Summary:

- The foundation for what made Visa a solid investment many years ago remains in place today.

- A positive business outlook, solid market position, and strong leadership are reasons to invest in Visa.

- Visa has never been cheap and likely won’t be as long as the company continues growing, but, so far, it has managed to grow into its valuation.

DNY59

Investment Thesis

Visa (NYSE:V) is my 3rd largest position, making up 6.4% of my portfolio. I haven’t sold a single share since I first invested, and my latest purchase was December 2021, when I picked up shares at $192.83 per share. I plan on expanding my position down the road as I intend on holding this position for as long as I can. As such, I’m of course also biased in favor of the company, which is relevant to know when reading this article.

As investors we are only able to allocate any given capital once, which leads to the need for decision making in terms of what investment opportunities to prioritize. From personal experience, I’d say we as investors often end up hesitating when it comes to favoring the company with a more expensive price tag. Here I refer to a steeper valuation, where we feel as if we get more ‘back for the buck’, if we go with the alternative stock that carries a less expensive valuation. All investors are different, but this is at least something I’ve observed amongst those who are less risk averse and focus on capital preservation – which includes myself. This can sometimes prove to be a mistake, and looking back, I’m glad I managed to fight off the urge to not invest in Visa as I remember thinking it wouldn’t be able to grow into its steep valuation back when I first picked it up. In the rearview, it can appear very obvious how everything played out, but when you are on the ground in the midst of things, doubt can creep into your mind, and it’s proven that losses hit us harder than gains, which is referred to as loss aversion.

I went long Visa back in 2016, but I remember struggling severely before I finally managed to persuade myself to go ahead. I’d been looking into the company for a couple of years, and it was just consistently trading at a steep valuation that I wasn’t sure it could justify over time. Back then, the company raked in $13.8 billion in revenue with a net income of $6.3 billion, compared to a FY2022 revenue of $29.3 billion with a net income of $14.9 billion. The detail orientated reader will notice how Visa is commanding a stronger net income margin today, on the basis of a larger revenue pool compared to back then – more on that later.

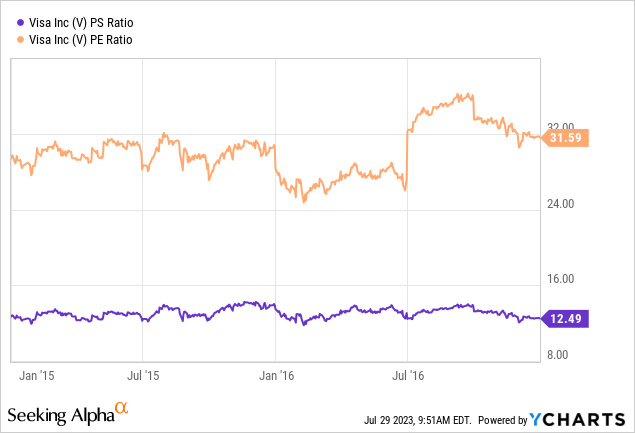

Today, it’s almost a $500 billion dollar market cap, making it one of the absolute heavy weights globally. Sure, it was just around the $200 billion market cap back then, but as I did my due diligence throughout 2015 and beginning of 2016, it was still trading at a price to sales ratio >12 and a price to earnings ratio >25. Even so, $200 billion is no slouch for a market cap, especially before we started talking about market caps measured in several trillion dollars.

You can see the valuation for Visa back in 2015-2016 in the chart below.

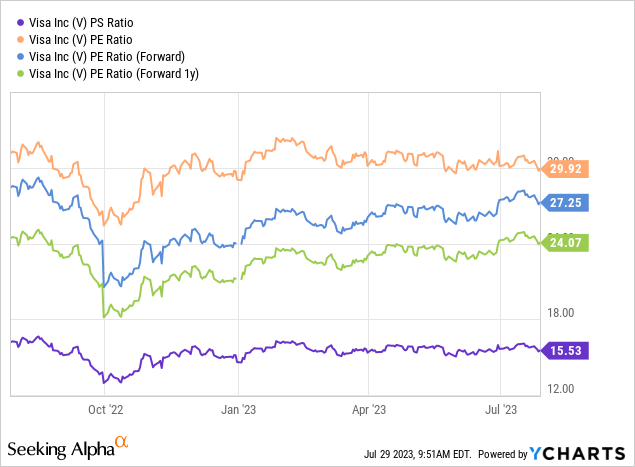

Today, the company is still trading at a valuation of similar sorts. The P/S ratio is higher, but the P/E ratio is close to identical given the fluctuations we see with the stock moving up and down as time passes. The company is also managing better unit economics, which logically allows for some sort of expansion in the valuation.

Where am I trying to go with this? I’m of the opinion that the same arguments that persuaded me to invest eight years ago, still hold true today, and can form the foundation as to why Visa remains a company with a promising future. Therefore, I’ll focus this article on my three arguments from back then.

Argument number 1: The marketplace opportunity – going cashless

Visa, and its peer Mastercard (MA) exist on the premise that individuals want to conduct payment transactions digitally as opposed to via the traditional cash in the form of bills & coins. This covers both domestic and cross-border transactions, as well as credit & debit cards.

Maturity in terms of going cashless differs vastly across nations globally. I can’t remember having used cash in my own country for the past ten years. It’s just not needed anywhere, anymore. At the same time, my neighboring country, Germany, here cash remains the preferred form of payment. Similarly, I remember being surprised by the US favoring cash when I first went there many years ago. Having been there many times since, latest last summer, I always ensure to bring plenty of cash with me. There is nothing wrong or right with either of these opposites, but it’s just to say that Visa operates in a marketplace where we are far from being able to call it fully mature or saturated on a global scale. Having travelled to many undeveloped regions of the world, I can say there is still growth opportunities out there for Visa.

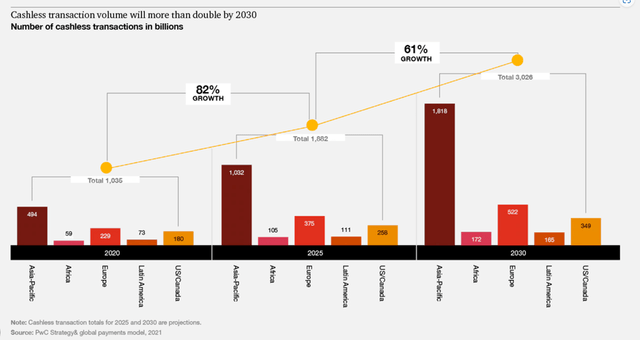

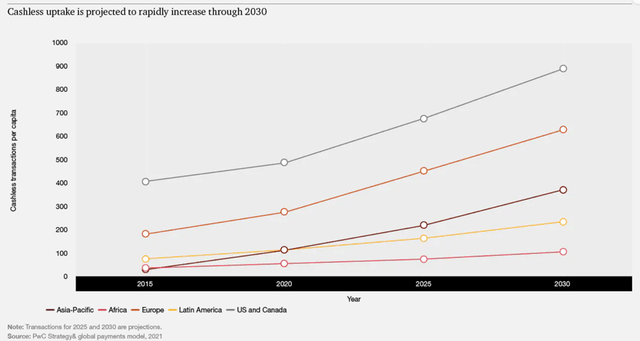

The above is my personal experience, which doesn’t carry much validity, but if we observe actual empiric data looking into the topic, then it confirms that exact observation.

Payments 2025 and beyond (pwc.com)

Cashless transactions are forecasted to grow massively throughout this decade and beyond.

Payments 2025 and beyond (pwc.com)

It’s expected to do so both in volume and value, both which are value drivers for Visa. In addition, we are living in a world with a growing middle class, who want to travel to see the world and divulge in the goods and services of other parts of the world. This drives up the number of cross-border transactions, another focus area for a company like Visa.

I’m often looking at the total addressable market opportunity for a company before I invest. For a company like Coca-Cola (KO), that is a somewhat depleted opportunity as you can’t find a nation on this planet where you can’t pick up a bottle of coke on more less any corner. For a company like Visa, there is plenty of opportunity remaining. Sure, there is also growing competition from Fintech and crypto alternatives, but this is a company with a substantial moat as they are operating under network benefits, as also seen from the growing margins I alluded to earlier.

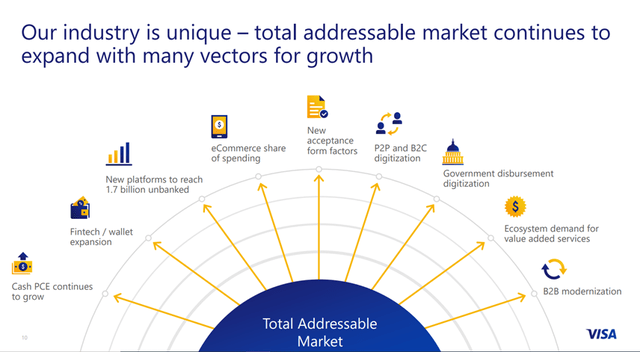

This is of course also something Visa is quick to point out themselves, as observed from their investor day presentation material.

Visa Total Addressable Market (Visa Investor Day 2020)

Visa has taken its shareholders on a tremendous journey, and in many ways thanks to the simple and intuitive nature of their product.

If I were to summarize some of the selling points for why a company like Visa is needed in this world, I’d look like the following

- Consumers want a more seamless experience once first becoming available. Obtaining cash is a hassle and time can be saved from simply swiping your card at the store.

- Businesses pay significant costs associated to handling cash and storing it safely. They run the risk of theft, but if there is no cash, there isn’t much for a thief to go after. In the last decade, banks started introducing cashless branches nationally in my country, and in 2015, the amount of bank robberies had fallen 84.4%. Think about that for a second.

- Governments want to be able to track money transactions both to avoid money laundering but also to ensure incomes are taxed. It’s well known that large bills, such as the EUR 500 bill, is used for illegal purposes.

- The small DIY coffee & ice cream stand in the local park want to be able to receive payment from customers but can’t afford to carry substantial amounts of change. Here, digital payment once again makes it easier for both parties.

The list goes on, and I’m sure you can come up with similar examples to underline just why digital forms of payment creates value for both sides of the transaction.

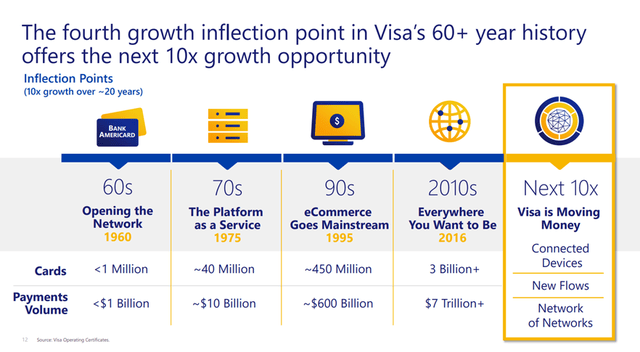

Visa Growth Inflection Point (Visa Investor Day 2020)

There comes a day where growth will stall, and as is always the case in the stock market, it will be a surprise and the stock will take a massive beating. However, I don’t personally see that as something that’s looming just around the corner. But of course, we never know, but in my opinion, the business foundation for Visa is just as alive today as it was back in 2015-2016.

Argument number 2: A solid management team

When I try to gauge if a company has a solid management team, I investigate several things. Of course, any company the size of Visa will have a management team filled with people carrying the highest degree’s possible and lots of sector related experience prior to ever joining the higher echelons of management. That is the case for any company out there, so it doesn’t really necessarily say much on its own.

When I first started looking into Visa, the chief executive officer at the time was Charles Scharf. I observed how he behaved in conference calls and of course compared that to the company performance. This was before I became familiar with the possibility of looking up Glassdoor reviews, but I reached the conclusion that this guy was the right person to steer the ship. Shortly after I decided to invest, he resigned his position on his own terms as he concluded he couldn’t dedicate sufficient time and that the company needed someone who could. Alfred Kelly Jr. took over in December of 2016 and held the position until just recently, and he also did a very good job seen from the outside of an amateur investor. The new CEO, Ryan Mcinerney took over February this year, so I haven’t had much chance to really observe him yet. In my time as a Visa shareholder, the board of directors has proven capable of picking individuals who the general employees may rally around, and that’s just as important, and I’m confident they have done so once again. What I like about having given Ryan the opportunity is first of all that he’s from inside the company and secondly that he used to run the international operations of Visa. And where does the opportunity lie again for Visa going forward? A big chunk of it will be internationally.

In essence, I consider a management team solid when they under promise and consistently overdeliver.

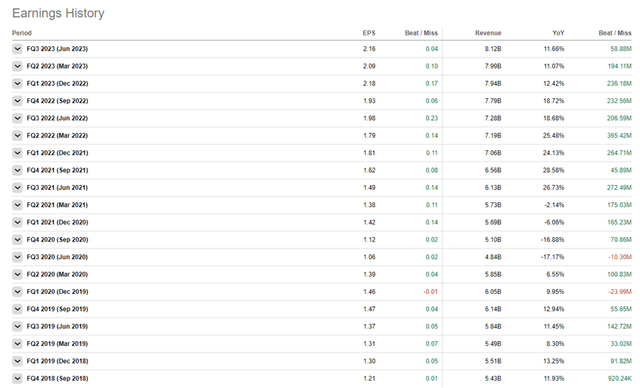

This is best viewed by looking at the earnings history. I don’t want management teams who start empire building such as conducting value destroying acquisitions or fattening the company to the point where it begins eroding margins. No, I want to see the company grow its operations profitably.

Visa Earnings History (Seeking Alpha)

In the illustration above, you can see the earnings history for Visa over the past twenty quarters. Green indicates a beat of the consensus expectations while red indicates a miss. It’s clear to me how this company usually performs.

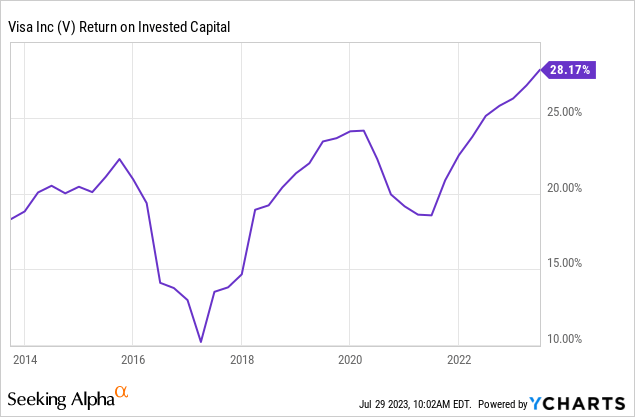

There is also one financial metric I always look at, which is return on invested capital (‘ROIC’). Basically, it offers a perspective on the effectiveness of a management team in allocating capital to profitable ventures. How efficient the company is in allocating the capital under its control. Similarly, to investors, a company can only allocate its capital once. Then you may be able to recuperate it via asset sales, but even if that is possible, it always comes at a price or loss compared to your original costs associated to establishing that asset.

Therefore, this is a key parameter for me, telling me a lot about how capable a management team really is. It can be difficult to compare such a financial metric across sectors and even within a given sector, but the important thing is that the ROIC outpaces the costs associated to obtaining capital, be it debt or equity. I prefer to observe a ROIC in excess of 15%. Luckily for me, Visa still delivers on this parameter. A bit of bonus info is, that Mastercard actually does better than Visa on this parameter.

Argument number 3: Company operations moving in the right direction

Here we’re looking at a number of things. Preferably, everything is as I’d like, but oftentimes I have to accept some unpleasantries at the expense of still investing. No company is perfect, and very few are close to. Summarizing, it comes down to some of the following aspects.

- A strong balance sheet meaning a limited amount of debt, goodwill not exceeding equity supplemented by a net cash position if possible

- Strong credit rating by the recognized agencies.

- Free cash flow positive

- Strong operating margins, preferable expanding over time as the company grows

Visa carried no long-term debt back in 2015, but today carries $20.5 billion TTM. Goodwill makes up $18 billion which is well below equity coming in at $37.2 billion. I’m always looking at goodwill, as it’s one of the first things on a balance sheet to often prove worthless in a situation where a company becomes destressed. Your debt is carved in stone, creditors want their money, while goodwill is soft as butter. Many assets carry some sort of value, but goodwill is just the arbitrary value the company slapped onto something they often acquired, and perhaps overpaid for. It’s downright dangerous if goodwill makes up a substantial amount of the balance sheet, at least seen from my perspective. Lastly, Visa currently holds $18.8 billion in cash and short-term investments, which means it almost carries a net cash position. Therefore, it’s also of little surprise that the rating agencies provide Visa with a stable and solid credit rating in the ‘A’ bracket.

The balance sheet of today, isn’t dramatically different from when I first invested, and I’m pleased to be able to make that conclusion.

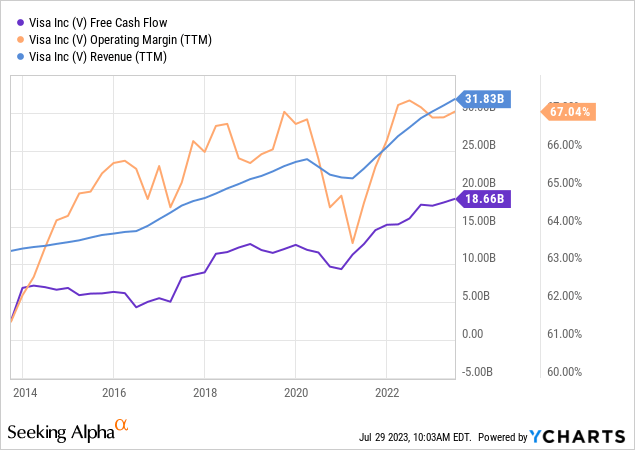

When it comes to business operations, a lot of positive change has happened since I first established my position. Revenue has more than doubled, and the annual free cash flow has gone up more than three times. The company has managed to expand its margins by quite a bit, as illustrated by the operation margin in the graph. This is downright impressive, and it speaks into the very strong market position of Visa. I would however be cautious in expecting the company to be able to expand margins even further from their current level.

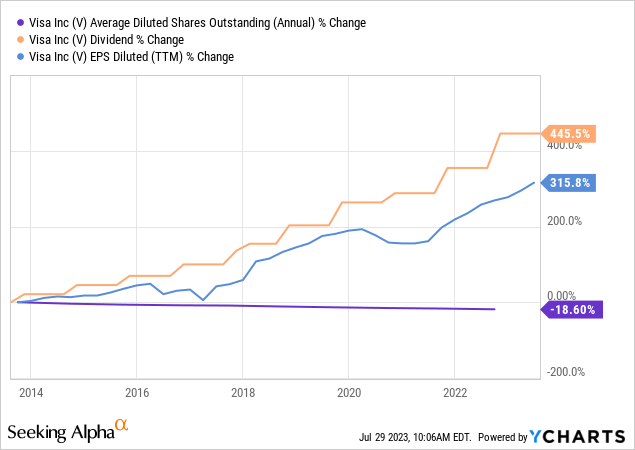

Running a business with strong earnings power and prudent capital allocation allows for conducting shareholder friendly activities. Visa has managed to buy back a fair chunk of its own shares in the past decade, grown the dividend massively and seen its EPS expand along the way.

In a forward-looking perspective, Visa isn’t expected to slow its growth. Both revenue and EPS is expected to grow in excess of 10% annually for the coming three fiscal years. This is of course much more interesting than the historical performance for those who would consider becoming Visa shareholders today.

The Valuation

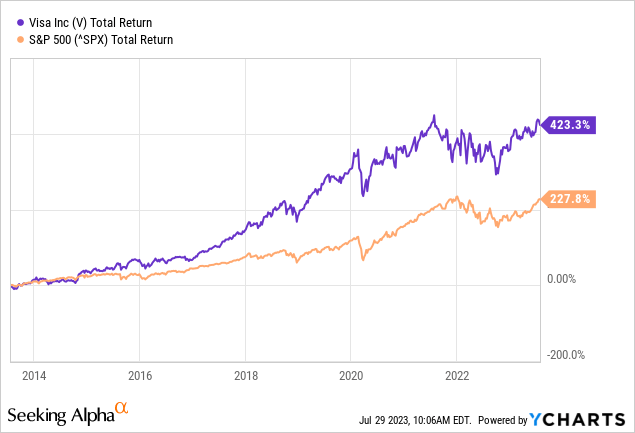

Visa was never cheap, and it isn’t cheap today either. That’s a conundrum associated to investing in this company. It’s obtained a strong duopoly like market position, strong earnings power and a great outlook. Wall Street knows it and the stock is priced accordingly. Visa has beaten the broader index over the past decade even despite having secured little appreciation since 2021.

From my vantage point, Visa holds the potential for it to remain a market beating stock due to the aforementioned reasons I’ve gone through.

If I find myself in a situation where a stock is expensive, as I believe Visa is. I dollar cost average my way into the company. Either I’m lucky enough that the stock appreciates, and I’ve managed to establish a position that’s increasing in value, which I can then add to. Otherwise, I’m fortunate enough that I didn’t throw everything into the mix just to experience the stock decline 25% over a short initial period, which would allow me to lower my average cost. The valuation isn’t a screaming buy, and it never has been with Visa. That’s part of what we as investors must accept if we want to go long the company. There is a premium to be accepted for a company with such stellar performance

If the forward-looking consensus expectations are met, the company will continue growing into its valuation, as it has done over the past ten years, but the future remains uncertain, same as it did ten years ago.

Takeaway

The arguments that compelled me to invest in Visa back in 2016 are just as relevant today. The company has delivered stellar results for the past many years thanks to a strong market position, solid and prudent leadership as well as a marketplace that continues to offer a promising outlook.

For investors who are on the risk averse part of the spectrum however, Visa can be a daunting offer, as it continues to trade at a steep valuation. However, it’s also a market beating stock, that has continued to outpace the broader index, while growing into its valuation.

If the circumstances surrounding Visa hasn’t changed substantially, with the future outlook still appearing as promising, then it could be worth considering challenging oneself in terms of whether this stock couldn’t play a value-adding part in one’s portfolio, despite the current valuation. It has done so in mine for many years, but it only did so as I managed to challenge my own risk averse nature and invest with respect to ensuring I had a diversified portfolio in the scenario that I was wrong. I opted for a dollar cost average strategy, and I believe that’s a fair way to obtain exposure going forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.