Summary:

- PayPal’s stock price has experienced a significant decline, but its fundamentals and position in the fintech industry offer potential for growth.

- Technical analysis suggests that PayPal’s stock price is currently trading at a long-term support level, indicating a potential uptrend.

- The price is presently breaching the triangle formation, which suggests a potential surge in PayPal’s value.

Justin Sullivan

The evolving dynamics of PayPal Holdings, Inc.(NASDAQ:PYPL)’s stock performance paint a complex image, oscillating between the worries induced by its recent dip and the hopeful outlook arising from the company’s robust fundamentals and strategic standing in the fintech industry. This article dives deep into the forces behind PayPal’s recent downturn, the state of its core business, and the prospects of its future performance, based on technical analysis. The observation reveals that PayPal’s stock price is currently trading at its long-term support and breaking free from a triangle pattern, signaling a potential uptrend.

A Study of Resilience and Potential Growth

The recent downward trend in PayPal’s share prices and a slowdown in earnings have raised caution among investors. However, when one takes a broader view of the company’s evolution and future prospects, the situation appears less bleak. The current value of PayPal shares, trading at a substantial discount of over 70% from the peak, could represent a noteworthy investment prospect. It’s crucial to remember, of course, that investing always carries risk, and theoretically, any stock can decline to zero. But by deciphering the causes behind PayPal’s downward shift and evaluating its core business health, a more accurate evaluation can be made of its future performance.

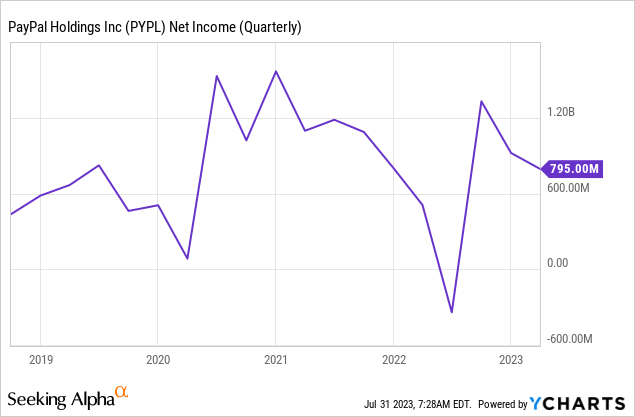

The decline in PayPal’s stock price was primarily attributed to several factors. Firstly, PayPal set optimistic forecasts for its user growth, which unfortunately did not materialize as expected. The Covid-19 pandemic acted as a powerful driving force, adding around 73 million active users to PayPal’s base in 2020 and propelling the total user count to 377 million by year’s end. This robust performance amid the pandemic led CEO Dan Schulman to forecast a surge in PayPal’s user base to 750 million by the close of 2025. However, user growth began to decelerate, with the addition of only 49 million users in 2021 and a mere 9 million in 2022. This slowdown stirred apprehension among investors, deterring further investments in PayPal and causing its stock price to dip. Yet, the user growth observed in 2023 presents a remarkable upturn, signaling a bullish future outlook. Secondly, the company’s earnings momentarily dipped into negative territory last year as seen in the chart below. This fall was observed after a significant spike during the lockdowns induced by the Covid-19 pandemic. Despite these setbacks, PayPal’s underlying business potential remains strong. Currently, PayPal shares are available at just 15 times the company management’s earnings estimate for 2023. This valuation appears attractive, considering the projected revenue and earnings growth of the company.

PayPal’s strength lies in its wide user base and its competitive positioning in the fintech industry. Although there’s a surge of agile fintech start-ups, PayPal has the advantage of being a well-established and popular platform with both merchants and consumers. Furthermore, the steady increase in transaction volume and usage of the platform by existing users reflects the firm’s robustness. PayPal has also attracted the attention of Elliott Investment Management, which recently opened a $2 billion stake in the company, indicating a degree of confidence in the fintech’s future prospects.

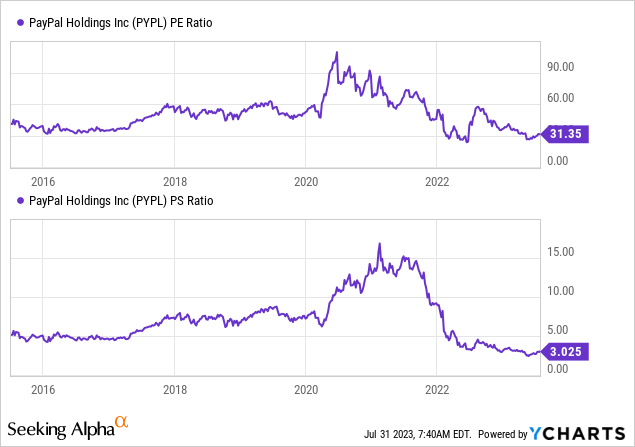

PayPal, currently having a PE ratio of 31.35 and a PS ratio of 3, is near its lowest valuation since its debut in the public market. PayPal’s resilience and potential for growth are enhanced not only by its current low valuation but also by its network effects, similar to those observed in Visa Inc. (V) or Discover Financial Services (DFS).

Moreover, Microsoft Corporation (MSFT)’s announcement to integrate more PayPal financing options, including PayPal’s Pay Later and Venmo services, represents a bullish implication for PayPal. This expansion, reaching across multiple countries, strengthens the 16-year partnership between PayPal and Microsoft, further bolstering PayPal’s user base and transaction volume. The introduction of installment payments and split payments upon purchase further diversifies PayPal’s service offerings, potentially attracting new customers and driving revenue growth.

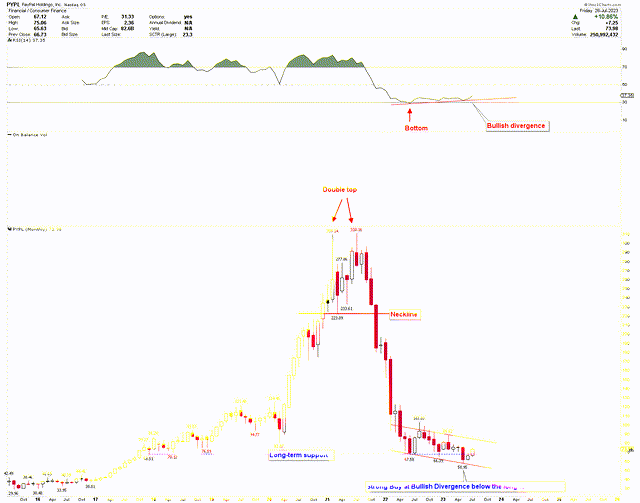

Exploring Investment Opportunities Through Bottom Formation

The technical analysis of PayPal, as illustrated in the monthly chart below, underscores that the market is currently trading at a vital long-term support level, indicating a potential for a strong rebound. This long-term support line, shown as a dotted blue line, has been the basis of a substantial rally from 2018 through 2021. Various factors interwove to fuel a significant increase in PayPal’s stock price during 2020 and 2021. Among these was the COVID-19 pandemic, which spurred a shift toward digital payments and online commerce. In this transformed scenario, PayPal found itself in an ideal position to capitalize on the opportunities presented. The surge in new account creation and payment volume provided a significant boost to PayPal. Furthermore, PayPal’s move to enable transactions in cryptocurrencies, including Bitcoin, appealed to a broader customer demographic, fostering both diversification and expansion. PayPal also introduced innovative features like the “Pay in 4” option, a buy-now-pay-later service, and extended its QR code payment system. These enhancements added a competitive edge to its service offerings. All these factors, synergizing with robust financial performance, optimistic market sentiment, and a vibrant tech market, were key in propelling PayPal’s stock price steeply upwards in 2020 and 2021.

PayPal Monthly Chart (stockcharts.com)

However, the peak was reached in 2021 with a double top at $309.14 and $310.16, after which the stock price started to decline, falling to $58.95 by May 2023. This plummet was primarily due to a significant slowdown in 2022 post-pandemic, as consumers reverted to pre-pandemic behaviors and macroeconomic conditions worsened. However, this decline started losing momentum in the last 12 months, hinting that PayPal is attempting to stabilize at the long-term support, denoted by the blue dotted line.

This stabilization process began in July 2022, as indicated by the RSI’s oversold readings. Since then, the price has been consolidating within a red channel, as shown in the above chart. It’s worth pointing out that a bullish divergence has manifested within this period of price consolidation, spanning from July 2022 to the present. This divergence is typically a sign of a market bottoming out and a potential price increase. The notably lower price levels currently observed present a compelling investment opportunity for long-term investors.

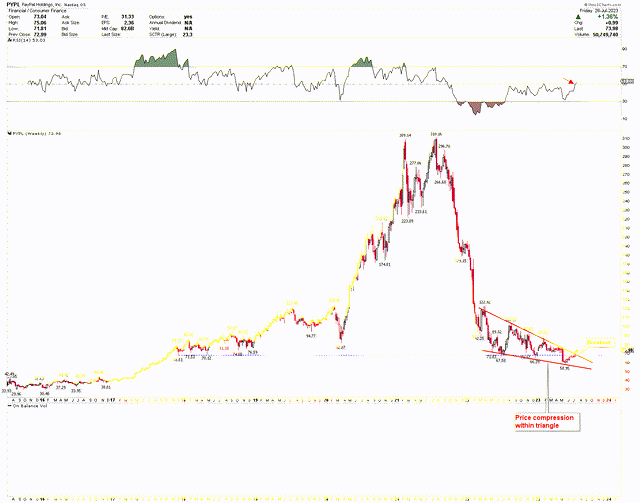

Further importance of the current levels in PayPal’s stock is evident in the weekly chart below, which also underscores the bullish potential. The blue dotted line from the monthly chart appears here too, highlighting the support level with even greater clarity. The chart shows a triangle forming at the long-term support, and the price has moved out of the apex of this triangle, suggesting a bullish pattern break and a potential upward acceleration. This triangle formation symbolizes price compression, hinting that a major move may be on the horizon once the market surpasses key thresholds. If PayPal’s stock continues its upward trajectory, the key market resistance to watch out for is $122.92. A rise above this level would signify that PayPal is on a path toward much higher levels. However, with limited downside at current levels, investing now offers a low-risk opportunity. Therefore, long-term investors may consider adding positions at this level, anticipating higher prices.

PayPal Weekly Chart (stockcharts.com)

Market Risk

The company’s future performance heavily relies on its ability to maintain and grow its user base in the face of increasing competition within the fintech industry. The emergence of nimble startups and established tech giants expanding into the financial services sector could potentially disrupt PayPal’s market share and profitability. Moreover, the global economic outlook and consumer spending habits significantly impact PayPal’s business. If economic conditions worsen or consumer spending decreases, particularly in online commerce, PayPal’s revenues could be adversely affected.

Moreover, PayPal’s stock price has plummeted by over 70% from its historical highs, indicating that a bottom formation process might be necessary before the commencement of the next rally. From a technical perspective, this bottom formation process is typically associated with substantial consolidation, implying that the stock price might oscillate within this consolidation phase before a potential rally takes shape. A continued downtrend for PayPal could be signaled if the stock price descends below the $50 threshold.

Bottom Line

In conclusion, despite facing a considerable decline in its share price over the past two years, PayPal still represents a potentially valuable investment proposition, considering its firm footing in the fintech sector and its robust core business. PayPal’s large user base, the steady increase in transaction volumes, and the confidence shown by entities such as Elliott Investment Management make it a resilient player in the industry. Its discounted share price, combined with its promising business fundamentals, presents a potentially appealing opportunity for long-term investors.

However, from a technical perspective, PayPal’s stock is in the process of bottoming out, a period typically associated with considerable consolidation. This could indicate a potential rally in the near future. The bullish divergence and the formation of a bullish pattern breakout on the weekly chart suggest the possibility of an upward price movement. Moreover, the stock is trading at key support levels, indicating limited downside and thus a relatively low-risk investment. Investors can consider buying at the current rates with the expectation of higher prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.