Summary:

- Roku reported a strong Q2’23 with results smashing analyst consensus estimates.

- The company provided tepid Q3 guidance, but the video streaming platform has a trend of providing conservative guidance.

- ROKU stock is cheap trading at less than 3x ’24 sales while holding $1.8 billion in cash.

Justin Sullivan

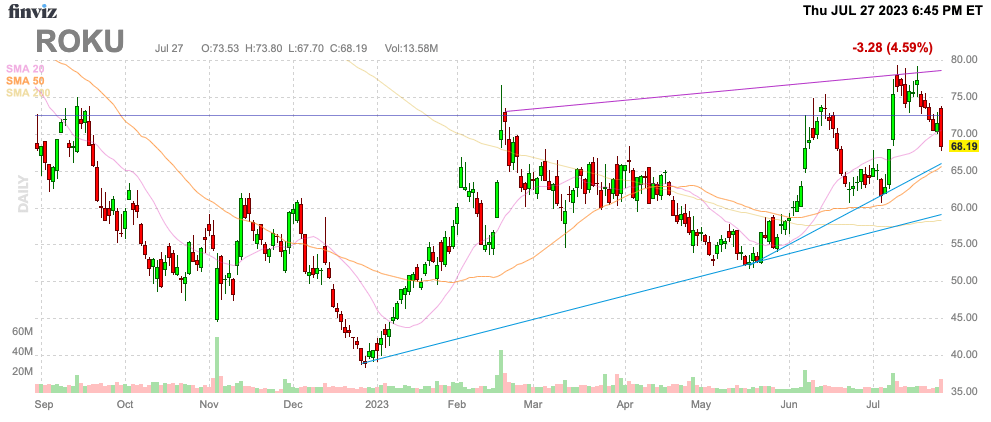

The promises of Roku (NASDAQ:ROKU) are starting to shine through the business after a tough last year. The video streaming platform continues to recover from a difficult TV advertising market, especially considering their existing position in the scatter market. My investment thesis remains ultra Bullish on the stock following a strong Q2’23 and the potential breakout of Roku.

Source: Finviz

Q2 Rebound

While economist still debate whether the U.S. economy will enter a recession later this year, the ad market had a brutal 2022. The numbers from Roku would even suggest the ad market is entering its own recession.

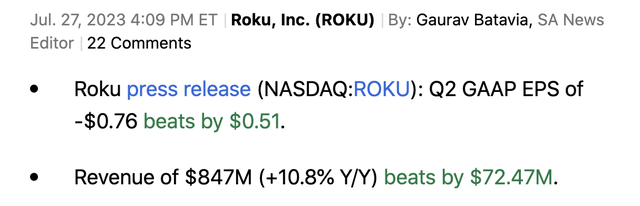

The Q2’23 results from Roku are supportive of an improving business as follows:

For the first time since Q3’21, Roku reported accelerating growth. The video streaming platform went from 50% sales growth in the September quarter about 2 years ago to sub-1% growth in the prior 2 quarters. Roku reported nearly 11% growth in the last quarter for a big jump.

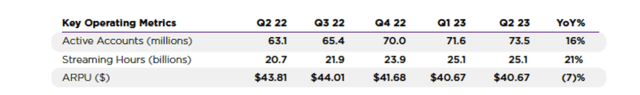

One of the prime reasons to previously expect this growth to return is the metrics on active accounts and streaming hours. Roku has continued to post numbers in these categories right around 20% annual growth.

Source: Roku Q2’23 shareholder letter

Ultimately, Roku should be able to monetize these users at higher points providing juice to the revenue growth above the viewership levels. Right now, ARPU is down 7% YoY to $40.67, though flat with the prior quarter.

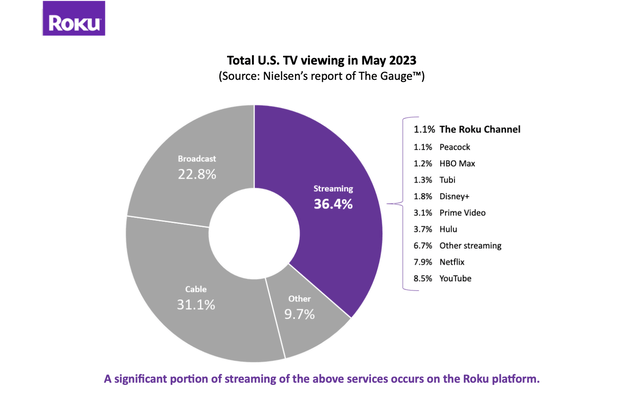

This monetization issue is mostly due to a tough ad scatter market and Roku not previously having upfront ad deals. These issues are automatically resolved over time. As Roku highlighted in the shareholder letter, The Roku Channel is already a powerhouse in the streaming category.

Source: Roku Q2’23 shareholder letter

The huge revenue rebound in Q2 helps tremendously on the bottom line where the market feared the ongoing large losses. For Q2’23, Roku reported an adjusted EBITDA loss of only $17.8 million.

The quarterly EBITDA loss had jumped up to ~10% of revenues in the last couple of quarters. The revenue rebound combined with controlled costs dramatically cut the adjusted EBITDA margin loss to only 2.1%.

The company is only rolling out the Shoppable Ad technology with Shopify (SHOP) after already having a deal with Walmart (WMT). The ability to directly buy a product seen in an ad on Roku is the holy grail of advertising versus hoping to drive a future transaction.

Mixed Guide

While Q2 was surprisingly bullish, the guidance for Q3 left investors wanting more to guarantee a breakout of the stock. Roku guided to Q3’23 revenues of $815 million, above consensus estimates of $808 million, while guiding to a $50 million adjusted EBITDA loss.

The Q3 forecast tops the original guidance for Q2 of $770 million, but the number suggests a major dip from the $847 million just reported. The market won’t appreciate adjusted EBITDA dipping back to a major quarterly loss of $50 million after the huge improvement just reported in Q2.

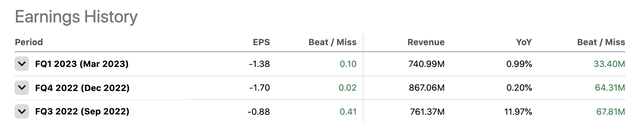

Roku has a recent trend of under promising and over delivering. Including the Q2’23 number not in this table, the video streaming platform has exceeded consensus revenue estimates by at least $33 million each quarter and has beaten those estimates by at least $64 million in 3 of the 4 quarters.

The stock trades under 3x 2024 sales targets. Any weakness provides a great opportunity to load up on Roku here prior to a potential breakout above the $70 to $75 range before the ad market fully rebounds.

Roku has a massive cash balance of $1.8 billion with a market cap below $10 billion. The company isn’t burning a lot of cash from operations, though purchases of property and equipment has utilized $70 million worth of cash in the 1H’23.

The company is guiding to adjusted EBITDA profits for 2024 providing a big key to the investment thesis. Once Roku can convince the market the cash burn is negligible going forward, investors will view the stock with an enterprise value of only $8 billion here adding to the discounted value.

Takeaway

The key investor takeaway is that Roku reported a strong Q2 while providing tempered guidance for Q3. The market appears bullish on the stock in after-hours trading, but investors shouldn’t be shocked with some pullback. Investors should buy any weakness in the stock as Roku appears poised to report strong numbers in 2024 when the ad market normalizes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free 2-week trial.