Summary:

- Intel reported better than expected earnings for Q2 due to a stabilization in the PC market and easing pressures in the important Client Computing Group.

- Intel also reported its first quarterly profit in three quarters. Gross margins are showing signs of stabilization as well. Still, CCG revenues declined 12% Y/Y in Q2’23.

- Positive EPS estimate revisions could support Intel’s shares.

- While uncertainty remains, Intel is worthy of a rating upgrade.

Intel (NASDAQ:INTC) reported much better than expected earnings for its second fiscal quarter last week, thanks to a stabilization in the PC market and easing pressure on Intel’s Client Computing Group. While a post-pandemic slowdown in consumer demand has weighed especially heavy on the device market recently, I believe the situation is now improving to such an extent that a rating upgrade for Intel is justified.

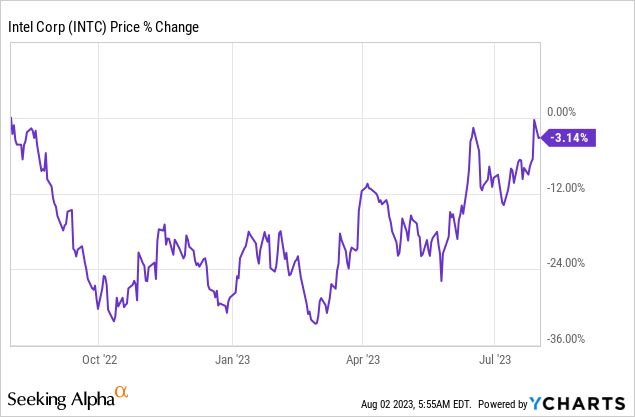

After two consecutive quarterly losses in Q4’22 and Q1’23, Intel is now looking at an improved earnings picture and a potential successive stabilization in the device market. Positive EPS estimate revisions going forward are also a potential reason to be a little more optimistic about Intel. Since conditions in the PC market appear to be improving and Intel guided for a gross margin recovery, I am upgrading Intel from my latest sell rating (I previously rated INTC a sell due to the firm’s exposure to the device market as well as plunging revenues in the CCG business) to hold!

JHVEPhoto/iStock Editorial via Getty Images

The worst may be behind the PC market (and Intel’s CCG business) at this point

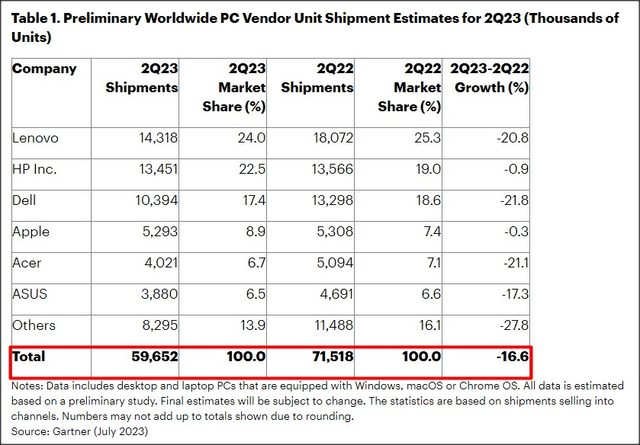

Research company Gartner recently disclosed preliminary numbers for global PC shipments in the second-quarter and while the market overall continued to contract at double digits, there are signs that the worst may already be behind Intel and other manufacturers. Two observations stand out from the Gartner preliminary report: (1) The rate of negative growth slowed from 30.0% in Q1’23 to 16.6% in Q2’23, and (2) The absolute number of worldwide PC shipments sequentially increased 4.5M units to 59.7M total shipments in the second-quarter. In other words, the PC market has seen Q/Q growth in worldwide PC shipments in Q2’23, potentially indicating that the market already bottomed in the first-quarter.

This Q/Q rebound in PC shipments in the second-quarter has helped take pressure off of Intel’s Client Computing Group which faced sharp headwinds in the last few quarters due to crashing consumer demand, falling prices and rising inventory levels.

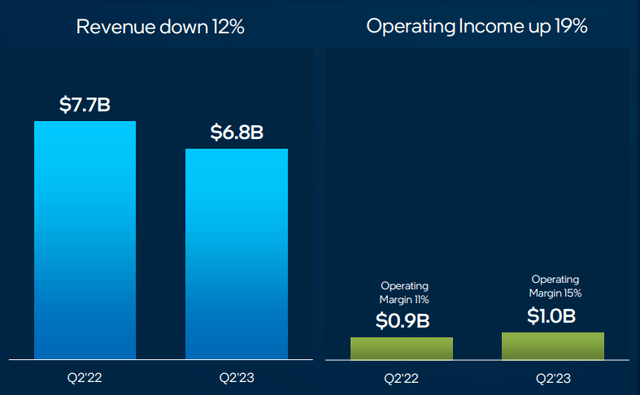

Intel’s Client Computing Group generated $6.8B in revenues in the second-quarter, showing a decline of 12% year over year. Client Computing Group revenues accounted for a revenue share of 53% in Q2’23 and they typically accounted for around half of Intel’s revenues in the previous two quarters. Intel’s Client Computing Group saw its top line decline 38% in the first-quarter, so although revenues kept dropping in Q2’23, the segment’s top line declined at a much slower rate.

In Intel’s second-quarter earnings release, two elements stood out that I believe confirm indications that Intel may have already seen a market bottom.

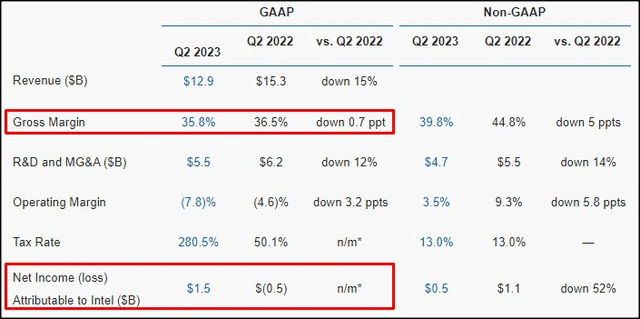

The first is that Intel reported a first-quarter net profit of $1.5B, thereby reversing a negative earnings trend that lasted for two quarters and generated cumulative losses of $3.5B. In fact, Intel reported its highest quarterly profit since Q1’22 in the last quarter.

The second is that pressure is coming off of Intel’s gross margins… which are typically used to evaluate operating performance of chip makers. Intel’s gross margins still fell 0.7 PP year over year in Q2’23, but they bounced back 1.6 PP compared to Q1’23. Together with Intel’s gross margin forecast (which calls for a gross margin of 43%), this is a strong reason to expect that the worst is behind Intel at this point.

Intel’s valuation

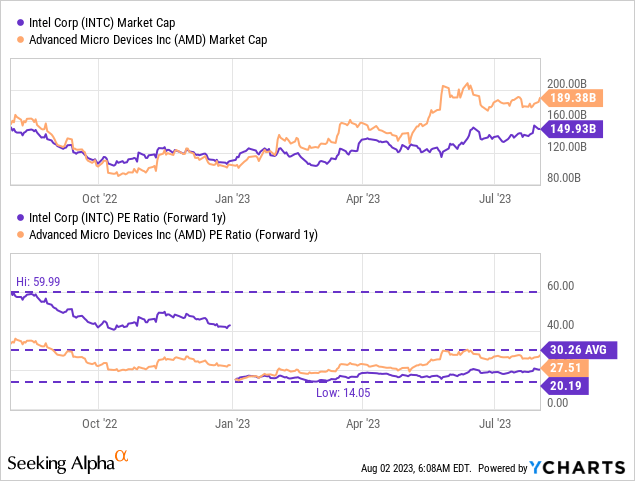

Over the last couple of years a large valuation gap has opened up between AMD (AMD) and Intel, in part because AMD made massive gains in the server market as Intel messed up the launch of its Xeon Server processors. The launch of these processors has been delayed multiple times but Intel finally got its act together in January 2023 and launched the Sapphire Rapids processor with which Intel seeks to compete against AMD’s EPYC server chips.

Intel is currently valued at 20.2X forward (FY 2024) earnings which implies that shares are trading 33% below their 1-year average P/E ratio. AMD is trading at 27.5X FY 2024 earnings and my latest rating on AMD was sell due to what I believe is an excessive AI hype stretching the firm’s valuation.

The valuation gap between AMD and Intel is likely due to Intel botching the release of its server chip which definitely helped AMD gain a stronger foothold in the server market. Given the upbeat earnings report for Intel’s Q2, I believe investors could see EPS estimates reset to the upside.

Risks with Intel

Intel’s Q2’23 earnings report suggested improving operating trends, especially as they affect Intel’s dominant Client Computing Group. The trend in net income and gross margins was also positive. However, there is no assurance that the PC market has indeed bottomed out and a recession could result in a broader and longer term contraction of Intel’s gross margins. What would change my mind about Intel is if the company saw a reversal of recent gross margin gains and an accelerating drop in CCG revenues.

Closing thoughts

Intel reported a solid earnings sheet for the second-quarter that showed easing pressures in the PC market, a picture that has been confirmed by Gartner’s preliminary shipping estimates for Q2’23, a net profit after two consecutive quarters of losses and a forecast that calls for a sequential increase in gross margins. Gross margin growth is the clearest indicator that pressure in Intel’s operation portfolio is easing, which continues to be dominated by the Client Computing Group. Since analysts are also likely to upgrade their EPS estimates following a strong earnings report and since the PC market is not completely out of the woods yet, I am upgrading my rating from sell to hold!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.