Summary:

- Meta Platforms, Inc. has made progress in the AI space with the Llama 2 AI model and partnerships with Microsoft Corporation and Qualcomm Incorporated.

- Reels, a copycat feature similar to TikTok, is expected to provide a substantial revenue stream for Meta.

- The Threads feature on Instagram has potential for positive margins and could capture market share from Twitter.

- A little to expensive to jump in right now, however, Meta is no stranger to massive swings.

Justin Sullivan

Investment Thesis

I would like to revisit my thesis on Meta Platforms, Inc. (NASDAQ:META) that I did about half a year ago to see what kind of progress the company has made since then and give my view on the outlook of the main revenue segments the company has and where I see them going. I am also assigning a hold rating due to the very quick recent run-up in share price, which does not provide the risk/reward I am looking for right now. The long-term thesis is still intact; however, I would wait for a slight pullback before investing more/ starting a new position.

Outlook

Artificial Intelligence

The company finally jumped on board the artificial intelligence (“AI”) hype train. I would say the buzzword had a lot to do with how the company’s share price skyrocketed over the last 6 months since I’ve covered it. The Llama 2 AI seems like a very capable model, and the partnerships with Microsoft (MSFT) and Qualcomm (QCOM) will keep the AI model on everyone’s radar.

So, the partnership with MSFT would enable people/ organizations to build generative AI tools and everything that comes with it. Right now, the management isn’t focused on monetizing the model, however, this should change in the future once organizations, through Azure, want to use the model for commercial use. They would have to pay MSFT for the license to build out their cloud tools with the Llama AI, and Meta will be looking to grab some of that revenue when large enterprises decide to use the tools, as CEO Mark Zuckerberg alluded in the latest transcript.

Another big news item that helps Llama 2 to stay relevant is the partnership with QCOM. This means that the LLM will function on the new smartphones from 2024. This will scale the AI and bring it to the larger population at a significantly reduced cost basis.

In summary, I don’t think this project of Meta’s is going to disappear like the crypto project it had previously. It is hard to put a number on what kind of revenue it will eventually bring, however, it can only be a positive in my opinion.

Reels

The company is very good at being a copycat of already popular and money-making applications. With the advancements of AI at the company, Meta managed to grow annual run rate revenue from $3B to $10B as of the latest quarter. Meta has a huge reach globally, so I think it is pretty easy for it to copy a feature from other companies like TikTok, use its AI tools to target the users better, and provide them with content that will make them spend more time on the platform. I don’t see this revenue slowing down any time soon. The ad platform with the implementation of AI helps advertisers create higher quality ads that are going to be more relevant to the consumers.

Reels are not the highest revenue generator from ads; however, I don’t think it is going to hurt other higher revenue features like Feeds or Stories. I would say it’ll continue to be behind them but will provide a substantial revenue stream going forward.

How likely it is that TikTok will be banned in the future I’m not sure, but that would be one big positive outcome for Reels because TikTok dominates this space by taking about 54 mins of people’s attention per day in the U.S. compared to 33 minutes for Instagram (same article as above).

Threads

The boom of the new feature Threads on Instagram has been numerously covered in the past couple of weeks. The quick reach to 100m users in a couple of days to the plummeting in the following weeks has the bears saying it was a failed project. There are a couple of things that will be tailwinds for Threads, and I believe that Threads will contribute to positive margins for the company in the future. The feature was built by a small team, which means there was not much in terms of costs, and if the company manages to attain higher numbers of users in the future, it will be one of the better apps margins-wise, in my opinion.

Another thing is the ecosystem that the Family of Apps represents. It will not be hard for the platform to achieve higher numbers in the future if Meta executes on engaging the user and providing a service that is of value to them. Threads are still not available in many countries, including all of Europe, and the app is not monetized at all yet.

The reputation of X, formerly known as Twitter, continues to be shaky, and the future is uncertain, which I believe will create an opportunity for Meta to swoop right in and take a good chunk of the market share that Elon’s company may still have.

Metaverse and Reality Labs

I wasn’t particularly happy to hear in the latest quarter that losses at Reality Labs (“RL”) are going to be accelerating. RL lost around $13B in ’22 and has already lost $7.7B in the first 6 months of ’23. The segment is well on its way to losing around $15B. I am a little worried that Zuckerberg is very adamant in making the Metaverse the end game here and that costs might continue to balloon. On a positive note, the company still makes most of its money from its Family of Apps and is still generating a lot of money to funnel into RL, and once this segment starts to pay off by either organically coming into positive margins or by cutting it completely, the company will have access to an extra $15B to deploy into something else.

Advertising- The Bread and Butter

All of the above different revenue segments are great and all, but let’s not forget, the company makes its money through advertising, and it does not matter how many features should introduce if advertisers won’t want to put up ads on those platforms. The big problem back when the company’s share price reached around $90 was the Apple (AAPL) privacy policy changes and how Facebook was doomed because of it. Now that advertising has picked up already quite considerably, the advent of AI marketing is bringing in a new revolution. It is predicted that AI marketing will see the upward trajectory continuing in ’24, and Meta will surely be a major beneficiary of this re-accelerated growth.

In summary, Meta has a lot of positives going on in the long run. It has been a cash cow for many years now and I don’t see this changing anytime soon unless the spending on the Metaverse and Reality Labs becomes a serious problem. With the advertisers coming back to the platform and spending more, Meta will continue to generate billions of dollars and fund Zuckerberg’s Metaverse dreams. It will be great if the expenses stabilize in the next couple of years and Metaverse works out in the end; however, I wouldn’t be opposed to just scrapping the whole idea and getting $15B back and putting it towards something that will make money.

Briefly on Financials

The company has a lot of liquidity as of Q2 ’23. It is currently sitting at around $53B in cash and marketable securities against $18.3B in long-term debt. That in my opinion is not an issue for a company that can generate over $50B in operating cash flow and what I project for FY23 is around $40B in EBIT.

The company also has a healthy current ratio of around 2.3, which is just above what I would like a company to have. I prefer it when companies sit at around a 1.5 – 2.0 ratio because to me, it means the company is being very efficient with its assets and is not holding on to too much cash that could be used for projects to generate more profits or share buybacks (at a reasonable price). It is safe to say META has no liquidity or insolvency risks.

Valuation

In my previous article, I was overly conservative on META because of the negative sentiment around it and how Apple’s privacy policy is going to destroy revenues, and how its margins are going to suffer. The year of efficiency has been going well, I believe, and so I had to make some adjustments to operating margins and revenues.

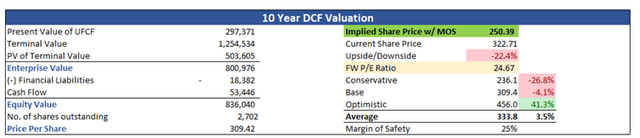

I will anchor my assumptions to what analysts are predicting META will be able to achieve in the next 3 years in terms of EPS. Analysts estimate that META will make around $13.36 a share in FY23, $16.18 in FY24, and $18.85 in FY25. I went with $13.08, $16.17, and $18.42, respectively.

Over the next decade, I assumed net margins will improve from around 20% in FY22 to around 35% by FY32, which I think is reasonable seeing that net margins were at around 40% back in FY18.

For revenue, I kept it relatively reasonable. For the base case, I went with a 9.5% CAGR over the next decade. For the optimistic case, I went with 13.3%, while for the conservative case, I went with 7.5%.

Just to give myself an extra cushion, I will keep the 25% margin of safety I assigned 6 months ago also. With that said, Meta’s intrinsic value and what I would be willing to pay for the company is around $250 a share, meaning that according to my estimates, it’s a little expensive for my risk/reward and I will wait for some profit-taking.

Closing Comments

I’ve been in and out of Meta Platforms, Inc. many times over the last 5 or 6 years. It was always a great company to own, and I was never afraid to add to my position and dollar cost average in the past when people fell out of love with the company, like the Cambridge Analytica scandal.

Unfortunately, I was not able to get in when the company was trading at its lowest levels in recent times, and so now that I would be able to, I believe it is not the right time and I would love for it to drop around 20% or even more. I am going to be patient and follow what happens with the company in the future and reassess if needed. I missed the boat for now, but it won’t be the last time an opportunity presents itself, I’m sure.

The company will continue to perform well in my opinion, and everyone should welcome a pullback so you can add to your position in the long run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.