Summary:

- Leading offshore driller Transocean reported solid Q2 results, but third quarter guidance fell short of expectations.

- Last week, the company released another strong fleet status report, with backlog increasing by 7.6% sequentially to a new multi-year high of $9.2 billion.

- On the conference call, management highlighted expectations for the company’s average dayrates to increase by almost 20% over the next 12 months.

- Following the most recent rally in the shares, CFO Mark Mey prepared investors for the likely near-term conversion of up to $619 million in outstanding exchangeable notes.

- With the industry outlook being the strongest in almost a decade, I would advise investors to use any major weakness in the shares to enter or add to existing positions.

Ion-Creations

Note:

I have covered Transocean Ltd. (NYSE:RIG) previously, so investors should view this as an update to my earlier articles on the company.

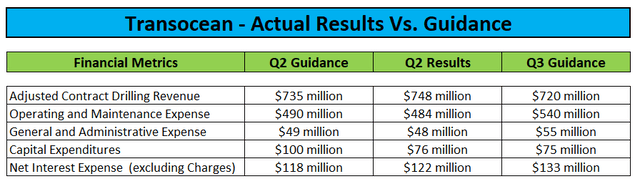

After the close of Monday’s session, leading offshore driller Transocean Ltd. or “Transocean” reported second quarter results slightly ahead of previous guidance.

That said, Q3 guidance provided by management on Tuesday’s conference call was somewhat disappointing:

Company Press Releases and Conference Call Transcripts

Particularly the projected sequential jump in operating and maintenance expense in combination with lower contract drilling revenues is going to hurt cash flows in the third quarter.

On the conference call, management attributed the anticipated increase to a number of issues including elevated levels of contract preparation expense:

This quarter-over-quarter increase is due to the changes in fleet activity, timing of in-service projects, continuing preparation of the Deepwater Orion in advance of its contract commencement in Brazil and the start of contract preparation activities on Transocean Equinox, the Transocean Endurance with a work in Australia.

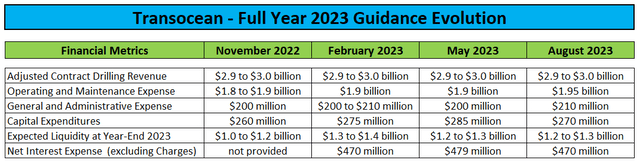

On the flip side, full year expectations were tweaked just slightly with the closely-watched year-end liquidity forecast remaining intact:

Company Press Releases and Conference Call Transcripts

In Q2, Transocean recorded a $53 million impairment charge in conjunction with the recently announced sale of the vintage harsh environment floaters Paul B. Loyd, Jr. and Transocean Leader to Dolphin Drilling.

While the company’s desire to dispose of legacy, lower-specification assets is understandable, I was surprised to see Dolphin Drilling announcing a letter of intent with Harbour Energy for a three-year contract extension for the Paul B. Loyd, Jr. at substantially improved terms.

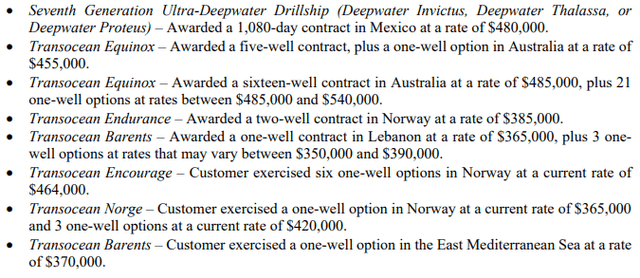

Last week, the company released a new quarterly fleet status report with total backlog of $9.2 billion being up 7.6% sequentially thus representing the highest level since Q1/2020.

That said, basically all major contract awards bagged during the quarter had been announced by the company or reported in the media before already:

In addition, the ultra-deepwater drillship Deepwater Inspiration continues to sit idle in the U.S. Gulf of Mexico after rolling off contract in April.

In total, Transocean secured approximately $1.2 billion in new work with another up to $500 million in potential revenue from associated options.

On the conference call, the weighted average new contract day rate was stated at approximately $456,000.

In addition, management pointed to the strong increase in average backlog dayrate as compared to one year ago and projected another 20% increase for Q2/2024 (emphasis added by author):

Importantly, our ultra-deepwater fleet average day rate increased significantly over the same time period. For our fleet status reports, in the second quarter of 2023, our average day rate was approximately $363,000 per day versus $312,000 per day in the second quarter of 2022. And based on existing backlog by the second quarter of 2024, we expect it to approximate $433,000 per day.

With demand for both high-specification drillships and harsh environment semi-submersible rigs at levels not seen in almost a decade, management remained highly constructive on current market conditions:

More customers expressing strong interest in securing rigs for longer-term projects starting further in the future. (…)

We believe this signals our customers’ recognition of the scarcity of capable high-specification assets and clearly demonstrates their strength and commitment to offshore projects, further validating that we are in an up cycle that would be of significant longevity.

Contract durations are lengthening materially. In fact, year-to-date 2023, the average contract length of a drillship awards has increased to 495 days versus 310 days in 2022 and representing a year-over-year increase of nearly 60%.

(…)

As further evidence of market strength, a number of operators are evaluating and increasingly pursuing long-term rig contracts that are not yet tied to specific projects or may not yet have the approval of all project partners. We have not seen this type of market behavior in some time, and it is perhaps one of the more exciting and encouraging market developments to-date.

(…)

Several operators seek rigs for projects that could be greater than five years in duration.

Management also stated its expectation for finalizing the maiden contract for the managed drillship Deepwater Aquila offshore Brazil later this month following a tender offer win earlier this year.

CFO Mark Mey also pointed to the fact that following the recent rally in Transocean’s shares, all of the company’s remaining $619 million in exchangeable notes are deeply in the money for noteholders which has resulted in a number of inquiries regarding early conversion.

Particularly the ill-advised $300 million exchangeable note issuance last year would hurt Transocean again, as an early conversion would result in outstanding shares increasing by 87.2 million or more than 11%.

Assuming early conversion of all existing convertible debt, outstanding shares would increase by almost 20% to approximately 914 million.

During the questions-and-answers session of the conference call, a number of analyst questions again focused on the potential reactivation of cold-stacked rigs.

Keep in mind that in contrast to competitor Valaris (VAL), Transocean has not activated a single cold-stacked drillship so far but offered the 7th generation drillships Ocean Rig Apollo, Ocean Rig Mylos and Ocean Rig Athena in a recent Petrobras (PBR) tender.

With an estimated up to $125 million in reactivation expense for a cold-stacked rig, depending on the timing and execution of potential reactivation projects, free cash flow might see some pressure in the near- to medium term which should be largely offset by substantially higher average dayrates next year.

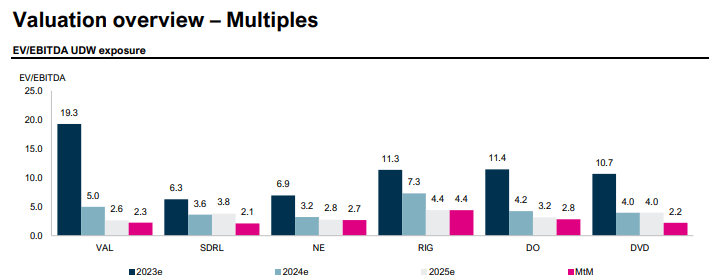

Valuation-wise, Transocean remains expensive relative to peers based on profitability expectations:

Pareto Securities

Given this issue, investors should also consider other U.S. exchange-listed competitors like Noble Corp. (NE), Valaris (VAL), Seadrill (SDRL), and Diamond Offshore Drilling (DO) as well as jack-up pure play Borr Drilling (BORR).

Bottom Line

Transocean released a strong fleet status report last week followed by solid second quarter results on Monday but management’s projections for Q3 came in somewhat weaker than expected.

Not surprisingly, market participants’ reception was kind of lukewarm with shares ending Tuesday’s session down approximately 5%.

Following the most recent rally to new multi-year highs, the stock might indeed be due for a breather but with the industry outlook being the strongest in almost a decade, I would advise investors to use any major weakness in the shares to enter or add to existing positions.

Citigroup analyst Nikhil Gupta expects Transocean to generate almost $2 billion in free cash flow until the end of 2025 which in combination with exchangeable note conversions would result in net debt decreasing to well below $4 billion over the next 30 months.

While Transocean remains expensive relative to peers, investors should note that the company’s sizeable cold-stacked fleet provides for some decent optionality going forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.