to Adobe, Inc. (NASDAQ:ADBE) at $910 for 2028. However, I must emphasize that there was an error in the DCF calculation, which resulted in displaying only the future value instead of the present value. Regardless, my projections for Revenue, Net Income, EBITDA, and EBIT are nearly on track to be met. Additionally, the Q3 and Q4 results have not been released yet, but I believe Adobe will likely achieve them with ease.

In this article, I will analyze the impact of the Figma deal on Adobe’s revenue. However, even if the deal doesn’t go through, I still consider Adobe a strong buy. The present value of my previous DCF is $490.95, and as you know, the current price of Adobe is $521.13, which is 6% above the fair price indicated by my DCF. For 2028, I am increasing my previous future target to $1012. Considering the current prices, this would mean an annual return of 16% from 2023 to 2028.

Finally, it is important to note that my revenue projections were lower for 2023 and 2024 compared to analysts’ expectations (you can find those expectations in the “summary” section of Adobe’s quote on Seeking Alpha).

Overview

Figma is a collaborative web application for interface design. One of the main reasons behind Adobe’s decision to acquire Figma (a deal that was announced in September 2022) is to maintain a competitive edge in the design software market. As is well-known, creating web applications and software requires relatively little capital investment, which opens the door to the possibility of new competitors emerging. Consequently, major companies like Adobe utilize their significant financial resources to acquire such ventures and continue leading the industry.

Another compelling reason for the acquisition is to enhance Adobe’s collaboration tools. Figma’s application facilitates real-time teamwork for teams, and Adobe intends to leverage it to improve its own collaboration tools, including Adobe XD.

Lastly, the acquisition aims to capitalize on Figma’s existing customer base and expand its reach to new audiences.

Why $20 billion?

Figma is currently valued at $10 billion, not $20 billion, which suggests that the acquisition might involve an overpayment. Nevertheless, Figma boasts an impressive gross profit margin of approximately 90% and has already secured prominent clients such as Kimberly-Clark Corporation (KMB), Microsoft Corporation (MSFT), and Salesforce, Inc. (CRM). While Figma is projected to generate $400 million in annual recurring revenue, this amount pales in comparison to Adobe’s revenue.

However, the question of why Adobe acquired Figma remains unanswered. The most probable answer is that this move showcases Adobe’s determination to prevent nimble start-ups from chipping away at their market share. Figma posed a potential threat in this regard because, as a web application, it required less computing power, resulting in cost savings on PC purchases. Their objective was to match the power of Adobe’s software but on a web-based platform, and they were making progress until Adobe decided to acquire them. Regardless, the CEO of Figma seemed content with the acquisition, as he expressed in an interview:

“If we want to go and make it so that we’re able to go into all these more productivity areas, that’s gonna take a lot of time. To be able to go and do that in the context of Adobe, I think gives us a huge leg up, and I’m really excited about that,”

Furthermore, Figma offered a free subscription, albeit with the restriction of not being able to work in a team. However, this proved to be highly advantageous for young designers without the financial means, as it allowed them to neutralize the risk of investing a significant amount of money into a tool that might not yield the desired results in the end.

Figma’s numbers

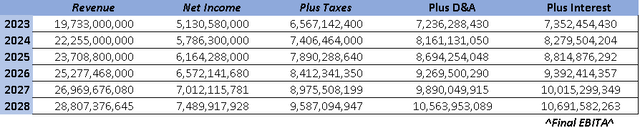

In 2021, Figma’s revenue was $210 million, and their projections for 2022 exceeded $400 million. As a small company, they were at a stage where they were doubling their revenue every year. Now, let’s take a look at the revenue projections until 2028:

| Year | Sacra Projection |

Grand View Research Projection |

| 2022 | $400 million | $400 million |

| 2023 | $500 million | $520 million |

| 2024 | $625 million | $660 million |

| 2025 | $781 million | $820 million |

| 2026 | $974 million | $990 million |

| 2027 | $1,208 million | $1,180 million |

| 2028 | $1,500 million | $1,390 million |

As you can see, Sacra’s projections are slightly more optimistic in the final years, whereas Grand View’s are more conservative in the initial years. Despite this difference, both sets of projections are quite similar. Therefore, during the valuation process, I will primarily rely on Sacra’s projections, with one exception: for 2023, I will still utilize the figure of $400 million.

Valuation

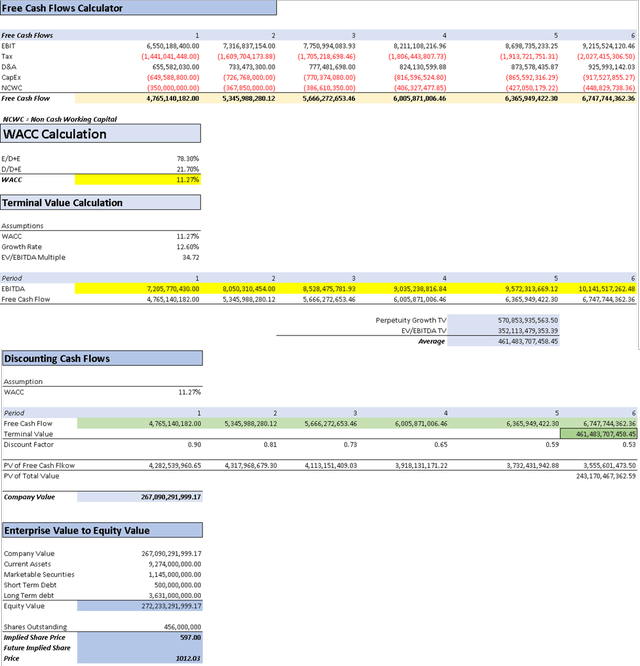

Previous Valuation:

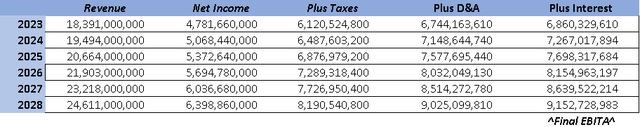

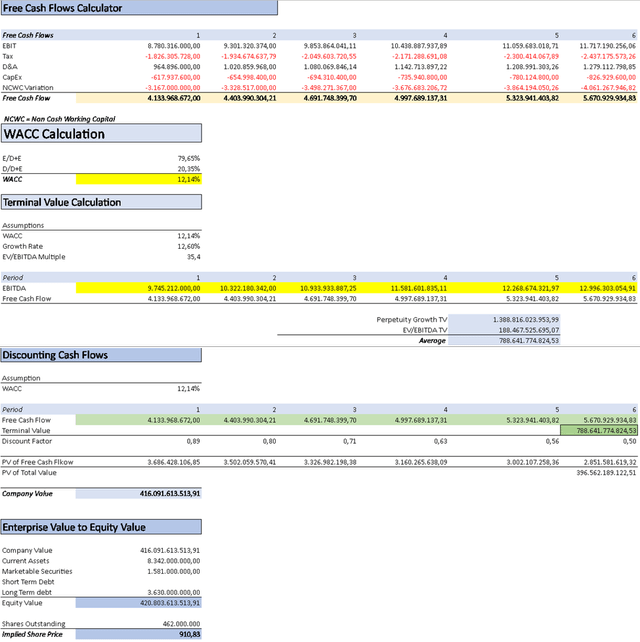

First and foremost, I will present my previous expectations along with the earlier DCF model, which I addressed in the thesis section of this article. It is important to note that the DCF model had an error that caused it to display the future value instead of the present value.

Previous Revenue Projections (Author’s Calculations) Previous DCF (Author’s Calculations) Previous Current & Future Stock Price Targets (Author’s Calculations)

As you can observe in my previous DCF model, the future stock price is projected to be $911.33, and the present fair value was estimated at $490.95. However, since Adobe has already released its Q2 earnings and certain aspects have changed, it is no longer realistic to stick with those initial projections. The Q2 results have practically met my expectations, making it unrealistic to assume that Adobe will not generate additional revenue from this point until its Q4 earnings.

Without Figma:

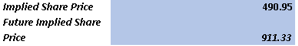

Now, I will rely on the revenue expectations provided by Seeking Alpha, which you can find in the “summary” section of Adobe’s stock quote.

Revenue Projections without Figma (Author’s Calculations) DCF without Figma (Author’s Calculations)

Considering these revised expectations and excluding the Figma deal, the present fair price of Adobe’s stock is calculated to be $597, with the future target increasing to $1012.03.

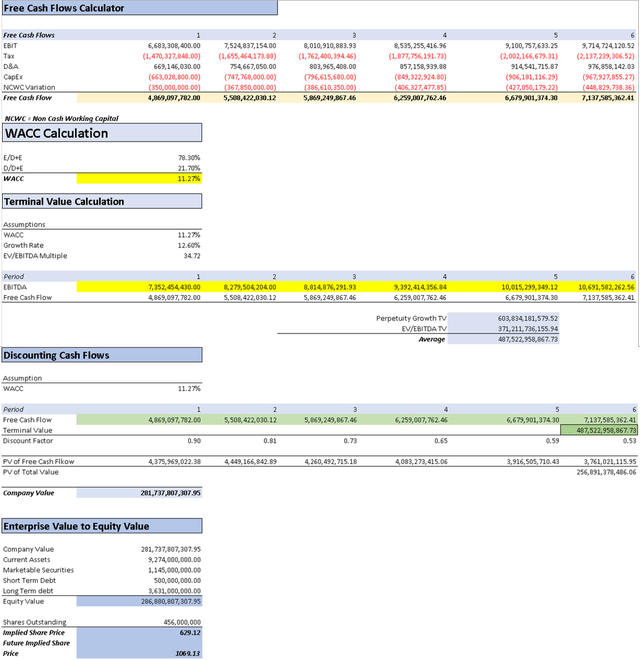

With Figma:

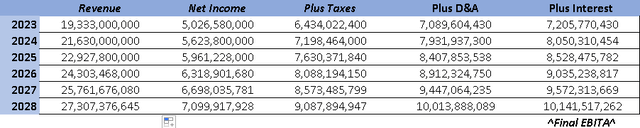

Revenue Projections with Figma (Author’s Calculations) DCF with Figma (Author’s Calculations)

As you can see, the overall scenario changes significantly with the inclusion of Figma’s projections. The suggested present value rises to $629.12, while the future value increases even further to $1069.12.

Then, is it undervalued or overvalued?

A DCF model is regarded as “intrinsic,” meaning it represents the real value of a company. However, the market may still value companies above or below their intrinsic value, indicating that other variables come into play.

Now, you might wonder how the fair value went from $490 to $597. Well, when I adjusted my initially conservative expectations to align with those of the analysts’, it added around $2 billion more in revenue to the equation. This, in turn, resulted in the compounding of those $2 billion when applying the 6% annual revenue growth, leading to an increase in the free cash flow.

Despite this, in the current market climate, reaching the $597 mark in a full-scale bull market would not be a challenge for Adobe. However, as we are not precisely in one, and there’s a debate over the market’s status, I will still stick to the fair value of $490. Nevertheless, I would raise the 2028 target to $1,012, implying an annual return of 15% until 2028. So, in essence, the stock remains a “strong buy” for those unfazed by the near-term headwinds (as it is overvalued by 6%). On the other hand, for traders or those considering near-term call options, buying the stock at the current level could be risky, making it a “hold” in such cases. Personally, I would be willing to buy the stock at the current level and consider adding more if it goes down, as long as the expectations remain attainable. The potential acquisition of Figma could be a catalyst for either a stock surge or decline, and the verdict, expected on August 7, will play a crucial role.

Furthermore, I want to clarify that if these price targets seem excessively high, keep in mind that the longer the projection period, the higher the target price will be. This is because a company can generate more cash flow/earnings over six years than over two years, which is the typical length analysts use for projections.

Risks to thesis

In the near term, my “strong buy” rating may be impacted if Figma’s deal isn’t approved, potentially causing the stock to decrease to its fair value of $490, mainly due to market sentiment.

Looking ahead to the long term, sustaining my “strong buy” rating for Adobe would hinge on the company’s ability to fend off smaller competitors and preserve its market share through strategic mergers and acquisitions (M&As). However, it’s crucial to be cautious about the speed at which competitors could emerge in this sector. Excessive M&As could lead to significant debt issues and erode margins, ultimately harming Adobe’s currently excellent balance sheet.

Figma, as a stand-alone company, has proven its ability to innovate rapidly, making it a worthy competitor. In the event the acquisition is blocked, Adobe might need to replicate Figma’s model to remain competitive. Despite Adobe’s advantage in size during a price war, it may still acquire Figma at a discount, but inheriting potential debt from such a scenario could be detrimental. Hence, it would be better for Adobe to engage in a price war and let Figma sink into bankruptcy.

Moreover, there is a macro risk to consider, such as a recession, potentially caused by the Federal Reserve’s rate hikes and inflation eroding consumer purchasing power. As companies experience a drop in revenue, Adobe, as a provider of productivity software, could be subject to budget cuts.

I want to reiterate that my “strong buy” rating is based on my medium to long-term investment approach. In my view, there is enough potential for gains from investing in Adobe to warrant starting a position in the stock.

Conclusion

In my analysis, I’ve looked into Adobe, Inc. and its potential acquisition of Figma, which has given me valuable insights into the company’s future prospects. By applying the discounted cash flow [DCF] model, I considered both my own expectations and industry analysts’ views, leading to varying fair value estimates for Adobe’s stock. Without the Figma deal, the present fair price was calculated to be $597, but with Figma’s projections, the future target increased to $1069.12.

The decision on the Figma deal carries significant weight in shaping Adobe’s trajectory. If the acquisition is not approved, the stock’s performance might suffer in the near term, potentially resulting in a decline in its value driven by sentiment. On the other hand, a successful acquisition could strengthen Adobe’s market position and contribute to its long-term growth.

In the long run, I believe sustaining a “strong buy” rating for Adobe depends on its ability to fend off smaller competitors and protect its market share through strategic M&As. However, it’s essential to exercise caution to avoid excessive debt and margin erosion resulting from numerous acquisitions.

Figma, as a standalone company, has demonstrated its agility in innovation and poses as a worthy competitor. If the acquisition is blocked, Adobe may need to adopt aspects of Figma’s model to remain competitive. Although Adobe’s size provides an advantage in a price war, the company should carefully consider the potential risks and debt associated with acquiring Figma at a discount in such a scenario.

Considering my medium to long-term investment approach, I still believe there is enough potential for gains in Adobe’s stock, warranting the initiation of a position. The ultimate decision on the Figma deal and Adobe’s strategic moves in the face of competition and market uncertainties will undoubtedly shape the company’s future performance and investor sentiment. As investors, we should carefully assess our risk tolerance and investment horizon when considering our positions in Adobe, taking into account the potential outcomes of the Figma acquisition and macroeconomic conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ADBE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.