Summary:

- AT&T has been on a downtrend for the last 20 years, but I think the bottom is in.

- The dividend, despite the recent fear, looks more than sustainable.

- Technical outlook for AT&T looks great, with a bullish divergence in the weekly RSI.

- AT&T is too cheap to ignore, and despite its problems, this is now a buy.

klenger

Thesis Summary

AT&T (NYSE:T) has seen its stock price plummet recently due to increased concerns over its growth and dividend sustainability.

In my last article on T, I rated the stock a hold, due to the high debt and lowering asset turnover. However, I believe the dividend is sustainable, and the technical outlook for the stock is attractive after the latest fall in price. AT&T is too cheap to ignore.

While several risks remain, I think this could be a good spot to buy some T shares, especially for income-focused investors.

AT&T’s Q2 2023 Results

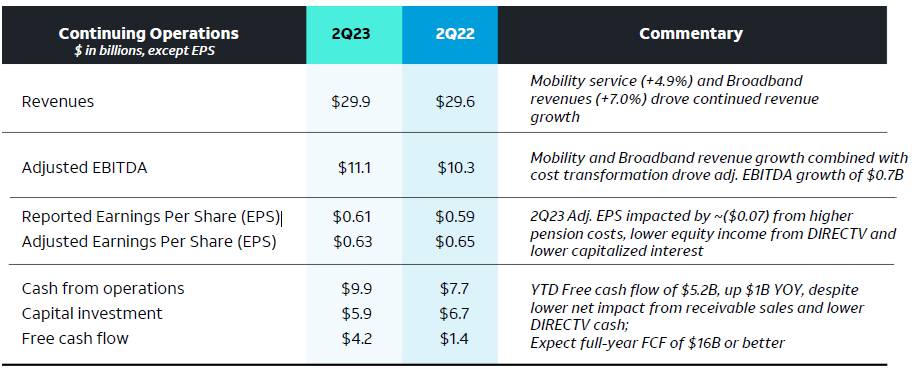

According to the Q2 2023 financial results, AT&T reported revenues of $29.9 billion, up 0.9% in comparison to last year. The company’s net income attributable to common stock was $1.5 billion, a significant improvement from the net loss reported in the same period last year.

Continuing Operations ( Q2 2023 Report (AT&T))

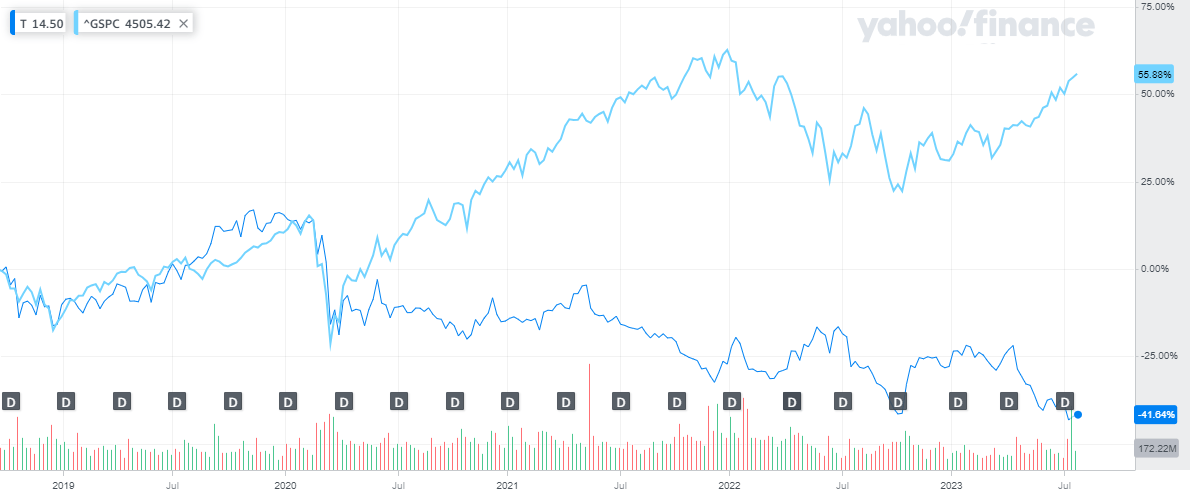

However, the company’s stock price has been on a downward trend, which has affected the market value of its shares. As of Q2 2023, AT&T’s stock price had declined by over 40% from its peak, causing its market capitalization to reach a five-year historical low.

However, the latest results show some encouraging trends:

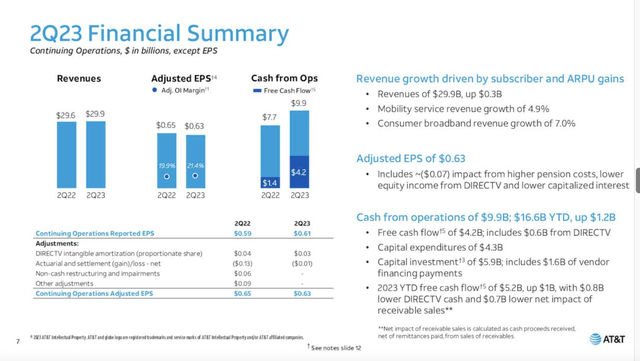

2Q23 Financial Summary (Investor Presentation)

As we can see, cash from operations has increased to $9.9 billion which has been possible thanks to increased profitability. AT&T actually increased its EBITDA margin by 210 bps YoY.

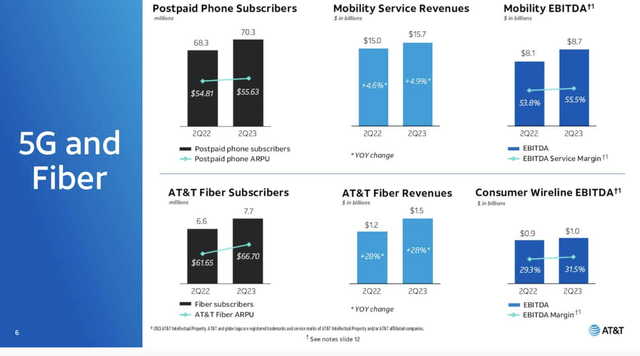

Furthermore, growth in mobility service revenue came in at 4.9%, and consumer broadband grew by 7%.

5G and Fiber (Investor Presentation)

5G continues to drive growth, and as we can see above, EBITDA margins are also increasing.

AT&T’s Performance and Dividend Sustainability

Over the past three years, T’s performance has diverged significantly from the S&P 500. This divergence has been largely due to a reduction in AT&T’s stock price, which has led to its valuation reaching 5-years historic low. As of Q2 2023, AT&T’s trailing twelve months price-to-earnings (P/E) ratio stands at 5.79x, and it’s forecasted to be at a similar level of 5.89x. These figures suggest that AT&T is currently undervalued compared to its historical averages.

S&P 500 and T ( Yahoo Finance)

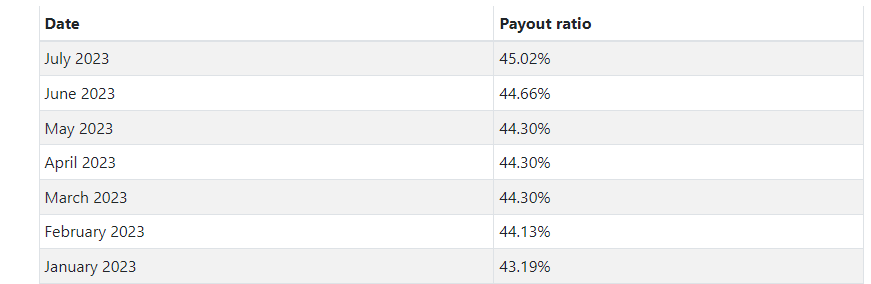

Despite the decline in stock price, AT&T’s dividend appears to be sustainable. The company generated around $4 billion in free cash flow in Q2 2023 and expects to generate over $16 billion in free cash flow for the full year 2023. This level of cash generation provides a solid foundation for AT&T’s dividend payments. Analysts expect AT&T to pay dividends of $1.12 per share in 2023, increasing to $1.132 per share by 2027. This would translate to a dividend yield of around 7.5%, which is attractive for income-focused investors.

Future Outlook

AT&T is focused on growing its customer base in profitable areas such as 5G and fiber. The company added 464,000 postpaid phone net additions and 251,000 fiber net additions in Q2 2023, bringing its total phone subscribers to 70 million and fiber subscribers to over 7 million. This growth in customer numbers, coupled with an increase in average revenue per user, indicates a positive trajectory for the company.

AT&T is also committed to cost savings and operating in a more streamlined fashion. The company plans to achieve an incremental $2 billion in cost savings, adding to the $6 billion it has already achieved.

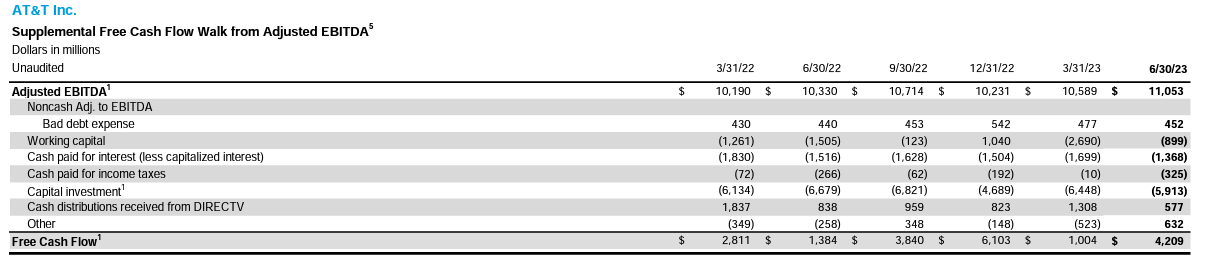

In the past six quarters, AT&T has been re-investing a significant portion of its EBIDTA in CAPEX to remain competitive. Despite this, the company has managed to generate a healthy free cash flow of $4,209 million in Q2 2023. Considering that the company needs to pay around $2 billion in dividends, it’s clear that AT&T generates enough cash to comfortably cover its dividend payments.

FCF (AT&T Quarterly Report)

AT&T’s consistent cash generation has allowed it to maintain a healthy payout ratio of 44% as of Q2 2023. This indicates a sustainable dividend, with AT&T balancing shareholder returns and business reinvestment effectively.

T payout (Digrin.com)

Technical Outlook

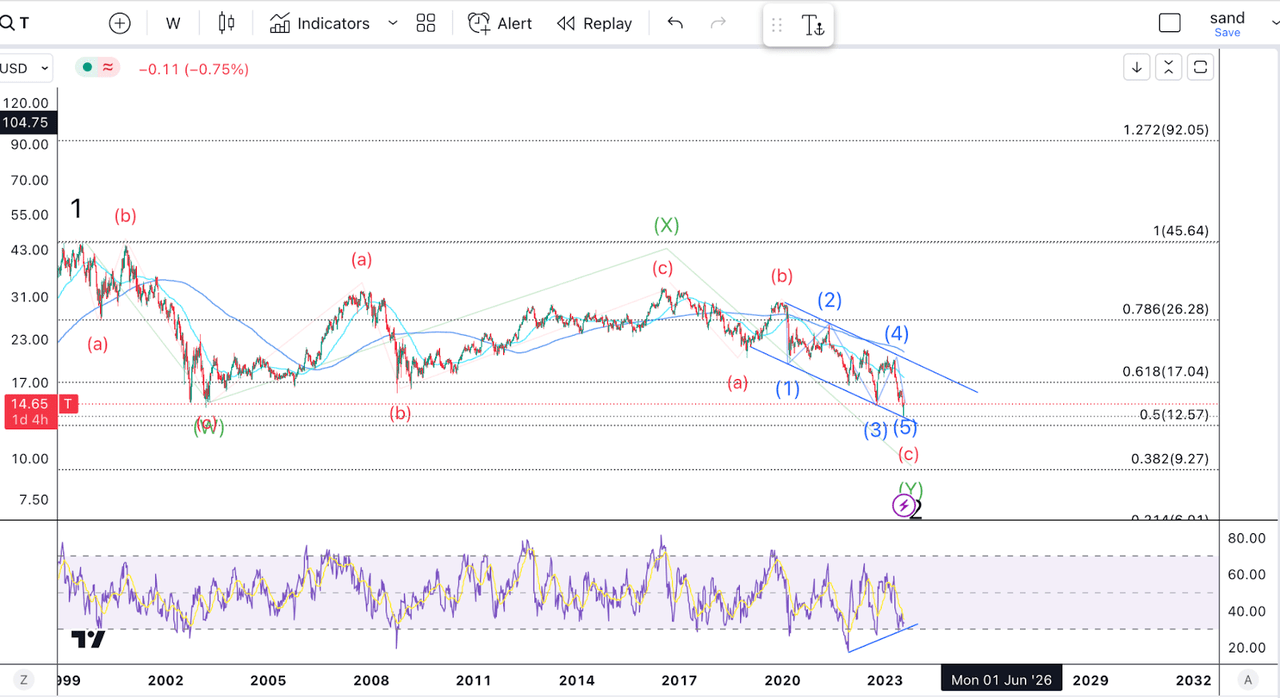

I see some strong evidence that T stock could have bottomed.

T Technical Analysis (Author’s work)

T stock peaked back in 1999, and this could be labeled as a wave 1 of an impulsive Elliott Wave structure. The following 20 years have given us a WXY correction, each subdivided into three wave ABC moves. Looking at the latest price action, there’s enough to count a finished ABC structure, which ends with a 5-wave impulse in wave C as shown in blue. We are also nearing the 50% retracement from the all-time low to the all-time high, and this is a natural target for a wave 2.

To top things off, we see a clear bullish divergence in the RSI and price on the weekly chart.

While this could arguably still give us one more low closer to $12.5, we should be near a bottom, if not already bottomed.

Risks and Challenges

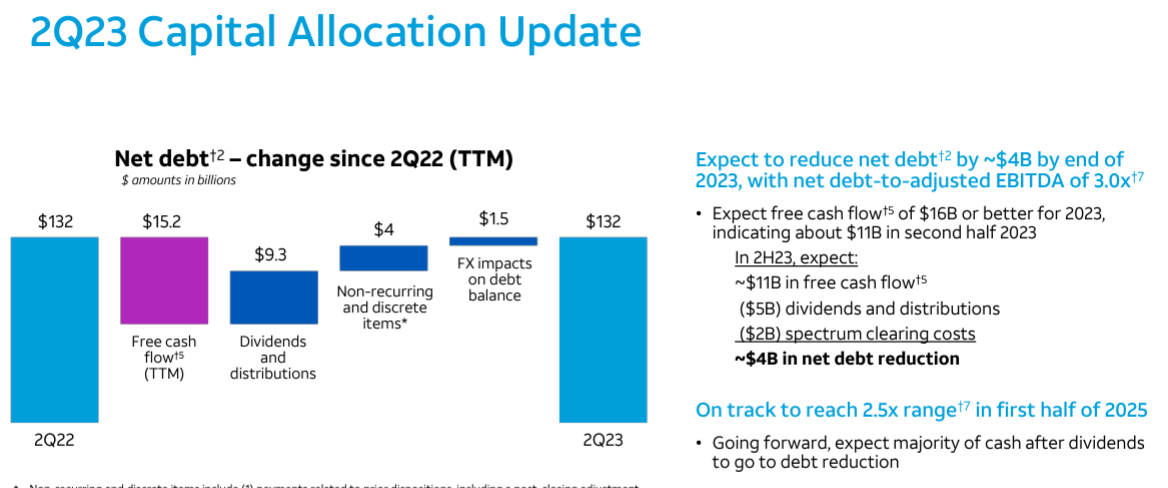

Despite these positive indicators, AT&T faces several challenges. The company’s high debt levels, which stood at $143 billion at the end of Q2 2023, pose a significant risk. AT&T plans to reduce its net debt by around $4 billion by the end of 2023, but this will require disciplined capital allocation and strong cash generation.

2023 capital allocation (AT&T earnings report)

Another risk is the potential for share dilution. Over the past six years, AT&T’s number of shares has increased from 4.6 billion to over 7 billion. Further share issuance could dilute the value of existing shares and put downward pressure on the stock price.

AT&T also faces stiff competition from other major players in the telecommunications industry, such as Verizon (VZ). These competitors have similar offerings and could potentially lure away AT&T’s customers.

Conclusion

In my opinion, AT&T presents an interesting case for income-focused investors due to its high dividend yield. However, it’s important to note that AT&T is primarily a dividend income stock and may not offer significant capital appreciation potential. The company’s high debt levels and potential for share dilution pose risks that could impact its future performance.

Moreover, the stiff competition in the telecommunications industry could limit AT&T’s potential for price appreciation. While AT&T’s dividend appears sustainable in the near term, the possibility of a dividend reduction in the longer run cannot be ruled out. Therefore, investors seeking similar yields may want to explore other alternatives with a more favourable growth outlook.

Still, at the current share price, AT&T seems like a solid investment. There are good companies that are too expensive, but AT&T is an okay company that is too cheap.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is just one of many exciting stocks you can buy right now!

Join The Pragmatic Investor to get weekly macro reports, trade ideas and technical analysis on numerous stocks.