Summary:

- Many analysts have pointed to the recent margin decline in Tesla, Inc. as a sign of future challenges.

- Tesla’s margin flexibility gives the company a significant advantage in the coming battle against traditional automakers.

- Wall Street has rewarded companies with higher revenue growth rates and modest margins compared to companies with modest revenue growth and high margins.

- Even at 25% YoY revenue growth, Tesla’s annualized revenue should hit $500 billion by 2030, giving the company more than 20% revenue share in annual auto sales.

- Long-term investors should focus more on the revenue growth trajectory to gauge the return potential in Tesla stock.

SimonSkafar

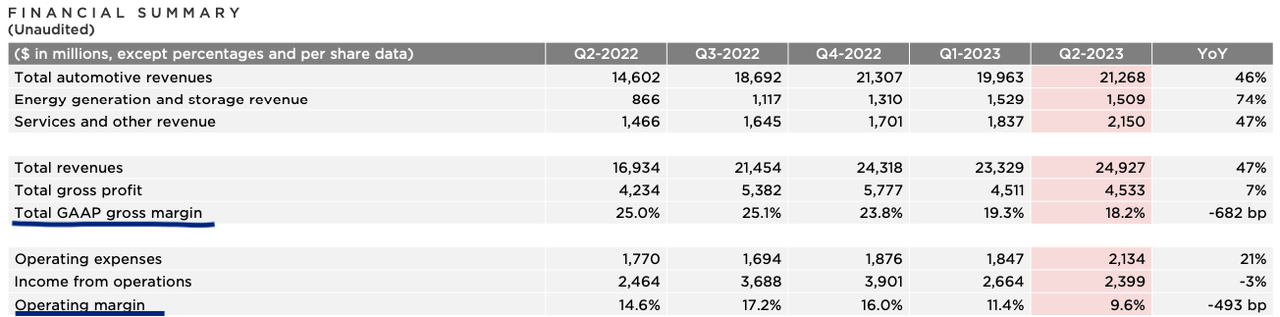

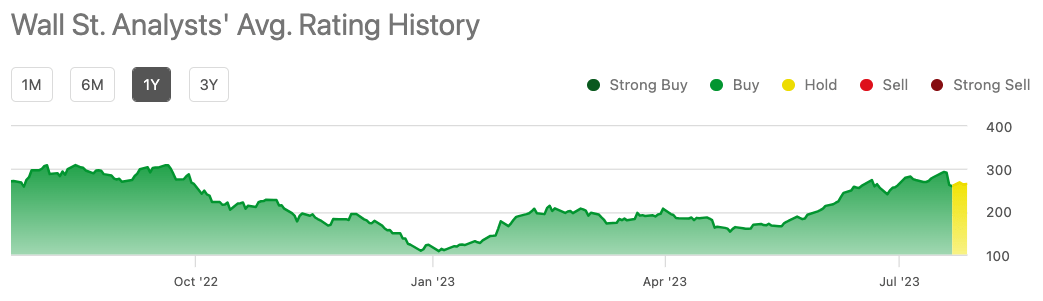

Tesla, Inc. (NASDAQ:TSLA) reported a 6.8 percentage point decline in gross margin in the recent quarter compared to the year-ago quarter. This has led to many analysts sounding alarm bells over the long-term performance of the stock. The average rating for Tesla stock among Wall Street analysts has also moved to Hold after more than a year of Buy rating.

All the bearish calls for Tesla stock point to the recent margin declines. However, it should be noted that the company has a lot of flexibility in terms of margins and pricing. Tesla can sacrifice margins for a few quarters to boost revenue growth. This is not possible for traditional automakers who have significantly lower margin flexibility.

Tesla has delivered close to a 50% compound annual growth rate for revenue over the last ten years as its ttm revenue increased from $1.7 billion in 2013 to $94 billion in the recent quarter. Tesla’s management has forecasted a similar 50% annual growth rate till 2030. Even if the company delivers half of this, at 25% CAGR Tesla’s revenue base would touch $500 billion by 2030. A lot depends on the future product lineup and manufacturing expansion. But a higher revenue base opens up greater monetization options for Tesla beyond the margins obtained by selling cars. Tesla stock looks pricey due to the recent margin dip, but the long-term return potential remains quite robust.

A big advantage over competitors

Tesla has an advantage in terms of product engineering when compared to other big automakers who are now trying to shift towards an electric vehicle (“EV”) manufacturing supply chain.

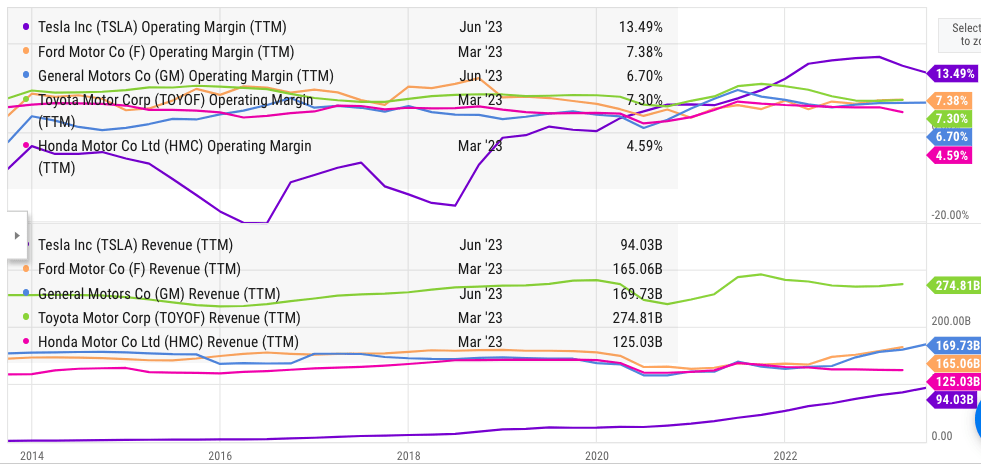

But Tesla also has a major advantage in terms of margin flexibility. Over the last ten years, Tesla’s operating margin has been as low as negative 21% in Q1 2016 to a peak of 19% in Q1 2022. On the other hand, most of the major automakers including Ford Motor Company (F), General Motors (GM), and others have delivered operating margins in a narrow range of 3% to 8%.

YCharts

Figure 1: Comparison of operating margin and revenue between Tesla and other automakers. Source: YCharts.

This margin flexibility was a key reason behind the massive revenue growth of Tesla in the last ten years, while all other traditional automakers showed a stagnant revenue base. Many automakers also pay massive dividends, which further reduces the ability of the management to make big changes in the operations.

Figure 2: Decline in gross margin and operating margin of Tesla in the last few quarters. Source: Company Filings.

This financial flexibility can be a big advantage in mature industries. As an example, we can look at the growth of T-Mobile (TMUS) over the last ten years, while Verizon (VZ) and AT&T (T) have been mostly stagnant. T-Mobile does not give any dividends, while AT&T and Verizon have to pay close to $10 billion annually towards dividends.

T-Mobile used this financial flexibility to give greater discounts to customers and increase investment in 5G network. The result is that T-Mobile stock’s total returns have significantly outpaced AT&T and Verizon. Tesla’s lack of dividends and margin flexibility will similarly help the company in the upcoming battle against traditional automakers as new EV models are launched by all major players.

Revenue vs. Margin

Wall Street has mostly given higher valuation multiples to companies that are able to deliver better revenue growth even at the cost of some margin decline. Tesla is an ideal example of this. The operating margin of Tesla is not significantly better than Toyota or other automakers. Due to the massive YoY revenue growth, the stock has received a valuation which would be impossible in this mature industry.

However, investors should buckle up for some short-term margin headwinds in Tesla. The average rating for Tesla stock by Wall Street analysts has turned to Hold after more than a year of Buy rating. This was mostly due to the recent margin decline. If we see another quarter or two of steep margin declines, the average rating could further dip into the Sell territory.

Seeking Alpha

Figure 3: Average rating of Tesla stock by Wall Street analysts.

Tesla has delivered a staggering 50% CAGR in revenue over the last ten years. The management has set a goal of a further 50% CAGR till 2030. Even if the company is able to deliver half of this growth, the revenue base of Tesla would be a staggering $500 billion at 25% CAGR till 2030. The total auto sales in 2022 were equal to $2.5 trillion. At a “modest” revenue growth rate of 25%, Tesla should have a revenue share of 20% within the entire auto industry by 2030. Higher revenue base also opens up new opportunities for monetization.

New monetization options

Many Big Tech companies have their stock valuation due to revenue streams that were initially not a core part of the company’s operations. A good example is Amazon (AMZN). Back in 2005, Amazon was considered as an e-commerce company only. The management had to build a massive tech platform in order to run its e-commerce operations. This tech platform eventually turned into Amazon Web Services, or AWS, which today contributes over 60% of the company’s operating margin and has significant standalone valuation.

Similarly, the growth of e-commerce sales helped Amazon build a subscription business that has over $35 billion in annual revenue. Massive customer engagement on the e-commerce platform also helped Amazon in building an online advertising segment that has now broken the duopoly of Google (GOOG) (GOOGL) and Meta Platforms (META) in digital advertising. Amazon’s AWS, subscriptions, and advertising segment have higher margins and growth than the traditional e-commerce platform.

Apple (AAPL) has also gained a good advantage from services that were not a core part of the company. There has been massive growth in licensing revenue from Google which has very high margins. Apple’s App Store also brings in a high-margin revenue stream through commissions.

Tesla is likely to gain good monetization options as its revenue base increases. Charging networks and autonomy are generally considered future margin expansion services. However, there could be a lot more options that are not clearly visible at this point. A bet on Tesla stock is also a bet on the ability of the management to open up new high-margin monetization options.

Future trajectory of Tesla stock

It is highly likely that Tesla’s management would be able to deliver strong revenue growth in the next few years. They have an advantage in terms of product lineup as well as margin flexibility to absorb short-term losses. But we could see some short-term correction in the stock if the quarterly operating margin declines to low single digits. Investors with a longer-term outlook could take advantage of this correction.

As pointed out above, even with a 20% to 25% CAGR, Tesla should be a market leader by 2030 with a revenue base of close to $500 billion. There are many monetization options that can allow the company to improve margins over the long term. Strong revenue growth and new high-margin segments should improve the long-term returns potential of Tesla stock.

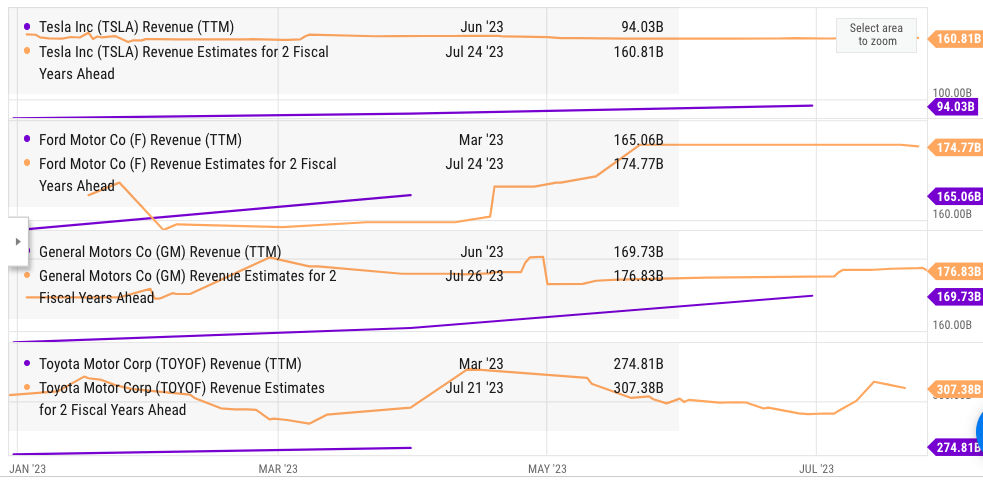

YCharts

Figure 4: Revenue estimates for 2 fiscal years ahead for Tesla and other rivals. Source: YCharts.

The consensus estimate for 2 fiscal years ahead shows that all the traditional automakers would deliver modest single-digit growth while Tesla could show more than 30% YoY revenue growth. The higher revenue base and growth rate of Tesla could lead to a rapid decline in market share for these traditional automakers. Reuters has recently reported that seven major automakers are forming a company to build a national EV charging network that will rival Tesla’s supercharger network. This shows the threat felt by traditional players due to the growth of Tesla’s market share in total auto sales. Tesla stock is a bit pricey at a P/E multiple of 75, but the long-term revenue growth and future monetization options make it a good bet.

Investor Takeaway

Tesla’s recent margin dip has raised concerns regarding the future profitability of the company. However, this margin flexibility also gives the company a big advantage over other automakers. We will be seeing a major churn within the auto industry in the next few years. If Tesla is able to deliver a reasonable 25% YoY growth rate, its revenue base would be $500 billion by 2030. This would be close to 20% of the total revenue share in the world.

More monetization options will likely open up for Tesla, Inc. as it corners greater market share within the auto industry. This should help Tesla report better margins and improve the future revenue growth runway.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.