Summary:

- Alphabet posted strong 2Q23 results as it beat expectations for revenue, operating income and EPS.

- Google Search and YouTube results show that advertising trends are improving and YouTube Shorts continue to gain momentum.

- Google Cloud’s growth showed signs of stabilization but management cautioned that cloud spend optimizations continued in the quarter.

- Generative AI was providing tailwind to Google Cloud and management saw strong demand for its generative AI capabilities in the quarter.

- While there are elevated investments expected in technical infrastructure needed for AI opportunities to come, management is looking to maintain operating margins by re-engineering its cost base.

Ole_CNX

Alphabet (NASDAQ:GOOG) was once seen as a market darling given its somewhat monopolistic market positioning in the search space.

However, the company faced a rude awakening in the form of OpenAI’s ChatGPT. There has never been more at stake for Alphabet as there are increasing concerns about its dominant search market share and its own AI capabilities.

Today, I will be reviewing the company’s 2Q23 earnings report to see how the company is faring in this uncertain and competitive environment.

2Q23 overall results revenue

Alphabet beat both revenue and profit expectations in 2Q23.

Revenue came in at $74.6 billion, 2% higher than market consensus.

Operating income or operating margin came in at $21.8 billion or 29.3% margin, 9% higher than market consensus.

GAAP EPS came in at $1.44, 7% higher than market consensus.

2Q23 results overview (Alphabet)

Google Search and YouTube

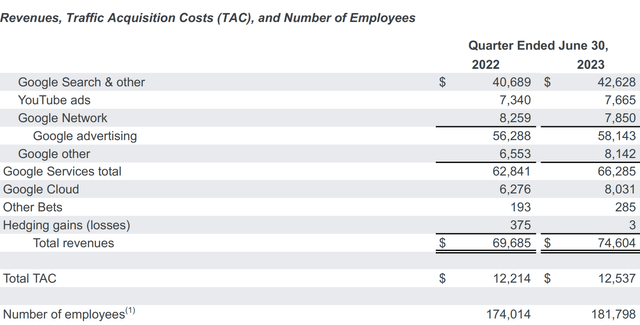

I provide the breakdown in terms of revenue segments below.

Breakdown of revenue (Alphabet)

Search & Other Revenue accelerated 3% to grow 5% year on year to $42.6 billion in 2Q23. This was 1% above market consensus.

YouTube Revenue grew 4% year on year to $7.7 billion. This is 3% above market consensus, and suggests that YouTube’s advertising revenues are stabilizing and in fact, now turning to growth.

Both results suggest that there are improving advertising trends.

There are more than two billion users each month watching YouTube Shorts, up from the 1.5 billion from the prior year. Also, the fastest growing screen in 2022 in terms of watch time is the living room as YouTube is reaching more than 150 million people on connected TV screens in the US and this growth traction is similar internationally.

Google Cloud

Google Cloud Revenues were up 28% from the prior year to $8 billion in 2Q23. This was 2% ahead of consensus expectations, which would suggest better-than-expected Google Cloud business. Furthermore, the year-on-year growth for Google Cloud decelerated by just 10 basis points compared to the prior quarter, which shows signs of stabilization.

In addition, cloud operating profit came in at $395 million or 4.9% cloud operating profit margin, which is ahead of the -$22 million or -0.3% cloud operating loss margin that the market was expecting.

However, when listening in to the earnings call, there was some hesitation or cautiousness in the management’s tone surrounding Google Cloud.

When Ruth Porat, CFO of Alphabet commented about the 2Q23 Google Cloud performance, she noted that while revenue growth in the Google Cloud Platform was strong across geographies, industries and products, she continued to see moderation in the rate of consumption growth. This implies that consumers continue to optimize their cloud spend.

In terms of the outlook for Google Cloud, Ruth provided a somewhat balanced commentary. On the positive front, there is strong interest from customers in the company’s large language models, new generative AI offerings like Duet AI, AI-optimized infrastructure, and its AI platform services, but that said, it remains early days in all these new offerings. On the negative front, Google Cloud continues to face headwinds in the near-term as a result of cloud spend optimization.

Thus, in the near-term, I see that for Google Cloud and perhaps other cloud players, it is somewhat of a tug of war between the headwind from the cloud spend optimization occurring in the industry, as well as the tailwind from the increasing interest in AI opportunities.

AI opportunities

Alphabet emphasized that it has been an AI-first company for the past seven years even though the AI opportunity is being heavily discussed today.

In fact, its AI-optimized infrastructure is deemed as a leading platform for the training of generative AI models.

Sundar Pichai, CEO of Alphabet, stated that more than 70% of generative AI unicorns like Cohere, Jasper and Typeface, are Google Cloud customers.

Alphabet also recently launched its brand new A3 AI supercomputers that are powered by Nvidia’s (NVDA) H100.

In addition, Alphabet’s generative AI offerings are seeing strong demand from existing and new customers. For its more than 80 models, which includes third party and popular open source in its Vertex, Search and conversational AI platforms, they are seeing strong demand, with the number of customers growing more than 15x from April to June. Some of the customers using the generative AI offerings of Alphabet include Carrefour, Capgemini and Priceline.

Expenses and investments

In the second quarter of 2023, the largest capital expenditure was on servers as a result of considerable increase in investments needed for AI compute. The increase in capital expenditures in the quarter was lower than expected as the company moderated the pace of the construction and fit-outs of its office facilities while there were some delays in some of the data center projects that it is constructing.

Looking forward to the second half of 2023 and 2024, Alphabet expects to see elevated investment in technical infrastructure. Of course, this is expected to be primarily driven by the increasing opportunities in AI that Alphabet is investing in. These investments include the need to invest in GPUs, proprietary TPUs, and data center capacity.

However, with the elevated investments and capital expenditures in AI-related infrastructure, Alphabet continues to be focused on reallocating its cost base to ensure margin stability or even, improvement.

In terms of reallocating and reengineering its cost base, it includes the reduction in pace of growth in headcount and the reallocation of current headcount to higher priority growth areas.

In particular, the sequential improvement in operating margins in the second quarter of 2023 was a result of reductions in its workforce as well as optimizing its office space globally. In terms of reallocation of current headcount, a number of teams have been moved to higher priority areas. For example, Bard and Search Generative Experience (“SGE”) currently have small and fast moving talent that have been reallocated to these efforts that are deemed higher priority.

In my opinion, one of the more interesting aspects of the 2Q23 earnings call was the focus on cost discipline to ensure that COGS and operating expenses were growing slower than revenues.

Valuation

Alphabet is currently trading at about 21x P/E after the positive reaction to its earnings report.

My 1-year and 3-year price targets are based on 20x P/E multiple. As such, my 1-year and 3-year price targets are $134 and $176, representing 1% and 33% upside respectively.

In my view, the near-term opportunity with Alphabet looks neutral but the long-term opportunity remains compelling.

Conclusion

I think that Alphabet showed decent execution in an uncertain environment.

Google Search and YouTube showed that advertising trends were improving.

The 28% revenue growth in the Google Cloud segment was also a positive sign of potential stabilization in the segment. While Google Cloud faced the headwinds it has been facing due to cloud spend optimization, the growing opportunities from generative AI is driving momentum in the business. The Google Cloud’s business numbers were better than expected.

The commentary around the AI opportunity for Alphabet also looks encouraging and management gave plenty of real examples where customers are using the company’s generative AI offerings.

While Alphabet is bound to spend and invest more in the generative AI opportunities in the near-term, the company is looking to reallocate its cost base and continue to focus on cost discipline to ensure operating margins are sustained.

All in all, Alphabet’s valuation multiple reflects its current situation. The company needs to prove to the financial markets that it is able to defend its competitive position and show that it is able to do so in a profitable manner as it balances the costs needed to build its generative AI capabilities with the potential revenues it brings.

As stated above, my 1-year and 3-year price targets are $134 and $176, representing 1% and 33% upside respectively.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 97% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!