Summary:

- AT&T Inc.’s second quarter earnings release showed strong performance, with improved profits, cash flow, and cost-cutting initiatives.

- The company’s debt decreased, and management provided encouraging guidance for the second half of the year, including further debt reduction.

- AT&T’s growth areas, such as connected devices, fiber operations, and 5G spectrum coverage, continue to expand rapidly.

- All of this points to the bearish arguments for the firm being dead, which should usher in more upside.

Brandon Bell

Even though I have felt this for a long while, I firmly believe it is not a stretch to say that essentially all of the bearish arguments regarding telecommunications conglomerate AT&T Inc. (NYSE:T) are dead. Although shares did not rise materially in response to the news, the second quarter earnings release made public by the management team at the business came in very strong. Yes, revenue failed to meet expectations. But by pretty much every other measure, the situation regarding the enterprise has only improved.

As somebody who has the company as the largest holding in my portfolio, comprising 17.9% of my assets, this is most certainly a relief. And while it was disappointing not to see shares pop on the news, I can sleep soundly knowing that the future for the business is looking bright.

Touching on the headline news

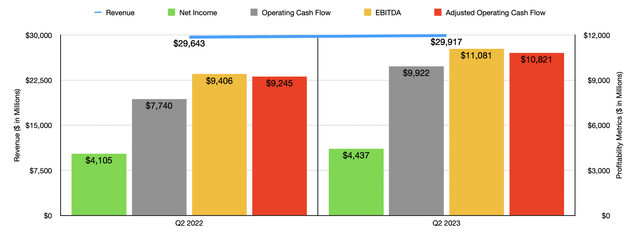

The first thing that we should touch on when it comes to AT&T are the headline news items. At the very top of the list is revenue. During the second quarter of the year, management reported sales of $29.92 billion. This presents a modest improvement over the $29.64 billion in revenue generated the same time last year. But it was $30 million lower than what analysts anticipated. Given just how large AT&T is, I could spend an entire article going into the miscellaneous components that contributed to the revenue increase. But management said that the rise primarily reflected greater revenue associated with the company’s Mobility segment, as well as base strength in both its Mexico and Consumer Wireline operations.

On the bottom line, management actually exceeded expectations. Analysts thought that earnings per share would come in at only $0.61. Management matched this and beat out the $0.59 per share that the company reported one year earlier. But adjusted earnings per share of $0.63 ended up being $0.03 per share greater than what analysts forecasted.

Even though a few pennies here and there may not seem like much of a difference, the year-over-year increase in profits per share translated to net income rising from about $4.11 billion to $4.44 billion. Other profitability metrics also performed incredibly well. Operating cash flow, for starters, jumped from $7.74 billion to $9.92 billion. If we adjust for changes in working capital, the metric would have risen from $9.25 billion to $10.82 billion. Meanwhile, EBITDA for the company expanded from $9.41 billion to $11.08 billion.

These significant bottom line improvements were largely the result of management’s cost-cutting initiatives. Leading up to this time, management had said that their goal was to achieve $6 billion in annual run rate cost savings by the end of this year. This target was actually achieved during the second quarter. And to make things even better, management was able to increase their target for savings of $8 billion annually, with the incremental $2 billion improvement developing over the next three years.

One thing I did find very interesting about the cost-cutting initiatives is that management gave some credit to software giant Microsoft (MSFT). According to AT&T, a custom-built generative AI tool called Ask AT&T was instrumental in accelerating cost savings.

Ask AT&T was originally announced in June of this year. However, it flew under the radar of many analysts. In a blog post announcing its launch, management lauded it as an impressive employee productivity tool. The first iteration of it uses OpenAI’s ChatGPT functionality. Using it, AT&T employees can more easily work with data without said data leaking to the public. Use cases pointed out by management include, but are not limited to, using it to help optimize its own network, upgrading legacy software code and environments, helping answer employee questions such as those that would normally be directed to Human Resources, etc.

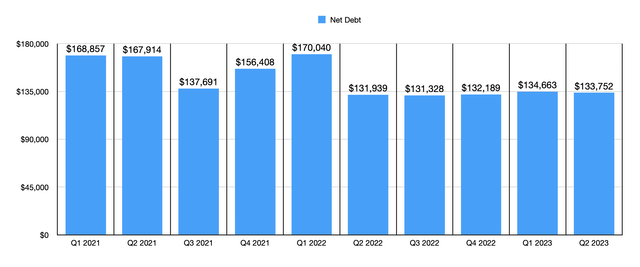

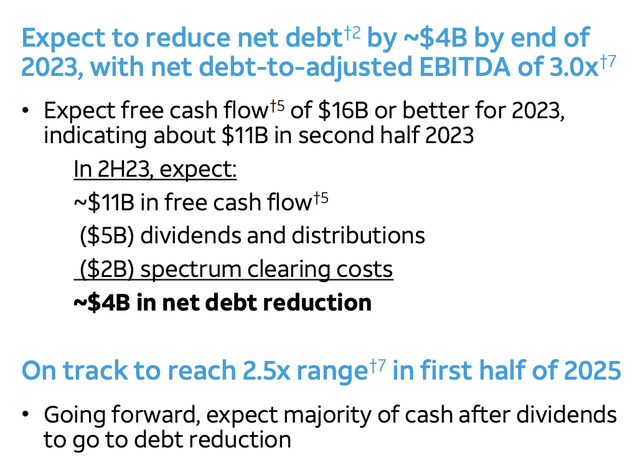

In an earnings preview that I wrote about the company, I told investors to pay attention to the headline news items. But one of the items that I also mentioned in that article was debt. One criticism that the bears have had regarding AT&T is that the company does have a great deal of debt on its books. However, that picture is now changing. Net debt as of the end of the second quarter totaled $133.75 billion. This represents a decrease of $911 million compared to the $134.66 billion in net debt that the company had at the end of the first quarter of the year. Even though this is a drop in the bucket on its own, management has provided some encouraging guidance for the second half of the year.

During the second half of 2023, management is forecasting free cash flow of around $11 billion or more. This would be enough, management indicated, to hit or exceed the $16 billion in free cash flow that the company has been targeting for 2023 in its entirety. Around $5 billion of this extra cash flow will go toward dividends and share buybacks. Another $2 billion will be dedicated to spectrum clearing costs. This will leave about $4 billion for the company to use to reduce debt further. Should this come to fruition, it would bring net debt down to roughly $129.8 billion. According to estimates that I provided in a prior article, EBITDA for the business should be around $42.7 billion this year. That should make the net leverage ratio for the company 3.04 by the end of 2023. Management is targeting a reduction to 2.5 sometime in the first half of 2025.

We do know that substantially all of the excess free cash flow the company produces each year moving forward should go toward debt reduction. But growth is definitely a component of this as well. If, for instance, EBITDA is to grow at about a 3% annualized rate moving forward, that would imply net debt by the end of the first half of 2025 of $111.6 billion.

Growth initiatives have been doing well

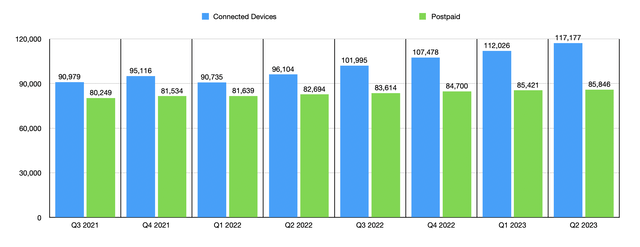

It is undeniable that AT&T as a whole is no longer a growth company. However, there are certain aspects of the company that continue to expand at a rapid pace that investors should keep a close eye on. My favorite part is referred to as the Connected Devices unit. During the second quarter, the company had grown to have 117.18 million connected devices subscribers. This represents an increase of 5.13 million over the 112.03 million that the company had only one quarter earlier. It’s also materially higher than the 96.10 million that the business reported for the second quarter of 2022. That’s an increase of 21.9% in the course of a single year.

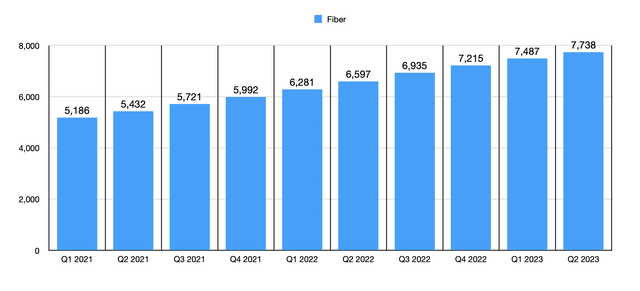

Another big growth area for the company involves its fiber operations. At the end of the first quarter, total fiber subscribers hit 7.49 million. That number increased further to 7.74 million by the end of the second quarter, translating to 251,000 net additions to its network. It’s also 17.3% above the 6.60 million that the company had one year ago. Management said that they remain on track to pass 30 million fiber locations by the end of 2025. For context, the current fiber network can provide services to 20.2 million residential consumers and over 3 million business consumers as of the end of the second quarter. This is up from the 19.7 million residential consumers and 3 million business consumer locations that the company achieved at the end of the first quarter.

Mid band 5G spectrum can now cover 175 million people according to the company. That’s up from 160 million that the company stated at the end of the first quarter. And management believes that they are on track to reach 200 million people with mid band 5G by the end of this year. Though not a growth area of the company, it is worth noting that the number of post-paid subscribers continues to grow as well. The company ended the most recent quarter at 85.85 million. That’s 464,000 net additions that the business recorded for the quarter, with postpaid phone net additions totaling 326,000.

Takeaway

Pretty much any way you look at it, the picture for AT&T Inc. and its shareholders looks fantastic. Yes, revenue did miss expectations modestly. But outside of that, the company had a lot of wins. Cost-cutting initiatives are going great. Profits and cash flows are rising materially year over year. Debt reduction is becoming the norm. Key growth areas for the company continue to fare well, even in the face of broader economic concerns.

Perhaps the only issue that bears can still point to is the potential lead exposure for the company. But in its earnings call, the firm said that it is willing to work with regulators and that it has no concerns did anything material will hurt it on that front. Earlier in the month, the company even said that less than 10% of its footprint of roughly 2 million sheath miles of cable contain lead. And more likely than not, this is an issue that will take years to truly understand and reach a resolution for if it is an issue at all.

In the meantime, the company will continue to grow, generate robust cash flows, payout hefty distributions, and reduce debt. And when you add all of this positive to the mix, I have no problem keeping AT&T Inc. rated a “strong buy.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!