Summary:

- Apple looks like Meta’s main competitor in the XR market.

- I believe Meta lacks the important tools to battle Apple.

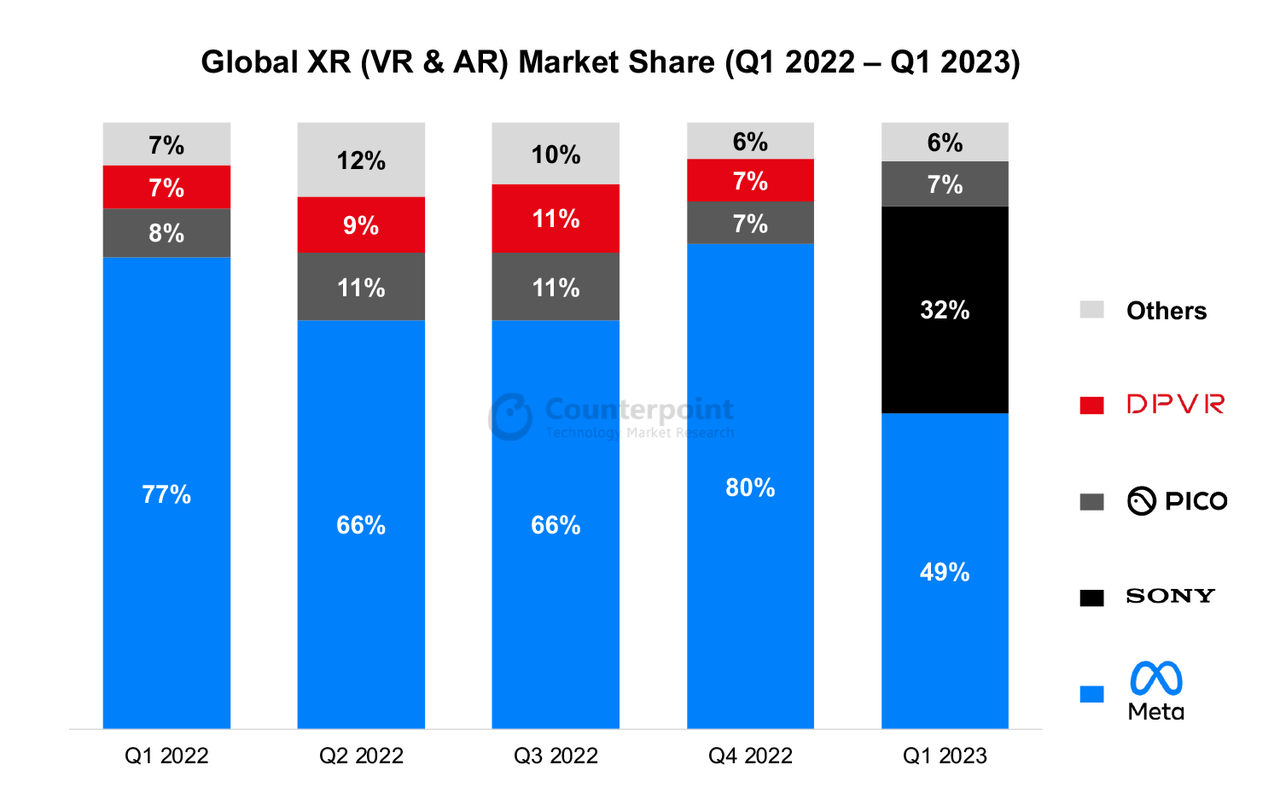

- Meta dominates the XR market, but this may change in the coming years due to a release of Vision Pro.

- META stock looks overvalued.

Alberto Menendez/iStock via Getty Images

Introduction: How has XR become a battleground?

Interest in XR (extended reality) began to skyrocket in 2021 after Meta (NASDAQ:META) shared the concept of the metaverse – an immersive online world. However, over time, enthusiasm for this idea cooled massively as it became clear that the integration of this futuristic world into real life would require more years of work on the appropriate technologies.

XR is an umbrella term for AR, VR and MR

Nowadays even specialized gaming devices that are designed for a more enthusiastic audience, don’t find any kind of big success. Any attempts to get a mass audience on XR have failed so far, especially in the format of replacing a smartphone, laptop, or TV. Take, for example, Samsung Gear VR (support ended in 2020), Google Cardboard (the project was closed in 2021), Daydream (closed in 2019), MagicLeap, and Microsoft HoloLense.

Against this background, the presentation of the Apple (AAPL) Vision Pro mixed reality headset in June looked like a turning point in the battle for leadership in the promising field of extended reality technologies.

Each new stage in the development of user technologies is characterized by fierce competition. Apple’s rivalry with Microsoft (MSFT) played a huge role in the early days of personal computing and former Apple CEO Steve Jobs declared Google (GOOG)(GOOGL) a “thermonuclear war” on smartphones. Now Apple and Meta seem to be two main rivals in the fight for leadership in the world of virtual and augmented reality.

Likely no instruments to fight Apple with

I think there is a reasonable belief that “meta” could be such a mistake that it could potentially even kill Facebook. The project, on which Zuckerberg made an ambitious bet, by itself, of course, will not destroy the world’s largest social network. But focusing on XR at a time when Facebook itself is suffering from age-related issues both for the service itself and for its audience will deprive it of its most valuable asset in my view: the time it takes to transform. Most likely, I believe Zuckerberg himself understands that the era of Facebook has passed – so he made a bet on Meta.

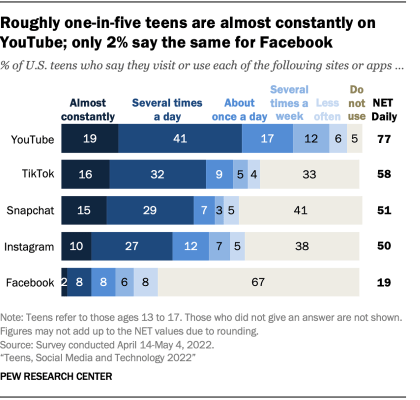

PEW Research Center

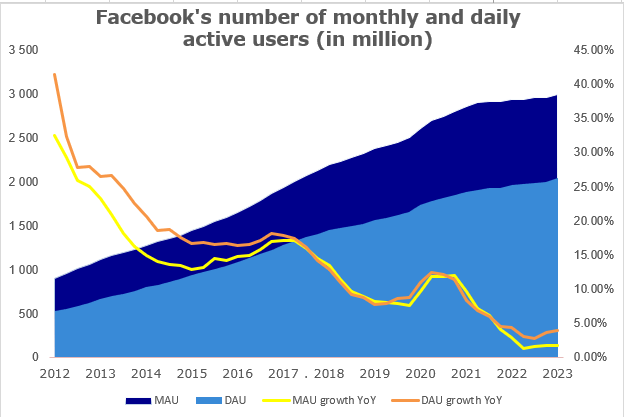

I believe that both of Meta’s key products, Facebook and Instagram, lack the drivers to attract new generations of users. Their full potential is the ability to deplete the audience of users they have already attracted years back. The company clearly seem to see that the new generation is choosing YouTube and TikTok. But it follows that the development of the Zuckerberg empire requires a product that will attract the next generation.

Current growth within Meta’s platforms is inertial and starts to slow down in my opinion. When the inertial growth also ends, in the absence of new users (especially younger audience) and a decrease in the activity of the current user base (which we can already see now), structural stagnation in the company could potentially begin. And it is understandable that now they will try to achieve synergy between the user base of Facebook, WhatsApp and Instagram already in the XR space (i.e. first development of the VR concept of Metaverse, and then spread to MR and AR). That is what it was created for. This means that when Meta’s XR custom features start to roll out, we will most likely see them in the form of all sorts of integrations with these three products.

Author

Even assuming that the company can attract enough Facebook, WhatsApp and Instagram users to revitalize the XR sphere and live independently of its traffic donors, the question of what would attract the new audience still remains open.

If the company continues to position this as a replacement for the office (i.e. virtual workplace), then I think it is heading full steam ahead towards the same iceberg that Google+, Facebook Dating and Facebook Login faced. These projects rudely violated the distance between the different areas of the user’s life (i.e. communication, entertainment, work and relationships) in my view. And there is little room for maneuver here, in the gaming zone they will have to compete directly with PlayStation, Steam, Nintendo and others.

All in all, I think Meta will have to build its “Metaverse” as a new company as the need for the company’s actual products starts to wane. I believe it will simply be impossible to use what Facebook was built on. So it is possible to achieve economies of scale, but this is a very difficult task. Thus, it is generally incomprehensible what the Metaverse actually is since there is simply nothing to build positioning on. The problem is that Meta doesn’t have the tools that Apple has, namely:

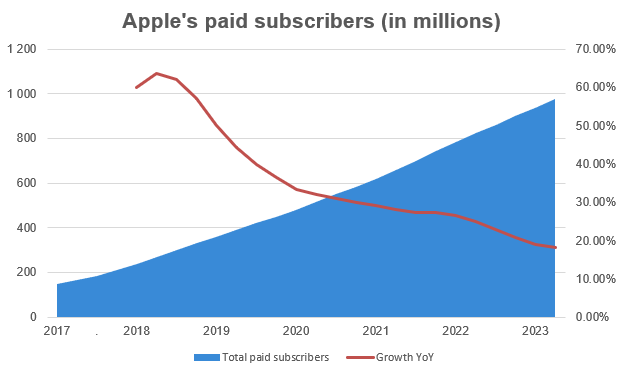

- Growing paid subscribers to whom Apple can easily sell services in XR.

Author

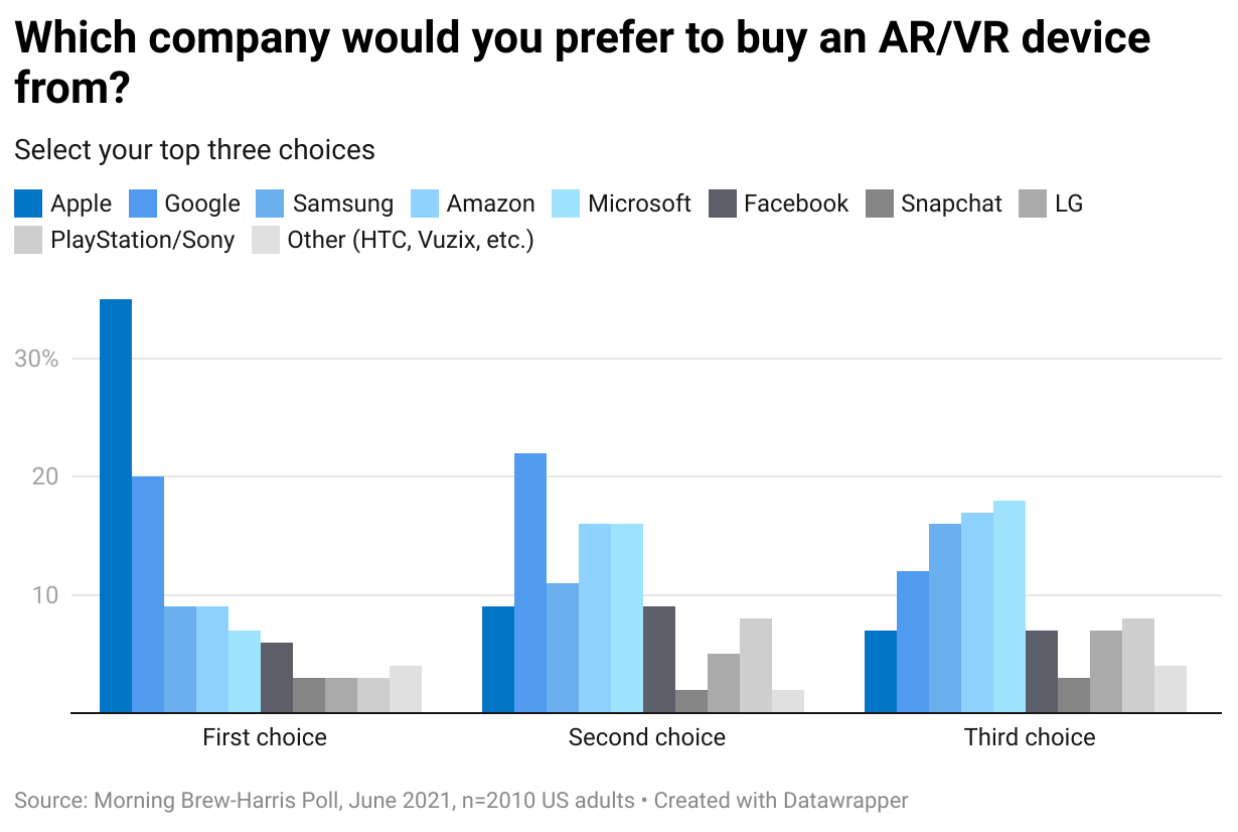

- A brand that consumers trust. In a 2021 survey, three times as many people said they were more likely to buy a headset from Apple than from second-placed company Google. Meta ranked sixth in the poll.

Tech Brew

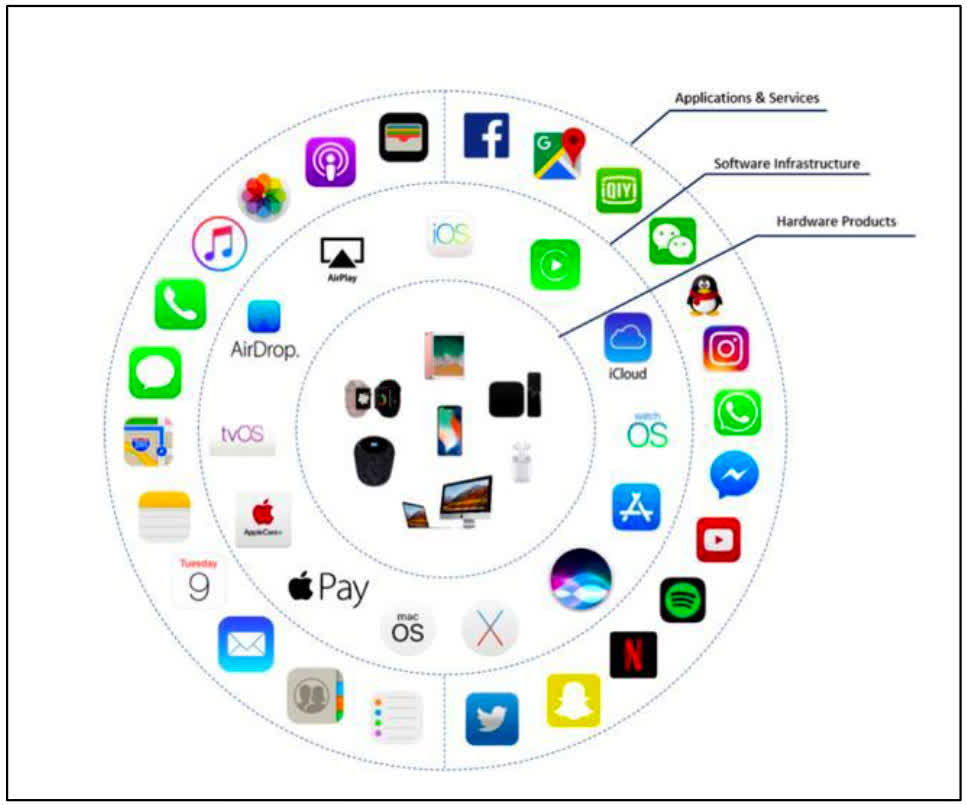

- The ecosystem of devices and applications. Developers can easily port existing applications to VisionOS and adapt them for AR/VR. Thus, Apple captures only the emerging market for AR applications.

Phoenix Cellular

While Apple would position their headsets as a small but necessary part of the product chain of a large company with a well-known brand, I believe Meta will only have a price advantage as it is not able to build positioning on any of these things.

Vision Pro is challenging Meta’s position in the XR market

Up to this point the Meta has dominated the XR market. The company has already sold a record 20 million Quest 2 headsets.

However, the position of Meta may be shaken in the coming years due to the release of a new device from Apple. And here the problems can go beyond mere positioning as Apple’s headset already has abilities that Meta probably just can’t copy.

While the Vision Pro still raises many questions, it’s already clear that it is indeed the “one more thing” moment. First, the desktop chip M2 is inside, which means essentially a complete Macbook is integrated into the device. So, if Apple won’t artificially limit the capabilities of the headset, then a full-fledged launch of desktop applications offline is potentially possible in standalone mode.

Second, the “transparent glass” feature looks game-changing since it is a key factor in increasing the social adaptation of wearing such a device in public. While wearing other headsets, eye contact is not maintained for both parties, so you have to take it off to interact with others. This shows how serious Apple is about getting this device into the mainstream quickly in my view.

Third, the 3d environment, which was shown in WWDC opens up almost limitless opportunities for recording and translating stereo just with the headset. For example, in a few generations (a couple of years), iPhones may be able to record “stereo-3d” video so that it can then be viewed in such XR headsets.

Apple did exactly the same thing that it did with the iPod, iPhone, iPad, Macbook and Watch. They waited, took the structure that has been proven successful from competitors, placed emphasis on slightly different things, paid more attention to the smoothness of the user experience and reinvented the class of devices, not introducing a revolution in the structure, but synthesizing a new direction in general.

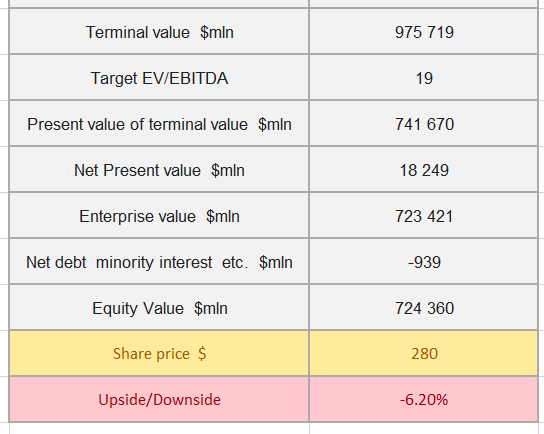

Valuations are excessive for Meta

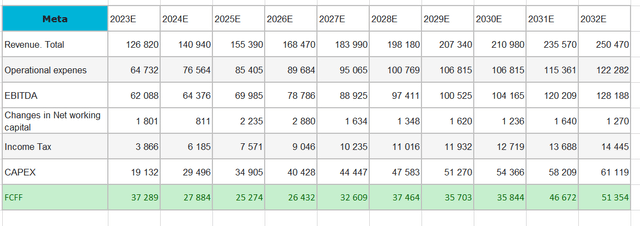

To analyze the value of Apple, I used the discounted cash flow method. I projected the company’s results through FY2032 assuming a very mild recession scenario (no YoY margin cuts) and used an average EV/EBITDA LTM over the last 5 years of 19x as a target multiple.

META stock looks just a bit overvalued for now.

Author, Finam, Reuters

Conclusion

I believe Meta is in a weak state to compete with Apple. Building a bridge between Facebook, Instagram and WhatsApp users and the “Metaverse” is a very difficult task, especially when the “Metaverse” has arguably nothing to position on. At the same time, Apple appears to be much stronger given its flexible integration between devices and software, and a much stronger brand. Given the excessive valuation of META, it is a Sell in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.