Summary:

- Exxon Mobil Corporation’s Q2 results were generally worse than last year’s due to crude oil and natural gas prices being lower.

- The company’s production was flat YOY, which is in line with what we are seeing across the sector.

- Exxon Mobil is having a great deal of success at achieving cost reductions, as these results were far better than Q2 2018.

- Crude oil prices are beginning to trend upward, and this could continue for the rest of the year, benefiting the company going forward.

- The stock is currently cheaper than the other supermajors, and does appear undervalued relative to forward earnings per share growth.

Detry26

On Friday, July 28, 2023, oil and gas supermajor Exxon Mobil Corporation (NYSE:XOM, “Exxon Mobil”) announced its second quarter 2023 earnings results. At first glance, these results appeared quite disappointing as the company failed to meet the expectations of its analysts on either the top or the bottom lines.

There were some good things here, though, such as the fact that Exxon Mobil’s refinery throughput set a new second-quarter record. The company is also making progress on its cost reduction efforts, which is nice because it should result in more money making its way through to free cash flow. Ultimately, though, the big question on the minds of most investors is almost certainly where the company is likely to go over the remainder of the year. That depends a lot on energy prices, but there are reasons to be optimistic about crude oil prices right now. I discussed that in a very recent article.

Exxon Mobil overall appears to be undervalued right now, so there are some reasons to consider it today, particularly if the thesis about rising energy prices proves to be accurate.

Earnings Results Analysis

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Exxon Mobil Corporation’s second quarter 2023 earnings results:

- Exxon Mobil Corporation received total revenue of $82.914 billion in the second quarter of 2023. This represents a 28.32% decline over the $115.681 billion that the company received during the prior-year quarter.

- The company reported an operating cash flow of $9.383 billion during the reporting period. That compares very unfavorably to the $19.963 billion that the company reported during the year-ago quarter.

- Exxon Mobil produced an average of 3.608 million barrels of oil equivalent per day in the most recent quarter. This represents a 3.32% decline over the 3.732 million barrels of oil equivalent per day that the company produced on average during the corresponding quarter of last year.

- The company reports that it is on track to deliver $9 billion worth of structural cost reductions by the end of the year compared to 2019 levels. The company has already managed to achieve $8.3 billion worth of these savings.

- Exxon Mobil reported a net income of $7.880 billion in the second quarter of 2023. This represents a substantial 55.85% decline compared to the $17.850 billion that the company reported in the second quarter of 2022.

It is essentially certain that the first thing that anyone reviewing these highlights will notice is that Exxon Mobil’s financial performance was generally much weaker than in the year-ago quarter. This is not particularly surprising since, as I have noted in numerous previous articles, crude oil and natural gas prices were lower during this quarter than they were last year. This is quite visible in this chart, which shows the price of West Texas Intermediate crude oil from April 1, 2022, to June 30, 2023:

It is a similar story with natural gas, except that those prices declined much more than crude oil over the period. However, 65.22% of Exxon Mobil’s production during the second quarter was crude oil so it is the price of this commodity that matters much more. On a related note, the fact that energy prices are lower year-over-year is the biggest reason why the headline inflation rate is showing improvement compared to the level that it had at this time last year.

It should be easy to see why lower energy prices would have an adverse impact on Exxon Mobil’s financial performance. After all, lower prices mean that the company receives less money for each unit of product that it sells. This translates into lower revenue, which means that less money is available to cover the company’s expenses and make its way down to the bottom line. It is the exact opposite situation that we see when energy prices are high and the company reports record profits (as was the case last year).

Another factor that caused the company’s financial performance to be worse than it was a year ago is that Exxon Mobil’s production was down relative to the year-ago quarter. As noted in the highlights, the company produced an average of 3.608 million barrels of oil equivalent per day during the quarter compared to 3.732 million barrels of oil equivalent per day last year. While this decrease in production is disappointing, it is somewhat in line with the levels that the company has had over the last year:

| Q2 2023 | Q1 2023 | Q2 2022 | |

| Oil-Equivalent Production (mboe/d) | 3,608 | 3,831 | 3,732 |

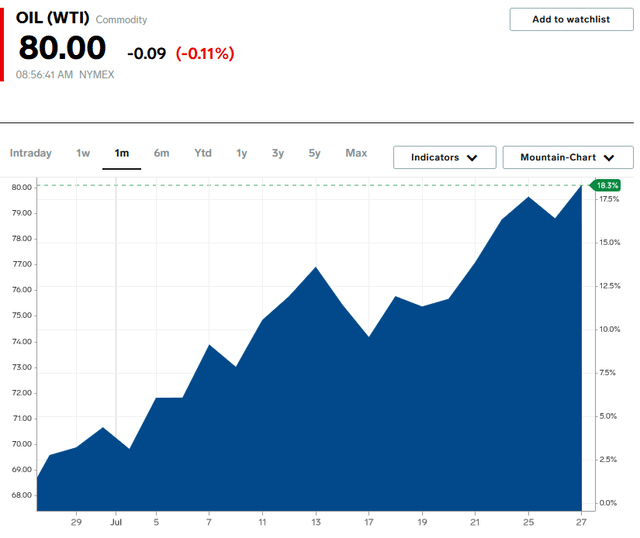

During the first six months of this year, Exxon Mobil produced an average of 3.719 million barrels of oil equivalent per day on average. This is almost perfectly in line with the 3.704 million barrels of oil equivalent per day that it produced on average during the same period of 2022. Thus, it appears that the company is simply trying to maintain its production, and it is doing a reasonably good job at that. This is something that we have been seeing numerous fossil fuel companies doing since the pandemic, which is in direct response to the hostile market and regulatory conditions that have existed since that time. It is not exactly a bad decision though, since the end result here is that there has not been a supply glut that crashes energy prices. In fact, the International Energy Agency is predicting that there may be a shortage later this year. That would, of course, push energy prices up due to the law of supply and demand. We are already starting to see that, as the price of West Texas Intermediate hit $80 per barrel today and is up 18.30% so far this month:

Obviously, this will be good for Exxon Mobil if crude oil prices remain at this level or go higher. It could even be enough to start pushing the company’s profits back up. Unfortunately, Exxon Mobil did not provide its second-quarter price realizations in either the earnings press release or the conference call, so we do not know what exactly it received on average for each barrel of oil that it sold during the second quarter. However, it is fair to assume that it was less than $80 per barrel since prices were lower than that for most of the quarter. Thus, we can be fairly confident that the recent rise in energy prices will have a positive impact on Exxon Mobil.

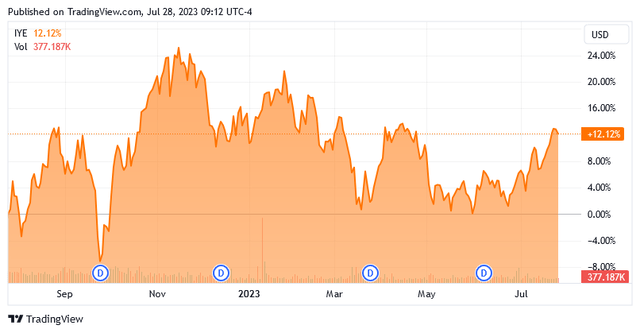

Curiously, the market does not seem to agree as Exxon Mobil’s stock price is only up 1.53% over the past month:

This is not necessarily a problem though since the stock is actually up 15.13% over the trailing twelve-month period despite the fact that energy prices are actually down. This is similar to several of the company’s peers, as the iShares U.S. Energy ETF (IYE) is up 12.12% over the past twelve months:

It, therefore, appears that the market has been anticipating a rebound in energy prices for quite some time and priced this in. As such, Exxon Mobil’s stock may not go up as much as would be expected if the next few earnings reports come in good due to high crude oil prices.

One trend that we have been seeing across the energy sector ever since the pandemic is a renewed focus on cost reductions. Exxon Mobil is certainly no exception to this as the company has the goal of reducing its costs by $9 billion annually compared to 2019 levels. It has managed to achieve $8.3 billion of this reduction year-to-date. This allows the company to improve its profitability in any commodity price environment, which management noted in the press release. Darren Woods, Exxon Mobil’s Chairman and CEO, made the following remarks:

The work we’ve been doing to improve our underlying profitability is reflected in our second-quarter results, which doubled from what we earned in a comparable industry commodity price environment just five years ago.

Mr. Woods is referring specifically to the second quarter of 2018, during which time crude oil and natural gas prices averaged about the same level as we saw in the second quarter of 2023. Exxon Mobil’s net income in the reported period was about double what the company reported then, due largely to the company’s cost-reduction efforts over the past few years. As just mentioned, Exxon Mobil continues with these efforts today.

Investors should generally be quite pleased with the company’s cost-reduction efforts and the progress that it has made on them. This is because the less money that the company has to spend on various items, the more that is able to make its way from revenue to profits and cash flow. Thus, the more money that the company should have available to reward its shareholders all else being equal. This is obviously something that we very much like to see.

Valuation

It is always critical that we do not overpay for any assets in our portfolio. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an oil and gas supermajor like Exxon Mobil, we can value it by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. As I have pointed out a few times in the past though, just about everything in the traditional energy sector is dramatically undervalued based on their actual earnings per share growth. As such, the best way to use this ratio is to compare Exxon Mobil against its peers in order to determine which company has the most attractive relative valuation.

According to Zacks Investment Research, Exxon Mobil will grow its earnings per share at a 19.55% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.61 at the current stock price. This suggests that Exxon Mobil is considerably undervalued at the current price. Here is how the company compares to some of its peers:

| Company | PEG Ratio |

| Exxon Mobil Corporation | 0.61 |

| Chevron Corporation (CVX) | 0.86 |

| BP (BP) | 0.98 |

| TotalEnergies (TTE) | 0.64 |

| Shell (SHEL) | 0.76 |

As we can see, all of the five energy supermajors are somewhat undervalued today. However, Exxon Mobil appears to be the most attractive overall. This is a sign that the company may be worth considering today.

Conclusion

In conclusion, Exxon Mobil’s earnings results were largely what we expected to see, despite the fact that the company missed earnings estimates. We see that it is limiting its production growth just like most of the rest of the sector while focusing on cost reductions to drive earnings growth. Overall, this is still to the benefit of shareholders. There are signs that energy prices are finally starting to trend up again, so the company is fairly well positioned to deliver reasonably strong results in the second half of the year as it benefits from this. When we combine this with a reasonable valuation, the company could be worth considering for purchase today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long various energy-focused funds that may hold long positions in any stock mentioned in this article. I exercise no control over these funds and their holdings may change at any time without my knowledge.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!