Summary:

- Visa Direct transactions soar in Q3 2023, with a remarkable 20% increase totaling $1.8 billion.

- Visa expands Visa Direct in key markets, including France and Bolivia, and partners with fintech companies.

- Progressive value-added services contribute to Visa’s growth, focusing on deepening client penetration, geographical expansion, and innovative solutions.

- Visa demonstrates strong performance in payment volume, showing growth in major markets and cross-border transactions while addressing potential risks and downsides.

David Paul Morris

Investment Thesis

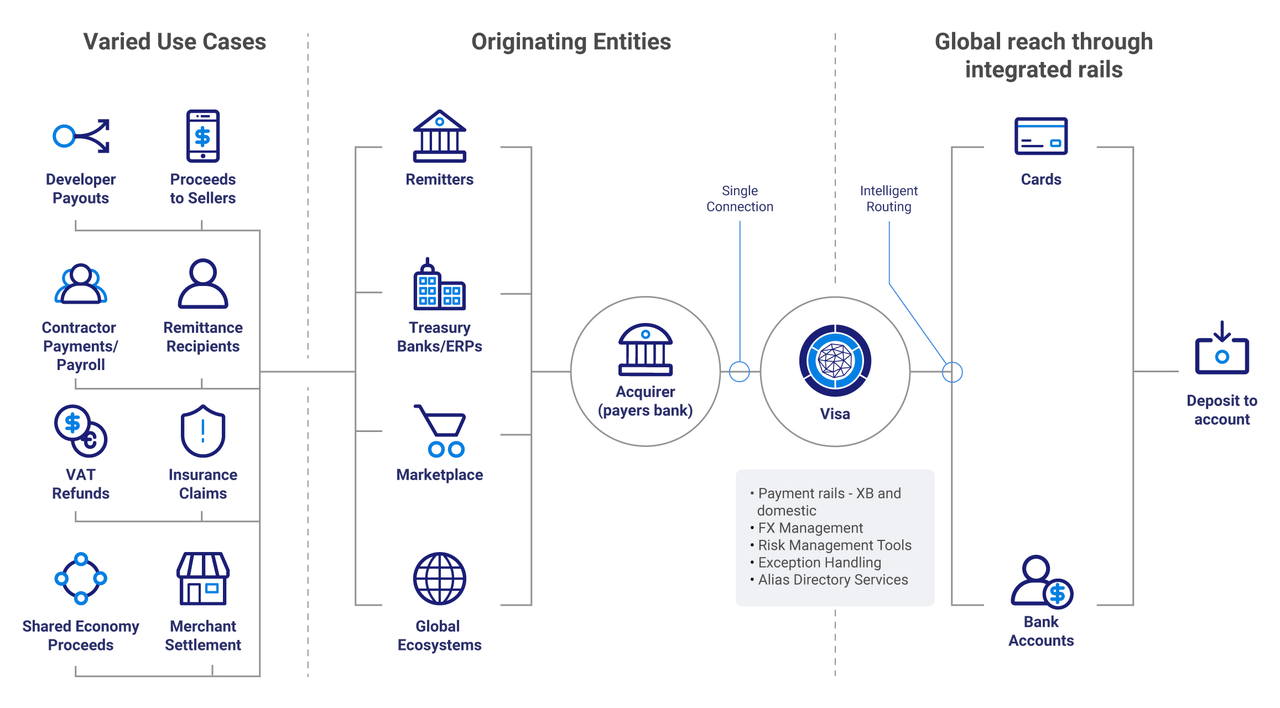

In Q3 2023, Visa Inc. (NYSE:V) reported strong growth in its Direct transactions, reflecting a remarkable 20% increase totaling $1.8 billion. The company’s Visa Direct service serves as a crucial revenue driver, enabling Visa to explore new markets and expand its cross-border presence.

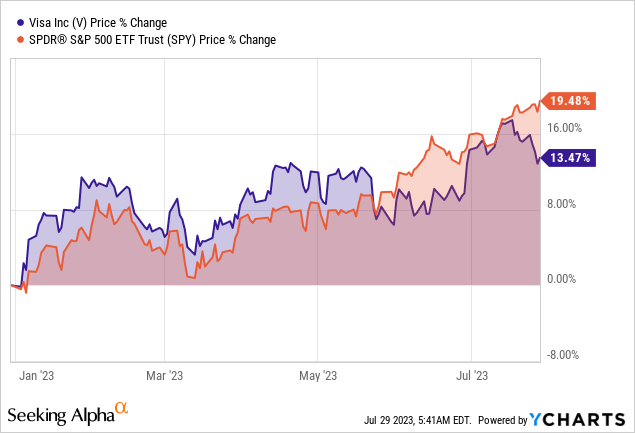

Despite V’s underperformance compared to the market, the company’s expansion into key markets and strategic partnerships underscore the growth potential of Visa Direct and solidify the company’s position as a key player in the competitive cross-border payments and remittance market.

Visa Direct Soars To New Heights

Visa has witnessed significant growth in Visa Direct transactions during Q3 2023, with a remarkable 20% increase totaling $1.8 billion. The company’s Visa Direct service is a crucial revenue driver as it enters new markets and expands its cross-border presence.

In Latin America, Visa experienced the transition of a bank client’s domestic peer-to-peer (P2P) transactions to an internal ledger system. While this transition may impact Visa’s transactions over the coming quarters, it is expected to have minimal revenue effects.

Visa Direct’s expansion into key markets highlights its growth potential. For instance, in France, Visa renewed its issuance relationship with Lydia, a leading P2P provider with over 7 million users, and signed a Visa Direct deal to enable users to top up their wallets using an eligible card. In Bolivia, Visa Direct will facilitate domestic P2P transactions within the app for fintech Libelula’s new app called Lula, with YellowPepper providing alias directory services.

The service also enables business-to-business (B2B) cross-border supplier payments for thousands of SME clients in Mexico through a partnership with fintech Alchemy Pay. Additionally, Visa has been expanding its remittance services in partnership with Revolut, now offering Visa Direct to 89 markets, and TransferGo, which has grown its Visa Direct-enabled corridors from 32 to over 160.

Therefore, as Visa continues to focus on effectively selling and activating its solutions, Visa Direct’s prominence is likely to contribute significantly to the company’s revenue growth and solidify its position as a key player in the cross-border payments and remittance market.

Progressive Value-Added Services

Visa has been experiencing strong growth in its value-added services, focusing on three key growth areas: deepening client penetration of existing products, expanding geographically, and building and launching new solutions. In the third quarter, Visa achieved remarkable success by selling over 300 new issuing services, 600 new acceptance services, and almost 500 new risk and identity services. This contributed to a substantial increase in value-added services revenue, which reached $1.8 billion, a 19% growth in constant dollars.

Visa’s strategy is to offer a broader range of smaller solutions in the value-added services segment. The company’s sales teams work closely with clients to understand their pain points and identify growth opportunities, leading to successful adoption and revenue generation from these services.

A notable example of Visa’s focus on new solutions and partnerships is its collaboration with Pay.UK, the account-to-account payments operator in the UK Visa, is piloting a new fraud capability called RTP Prevent, specifically designed for instant payments using deep learning AI models. This solution provides real-time risk scores to banks, enabling them to approve or reject transactions on the RTP network promptly. By expanding into new networks like RTP, Visa can tap into additional markets and deliver tailored solutions to meet specific payment needs.

Looking forward, Visa’s value-added services segment is expected to be a significant long-term growth engine for the company. The company’s strategic efforts to deepen client penetration, expand globally, and offer innovative solutions will continue to drive revenue and increase transaction yield. Finally, by capitalizing on structural and secular trends, Visa may sustain its robust growth in value-added services and remain a leading player in the global payment industry.

Robust Payment Volume

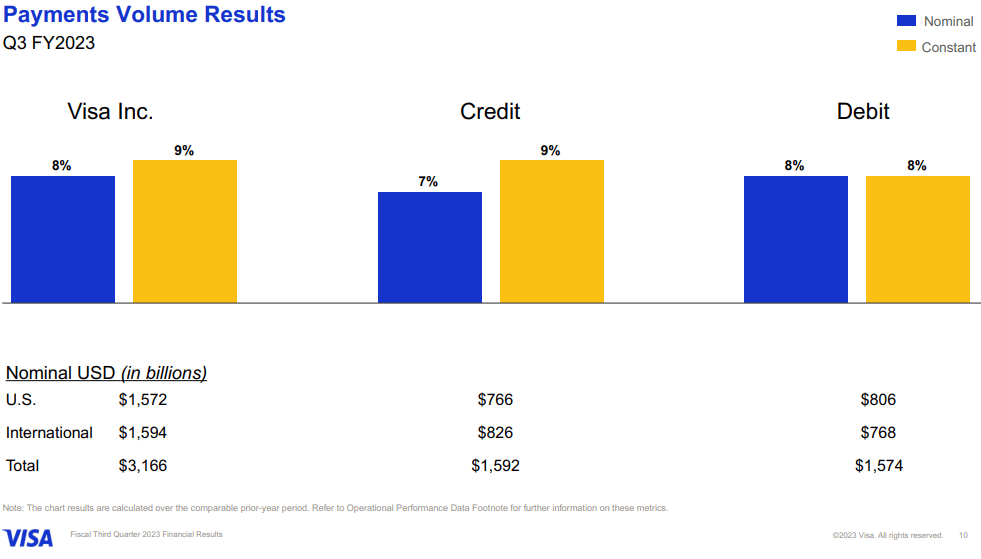

Visa has shown strong performance in its payment volume during Q3 2023. In constant dollars, global payment volume increased by 9%. However, the payments volume growth pace slowed year-over-year from the 12% experienced during Q3 2022, mainly due to inflationary pressures.

When indexed to 2019, it grew by an impressive 48%. US payments volume increased by 6% year-over-year, and transaction growth remained steady at 8%, reflecting pre-COVID levels. However, the average ticket size declined by 2%, primarily due to lower fuel prices and a general moderation of inflation across various categories.

Nevertheless, compared to 2019, US payments volume surged by 54%, while international payments volume grew by 12%. The increase in international payment volume can be attributed to the discontinuation of Russian operations.

Investor Presentation

The cross-border travel recovery is progressing as expected, with volume ex-Europe showing a 6-point improvement from the second quarter, indicating a gradual return to pre-pandemic levels. Summer travel across most regions, particularly in and out of Asia and CEMEA (Central Europe, Middle East, and Africa), while travel into the US remained steady at 2019 levels. Visa’s new flows and value-added services businesses grew at almost 20% in constant dollars, indicating diversification and expansion.

In the US, credit, and debit both grew, with credit increasing by 5% and debit by 6% year-over-year. Card-present spending in the US grew by 3%, and card-not-present volume (excluding travel) increased by 8%. However, the step-down in US payments volume growth since March was due to a 2% decline in average ticket size, mainly in fuel, retail goods, travel, and food and drug categories.

Internationally, Visa experienced robust growth in major markets, with Latin America up 20%, CEMEA up 28%, Europe up 10%, and Asia Pacific (excluding China) up 12% in constant dollars. Cross-border volume growth, excluding transactions within Europe, rose by 22% year-over-year and 49% compared to four years ago. Cross-border e-commerce spending also grew in the low double digits, similar to pre-COVID levels.

Regarding opportunities, Visa is optimistic about its commercial efforts, especially in the B2B sector. The company is actively releasing innovations in the commercial space, such as Visa Spend Clarity and Visa Commercial Pay, to enhance expense management and control for clients. Thus, the B2B market represents a significant total addressable market (TAM), and Visa sees ample room for growth in this space.

Navigating Challenges: Visa’s Resilience Amidst Legal & Regulatory Shifts

Visa’s operations are facing vital downsides, including a Block, Inc. (SQ) lawsuit that has caused market confusion. However, the lawsuit is covered under Visa’s share class structure, and the company maintains a solid and valuable relationship with Block.

Reg II is mentioned regarding regulatory changes, which could potentially impact Visa’s business. While it’s still early days with the implementation, Visa is confident in its ability to compete, citing its advanced fraud tools, risk-scoring capabilities, and product functionality enabled by dual messaging as advantages that could influence merchant routing choices.

Moreover, there’s a gap between nominal cross-border volumes excluding inter-European and international revenue on a nominal basis. The gap is attributed mainly to FX volatility, with last year experiencing higher volatility than usual. Other factors contributing to the gap include FX impact and mix factors, depending on corridors and other variables. Lastly, Visa’s tax rate guidance doesn’t anticipate any impact from recent Brazil tax law changes, suggesting that the company may have mitigated potential adverse effects.

Takeaway

With a strategic focus on value-added services, Visa has achieved significant revenue growth by deepening client penetration, expanding geographically, and launching innovative solutions. The company’s dedication to providing tailored services and forging strategic partnerships positions Visa as a leading innovator in the payment industry.

Overall, Visa’s growth in Visa Direct transactions, value-added services, and robust payment volume indicates a promising future for the company. By staying committed to innovation, strategic partnerships, and customer-centric solutions, Visa is poised to remain at the forefront of the global payment industry and continue its positive impact on finance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.