Summary:

- Intel may not achieve its pre-pandemic gross margins of over ~50% anymore, as highlighted by the CFO, David Zinsner, in the recent earnings call.

- With impacted ASPs, bloated inventory, and underloading, it is unsurprising that we are increasingly bearish on the stock, worsened by its ongoing price war with AMD.

- On the other hand, INTC seems to have well managed the elevated interest rate environment while remaining highly liquid through the market correction.

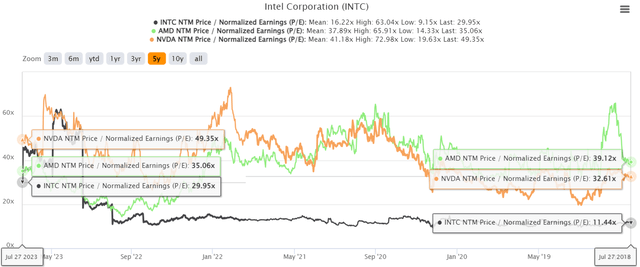

- However, the recent rally has propelled its valuations to 29.95x, nearer to its semiconductor chip peers, such as AMD at 35.06x and NVDA at 49.35x.

- Either market analysts expect this elevated valuation to be a new normal for INTC, thanks to its foundry ambitions, or the company is expected to eventually grow into this pulled-forward recovery. Only time will tell.

aristotoo/iStock via Getty Images

The INTC Investment Thesis Is Overly Optimistic Here

We previously covered Intel (NASDAQ:INTC) in June 2023, discussing its mixed prospects despite the generative AI boom. With its competitors rapidly gaining share, we were not certain if INTC might actually achieve its simultaneous ambitions in the CPU, GPU, and foundry market after all.

For now, INTC appears (on the surface) to have reported a double beat FQ2’23 performance, with revenues of $12.9B (+10.1% QoQ/ -15.7% YoY) and adj EPS of $0.13, compared to FQ1’23 adj EPS of -$0.66 and FQ2’22 adj EPS of -$0.11.

However, given the drastic decline compared to the FQ2’19 revenues of $16.5B and EPS of $0.92, respectively, we are not convinced for now.

Most importantly, it seems that we may not see INTC achieve its pre-pandemic gross margins anymore, as highlighted by the CFO, David Zinsner, in the recent earnings call:

Pat joined and we kind of launched into the 5 nodes in 4 years, we’re going to have a significant amount of startup costs that will hit gross margins that will affect us for a couple of years… We expect a pretty meaningful amount of that (the internal foundry model) to come out by the time we hit 2026… I think there will be multiple opportunities over the course of multiple years to improve the gross margin. (Seeking Alpha)

As a result, we may have to get used to INTC’s lower gross margins of 35.8% in FQ2’23 (+1.6 points QoQ/ +3.3 YoY), compared to FY2021 levels of 55.4% and FY2019 levels of 58.6%.

On the one hand, the management has already valiantly controlled its operating expenses to $5.65B (+4.4% QoQ/ -8.8% YoY) by the latest quarter, nearing its target of “$3B of spending reductions in FY2023.”

On the other hand, it appears that INTC’s cost optimizations have not been aggressive enough, since its FQ2’23 operating margins of -7.8% (+4.2 points QoQ/ -3.2 YoY) remains underwhelming, compared to FY2021 levels of 27.9% and FY2019 levels of 31.2%.

As a result of its impacted profitability and bloated inventory of $11.98B (-7.7% QoQ/ -9.3% YoY), compared to FY2019 levels of $8.74B, it is unsurprising that its reliance on debt has nearly doubled from pre-pandemic levels to $46.33B (-5.1% QoQ/ +22.9% YoY) by the latest quarter.

INTC’s forward guidance for FQ3’23 does not look promising as well, with revenues of $13.4B (+3.8% QoQ/ -12.5% YoY) and adj EPS of $0.20 at the midpoint, compared to FQ3’22 levels of $15.32B/ $0.25 and FQ3’19 levels of $19.19B /$1.35, respectively.

For now, the elevated interest rate environment remains a headwind, with the Fed opting to hike by another 25 basis points in the July FOMC meeting. The company’s annualized interest expenses have already expanded to $856M (+96.3% YoY) as well, though temporarily well-balanced by its annualized hedging instruments of $1.25B (+219.3% YoY).

Then again, while there will be $5.6B of debts maturing through FY2025, INTC remains well capitalized, with $24.24B of liquidity by the latest quarter (-11.9% QoQ/ -14.4% YoY).

In addition, while the company’s capex may remain elevated, the management has also well-balanced the timing of expenditure, while similarly qualifying for government offsets through the US Inflation Reduction Act and EU Chips Act.

Either way, these developments are painting a mixed picture for INTC’s prospects, in our opinion, since survival may not be an issue but with a less than satisfactory top and bottom line performance.

This cadence is further worsened by the INTC management’s decision to go into a CPU price war with Advanced Micro Devices (NASDAQ:AMD), in an attempt to regain its market share. The former has already undercut its MSRP by over -20% compared to the latter’s similar offerings, naturally impacting profit margins.

It remains if these drastic measures may actually contribute to INTC’s market share in Q2’23 as well, since AMD’s CEO has guided “good progress on our CPU business,” with an approximate server market share of over 25% (+7.4 points from 2022 levels).

This statement does not paint a pretty picture for the incumbent indeed, with INTC’s x86 overall market share steadily eroded to 65.4% (-3.3 points QoQ/ -6.9 YoY), against AMD’s 34.6% in Q1’23 (+3.3 points QoQ/ +6.9 YoY). Only time will tell, with updated data likely published over the next few weeks.

So, Is INTC Stock A Buy, Sell, or Hold?

INTC 5Y P/E Valuations

For now, INTC is trading at NTM P/E of 29.95x, elevated against its 3Y pre-pandemic mean of 12.24x. This is despite market analysts expecting an underwhelming FY2025 adj EPS of $2.41, suggesting a normalized CAGR of -11.1% from FY2019’s levels of $4.87, further confirming our bearish thesis.

Most importantly, the recent rally has propelled its valuations nearer to its semiconductor chip peers, such as AMD at 35.06x and NVIDIA (NVDA) at 49.35x.

This comparison is important, since both companies are expected to generate impressive bottom line expansions at normalized CAGRs of +42.4% and +45.8% through FY2025, respectively, naturally justifying the higher historical and current P/E valuations.

This cadence suggests one of two things. Either market analysts expect this elevated valuation to be a new normal for INTC, thanks to its foundry ambitions. Or, the company is expected to eventually grow into this pulled forward recovery.

Since the stock still enjoys immense support from its shareholders, despite cutting dividends, these two scenarios are likely indeed.

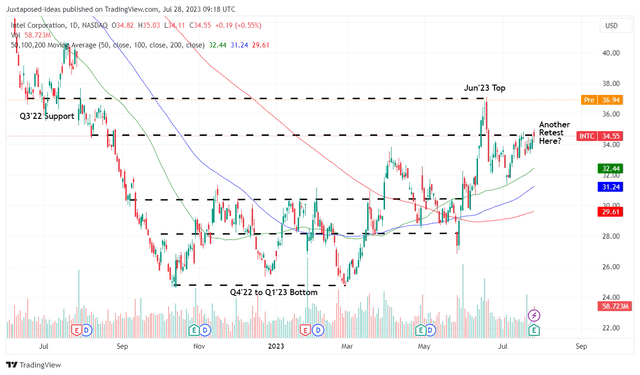

INTC 1Y Stock Price

Then again, while we remain INTC stockholders ourselves, we are uncertain about the sustainability of the recent recovery, especially given the CFO’s bearish commentary above.

We suppose the rising tide has lifted all boats for now, attributed to the bull run since the start of the year, thanks to the outperformance of the Magnificent Seven, namely Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Meta (META), Microsoft (MSFT), NVDA, and Tesla (TSLA).

However, with all of the upside already baked into our long-term price target of $29.49, we believe there may be a moderate pull back in the near term, based on its normalized P/E and the market analysts’ FY2025 EPS projection.

Therefore, we prefer to rate the INTC stock as a Hold (Neutral) here for long-term investors, while traders may consider taking some of their gains here.

Do not chase the rally here, especially since we are unlikely to see a raised dividend ahead, thanks to its impacted gross margins and reduced Free Cash Flow from the intensified capex moving forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, AMD, NVDA, GOOG, AMZN, MSFT, TSLA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.