Summary:

- We maintain our buy rating on Meta Platforms, Inc. stock post Q2 2023 earning results; the stock is up 234% since our November buy call, and we don’t think the upside is over yet.

- We think Meta is somewhat uniquely positioned to rebound and experience strong adoption of new ad formats, Llama 2 and Threads.

- Consistent with our expectations, Meta’s 2Q23 results confirmed the company’s on track for revenue acceleration and improving margins.

- Management noted that full-year capex would be lower in the $27B to $30B range, from the previous $30 to $33B forecast as CEO Mark Zuckerberg’s dubbed “year of efficiency” plays out.

- We continue to see an increasingly favorable risk-reward profile for the stock heading further into 2H23; we recommend investors explore favorable entry points at current levels.

Kativ

We continue to be buy rated on Meta Platforms, Inc. (NASDAQ:META) post Q2 2023 results, as we don’t think the upside surprise is over; we’re at the halftime mark. The stock is up roughly 8% since announcing 2Q23 earning results. We’re seeing increased engagement on Meta’s Family of Apps, or FoA, as the company monetizes generative A.I. to increase user engagement and ad targeting; we expect Meta to experience revenue growth acceleration into the higher double-digit percentage and improved margins in the back end of the year.

Meta stock was trading at roughly $160 per share a year ago; now, the stock is trading at $316 per share with a 52-week-high of $326. The stock is up 234% since our buy-rating in November, outperforming the S&P 500 (SP500) by 213%. Meta remains our favorite stock within the FAANG group, and we think we’re only now hitting the halftime mark in Meta’s recovery.

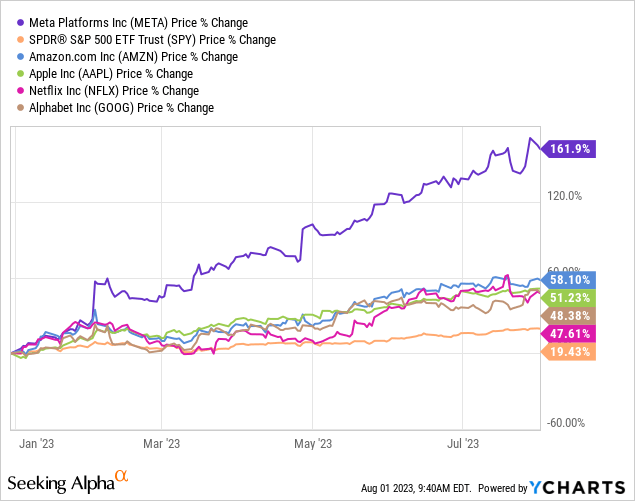

The stock is up 162% YTD, outperforming Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Alphabet (GOOG) (GOOGL) and the S&P 500. The following graph outlines the FAANG group’s YTD performance.

YCharts

Q2 2023 & Reeling in Expenses

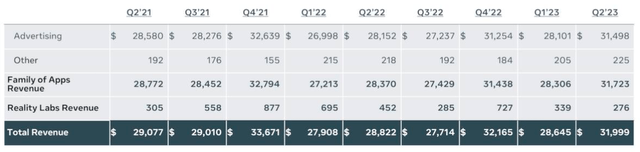

Meta beat top and bottom estimates this quarter, reporting revenue up 10.6% sequentially to $32B from $28.65B last quarter, and GAAP EPS for 2Q23 is $2.98. We think Meta will continue expanding its revenue growth sequentially into 2024; last quarter, revenue grew 2.7% Y/Y versus this quarter, up 11% Y/Y. The following graph outlines Meta’s segment results to highlight where the most weight comes from: ad revenue.

Meta 2Q23 earnings presentation (in millions)

FoA revenue represents the bulk of total revenues, at $31.7B, up 12% Y/Y and 10.7% sequentially from $28.3B in 1Q23; FoA ad revenue is Meta’s main revenue stream reporting revenue of $31.5B this quarter. Our bullish sentiment on Meta is twofold.

1. Higher engagement, A.I. monetization & Ad spend recovery

Meta now has an estimated 3.07B users that use at least one of the FoA on a daily basis and “approximately 3.88B people that use at least one on a monthly basis.” We’re seeing a sequential expansion of Meta’s FoA user engagement and expect the company will be able to monetize the increased engagement into significant ad revenue growth in 2024. Meta crossed 3B monthly active users with Facebook MAU at 3.03B in June, up from 96M last year. Looking toward daily click-to-WhatsApp ad business, revenue is expanding rapidly, up 80% Y/Y. We also expect Threads to substantially expand Meta’s reach to Twitter users, leveraging a wider base for advertisements. Management touched on Threads on the earnings call, noting that Meta would look into monetizing the platform after scaling the community first; we think Meta’s launch of Threads amid the “year of efficiency” puts to rest the previous concern over Meta not being able to balance efficiency with innovation after its overspending on Reality Labs. We believe Meta is uniquely positioned to experience double-digit ad revenue growth in 2024 as the macro headwinds wash out and ad spending picks back up. In the near-term, we’re seeing Meta’s ad revenue be resilient, especially relative to ad revenue in companies like Snap (SNAP); although both companies battled Apple’s iOS privacy change in 2021 and the macro backdrop, each company’s ad revenue recovered differently.

2. Zuckerberg’s Efficiency

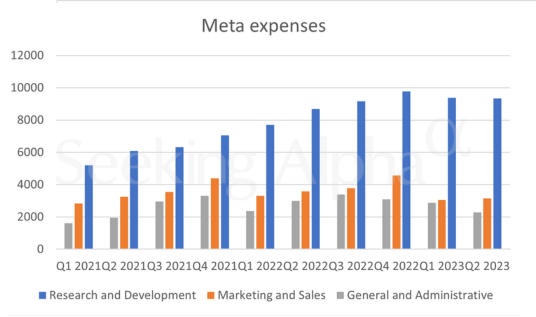

Zuckerberg’s “year of efficiency” has been paying off big time; this year, Meta’s shifted to cutting costs and improving profitability. Total expenses this quarter were $22.6B, up 10% Y/Y, similar to total expenses in 1Q23, up 10% Y/Y; the following graph outlines Meta’s expenses up to 2Q23.

Seeking Alpha

Meta’s R&D this quarter increased by 8%, lower than the percentage increase last quarter at 22%. We think Zuckerberg is walking the talk when it comes to cutting costs. The company’s operating income was $9.4B, representing a 29% operating margin. Among the takeaways from this quarter’s earning call was Meta’s capex outlook; management noted that they “expect capital expenditures to be in the range of $27 billion to $30 billion, lowered from a prior estimate of $30 billion to $33 billion.” Meta reduced forecast due to cost savings specifically for “non-A.I. servers”; this supports are broader thesis on A.I. not benefiting all semi-players as under a limited capex, non-A.I. offerings will be harmed by the A.I. boom amid the current macro backdrop. We expect Meta to continue to control expenses and see the stock outperforming in the mid-to-long run.

Valuation

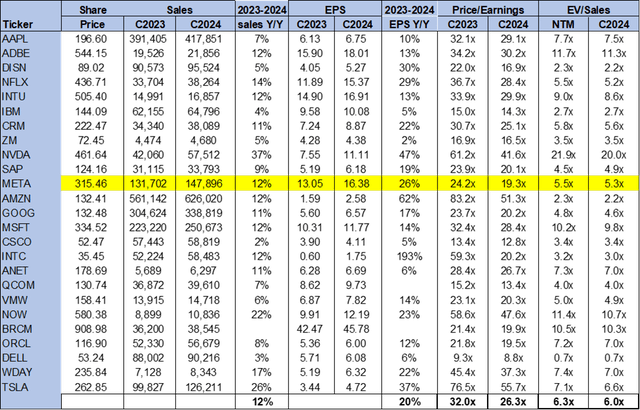

Meta is still relatively cheap, trading below the peer group average. On a P/E basis, the stock is trading at 19.3x C2024 EPS of $16.3B compared to the peer group average of 26.3x. The stock is trading at 5.3x EV/C2024 Sales versus the peer group average of 6.0x. We continue to see a favorable risk-reward for the stock and believe it’s undervalued at current levels.

The following chart outlines Meta’s valuation against the large-cap peer group.

Word on Wall Street

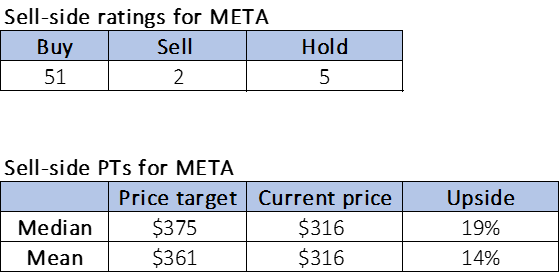

Wall Street is overwhelmingly bullish on the stock. Of the 58 analysts covering the stock, 51 are buy-rated, five are hold-rated, and the remaining are sell-rated. The stock is trading at $316 per share. The median sell-side price target is $375, while the mean is $361, with a potential 14-19% upside.

The following charts outline Meta’s sell-side ratings and sell-side price targets.

TSP

What to do with the stock

We see an attractive risk-reward profile for Meta into 2024; it’s rare to see a consumer Internet stock rally continue in the way Meta has since November. We see further upside for the stock driven by increased adoption of new ad forms as the company monetizes generative A.I. to increase overall time spent on FoA, up 7% this quarter. Additionally, we believe Meta’s installed base across its FoA provides a unique position to leverage A.I. into ad revenue growth. We continue to expect ad spending to remain somewhat muted in the back half of the year but expect Meta to be well-positioned to outperform once ad spending rebound in 2024 alongside the economy. We recommend investors explore favorable entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.