Summary:

- Nvidia Corporation serves as the “AI arms dealer” and has massively raised their Q2 guidance in response to incoming demand for their computing solutions.

- Even if the AI hype is short-lived, the company is well positioned to benefit from technological trends.

- We believe Nvidia’s current valuation is justified, though significant risks remain.

Justin Sullivan

Thesis

The ducks are quacking, and Nvidia is intent on feeding them. NVIDIA Corporation (NASDAQ:NVDA) is currently serving as the main arms dealer in the artificial intelligence (“AI”) race. The company provides hardware and software solutions that are in high demand, as evidenced by their monster guidance raise for Q2. We believe that Nvidia has what it takes to grow into their premium valuation. The company is well positioned for the future because of their exposure to technological trends with high amounts of growth potential.

AI Boom

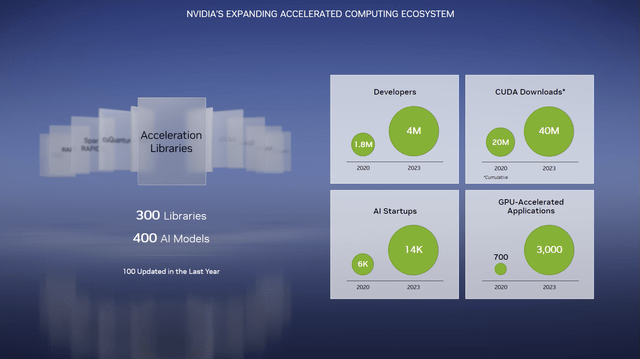

AI has become the tech buzzword of today. Companies across the economic spectrum are searching for ways to use AI to improve their business. Nvidia appears to be the arms dealer of choice for the “AI revolution.” The company has seen massive growth in their ecosystem over the past few years.

GTC 2023 Financial Analyst Presentation

There are some investors who have been quick to dismiss AI as just another tech fad, and others who have fully embraced the AI hype cycle. As with most tech trends, there will be companies that see tremendous fundamental benefits and companies who are simply trying to boost their stock price.

Time will separate fact from fiction and ultimately show where the main benefits of AI adoption lie. Nvidia is a picks and shovel play that will likely do well regardless of who ultimately finds the AI gold.

Q2 Guidance

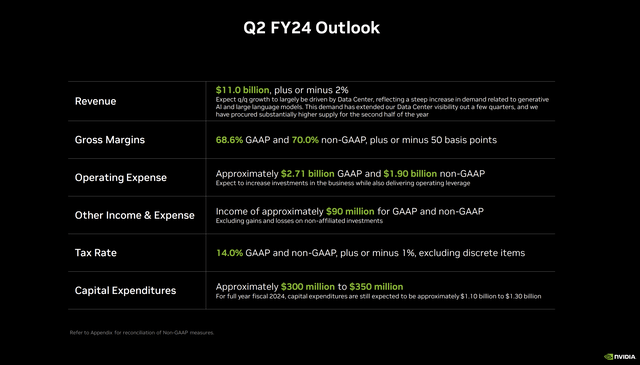

When they reported their Q1 earnings, Nvidia showed a revenue decline of 13% year-over-year. This would have probably been a lackluster result on its own, but the company also raised their Q2 revenue guidance to $11 billion. This guidance increase was massively higher than expectations and shows that the company is seeing high levels of demand. The big question is how much of this demand is sustainable and how much is pull forward due to companies rushing out to secure supply and perhaps even ordering more than they need.

Nvidia Q1 Earnings Presentation

Nvidia Q1 Earnings Presentation

For the time being, the market is cheering Nvidia’s near-term business outlook. Importantly for investors, even if the AI hype is short-lived, the company is well positioned to benefit from long-term technological trends.

Well Positioned for the Future

Regardless of the current buzz around AI one thing is certain: the demand for computing power will continue to increase. As technology improves the data generated will not only be larger in quantity, it will also be used for different purposes. Companies will find new and improved ways to utilize computing power to fuel innovation. As many investors have stated in the past, “data is the new oil.” We would broaden that statement to also say “computing power is the new oil” as computing power is required to make sense of all the data.

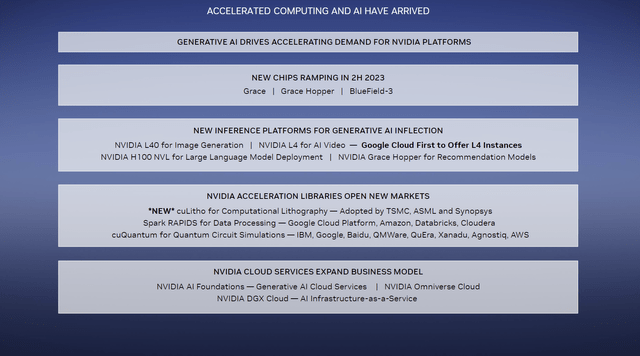

Nvidia is leaning heavily into AI and cloud services and is continuing to improve their software and ecosystem. Nvidia is quickly becoming the partner of choice for many tech companies due to their robust hardware and software offerings and focus on continued innovation.

GTC 2023 Financial Analyst Presentation

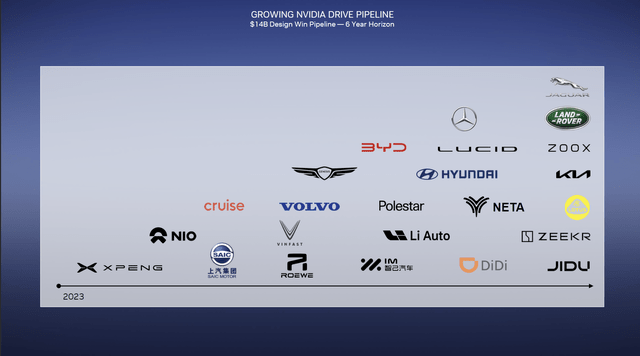

Nvidia has continued to grow their automotive pipeline. We view this as a significant area of opportunity for the company, especially if Tesla (TSLA) continues to innovate in this area. In order for automotive companies to keep up with Tesla, they will need to improve the driver assistance features in their vehicles, and will likely rely on Nvidia in order to make that happen.

Nvidia’s foray into serving the automotive market helps to cement their position as the arms dealer of computing regardless of use case.

GTC 2023 Financial Analyst Presentation

Price Action

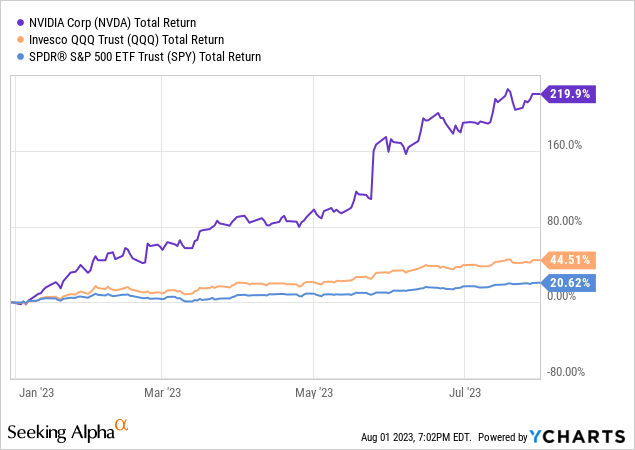

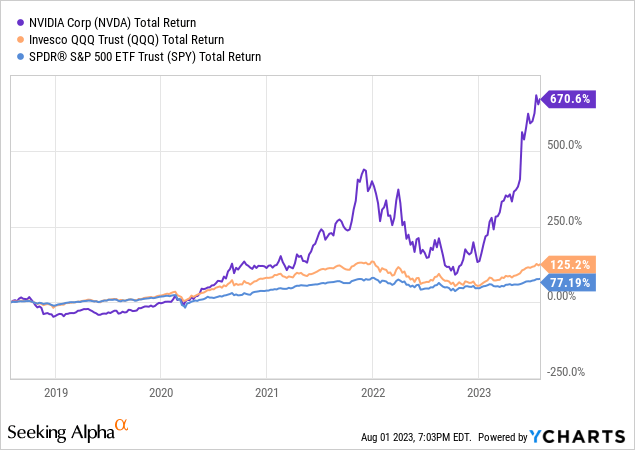

Nvidia’s stock has smoked both the Nasdaq 100-Index (NDX) and the S&P 500 (SP500) this year. The same can be said when looking out over a five year timeframe. The company has benefited from increased demand for computing power, but it remains to be seen if this outperformance can continue. We don’t think that investors should expect such massive outperformance going forward, however, we do believe that Nvidia can continue to beat the major indexes over the coming decade.

Valuation

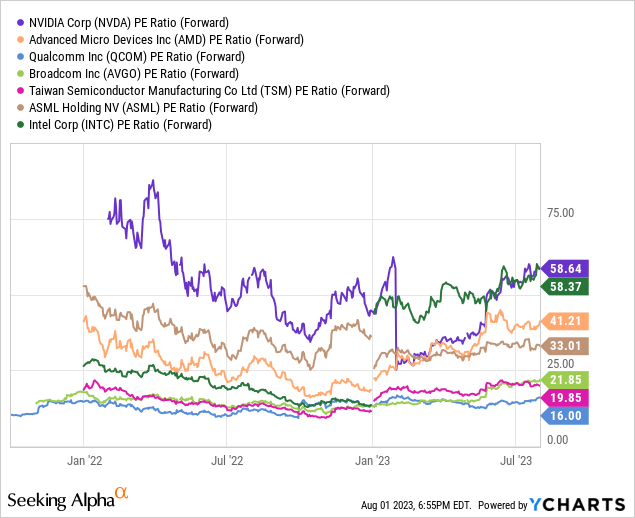

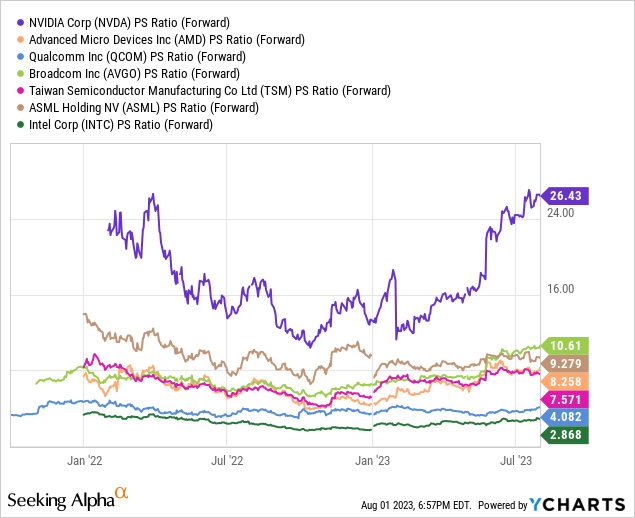

Nvidia is trading at a forward P/E premium to many large cap companies in the semiconductor industry. This valuation premium widens even further when looking at the P/S ratio. Nvidia will need to execute flawlessly over the coming years if they want to not only grow into their current valuation but also beat the market going forward.

A high valuation alone isn’t enough to make a stock not worth buying. The company appears likely to grow into their valuation. In addition, Nvidia is well positioned to benefit from technological trends which can fuel their growth over the coming years.

Nvidia is definitely an “own it don’t trade it” kind of name, but we would no longer be bullish on the name if it was trading above a forward P/E of 100 without also having a significant increase in the outlook for growth.

Risks

We are going to outline some of the risks to the bull case for Nvidia below.

Margin Compression: Nvidia could see margin compression due to increased competition. This risk appears to be muted for the time being but investors should carefully watch for signs that competition is able to pressure Nvidia’s revenue and margins.

Demand Slowdown: The AI hype could result in a massive pull forward in demand, leading to worse than expected revenue growth during the eventual digestion period. This risk may end up being material but it’s difficult to say in the interim exactly how much expected revenue growth can be attributed to a pull forward in demand.

Alternative Solutions: Companies may opt to design computing solutions in-house rather than use a generic solution such as a GPU or CPU. This is already happening for some specialized workloads. Nvidia can stave off this threat by providing a superior value proposition regarding performance and total cost of ownership.

Geopolitical Risks: Nvidia has a global supply chain and is a large customer of Taiwan Semiconductor (TSM). China is a valuable end market for Nvidia. If conflict were to break out in Southeast Asia it could drastically impair Nvidia’s supply chain and limit access to some of their end markets.

Restrictions on Sales: The U.S. government could increase restrictions on Nvidia’s ability to sell chips into some of their end markets. While the current focus of the U.S. government is on China, this focus could expand in size and scope over the coming years targeting new countries and technologies.

Investors in Nvidia should be aware that the risks are significant. We believe that the overall risk/reward remains reasonable here.

Key Takeaway

We believe Nvidia Corporation’s current valuation is justified. The company is serving as the “AI arms dealer” and is well positioned to benefit from technological trends. Regardless of who finds the AI gold, Nvidia is likely to do well. That being said, there are significant risks that could cause Nvidia Corporation stock to fall dramatically lower should any of them materialize.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, TSM, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to NVDA, TSM, and TSLA. UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. This is not investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.