Summary:

- Thanks to the password-sharing crackdown and ongoing SAG-AFTRA/ WGA strike, NFLX recorded expanding Q2’23 profit margins and EPS.

- With the expanded 2023 FCF of $5B, we may see the management double down on share repurchases in H2’23, on top of the $1.04B completed in H1’23.

- Naturally, there are risks to this investment thesis, since NFLX’s 2024 FCF generation may be impacted, due to the intensified content spend once the strike is resolved.

- Then again, NFLX remains well capitalized with a balance sheet of $8.57B and only $2.21B of its debt maturing through 2025.

- Investors may still buy here, since the ad-supported segment is still in a high growth cadence, with its EBITDA per share expected to grow at a CAGR of +20.99% through 2025.

fermate

NFLX’s Investment Thesis Is The Market Leading Streaming Profit Margins

We previously covered Netflix, Inc. (NASDAQ:NFLX) in April 2023, discussing its market leading EBITDA margins and rich Free Cash Flow generation, compared to its streaming peers.

Combined with its three monetization strategies, we believed that the streamer might remain highly profitable, while moderately growing its subscribers, no matter the potential impact of the recession.

For now, NFLX has delivered an excellent FQ2’23 performance, with revenues of $8.19B (inline QoQ/ +2.7% YoY) and accelerating GAAP EPS of $3.29 (+14.2% QoQ/ +2.8% YoY). Thanks to the password-sharing crackdown, it also recorded expanding gross margins of 42.9% (+1.8 points QoQ/ YoY).

In addition, the management competently managed costs despite the rising inflationary pressures, with its operating expenses remaining stable QoQ/ YoY, naturally boosting its operating margins to 22.3% (+1.3 points QoQ/ +2.5 YoY) in the latest quarter.

Despite the elevated interest rate environment, NFLX’s interest rate expenses remain stable, since its long-term debts are at fixed rates, suggesting the management’s highly prudent risk management thus far.

Therefore, while its Average Monthly Revenue per Membership growth has underwhelmed at $11.44 (-2.2% QoQ/ -4.9% YoY) in the latest quarter, we are not overly concerned, since the net effect has been positive, as reflected in its expanding FQ2’23 GAAP EPS.

As a testament to market analysts’ optimistic outlook on the paid sharing, NFLX’s global subscriber base has expanded to 238.39M (+2.5% QoQ/ +8% YoY), suggesting the highly sticky consumer base and its recurring revenue model.

Perhaps this is why the management felt confident enough to guide stellar FQ3’23 EPS of $3.52 (+6.9% QoQ/ +13.5% YoY), despite the lower than expected revenues of $8.52B (+4.1% QoQ/ +7.5% YoY). Investors may also expect a top-line acceleration in Q4’23, “as they start to see the full benefits of paid sharing plus continued steady growth in our ad-supported plan.”

Therefore, while there may be short-term uncertainties attributed to the ongoing SAG-AFTRA/ WGA strike, potentially contributing to its lower content spend, delayed production schedules, and reduced new content slate, these issues are not singular to NFLX, with other media companies similarly affected.

These headwinds have also inversely contributed to the streaming company’s improved EPS profitability and expanded FCF guidance of $5B in FY2023 (+210% YoY), compared to the previous guidance of $3.5B (+117.3% YoY), potentially boosting its stock repurchases in H2’23.

This is on top of the management’s $1.04B purchases over the last two quarters, potentially boosting its forward EPS.

Naturally, there are risks to this investment thesis, since NFLX’s FY2024 FCF generation may be impacted, due to the intensified content spend once the strike is resolved. However, this lumpiness is to be expected after all, due to the pulled forward cash flow in FY2023.

With only $2.21B of its debt maturing through 2025 and well-laddered schedule through 2030, investors need not be concerned about NFLX’s liquidity as well, thanks to its growing balance sheet of $8.57B (+9.5% QoQ/ +47.5% YoY).

So, Is NFLX Stock A Buy, Sell, or Hold?

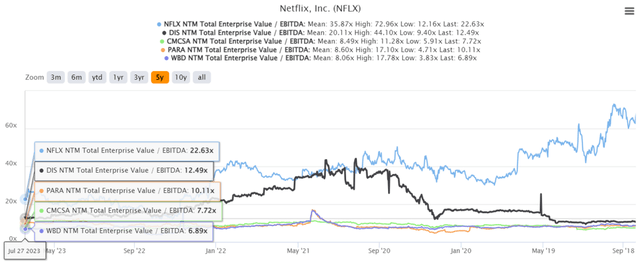

NFLX 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, NFLX still maintained its premium valuations at NTM EV/ EBITDA of 22.63x, compared to its 1Y mean of 21.38x, though naturally moderated from its 3Y pre-pandemic mean of 55.24x.

The streaming company’s market-leading EBITDA margins of 23.4% (+1.4 points QoQ/ +2.6 YoY) in the latest quarter remains highly promising, compared to DIS’ streaming EBITDA margins of -1.8%, PARA’s at -33.8%, and WBD’s at 4%, and CMCSA’s at 14.3% (consolidated with media).

Based on the market analysts’ FY2025 EBITDA projection of $11.22B and its current share count of 451.7M, we are looking at an EBITDA per share of $24.84 then, expanding at a tremendous CAGR of +20.99% from FQ2’23 annualized sum of $16.97.

This alone suggests that, while NFLX is no longer at a high growth stage in terms of its top-line or subscriber base, its bottom line expansion may still accelerate henceforth.

This is especially since the ad-supported segment is only at its nascency, with the “ads plan membership nearly doubling since Q1’23,” aided by the management’s strategic choice in phasing out the lowest-price ad-free plan, effectively raising its advertisement revenues and/or subscription revenues.

With market analysts expecting another expansion in its EBITDA margins to 26.3% (+2.2 points YoY) by FY2025, we believe NFLX’s premium valuation is highly justified indeed.

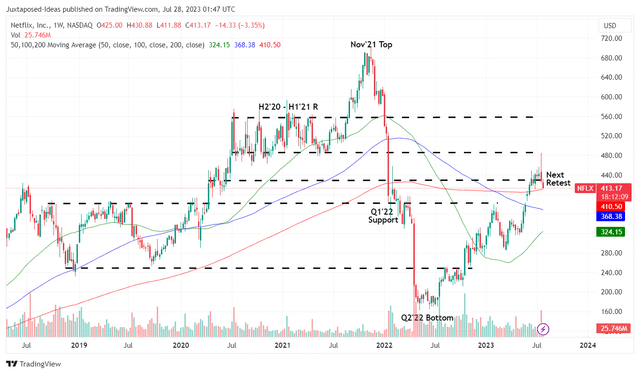

NFLX 5Y Stock Price

Trading View

We are also looking at a long-term price target of $562.12, based on NFLX’s valuations and FY2025 EBITDA per share projection, implying an excellent upside potential of +36% from current levels. This is despite the impressive rally of +146.7% from the Q2’22 bottom, or +49% since our buy in point in late December 2022.

Therefore, due to the excellent margin of safety, we still rate the NFLX stock as a Buy. While bottom fishing investors may consider waiting for a moderate retracement to between $290 and $380, we are fairly certain that current support levels may hold through the uncertain macroeconomic outlook.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.