Summary:

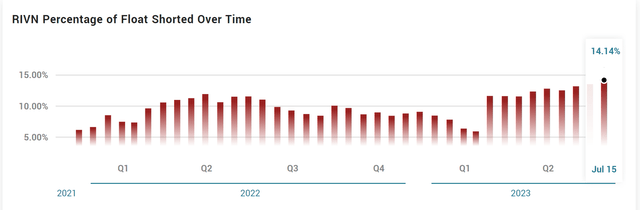

- While Rivian investors eagerly wait for its Q2 results, they should not overlook its short-interest ratio.

- The ratio currently stands over 14%, the highest level since 2021 Q4.

- Such high short interest suggests a strong bearish sentiment. And I do see a few good reasons for it.

- Competition is heating up, its next-generation consumer vehicle platform R2 is a long way off, and its valuation is still too high to justify.

Justin Sullivan

Thesis

A good way to look at investor sentiment is by checking the current short-interest ratio and volume. For readers new to the concept, a high short-interest ratio indicates that there is strong bearish sentiment and negative expectation for a stock, and vice versa.

With the above basics, the next chart shows the short interest for Rivian Automotive (NASDAQ:RIVN) since 2021. As seen, its short ratio currently stands at 14.14%, the highest level since 2021 Q4. To provide a broader context, the short interest for Telsa (TSLA) currently stands at 3.4%.

In the remainder of this article, I will detail my interpretation of its business fundamentals and explain why I see the Shorts having a few very good reasons to bet against the stock. And the top reasons are competition intensification, uncertain delivery prospects, and lofty valuation, as elaborated immediately in the next section.

RIVN’s Challenges

There are certainly reasons to be bullish about RIVN such as product differentiation and potential growth. And I will discuss these upside risks later. However, overall, believe headwinds have the upper hand in the near term. I see Rivian facing several strong challenges immediately ahead as detailed next.

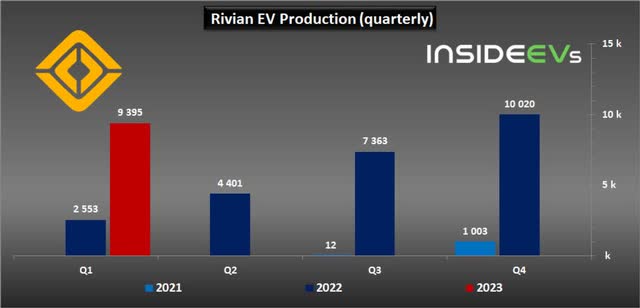

First, it has yet to show that it can scale up production and delivery in a profitable way. Back in 2022, RIVN has ambitious goals to produce and deliver 25,000 vehicles. But it then cited supply chain difficulties for preventing it from reaching its target. It also commented that its manufacturing equipment and processes would have the ability to produce over 50,000 vehicles if not constrained by its supply chain. However, its production as of this writing is still considerably lower than its target as seen in the chart below. It is also my view that the issues that RIVN faced are beyond supply chain issues and include design flaws, last-minute changes, and material costs.

Second, it has also yet to show meaningful progress toward its key vision. RIVN has made some bold promises to its customers and investors, besides offering premium features and enhanced, its vision also included an EV ecosystem with a membership program, a charging network, and a home energy product. However, RIVN has not yet proven that it can deliver on these promises in any meaningful way as I see it. On the contrary, it has delayed the launch of its SUV R1S several times due to production challenges. It has also been facing a stream of negative news such as quality issues and lawsuits.

Finally, competition in the EV space is intensifying and will only become more intense until the industry consolidates in the way I see things. And I don’t see RIVN having the best odds to be among the ones standing after the consolidation is done. The competitive EV market is currently dominated by Tesla and challenged by many other established automakers both in the U.S. (such as Ford and General Motors) and also overseas (such as NIO and XPENG). Even in RIVN’s sub-sector, it has plenty of competition to its truck lineups already in the market or on the horizon, such as Tesla’s Cybertruck, Ford F-150 Lightning, and General Motors Hummer EV. Besides larger scale, these competing products also offer various advantages over RIVN such as brand recognition, customer base, distribution network, service network, and financial strength.

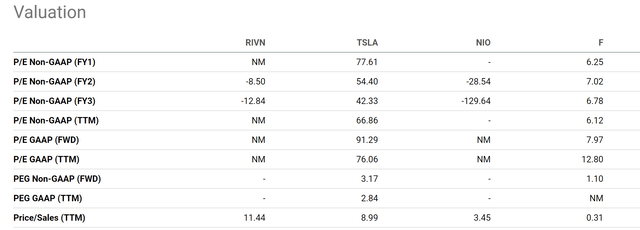

Valuation is still too high

I have no doubt that developing new EV technology and staying ahead of competitors will not be cheap. It will require sustainable investment. But RIVN’s business is not yet profitable. Recent cuts to federal tax credits for some car makers, which includes Rivian, would make things even worse. With the lack of profit, common bottom-line metrics such as P/E or price/cashflow ratios are not meaningful (which is a troubling sign in my view).

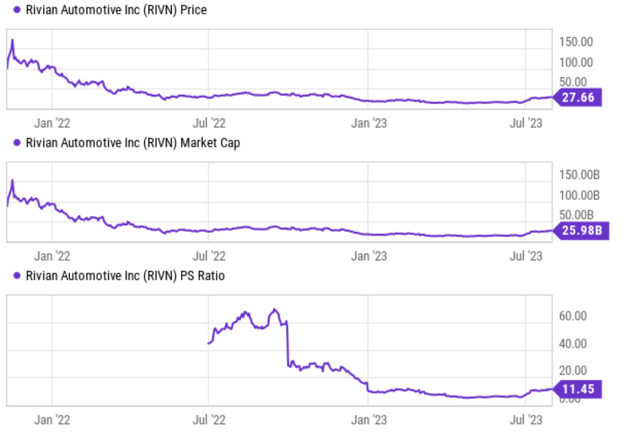

But even at its current share prices and by topline valuation metrics, the stock is still expensively valued. A bit of background here. When RIVN IPO’d in 2022, its stock price reached as high as $172, which gave it a market cap of over $130 billion. Those price levels translate into a P/S ratio of over 60x – a sign of a bubble in my view. The stock price has collapsed from peak levels.

At its current level, Rivian’s P/S ratio hovers around 11.5x. It is considerably lower than the 60x in its bubble stage, but still too high to justify in my view. As seen in the second chart below, P/S ratios (on TTM basis) are substantially higher than competitors who are larger and more established.

Source: Y-Chart Source: Seeking Alpha

Upside risks and final thoughts

I have been concentrating on its downside risks so far. Here I want to point out some of the factors that make RIVN stand out from other EV companies.

First, RIVN’s niche focuses on electric trucks and SUVs. It is a smart strategy to differentiate itself from the crowded EV market and target a segment that has high demand and low supply. According to the U.S. Department of Energy, light-duty trucks and SUVs accounted for 72% of new vehicle sales in 2020, up from 47% in 2010. However, there are very few electric options available for these types of vehicles, as most EV makers focus on sedans, hatchbacks, or crossovers. RIVN aims to fill this gap with its flagship products, the R1T pickup truck and the R1S SUV, which offer premium features, performance, and design. The R1T has a range of up to 400 miles, a towing capacity of 11,000 pounds, and a starting price of $67,500. The R1S has a similar range, a seating capacity of seven passengers, and a starting price of $70,000.

Second, RIVN aims for further differentiation by offering premium features, performance, and design that appeal to customers who want adventure and luxury. Rivian also claims to have the best battery technology in the industry, with a modular and scalable architecture that enables long-range driving, fast charging, and high-power output. Battery technology is a key enabler of the premium feature and performance that RIVN aims for. As a sign of its successful strategy, both of its flagship vehicles have received positive reviews from critics and customers alike and attracted over 55,000 preorders when they first came out.

Third, RIVN has also attracted strong backing from giants like Amazon and Ford. It obtained an agreement with Amazon.com to develop a global fleet of 100,000 vehicles to green its delivery fleet. These vans come in three different sizes and are expected to be delivered by 2030. Amazon’s investment and order give RIVN a stable source of revenue and exposure, as well as access to Amazon’s resources and network.

Despite these positives, I see the headwinds having an upper hand in the near term, as reflected in the surge in its short interest. And I see the downside risks outweigh the upside risks. I view the dominating forces in the near term to be its uncertain delivery prospects, lack of profit to sustain investment and lofty valuation. In the longer term, I do not see it having the best odds to be a winner when the EV sector’s consolidation is done.

Furthermore, the deal with a giant like Amazon could be a risk factor too. For example, in the case that Amazon has reasons to change or cancel the deal, it would create tremendous negative impacts on the company’s stock. With RIVN’s production scale and delays, I do think it is a plausible scenario for Amazon to change the deal (as an example, to cancel the exclusivity part of it).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.