Summary:

- PayPal Holdings, Inc. reported Q2 adjusted earnings per share of $1.16 (+24% YoY) and revenue of $7.3 billion (+7% YoY) – so why the precipitous drop?

- The company reported declining active accounts for the second time. I explain why the (small) decline is not that alarming, and why investors should instead keep an eye on margins.

- I continue to avoid PayPal stock, despite the (seemingly) cheap valuation, largely due to the questionable moat of this payment services provider.

- Management’s earnings adjustment policy is another reason why I would not risk capital here.

doidam10/iStock via Getty Images

Introduction

I first covered PayPal Holdings, Inc. (NASDAQ:PYPL) stock in October 2022. At that time, I rated it a “Sell,” even though it had already declined more than 70% from its all-time high. Recency bias can be insidious, and I noted that even at $90, there was a lot of (probably unattainable growth) priced into the stock. Higher interest rates, through the increase in the discount rate of cash flows far out in the future, contributed their fair share to the re-rating. I provided an earnings update on PayPal stock in May after the Q1 2023 report.

In the meantime, PayPal stock has returned to the $75 support level, but after the announcement of Q2 results, the stock is heading downward again. In this brief update, I share my thoughts on the earnings report – and whether the report was really that bad, considering that PYPL stock has declined by over 12% today.

PYPL Stock Q2 Earnings Review

The company reported adjusted earnings per share (EPS) of $1.16 (+24% year-over-year) and revenues of $7.3 billion (+7% year-over-year), both in line with expectations. The variance between GAAP and non-GAAP results remains significant at +25%, largely due to stock-based compensation (see my last article for an in-depth analysis of the – largely recurring – adjustments). Compared to Q1, GAAP EPS guidance was raised slightly from $3.42 to $3.49, while non-GAAP guidance was reiterated.

Free cash flow was negative in the quarter (-$0.4 billion versus $1.1 billion a year ago). However, the transaction with KKR & Co. Inc. (KKR), which agreed to buy up to €40 billion worth of “buy now, pay later” (“BNPL”) loans from PayPal, will lead to significant cash inflow in the second half of the year. PayPal expects proceeds of about $1.8 billion (slide 3, Q2 earnings presentation), but likely before taxes. A significant portion of the proceeds will be used for share buybacks.

Speaking of which, year-to-date, the company has repurchased about 41 million shares for $2.96 billion, or an average price per share of $72. That’s definitely a much better return on investment than the $220 average paid in 2021 (p. 109, 2021 10-K). I will not discuss PayPal’s share repurchases further in this update, as I elaborated on the situation in my previous article (Figure 6 therein), where I already warned that the net effect on “external” shareholders (who do not increase their holdings through granted performance shares) is much less than what management’s recurring statements about how much cash was “returned” to shareholders suggests:

“On a trailing twelve month basis, repurchased approximately 63 million shares of common stock, returning $49 billion to stockholders”

slide 3, PayPal Q2 2023 earnings press release.

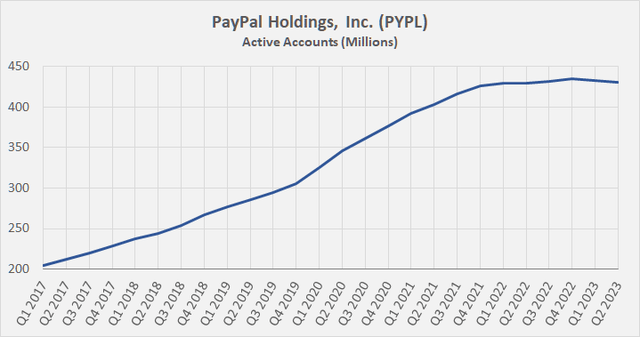

What stood out most – and has been communicated by all major news outlets – was the company’s second consecutive quarter of declines in active accounts. Two consecutive declines of 0.46% each are not overly alarming (Figure 1), but they do not fit the picture of a fintech leader with a strong moat.

Figure 1: PayPal Holdings, Inc. (PYPL): Quarterly active accounts (own work, based on company filings)

In my view, the stagnation since mid-2021 is a sign that PayPal’s moat may not be so wide after all, or may have weakened significantly over the years. While I acknowledge that the company’s business model benefits from tremendous economies of scale, the leverage from lock-in of consumer and merchants is not as pronounced. Personally, I can’t see PayPal’s unique selling proposition.

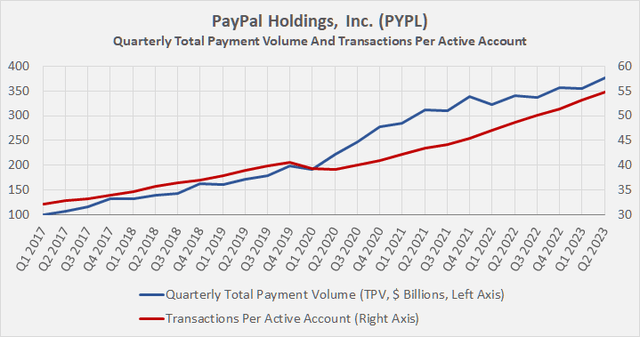

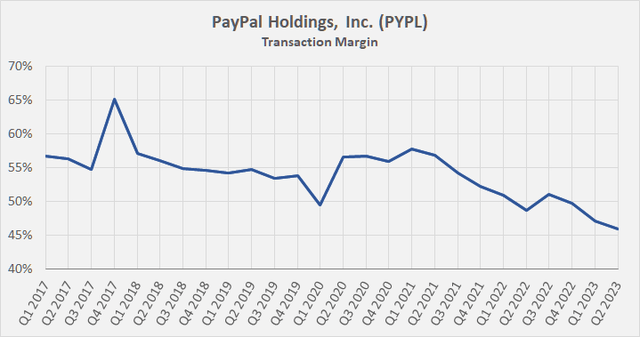

Quarterly total payment volumes increased significantly with sequential growth of 6.2%, while stagnating in the first quarter (Figure 2, blue line). Understandably, transactions per active account also increased, by 3.0% compared to the previous quarter (Figure 2, red line). Although this sounds quite positive, I would not over-interpret the growth in this context, as the company’s transaction margin continues to contract. Since the beginning of the year, PayPal’s transaction margin has declined by a whopping 380 basis points (Figure 3).

Figure 2: PayPal Holdings, Inc. (PYPL): Quarterly total payment volume (blue) and transactions per active account (red) (own work, based on company filings) Figure 3: PayPal Holdings, Inc. (PYPL): Transaction margin (own work, based on company filings)

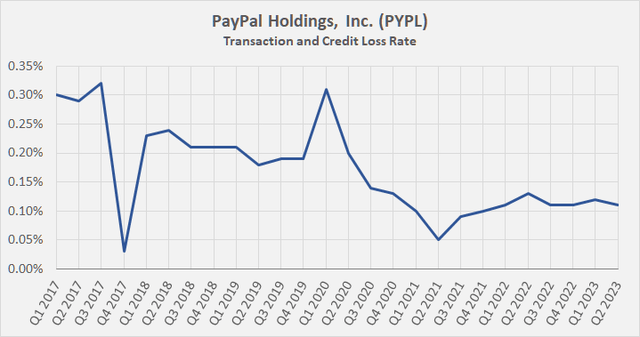

The increase in transactions per active account against the backdrop of a still weakening transaction margin could be a sign of a possibly aggressive discounting policy. If that is the case, I think it is another indicator that PayPal’s moat has weakened and/or the company is feeling growing pressure from competition. However, one could argue that the decline in margin is due to transaction and credit losses, but if you look at the quarterly transaction and credit loss rate, that hypothesis can be dismissed pretty quickly:

Figure 4: PayPal Holdings, Inc. (PYPL): Transaction margin (own work, based on company filings)

Finally, management reiterated operating margin expansion by at least 100 basis points, which is definitely a good sign. However, at the risk of coming off as overly negative here, investors should keep a close eye on the individual expenses that impact operating profitability. Remember that over the past five years, PayPal has reduced its customer support and operations expenses by 200 basis points, while general and administrative expenses have declined by 198 basis points and technology and development expenses have declined by 147 basis points. Of course, these declines (aside from customer support expenses) can theoretically be attributed to scaling effects, but I would still keep a close eye on the sustainability of PayPal’s cost-cutting measures.

Conclusion

PayPal Holdings, Inc. reported year-over-year revenue growth of 7% and adjusted earnings per share growth of 24%. While that sounds like a fintech growth company firing on all cylinders, it’s worth digging a little deeper.

The company’s number of active accounts declined for the second quarter in a row, and while I don’t see two consecutive declines of about 0.5% each as overly worrisome, it’s still a sign that PayPal’s moat could be weakening – or wasn’t so wide after all. Personally, I never understood the company’s unique selling proposition, except in the early days when it was more or less the only major and trusted online payment service provider.

And while the strong increase in total payment volume (+11% year-over-year on a constant currency basis) looks very solid indeed, I would not overinterpret it for two reasons. First, it is probably based on relatively easy comps, as inflation was very much in the headlines in the first half of 2022 and consumer sentiment in Europe and the U.S. has improved in recent months.

Second, total payment volume grew on the back of a higher number of transactions per active account and a much lower transaction margin (-120 basis points in Q2, -260 basis points in Q1). As PayPal’s transaction and credit loss rate remained very stable in Q2 (0.11% vs. 0.12% in Q1), the strong volume growth could indicate potentially aggressive discounting.

For these reasons, management’s rather aggressive non-GAAP adjustments, and the rather inefficient share buybacks in this context, I continue to avoid PayPal Holdings, Inc. stock – even after today’s precipitous drop. A blended blended price-to-earnings ((P/E)) ratio of about 14 certainly sounds cheap, but if you look at the valuation from a GAAP perspective (stock-based compensation is the main adjustment), the stock still trades at 22 times blended earnings. And assuming PayPal can stabilize its adjusted free cash flow at around $3.5 billion in 2023 (it’s been trending down since 2021), the stock trades at a free cash flow yield of just 5% – I don’t think that’s cheap, either, especially considering the company’s current challenges and questionable moat.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.