Summary:

- Meta Platforms’ Q2 revenue grew 11% YoY to $32.00 billion, surpassing analysts’ estimates.

- Q3 revenue guidance of $32-$34.50 billion implies a YoY growth rate of 15-25%.

- Meta’s Family Average Revenue per Person grew 5% YoY to $8.32, indicating a turnaround in its core business.

Chip Somodevilla

Investment Thesis

Meta Platforms’ (NASDAQ:META) mission is ‘to give people the power to build community and bring the world closer together’, and whilst the latter is somewhat debatable, the company has certainly changed the way we interact and connect forever.

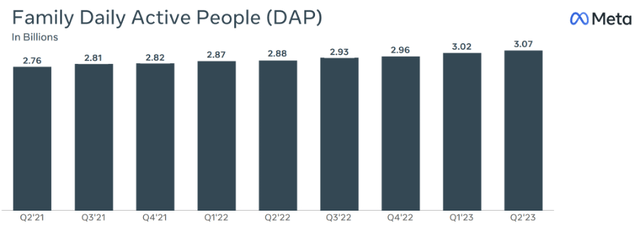

Meta’s core business revolves around its family of four apps: Facebook, Instagram, Messenger, and WhatsApp, which have a combined 3.07 billion daily active people – that is, ~38% of the world’s population use at least one of these apps on a daily basis. The company makes most of its money through advertising right now, with advertisers being able to showcase products across Meta’s Family of Apps to these 3.07 billion pairs of eyeballs.

Meta Q2’23 Earnings Presentation

It’s been a wild couple of years for Meta shareholders, with shares being on a bit of a rollercoaster as the company went from a social media company to a Metaverse company (anyone remember the Metaverse? That thing before AI but after Crypto?), and now I think it’s back to being a social media company that sells a headset every now and again.

The good news for shareholders is that Mr. Market quite likes Meta as a social media company! Especially when it’s delivering the kind of results that the company just came out with, so let’s dive into Meta’s Q2’23 earnings.

Meta Q2 2023 Earnings Overview

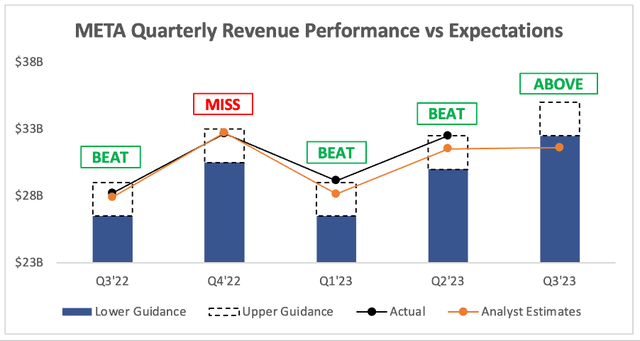

Starting from the top, Meta’s Q2 revenue grew 11% YoY to $32.00 billion, comfortably exceeding analysts’ estimates of $31.03 billion by almost one billion dollars. This was one of the most comfortable revenue beats that Meta has had for a long time, but the good news didn’t stop there.

Author’s Work / Seeking Alpha

Management’s Q3’23 revenue guidance of $32-$34.50 billion implies a YoY growth rate of 15-25%, so it’s no surprise that the guidance was well ahead of the $31.11 billion in revenue that analysts were expecting for Meta’s next quarter. This revenue guidance was aided by a 3% foreign currency tailwind due to the weakening dollar, but even so – it’s a very strong guide for a company that appeared to be struggling less than 12 months ago.

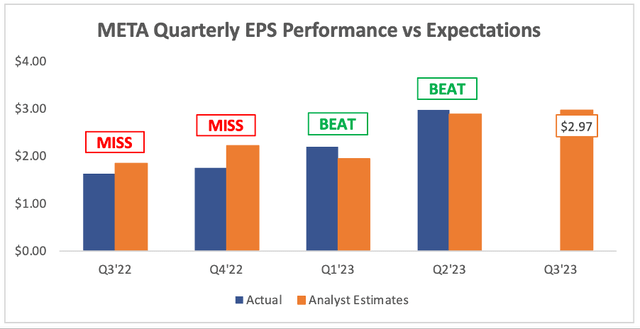

Moving onto the bottom line, and it’s more of the same. Meta grew its EPS by 21% YoY to reach $2.98, once again coming in ahead of analysts’ estimates of $2.89.

Author’s Work / Seeking Alpha

Clearly, these were some very strong headline numbers for Meta, but digging further down into the business should make shareholders even happier.

Not only are there signs of a turnaround in Meta’s core business, but there are plenty of future growth avenues that are starting to become ever more apparent – so let’s dive into some of these promising trends.

The Business Turnaround Continues

2022 was a painful year for Meta shareholders, as the company shifted its focus towards the high-risk, money-burning Metaverse whilst its once incredibly strong Family of Apps business felt a $10 billion headwind from Apple’s IDFA changes.

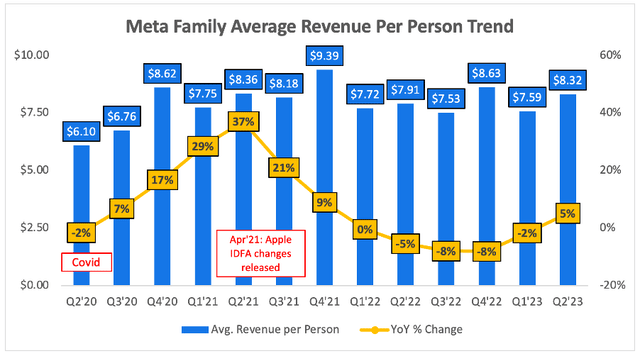

Thankfully for shareholders, the recovery appears to be well and truly underway. Meta’s Family Average Revenue per Person (which I will begrudgingly abbreviate to FARPP) grew 5% YoY to $8.32, which is roughly where it was back in Q2 2021 – the quarter in which Apple first introduced its IDFA changes – indicating that perhaps Meta has started to get around Apple’s roadblock to targeted and effective advertising.

Author’s Work

The chart above shows an upswing in this trend for Meta, as the company has started to see YoY improvements in its FARPP in the first half of 2023, and there’s no reason to believe that the company can’t continue to improve.

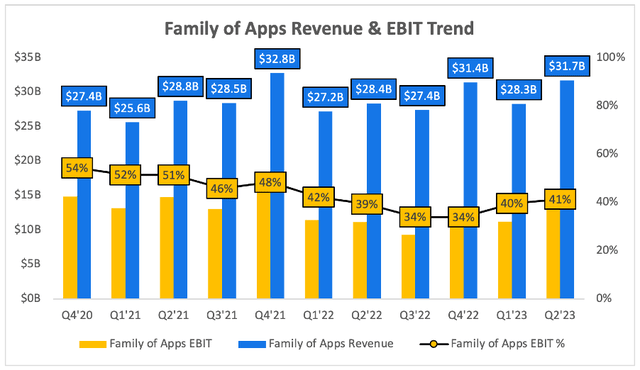

This also fed down to the bottom line, as Meta’s Family of Apps delivered EBIT margins of 41% – its best operating profit margin for the segment in over a year.

Author’s Work

These margins are likely to keep improving; not only is Meta now facing fewer headwinds, but the company was also impacted by some one-off restructuring charges and legal expenses of ~$2.65 billion. Assuming that these relate to the FoA (which I believe they do), then the removal of these one-off charges would have resulted in quite mind-boggling underlying EBIT margins of just under 50%, which takes Meta back to the kind of margins it was showing in 2021; it really is the Year of Efficiency!

The Future Looks… Bright?

Outside of Meta’s core advertising business, and ignoring the Metaverse (probably for the best, right?), there’s plenty of growth avenues to get investors excited.

In particular, Meta appears to be taking its monetisation of WhatsApp in the right direction as it begins scratching the surface of a potentially huge opportunity.

The number of businesses using Meta’s paid messaging products has doubled YoY. It currently has 200 million users on its WhatsApp Business app, and these users will now be able to create Click-to-WhatsApp ads for Facebook and Instagram – and, more impressively, revenue from these Click-to-WhatsApp ads grew at over 80% YoY in the latest quarter.

Monetisation of Reels has also been progressing well, as Founder and CEO Mark Zuckerberg said on the Q2’23 Earnings Call:

We’re seeing good progress on Reels monetization as well with the annual revenue run-rate across our apps now exceeding $10 billion, up from $3 billion last fall.

This is without going into detail on the “unprecedented growth out-of-the-gate” for Threads, Meta’s large language model Llama-2, and yes – even the Metaverse. All of these provide potential growth catalysts for Meta in the future, alongside a digital advertising market that appears to be rebounding after a sluggish 2022; all in all, plenty of reasons for shareholders to believe that Meta can keep delivering.

Meta Stock Valuation

My approach to valuation is to try and learn whether or not a company appears to be crazily overvalued or undervalued, but I believe that it’s the quality of the business that will ultimately result in success or failure for long-term shareholders – so let’s see what happened when I put Meta through my valuation model.

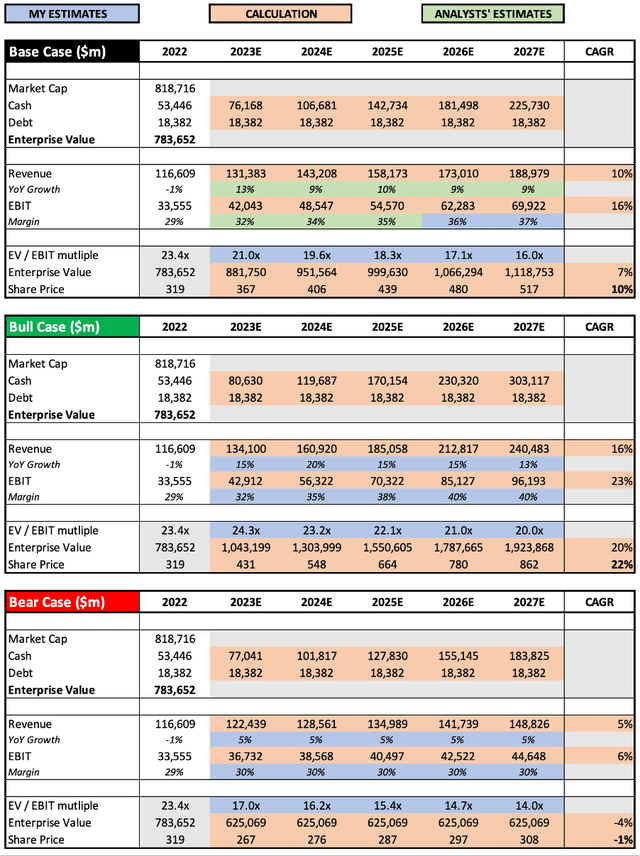

Author’s Work / Seeking Alpha / TIKR

I’ve made very few changes from my previous article; mainly updating the enterprise value and updating the analysts’ estimates, with analysts now becoming a bit more positive about Meta’s growth and margin prospects this year – and after such a strong quarter, it’s clear to see why.

Putting all that together, I can see shares of Meta achieving a CAGR of -1%, 10%, and 22% through to 2027 in my respective bear, base, and bull case scenarios.

Bottom Line

I think this is a quarter for Meta shareholders to be celebrating, and deservedly so! It may be overly quoted, but Buffett’s “Be greedy when others are fearful” absolutely paid off for anyone who purchased shares in this tech behemoth over the past 12 months.

But investing is a forward-looking game, so what should investors be doing now? I will personally maintain my ‘Hold’ rating on Meta shares, as I don’t necessarily think it offers an attractive enough risk-return at the current price.

However, if anyone came up to me after these results and told me they wanted to buy Meta shares, I would say “Be my guest!”, because there’s no denying that the results were very strong, the future is looking bright, and the share price is not looking crazy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PINS, TTD, ROKU, U, PUBM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.