Summary:

- PayPal Holdings, Inc. Q2 results met expectations, but a sequential decrease in users and operating margins is a negative for investors.

- While PayPal confirmed its FY 2023 guidance, operating fundamentals have deteriorated.

- While shares are still cheap, relative to Block, Inc. and to PayPal’s historical P/E ratio, the risk profile has worsened.

chameleonseye

Shares of PayPal Holdings, Inc. (NASDAQ:PYPL) declined 7% after the FinTech reported results for its second quarter earnings that largely met expectations. While PayPal saw a (temporary) decline in its free cash flow, PayPal reported its second consecutive quarter of declining users as well as a sequential decrease in its operating margin, which is a negative for the investment thesis as well.

I have previously named the company’s strong free cash flow (“FCF”) and potential for operating margin improvements as top reasons to buy PayPal’s shares. Since PayPal failed to achieve operating margin growth in Q2’23 due to increased loan losses, and the number of users dropped again, I am reflecting the deteriorating risk profile in a rating downgrade to hold!

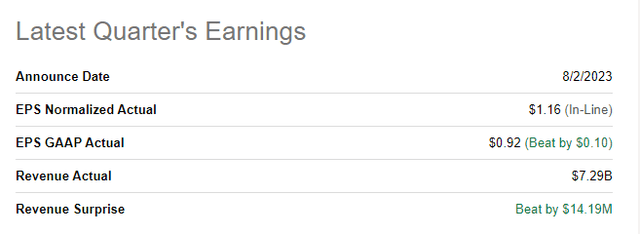

PayPal meets top and bottom line expectations

PayPal reported financial results for its second-quarter that largely fell in line with expectations. The FinTech company reported revenues of $7.29B, beating the consensus expectation by $14.2M. PayPal achieved slightly better-than-expected earnings for the second quarter, with GAAP EPS coming in $0.10 per-share ahead of actual results ($0.92 per share). Adjusted EPS was $1.16, in-line with expectations.

PayPal: reasons to be concerned after Q2

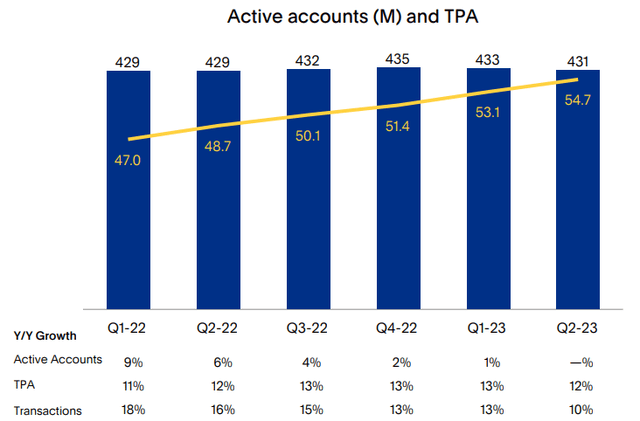

PayPal’s earnings release for Q2 included more negative than positive elements, in my opinion. One such negative event was that the FinTech reported a sequential decline in its user base. PayPal ended the second-quarter with 431M users on its platform, showing a decline of 2M compared to the end of the first-quarter. It was the second consecutive decline in users as well. Although PayPal’s transactions per account kept rising to 54.7, showing 12% year-over-year growth, the decline in users is concerning, as it obviously directly affects PayPal’s revenue and income potential.

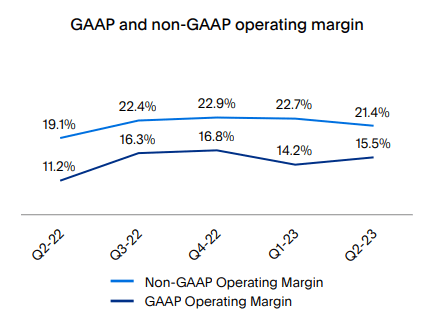

What also dipped for a second time in a row was PayPal’s non-GAAP operating margin, which fell from 22.7% in the first-quarter to 21.4% in the second-quarter. This was probably the biggest disappointment for me in PayPal’s Q2 ’23 report, because the company has guided for operating income improvements and I cited growth in operating income as a reason to buy the FinTech’s shares. PayPal said in its first-quarter earnings report that it expects its non-GAAP operating margin to expand at least 100bps in FY 2023, a guidance that PayPal confirmed in its Q2 ’23 earnings sheet. The decline in margins has been due to higher credit provisions in the merchant lending portfolio, which showed a deteriorating of credit quality in the second quarter.

Source: PayPal

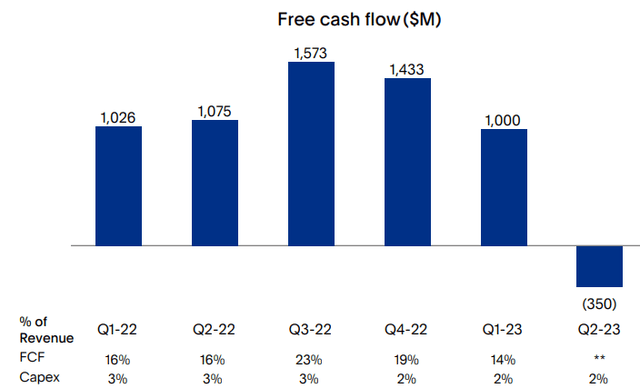

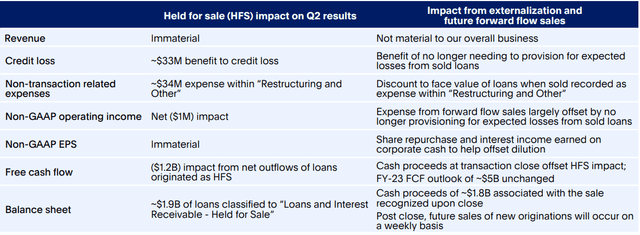

Free cash flow set to rebound

PayPal generated free cash flow of $(350)M in the second-quarter, but not because of a deterioration of operating fundamentals. The Q/Q drop-off in free cash flow relates largely to the classification of some loans as held for sale. PayPal is selling some European buy now, pay later (“BNPL”) loans, and the HFS adjustment has led to a one-time effect on the firm’s free cash flow. Adjusting for the HFS impact, PayPal reported an adjusted free cash flow of $0.9M. PayPal also confirmed its $5.0B free cash flow outlook for FY 2023.

PayPal announced in June that it will sell buy now, pay later receivables to investment company KKR & Co. (KKR). Under the agreement, KKR could purchase up to €40 billion in BNPL loans from PayPal. In connection with this transaction, PayPal increased its guidance for stock buybacks from $4B to $5B, meaning that PayPal is now on track to return 100% of its free cash flow through stock buybacks alone in FY 2023.

As the company pointed out in its earnings presentation, the effect of the HFS classification is expected to be cancelled out once the firm’s closes the loan transaction and receives cash proceeds from KKR.

PayPal’s valuation

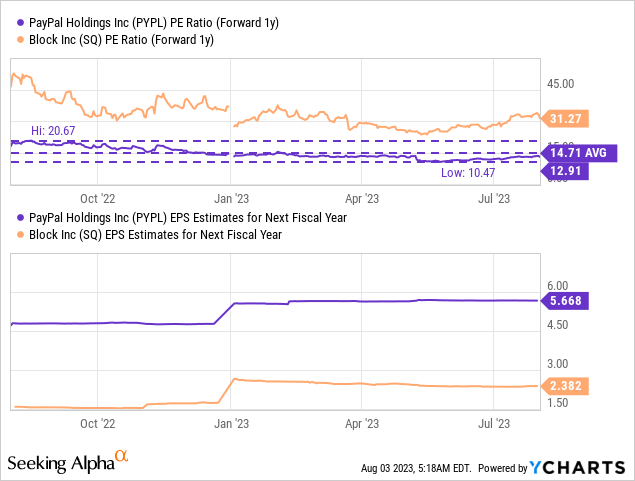

Despite the negatives represented in PayPal’s second-quarter earnings report, the one thing that I still like about the FinTech (and which prevents me from selling) is the firm’s valuation. PayPal is valued at 13X FY 2024 earnings compared to a P/E ratio of 31.3X for Block, Inc. (SQ), a key rival of PayPal in the FinTech space. Besides the cheaper valuation relative to Block and to PayPal’s historical 1-year average P/E ratio of 14.7X, PayPal has over twice, 2.4X, the earnings power of Block.

Risks with PayPal

PayPal’s risk profile has deteriorated after the company presented second quarter earnings in large part because users have departed the platform for the second consecutive quarter, which raises obvious concerns. Another concern I have relates to the firm’s operating income margin trajectory, because I expected a sequential uptick in margins.

Closing thoughts

The second-quarter earnings report was a disaster for PayPal Holdings, Inc., as it reported its second consecutive quarter of user losses and non-GAAP operating margin declines… resulting in a 7% sell-off post-earnings. What was not a negative was the decline in free cash flow — which fell only due to an accounting regulation. PayPal did confirm its FY 2023 free cash flow outlook as well as operating margin outlook, however, risks have definitely increased here. While I still like the company’s free cash flow, buyback potential and valuation, the deterioration of operating fundamentals justifies a downgrade of PayPal Holdings, Inc. to hold!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.