Summary:

- AT&T has dropped so much that its net debt is above its market capitalization as its dividend has become almost 8%.

- The company needs to deal with its massive net debt load and get it to a level the company is comfortable with quickly.

- The company is continuing to generate strong cash flow, but whatever happens remains to be seen.

Brandon Bell/Getty Images News

AT&T (NYSE:T) recently announced another batch of earnings. The company, with its $100 billion market capitalization, now has a dividend yield pushing 8%. That, combined with its dividend yield, the recent lead crisis, which we discuss here, and the potential of associated costs, has resulted in consistent concern about the company’s dividend.

AT&T Improvements

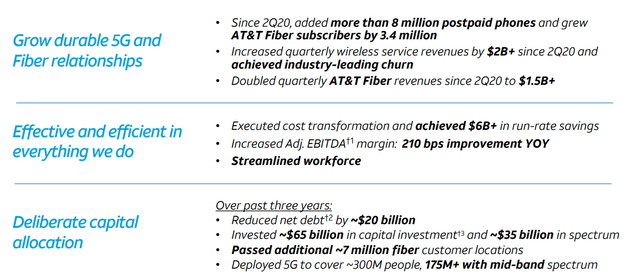

The company has managed to make a substantial number of improvements for its business.

The company managed to, over the last 3 years, increase its postpaid phone subscribers by 8 million. It also managed to grow its AT&T Fiber subscribers by 3.4 million. That’s enabled the company to increase quarterly revenues by almost $3 billion, while continuing to improve margins by 2.1% YoY. That has enabled overall profits to increase.

Over the past 3 years, the company has reduced its net debt by ~$20 billion. That rate of reduction has slowed down. The company has had to spend $100 billion on its business over the same time period, with $65 billion in capital and $35 billion in spectrum. That’s enabled the company to pass an additional 7 million 5G spectrum with mid-band spectrum covering 175+ million.

AT&T 5G and Fiber

The strength in the company’s various businesses is clear below.

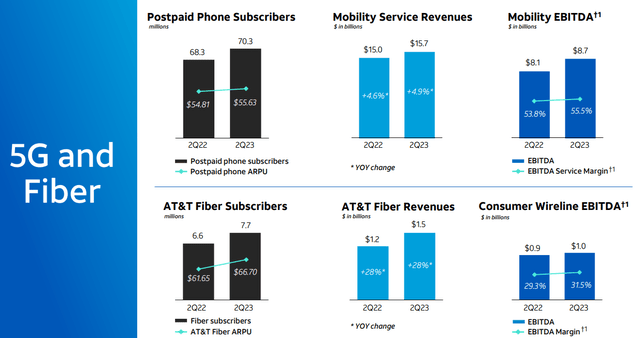

The company managed to increase its postpaid phone subscribers from 68.3 billion to 70.3 million YoY. At the same time, the company managed to increase its ARPU from $54.81 to $55.63 (~1.8%). That’s lower than inflation rates over the same time period, showing the company has had some pricing issues.

That has enabled the company’s revenue to increase almost 5%. EBITDA margin improvements of almost 2% YoY have enabled EBITDA to increase much faster, by ~7-8%. In the fiber business, revenue has increased by 28% YoY, a trend that’ll continue and new customer locations open up. The company’s EBITDA margin is now 31.% with double-digit YoY EBITDA growth.

This business is of course much smaller currently, but we expect it to remain strong and grow. That’s a big risk to the company.

AT&T Financial Performance

Putting this together, the company’s financials were strong for the quarter.

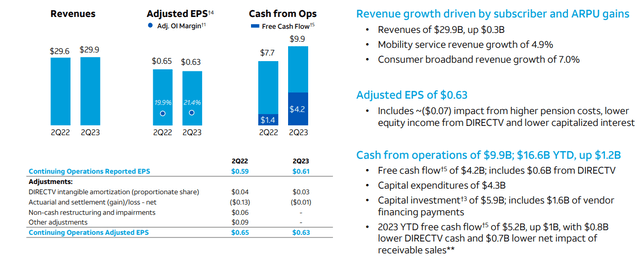

The company earned almost $30 billion in revenues, up just 1% YoY. The company’s EPS decreased slightly, but its adjusted margin increased by almost 2%. The company’s FCF has managed to improve substantially YoY and from the 1Q. The company managed to earn $9.9 billion in CFFO and $4.2 billion in FCF. That FCF includes $0.6 billion from DirecTV.

The company has earned $5.2 billion in FCF YTD but expects that to expand substantially in the 2nd half of the year, and that’s after continued strong investments in its business.

AT&T Cash Flow

The next thing to pay attention to is what happens with the company’s cash flow.

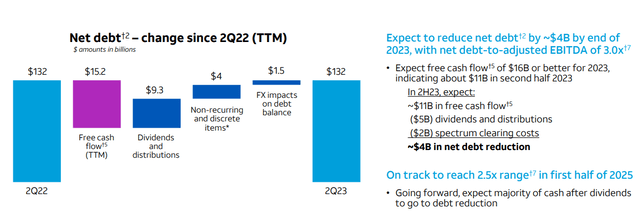

Over the past year, the company’s net debt has remained constant. The company earned just over $15 billion in FCF and spent $9.3 billion in dividends and distributions. The company’s dividend is almost 8% and we expect that its dividend will remain at that lofty level. But at that level it doesn’t justify investing if the company can’t cut its debt.

The company had $4 billion in discrete items last year. This year, with its remaining FCF, it has another $2 billion in spectrum clearing costs. That’s a one-time cost related to the company’s prior capital spending on spectrum. Even with that, it expects to have $4 billion in net debt reduction. It expects to hit its target of 2.5x EBITDA by the 1H 2025.

The company expects to end the year with $128 billion in net debt. Its ability to not cut its dividend depends on it getting to <=$90 billion in net debt without cutting that dividend over the next few years. Whether that can happen remains to be seen, but we expect that the company can hit its targets.

Our View and Options

For those looking to invest, we recommend taking advantage of options.

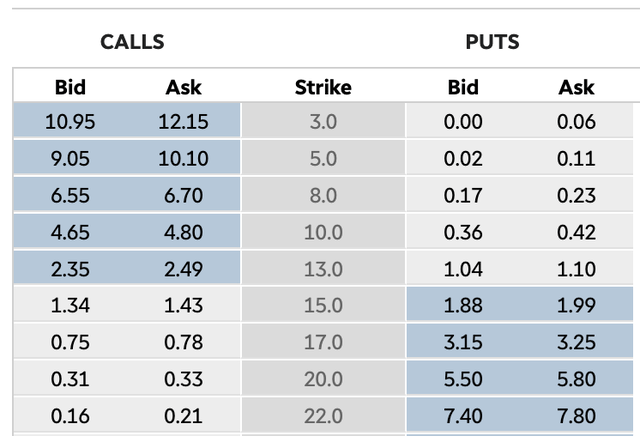

For example, the above chart shows the Jan. 2025 (16 months) option chain for A&T. Investors can sell a cash-secured PUT @ $13 / share or 4% below the lows set after the lead crisis impact. It also represents more than 10% below current prices. The market would need a strong dip to hit this level, and it’d be an interesting chance to invest.

There’s two scenarios here. The first is that AT&T drops below $13 / share and you get to invest at a breakeven of $11.93 / share. That’s an incredibly low price, where the company’s dividend would be almost double-digits. The company’s cash flow would be strong at that level and even if it cuts its dividend, it’d still have massive shareholder returns.

Alternatively prices go above that level and you get an 8% return on your cash for 16 months, or 6% annualized. Most brokerages won’t even require you to actually put the cash up, just to have it on the closing date. This would be a unique opportunity to take advantage of AT&T’s recent weakness.

Thesis Risk

The largest risk to our thesis is the company needs to maintain strong cash flow to be able to pay down its debt. The company is expecting to be able to pay down some debt but it still has a massive $132 billion in net debt in a rising interest rate environment. That could force it to cut its dividend at some point, even though we expect the company to be able to avoid it.

Conclusion

AT&T can afford its dividend at its current yield. It can also keep affording to invest heavily in its business and paying down debt. Several years of lower capital spending could enable the company to rapidly lower its debt and save dramatically on interest payments. That could enable overall shareholder returns to increase dramatically.

The company’s dividend of almost 8%, justifies investing all by itself. The company’s debt is a big concern, but we don’t expect the company will need to cut its dividend to paydown its debt. Of course there is the major risk of rising interest rates, but as long as the company can pay debt before it comes due it should be fine. The company’s overall growth remains strong. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.