Summary:

- AT&T and Verizon have both seen their stock prices decline in recent years due to challenges in the telecom sector.

- Both offer high yields today and appear to be attractively priced.

- We take a deeper look at both stocks in the wake of Q2 results and share our take on which is the better buy today.

akinbostanci/iStock via Getty Images

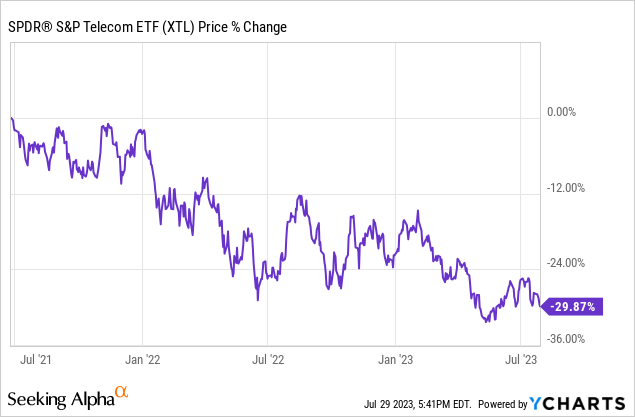

The telecom sector (XTL) has taken a beating over the past 25 months due to chronically low returns on invested capital, high CapEx requirements, rising interest rates, fears of Amazon (AMZN) potentially entering the industry, and a recently announced investigation of telecom companies by the Justice Department and EPA over lead cables:

In this article we will discuss two high yield industry giants that have also seen their stock prices take a beating in recent years – AT&T (NYSE:T) and Verizon (NYSE:VZ) – and share our opinion on which is the better buy after reporting their latest quarterly results.

T Stock Q2 Results

The biggest positive from T’s Q2 was that its free cash flow results improved markedly from Q1 and management was able to affirm its full year free cash flow guidance. However, given that the need to deleverage will continue to consume all excess free cash flow for the next two years at least, the impact of this news to the stock price was largely muted as expectations of increasing shareholder capital returns remain very low.

Moreover, T’s wireless customer growth decelerated during Q2, further hurting the growth outlook for a company whose growth expectations were already in the doldrums. Net postpaid phone customer growth slowed dramatically year-over-year from 813,000 to 326,000 largely due to the loss of a large enterprise customer and strong competition from industry rivals. T also faced some sharp questioning from analysts concerning their lead cable exposure.

Overall, it was a mixed quarter, with T’s floundering competitive positioning, anemic growth, and litigation risk all weighing on the stock and largely cancelling out the short-term positive news coming from solid free cash flow numbers.

VZ Stock Q2 Results

In contrast to T, VZ’s growth performance was a bit stronger. On the consumer side, wireless average revenue per postpaid account was up by a robust 6% year-over-year (4% when adjusting for an accounting change) and up 1.5% sequentially. On top of that wireless service revenue growth accelerated to 3.8% year-over-year from 3.0% in Q1. This stood in clear contrast to T’s decelerating growth rate.

Like T, VZ shaped some questioning from analysts on its lead cable exposure, though its responses sounded more optimistic and less combative in tone. Overall, it was a more positive quarter for VZ than for T as its competitive positioning and growth posture seem to be superior at the moment. However, it is still facing similar litigation and capex related headwinds and risks.

T Stock Vs. VZ Stock: Dividend Analysis

Neither T nor VZ are in a position to grow their dividends rapidly in the coming years, with the Wall Street analyst consensus projecting that both will only increase their dividends at a 1.2% CAGR through 2027.

That said, VZ’s dividend track record and current positioning are superior to T’s. For starters, while T slapped a pretty significant dividend cut on shareholders in 2022, VZ has grown its dividend every year for the past 18 years. Moreover, VZ’s balance sheet is in better shape and is headed for a more conservative position with management targeting a 2.25x leverage in contrast to T focusing on reaching a 2.5x leverage ratio in 2025.

Last, but not least, contrasting management commentary regarding their dividend growth outlooks paints a picture that VZ’s dividend growth outlook appears much more healthy than T’s is.

T’s management stated on their Q2 earnings call that they are going to be maximizing the use of free cash flow to pay down debt, stating:

[we] now expect to use an increasing amount of our free cash flows after dividends to accelerate our debt reduction efforts. We remain committed to achieving the 2.5 times range for net debt to adjusted EBITDA in the first half of 2025.

Moreover, the CEO was asked on the earnings call if the lead cable investigation could change how they think about the dividend. While the CEO stated that “that hasn’t come into characterization right now,” he did not unequivocally double down on the fact that the dividend is safe regardless of what comes of that investigation and just the fact that the question was asked implies that the dividend is far from safe. Moreover, T’s need to drive hard to deleverage the balance sheet implies that it lacks the needed wiggle room to absorb any major financial shocks from potential litigation/penalties resulting from this investigation.

As a result, we would not be surprised at all if T not only underachieved Wall Street’s already dismal expectations for dividend per share growth, but if it actually cut its dividend again in the next few years.

In contrast, VZ’s management appears more bullish on the outlook for their stock’s dividend, stating on their earnings call:

[we are positioned] to generate strong cash flow and continue to invest in our business and pursue dividend increases as we execute on our capital allocation strategy.

On top of that, they are even discussing the prospect of share buybacks in the not-too-distant future:

The cash generation, as I said, is strong, gives us optionality and supports a much-improved dividend payout ratio. Our capital allocation priorities are unchanged. We said first we would invest in the business. The second priority is our commitment to the dividend. Our third priority is to delever, and you’ll see us be focused on that. And then once we get to the leverage metric of 2.25, we will consider buybacks at that time.

It is also worth noting that VZ did not receive any questions surrounding the viability of their dividend on their earnings call. Furthermore, management made clear that the lead cable investigation should not pose too big of a risk to them since, as they stated on the earnings call:

to be very clear, lead infrastructure makes up a small percentage of our copper network, and we began phasing away from installing new lead cable by the 1950s.

VZ’s consensus earnings per share CAGR through 2027 is also slightly higher than T’s at 2.0% vs 1.6%. Overall, we have a lot more confidence in VZ continuing to grow its dividend over the next several years than we do in T doing so.

T Stock Vs. VZ Stock: Valuation Analysis

T looks cheaper than VZ on a price to earnings ratio basis with a 5.88x forward P/E ratio compared to VZ’s 7.26x P/E ratio.

However, on the leverage-neutral valuation metric EV/EBITDA, they are virtually evenly valued with T priced at a 6.36x multiple and VZ priced at a 6.58x multiple. On top of this, VZ is actually cheaper compared to its historical valuation EV/EBITDA multiple as VZ’s 10-year average EV/EBITDA multiple is 7.07x whereas T’s 10-year average EV/EBITDA multiple is 6.85x.

Finally, VZ’s NTM dividend yield of 7.86% is slightly higher than T’s NTM dividend yield of 7.77%. Given that VZ’s dividend growth track record is much better than T’s and its forward growth outlook appears to be a bit stronger as well, VZ’s dividend yield looks much more attractive than T’s at the moment.

Overall, we view VZ as being a better value than T at the moment.

T Stock Vs. VZ Stock: Investor Takeaway

Overall this is a pretty easy choice for us. VZ appears to be qualitatively superior both in terms of its balance sheet, its dividend growth track record, and its growth trajectory. Moreover, a strong case can be made that its valuation is more appealing at the moment as well.

While we are not interested in buying either one of these stocks today given their weak growth outlook, lead cable litigation risk uncertainty, and the plethora of superior high yield opportunities available at the moment, if we had to pick one of these after Q2 earnings it would be VZ, hands down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!