Summary:

- AbbVie’s Q2 2023 financial results exceeded expectations, driven by strong sales of innovative drugs Skyrizi and Rinvoq.

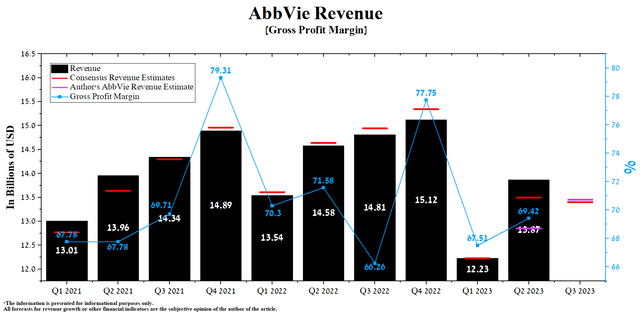

- AbbVie’s revenue for the second quarter of 2023 was $13.87 billion, up 13.4% from the previous quarter and down 4.9% from the second quarter of 2022.

- AbbVie’s share price grew by 4.9% following the positive financial report, but it has underperformed compared to the S&P 500.

- On the other hand, despite the decrease in revenue of the hematologic oncology segment and weak sales of Botox, the company’s guidance for 2023 was increased from $10.57-$10.97 to $10.90-$11.10.

- We continue our analytics coverage of AbbVie with a “hold” rating for the next 12 months.

DNY59

Yesterday, July 27, AbbVie (NYSE:ABBV) released its Q2 2023 financial results, which not only beat analysts’ expectations but demonstrated that demand for innovative drugs such as Skyrizi, Vraylar, and Rinvoq is growing faster than many on Wall Street expected. On the other hand, more than half of the company’s medicines showed a decrease in sales compared to the previous year, which puts the company in severe dependence on the immunology segment.

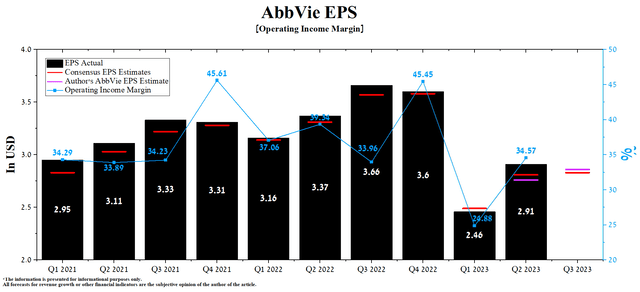

AbbVie’s revenue was about $13.87 billion, exceeding our expectations by $1.02 billion. At the same time, the company’s non-GAAP net earnings were $5.18 billion or $2.91 per share, $0.15 more than we previously forecast. This was mainly due to higher combined sales of Skyrizi and Rinvoq of $2.8 billion, up 51.9% year-over-year. As a result, Mr. Market favorably assessed the company’s financial report, which was reflected in its price growth of 4.9%.

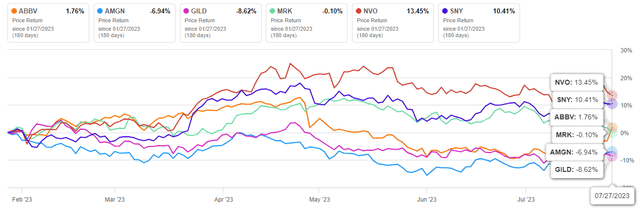

Over the past six months, AbbVie’s share price has gained 1.76% despite multiple drug approvals, outperforming competitors in the global cancer therapeutics market, such as Merck (MRK), Amgen (AMGN), and Gilead Sciences (GILD). But at the same time, the S&P 500 (SPY) pleased investors much more, showing an increase of 12.1% over the same period.

Author’s elaboration, based on Seeking Alpha

We continue our analytics coverage of AbbVie with a “hold” rating for the next 12 months.

AbbVie’s Q2 2023 financial results and outlook for the second half of 2023

AbbVie’s revenue for the second quarter of 2023 was $13.87 billion, up 13.4% from the previous quarter and down 4.9% from the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

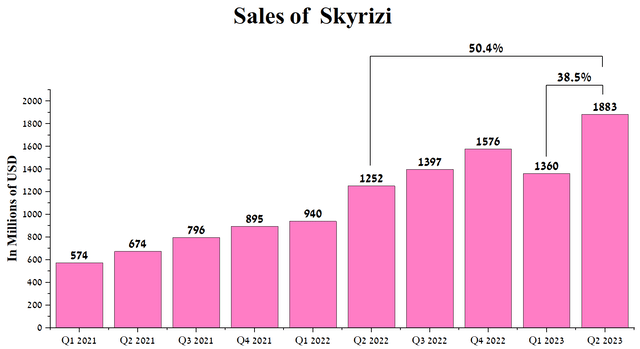

The quarterly increase in revenue was mainly due to sales of Skyrizi (risankizumab), an IgG monoclonal antibody that inhibits interleukin-23 and thereby reduces the release of proinflammatory cytokines. Skyrizi’s net revenues were $1,883 million in Q2 2023, up 38.5% QoQ. Growth in sales of AbbVie’s medicine was driven by continued growth in prescription volume and increased market share, driven by the publication of positive clinical trial results at various conferences such as the American Academy of Dermatology Annual Meeting and the 18th Congress of European Crohn’s and Colitis Organization.

Author’s elaboration, based on quarterly securities reports

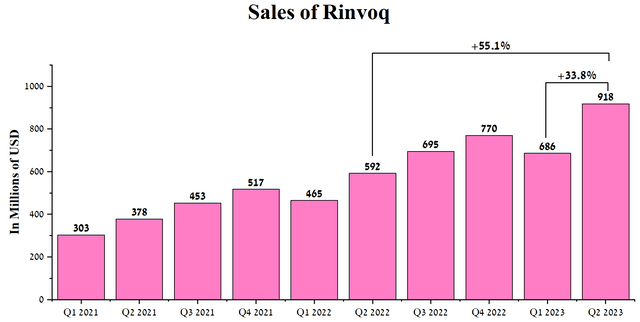

Another medicine in the immunology segment that has minimized Humira sales declines is Rinvoq (upadacitinib), whose mechanism of action is based on inhibiting intracellular cytoplasmic JAK enzymes. Rinvoq’s net revenues were $918 million in Q2 2023, up 55.1% year-on-year. The sales increase was driven by sales volume growth and expansion of its use in the US and Europe. So, on May 18, 2023, the FDA approved AbbVie’s product for treating adults with moderately to severely active Crohn’s disease.

Author’s elaboration, based on quarterly securities reports

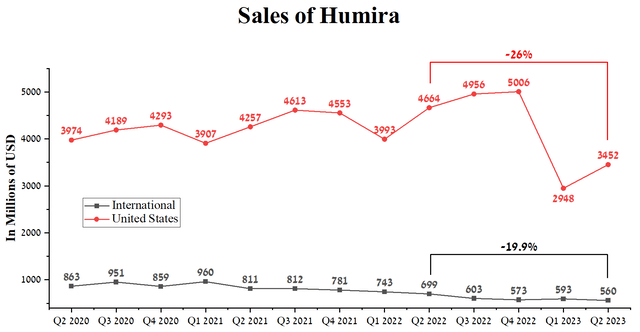

According to Seeking Alpha, AbbVie’s revenue for Q3 2023 is expected to be $13.1- $13.68 billion, down 0.9% from analysts’ expectations for Q2 2023. At the same time, following our model, the company’s total revenue will be slightly higher than the median value of this range and will amount to $13.45 billion. This will primarily be due to more robust sales of Humira in the US due to slower market penetration of its biosimilars and the FDA’s refusal to approve Teva’s interchangeable high-concentration biosimilar. For example, sales of the AbbVie blockbuster in the US amounted to about $3.45 billion in the second quarter of 2023, an increase of $502 million compared to the previous quarter.

Author’s elaboration, based on quarterly securities reports

In addition, a smaller year-on-year decline in revenue from our previous expectations will be due to the publication of the results from the Phase 4 IMMpulse study, which evaluated the efficacy and safety of Skyrizi versus Otezla, which generated $2.29 billion for Amgen in 2022. AbbVie’s product showed higher efficacy in treating patients with moderate plaque psoriasis.

Thus, it was demonstrated that in 63.6% of patients with plaque psoriasis taking Skyrizi, the skin was completely cleared, while only 2.7% of patients receiving Otezla achieved PASI 100 by the 52nd week. In addition, AbbVie’s drug met all of the primary endpoints, indicating it can provide a higher level of skin clearing in adults with psoriasis relative to Amgen’s oral medicine.

AbbVie’s earnings per share (EPS) for the second quarter of 2023 was $2.91, down 13.6% from the previous year. Despite its decline, the company’s management raised the guidance for 2023 from $10.57-$10.97 to $10.90-$11.10, which market participants certainly perceived positively.

According to Seeking Alpha, AbbVie’s Q3 EPS is expected to be $2.78-$2.88, up 0.7% from the consensus estimate for Q2 2023. While we believe this is slightly underestimated, our model puts AbbVie’s EPS at $2.86.

Author’s elaboration, based on Seeking Alpha

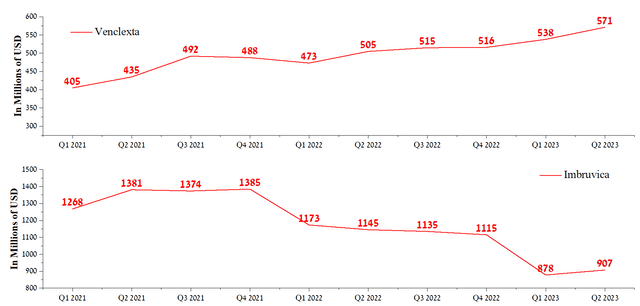

One reason for AbbVie’s year-over-year operating income decline is the falling demand for Imbruvica (ibrutinib), a drug used to treat certain types of blood cancer. Imbruvica’s total revenue was $907 million in Q2 2023, down 20.8% year-over-year due to increased competition in Bruton’s tyrosine kinase (BTK) inhibitors market. At the same time, sales of another AbbVie product, a BCL-2 inhibitor approved by regulatory authorities for treating chronic lymphocytic leukemia (CLL) and acute myeloid leukemia (AML), show weak growth dynamics. Venclexta’s sales were $571 million, an increase of only $33 million from the previous quarter.

Author’s elaboration, based on quarterly securities reports

Conclusion

Yesterday, July 27, AbbVie published financial results for the second quarter of 2023, which, despite beating analysts’ expectations, showed that more than half of the company’s medicines showed a decrease in sales compared to the previous year.

The company continues to generate more than 45% of revenue from sales of immunosuppressive medicines, which raises financial risks in the current period when many of the clauses of President Biden’s Inflation Reduction Act come into effect.

On the other hand, despite the decrease in revenue of the hematologic oncology segment and weak sales of Botox, the company’s guidance for 2023 was increased from $10.57-$10.97 to $10.90-$11.10. Moreover, we are also raising AbbVie’s EPS estimate for Q3 2023 and expect $2.86 now.

However, due to the slow expansion of the company’s portfolio of experimental drugs relative to competitors and the gradual increase in the interchangeable biosimilars of Humira, we continue our analytics coverage of AbbVie with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TEVA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.