Tesla: Love Me Or Leave Me

Summary:

- Despite the recent correction following the fiscal Q2 2023 earnings call, Tesla, Inc. stock still has managed to retain much of its premium and recovery from the January 2023 bottom.

- Elon Musk’s plan to flood the market with Tesla EVs appear to be working for now, with expanding Service gross margins despite the impacted Automotive gross margins.

- We have seen many tech giants turn to this subscription strategy, such as Amazon’s Prime membership and Nvidia Corporation’s GeForce Now/ Omniverse Cloud Service/ NeMo generative AI.

- We suppose herein lies the magic of Elon Musk and Tesla stock, simultaneously alternating between impressive future prospects and skepticism.

- As a result, it is evident that Tesla stock is also not for the faint-hearted or those easily swayed by FUD.

Dimitrios Kambouris

Tesla Is Not An Investment That Is For The Faint-Hearted

We previously covered Tesla, Inc. (NASDAQ:TSLA) in April 2023, with the CEO, Elon Musk, in favor of sacrificing margins for the long-term full self-driving (“FSD”) software as a service (“SaaS”) strategy.

Historically, the magic of TSLA was tied to Elon Musk and its market-leading EV sales/ margins. With the CEO previously distracted with Twitter/ ChatGPT and sales potentially impacted by legacy electric vehicle (“EV”) launches, we had been uncertain if the stock might regain its hyper-pandemic valuations and prices in the intermediate term.

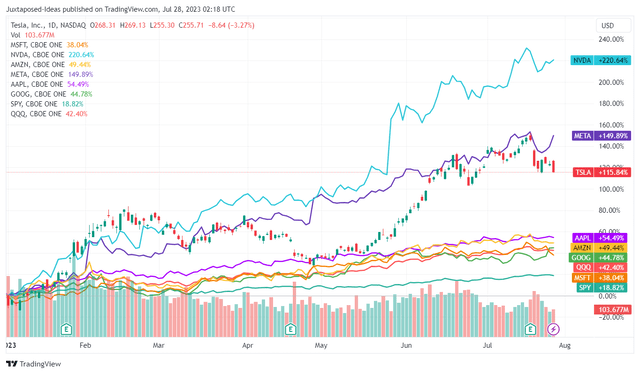

Magnificent Seven Stocks YTD

Trading View

For now, it appears that we have been proven wrong, with the fans coming in great numbers to support the TSLA stock. It has recorded an impressive recovery of +123% since our Buy rating in January 2023 and +73% since our Hold rating in April 2023.

This cadence may also be attributed to the supposed bull run since the start of the year, with the (SPY)/ (QQQ) also recording massive recoveries. This is thanks to the rally of the Magnificent Seven, namely Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Meta (META), Microsoft (MSFT), Nvidia (NVDA), and not forgetting TSLA.

Then again, with the great optimism embedded in TSLA, also comes the great responsibility of fulfilling investors’ lofty expectations. Therefore, it is unsurprising that the stock has also fallen as hard as it has after the FQ2’23 earnings call.

Much of this is attributed to the automaker’s impacted overall gross margins of 18.2% (-1.1 points QoQ/ -6.8 YoY), thanks to the ongoing price war. It appears that its operating expenses of $2.13B (+15.7% QoQ/ +31.4% YoY) have also accelerated compared to its top-line expansion to $24.92B (+6.8% QoQ/ +47.1% YoY) in the latest quarter.

On the one hand, some of those expenses are attributed to TSLA’s intensified R&D efforts of $943M (+22.3% QoQ/ +41.3% YoY), likely accelerating the FSD as a SaaS strategy and the upcoming Cybertruck launch.

On the other hand, the automaker’s operating margins have naturally been impacted to 9.6% (-1.8 points QoQ/ -5.8 points YoY), nearing our projection in the previous article and the legacy peers’ target for the EV division by 2026.

Now that TSLA no longer boasts its previously market leading profit margins, it is unsurprising that the Seeking Alpha analysts are increasingly bearish on the stock, with five sell ratings in the past week.

However, we remain cautiously optimistic about Elon Musk’s execution, for so long that the automaker remains positive cash flow, with FQ2’23 still recording an annualized $12.24B in cash from operations (+21.9% QoQ/ +30.3% YoY) and $4.02B of Free Cash Flow generation (+128.4% QoQ/ +61.8% YoY).

Combined with its growing balance sheet of $23.07B (+2.9% QoQ/ +21.9% YoY) and minimal debt of $872M (-58.3% YoY), TSLA remains profitable enough during these price wars, especially since the latter has contributed to the expanded delivery volumes of 466.14K (+10.2% QoQ/ +83% YoY) in the latest quarter.

While its production and delivery gap seems to be growing to 97.1% (+1.2 points QoQ/ -1.3 YoY), with inventory value similarly expanding to $14.35B (inline QoQ/ +77.1% YoY) with 16 days of supply (+1 day QoQ/ +12 YoY), Elon Musk’s plan to flood the market with TSLA EVs appear to be working for now.

This cadence may potentially boost the automaker’s fan base and in turn, boost its FSD as a SaaS and recurring revenue/ profit streams in the long-term. We have seen many tech giants turn to this subscription strategy, such as:

- AMZN’s Prime membership with bundled-in e-commerce, groceries, gaming, streaming, pharmacy, and others,

- NVDA’s GeForce Now for cloud gaming service, Omniverse Cloud Service for digital twin, Nvidia Drive for autonomous driving, NeMo generative AI, Picasso for image/ video/ 3D content generation, and others.

This is on top of TSLA’s expanding supercharger network with 48.08K connectors (+6.4% QoQ/ +32.9% YoY) in the latest quarter, potentially being a major revenue driver, due to its expanded partnership with multiple legacy automakers. Assuming a similar cadence, we may see a further increase to over 53K supercharger connectors by the end of 2023 and over 300K globally by the end of the decade.

These numbers are not overly aggressive indeed, since the U.S. and Chinese governments have committed to ambitious EV goals comprising 50% in vehicle sales by 2030 and 2035, respectively, on top of the EU’s target of entirely zero-emission vehicles from 2035 onwards.

With the EIA also expecting EV adoption to further accelerate to comprise ~36% of the vehicle market share by 2030, compared to the previous 2021 projection of 15%, it is apparent that high-speed charging infrastructure is highly critical to this cadence, one that increasingly demonstrates TSLA’s superior Supercharger network.

While battery technologies have also improved tremendously over the past few years, driving range has been a sore point for internal combustion engine (“ICE’) drivers after all, with the automaker’s Model 3 base model only offering ~270 miles per full charge, compared to a regular ICE sedan’s range of over 435 miles.

However, the increased availability of TSLA’s superchargers may assuage these fears, by offering up to 200 in additional mileage within 15 minutes of charging. This is compared to ChargePoint’s (CHPT) Level 2 charging at approximately 25 miles per hour, and Ford’s (F) BlueOval Charging Network at 54 miles per 10 minutes.

This may be why the robust TSLA ecosystem has been highly valued by market analysts, due to the combination of its vertically integrated supply chain, Dojo AI Machine Learning chips, improving FSD capabilities, and solar generation/ home charging system.

This is on top of the automaker’s sustained production ramp up in Berlin, Shanghai, Texas, Mexico, and Nevada, though the Optimus bot likely remains off a distance for now.

For now, anyone concerned about the potential crowding of TSLA superchargers need not be concerned, since only 12K are made available to non-Tesla drivers in the U.S., out of the total 19K connectors installed.

Even then, given that the U.S. records 1.96M of TSLA EVs by June 2023, comprising easily 65% of the 3M EVs on the roads as of February 2023, we believe the impact is not as dire as expected, with the automaker still iterating 1.8M of deliveries in 2023 (+37.4% YoY) and a volume growth target of +50%. Most of the users may still be comprised of TSLA drivers, depending on its peers ramp-up ahead.

As a result, we remain cautiously confident about Elon Musk’s strategy, since the automaker’s Services & Other segment has reported expanding gross margins of 7.9% (+0.5 points QoQ/ +4.1 YoY), with the Energy Generation & Storage also increasing to 18.4% (+7.5 points QoQ/ +7.2 YoY) in the latest quarter.

Therefore, it appears that there is logic to TSLA’s ambitions after all, despite the decline in its automotive margins to 17.4% (-0.8 points QoQ/ -8.3 YoY). Highly convinced investors only need to stay long during this uncertain transitionary period.

So, Is TSLA Stock A Buy, Sell, or Hold?

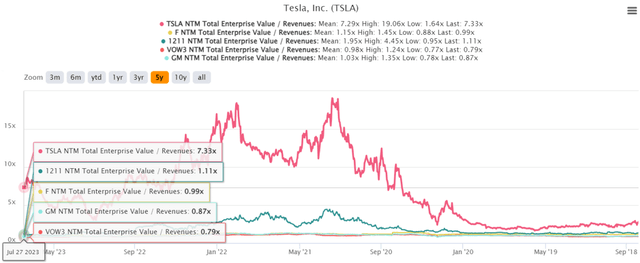

TSLA 5Y EV/Revenue Valuations

S&P Capital IQ

Perhaps this is why TSLA stock continues to trade at elevated NTM EV/ Revenues of 7.33x, compared to its automotive peers’ median of 1x, since the former is expected to record a top-line expansion at a CAGR of +25.4% through FY2025.

This is compared to Volkswagen AG (OTCPK:VWAGY and OTCPK:VWAPY) at +5.2%, General Motors (GM) at +4.2%, and F at +5.5%, though nearly in-line with BYD Company (OTCPK:BYDDF) at +28.7%.

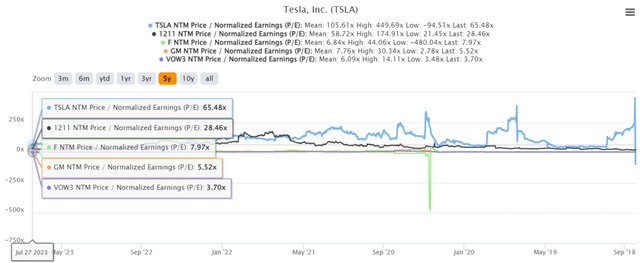

TSLA 5Y P/E Valuations

S&P Capital IQ

Then again, here is where things turn volatile, since TSLA continues to trade at an elevated NTM P/E of 65.48x, against its automotive peers’ median of 3.60x. While the former is expected to record a bottom line expansion at a CAGR of +15.4% through FY2025, this still lags behind BYD at +30.2%, though improved than GM at -1.8%, F at +1.4%, and VWAGY at +6.7%.

Not surprisingly, this is also where analysts have had mixed feelings about the stock’s overly premium valuations, despite the excellent returns thus far. We suppose herein lies the magic of Elon Musk and TSLA stock, simultaneously alternating between impressive future prospects and skepticism.

As a result, it is evident that the TSLA stock is also not for the faint-hearted or those easily swayed by fear, uncertainty, and doubt [FUD].

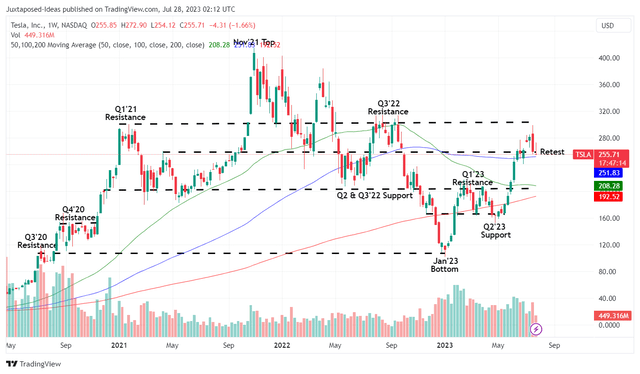

TSLA 3Y Stock Price

Trading View

Combined with its overly fast and furious rally thus far, we are uncertain if it is smart to add here, due to the reduced upside potential to our price target of $303.98, based on its 1Y P/E mean of 48.56x and the market analysts’ FY2025 EPS projection of $6.26.

Then again, with TSLA’s P/E valuations wildly swinging between its 1Y high of 79.03x and 1Y low of 20.31x, it appears that Mr. Market is unable to make up its mind as well.

As a result of the potential volatility, we prefer to rate the TSLA stock as a Hold here. Anyone looking to add may consider doing so at its previous Q1’23 resistance levels of $200 for an improved margin of safety.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, AMZN, MSFT, GOOG, META, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.