Summary:

- Engagement trends reached a record as its Family of Apps benefited from improved Reels adoption and the AI discovery engine.

- Reels has reached 200 billion plays per day, more than YouTube Shorts, and it now has a $10 billion annual revenue run rate.

- CEO Mark Zuckerberg emphasized their continued discipline in being a leaner organization in its year of efficiency, as illustrated by how Threads was created.

- As a result, management is calibrating the right amount of AI capital expenditures needed to drive its AI ambitions while being disciplined on costs.

- Due to improving fundamentals since when we entered a position, I am raising my price targets and intrinsic value for Meta.

panida wijitpanya

The 2Q23 results for Meta Platforms (NASDAQ:META) could not come in any better in my view.

The company showed that engagement reached record levels, enabled by its AI discovery engine and improved adoption of Reels. Reels also is operating at an increasing scale, with monetization ahead of expectations.

The company continues to invest in near-term opportunities in AI and longer term opportunities in the metaverse. The difference in the market sentiment today compared to when it first announced it was investing in the metaverse is that the Family of Apps business is at one of the strongest it has ever been and margins of this business is not only strong but also improving.

In addition to that, I think that management has executed very well in its year of efficiency as the leaner organizational structure has brought about an improved cost structure, stronger operating efficiency and higher margins. With this higher margins, it enables Meta to invest in future opportunities like AI and the metaverse.

At the same time, management is cautious in their investments in the near-term, in-line with their philosophy for the year of efficiency as it remains to be seen how strong its new generative AI products will take off.

With the multiple expanding from the 6x P/E when we entered into the stock to 19x 2024 P/E today, I think majority of the upside will come from upside in earnings, which will be elaborated in the earnings section.

Let’s dive right in and start first with the engagement trends we have seen in 2Q23.

Solid engagement trends

CEO Mark Zuckerberg mentioned in the earnings call that the business is seeing strong engagement trends, which I include below:

We’re seeing strong engagement trends across our apps. There are now more than 3.8 billion people who use at least one of our apps every month. Facebook now has more than 3 billion monthly actives with daily actives continuing to grow around the world, including in the US and Canada.

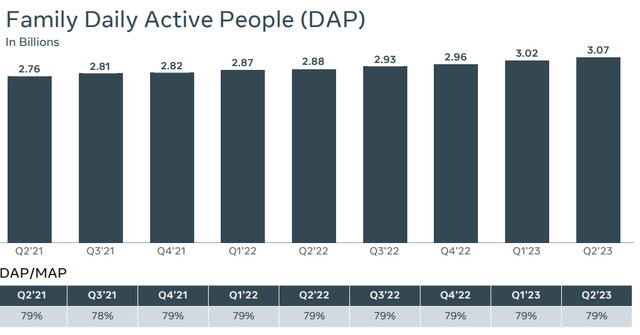

Meta’s Family of Apps Daily Active People and Monthly Active People came in at 3.07 billion and 3.88 billion, growing 7% and 6% year-on-year respectively. This came in above the market expectations.

This resulted in a DAP/MAP ratio of 79.1%, which is Meta’s highest ever. What this suggests is engagement is the highest it has ever been and illustrates the strength of the Family of Apps segment as the company continues to innovate and adjust to the changes in consumer trends.

Engagement in Family of Apps (Meta Platforms IR)

One reason for the increased engagement is due to the AI recommended content. AI recommended content from unconnected posts are now the fastest growing category of content on Facebook Feed and has driven a 7% increase in the total time spent on Facebook.

Thus, it’s clear that AI content discovery is adding value by improving engagement across Meta’s platforms.

Reels

Reels has been a key engine for Meta in terms of discovery and engagement. There are more than 200 billion Reels plays per day across Facebook and Instagram. This compares to YouTube Shorts 50 billion daily views as of 4Q22, which highlights to me the scale and size at which Meta operates.

In addition, monetization on Reels has also improved as Reels now has a $10 billion annual revenue run-rate, up from $3 billion in 3Q22.

According to Meta, about 75% of its advertisers use Reels Ads and Reels now account for about 8% of its total ad revenues in the second quarter.

For reference, Reels only started monetization in 2Q22 and back in 3Q22, it had an annual run-rate of $3 billion, which has grown to $10 billion annual run-rate today in 2Q23.

This has certainly surpassed market expectations by a huge extent and just shows how good Meta is in the ramping up of different features and formats.

I think as Meta continues to ramp the ad loads, launch new ad products like overlay ads, as well as more advertisers using Reels Ads, I expect we could see Reels exit 2023 with an annual run-rate of more than $15 billion.

Overall 2Q23 review

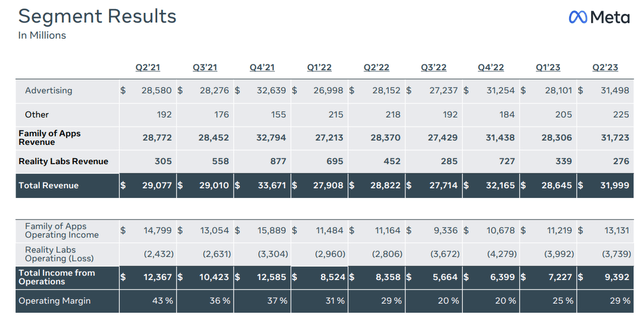

Meta’s revenue for 2Q23 grew 11% year-on-year to $32 billion, 3% above consensus expectations.

Operating income came in at $9.4 billion, or 29.4% operating income margin, which is in-line with expectations. This was due to continued restructuring costs of $780 million and legal charges of $1.9 billion.

Meta’s GAAP EPS came in at $2.98, 2% higher than the market consensus of $2.91.

Overview of Meta Platform’s financial results for 2Q23 (Meta Platform IR)

Meta’s advertising revenue grew 12% year-on-year to $31.5 billion, which beat market consensus by 4%. The largest contributor to year-on-year growth was the online commerce vertical, which came from strong demand for advertisers in China looking to reach customers in other markets. In terms of regions, the strongest region was Rest of World which grew 16% from the prior year and Europe, which grew 13% from the prior year. US & Canada was the weakest region, which grew 9% from the prior year. The Family of Apps revenue came in at $31.7 billion, up 12% from the prior year and the operating income for the Family of Apps segment was $13.1 billion, or 41.4% operating margin.

Reality Labs revenue was down 39% year-on-year to $276 million, which is 34% below consensus. Operating losses for the Reality Labs segment was negative $3.7 billion. Meta expects its operating losses in Reality Labs to increase year-on-year for the full year of 2023.

In my opinion, Meta is demonstrating strong operating leverage as its operating margin for the Family of Apps business grew 420 basis points year on year to 43.6% when excluding the restructuring charges. I think this highlights the improving margin expansion we are seeing with Meta, which is part of the investment thesis for Meta as part of their year of efficiency.

Guidance

Meta expects third quarter revenue to come in between $32 billion and $34.5 billion, which implies revenue growth between 16% and 25%. This came in 7% ahead of market consensus and shows the strength of the growth of Meta’s ad platform.

Meta increased their operating expenses guidance by about 2% from the initial range of $86 billion to $90 billion, to the new range of $88 billion to $91 billion. This is a result of legal-related expenses in the second quarter as mentioned above, and includes $4 billion of restructuring costs expected for severance and other personnel costs.

In terms of capital expenditures, Meta lowered their full year 2023 capital expenditures from the range of $30 billion to $33 billion down to the range of $27 billion and $30 billion. The lowered capital expenditure guidance was due to, according to the company, cost savings from non-AI servers and push back of some capital expenditures to 2024 as a result of project delays and equipment deliveries. There is actually no reduction in overall investment plans despite the lower capital expenditure guidance for 2023.

Meta’s CFO highlighted some high-level trends expected for operating expenses and capital expenditures for 2024, while not exactly providing quantitative guidance for the 2024 fiscal year at this point.

For 2024, expense growth is expected to be largely driven by spending and investment its long-term opportunities, which includes AI and the Metaverse. This includes higher infrastructure spending and costs for 2024 and along with the higher capital expenditures made in recent years, there is also a higher depreciation charge that comes along with that. Along with the growing infrastructure footprint, this will also mean higher operating costs for Meta.

Another form of increased spending for 2024 will come from the higher growth in payroll expenses as a result of shifting towards technical roles that have higher costs.

Lastly, in the earnings call, management shared that they “expect operating losses to increase meaningfully on a year-on-year basis” as a result of ongoing product development works in AR and VR as well as Meta’s efforts to scale its Metaverse ecosystem.

For 2024, management expects the total capital expenditure for next year to grow and are largely driven by continued investments in data centers and servers as a result of the focus on AI.

Year of efficiency

2023 was announced by CEO Mark Zuckerberg as the year of efficiency for Meta. I think that the company has followed through on this with discipline and strong focus, which has resulted in improvements in the operational efficiency and cost structure of the company.

As a result of this year of efficiency, Meta can achieve two goals, which includes emerging as a stronger organization and company while improving its financial results so that it can continue to have the ability to invest in its long-term roadmap.

I think Meta has shown that in this year of efficiency, while the company is leaner, it continues to be able to churn out high quality products as a result of a leaner but more efficiency organization. One example CEO Mark Zuckerberg gave was that with the launch of Threads, the product was built with a relatively small team with a rather tight timeline.

Another key thing that was mentioned in the earnings call is that the management team is planning for the AI capital expenditures for 2024 and this is done so in-line with the year of efficiency. Thus, management needs to work out what is the right amount of investment needed as there is not much visibility in terms of how fast their new AI products will grow.

Lastly, apart from the AI capital expenditure budget, the company has now gone through most of the layoffs and are looking to run the company as lean as possible. That said, Meta continues to hire in key areas although the headcount growth will still be relatively low as the company hires talent with the necessary skillset for the company’s long-term ambitions.

Continued adoption of generative AI offerings

Meta mentioned in its earnings call that almost all of its advertisers use at least one AI driven product.

The company has also recently deployed Meta Lattice, which is a new ad predictive performance model meant to predict an ad’s performance based on certain datasets and optimization goals.

It also recently launched AI Sandbox, which is meant for advertisers to experiment with generative AI tools for visual creation. This includes background generation, image outcropping and automatic text variation.

In addition, Meta partnered with Microsoft (MSFT) to open-source Llama-2 to make it available for both research and commercial use and to build leading foundation models to bring about a new generation of AI products.

Also, Meta stated that they are building new products using Llama that will work across its services and platforms. While there was not much disclosed in the call itself, the idea is that this will help people connect, bring about creative tools that makes it easier to share content, agents that provide assistance.

Metaverse

Meta remains committed to their metaverse ambitions and continue to invest in this. To a certain extent, management sees their ambitions in AI and metaverse as somewhat “overlapping and complementary”, which I can see why that is the case.

For the Reality Labs business, the next thing to watch is the Quest 3 launch, Meta’s mixed reality headset. Quest 3 is expected to be the first mainstream accessible device, it is 40% thinner than Quest 2 and has the next generation Qualcomm (QCOM) chipset with two times the graphics performance.

Roblox (RBLX) announced that it is now available in open beta on Meta’s Quest VR headsets.

I think management left most of the metaverse and Reality Labs update for its Connect conference on September 27 so I’ll be watching out for that one.

Threads

To me, Threads isn’t exactly a needed feature for Meta but if it is successful in Threads, it could provide another engagement surface for the company.

This was what CEO Mark Zuckerberg had to say about the Threads business in the 2Q23 earnings call:

On Threads briefly, I’m quite optimistic about our trajectory here. We saw unprecedented growth out-of-the-gate. And more importantly, we’re seeing more people coming back daily than I’d expected. And now we’re focused on retention and improving the basics. And then after that, we’ll focus on growing the community to the scale that we think is going to be possible. Only after that we are going to focus on monetization.

Of course, we are in the very early days for Threads and it does not seem to be much of a focus for the company at the moment. Perhaps it may be more meaningful to look at where Threads is a year from now to see if the community can scale and engagement can improve before we even talk about monetization of the surface.

I think what is crucial here is this: Meta has been very successful in running the social media playbook.

Meta has been successful with its playbook for Facebook, Instagram, WhatsApp, Stories, and Reels.

I think that we have seen a decent start for Threads given the huge size of the network that Meta’s Family of Apps commands. It remains early days but I think it is worth watching the surface for more product launches and improved features.

Valuation

Meta is trading at 19x 2024 P/E. I do not see this as expensive given that the business narrative has changed dramatically from when it was trading at a 6x P/E valuation when we entered a position in the company. Back then, its Family of Apps business were seen to face serious competitive threats, its metaverse ambitions and declining engagement and ads trends.

That said, majority of the upside will thus have to come from earnings upside, in my view, as a P/E multiple expansion is unlikely in this case. This earnings upside will come from continued margin expansion in its year of efficiency, growing monetization from Reels, improved engagement trends in its Family of Apps and increasing ad spend globally.

I am raising my 1-year price targets to $390. The raise comes from the higher P/E multiples of 25x I applied to 2024F forecasted EPS. This implies 22% upside. I think applying a higher P/E multiple of 25x compared to the earlier 15x to 20x P/E multiple is justified given how strong the business has recovered.

I have also raised my intrinsic value and long-term price target for Meta, which can be found in Outperforming the Market.

Conclusion

This Meta 2Q23 earnings review was one that proved that the contrarian thesis has worked really well. With Reels now seeing such strong adoption and monetization trends, Meta’s Family of Apps seeing record engagement, and the AI investments that Meta has made is paying off. While the competitive threat remains, I think what this proves is Meta’s ability to run the social media playbook well.

With improved profitability and margins following the initiatives from its year of efficiency, this leaves room for more investments into near-term and longer term opportunities in AI and the metaverse.

I am raising my 1-year price target to $390, implying 22% upside. All this comes from the improving fundamentals for Meta when compared to when we first bought into the company when it was at 6x P/E. The majority of the upside will come from earnings lift in the near-term, in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 97% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!