Summary:

- Alphabet’s Q2 2023 financial results showed consolidated revenues of $74.6 billion, a 7% YoY increase, primarily driven by robust Search and Cloud services.

- The company’s focus on AI was evident with various advancements, including the SGE and AI-driven advertising.

- Google Cloud demonstrated significant growth, with revenue reaching $8 billion, a 28% increase YoY, and it remains a leading platform for training and serving generative AI models, attracting top players.

- YouTube Shorts is gaining momentum, and the platform’s expansion into Connected TV has increased ROI for advertisers.

da-kuk/E+ via Getty Images

Investment Thesis

With its achievements in artificial intelligence (AI), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) has continued to lead the earnings season. The company experienced strong revenue growth in the second quarter, driven by its Search and Cloud offerings.

With its relentless focus on AI development, strategic expansion, and responsible practices, Alphabet remains at the forefront of innovation, solidifying its position as a global tech powerhouse, poised to shape the future of technology and deliver outstanding value to users, advertisers, and investors alike.

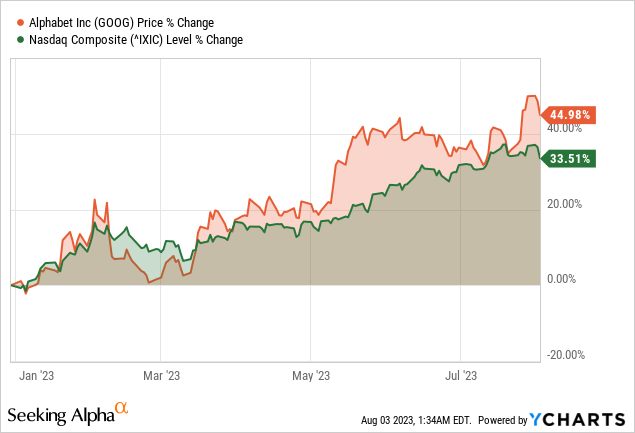

Climbing To New Heights

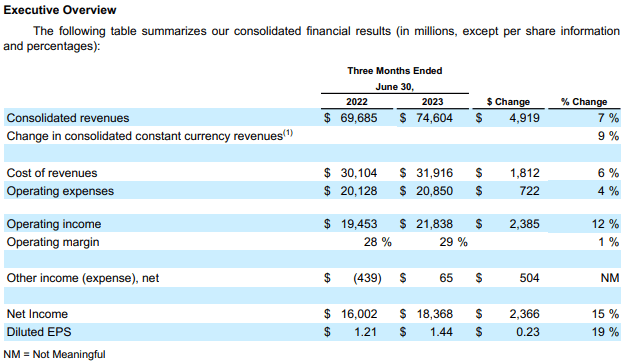

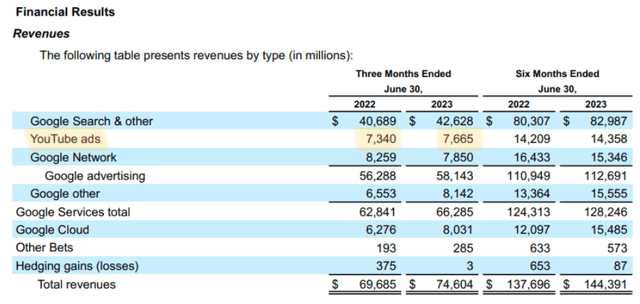

In Q2 2023, Alphabet reported consolidated revenues of $74.6 billion, a 7% year-over-year increase. The company’s robust Search and Cloud services drove the growth, with an operating income of $21.8 billion and a solid operating margin. Alphabet’s free cash flow of $21.8 billion in Q2 and $71 billion over the trailing 12 months were partly attributed to deferred tax payments. Google Services experienced a 5% growth, with Google Search and advertising revenues reaching $66.3 billion.

Similarly, YouTube advertising revenues saw a 4% increase, while network advertising revenues declined. Google Cloud segment revenues reached $8 billion, with Google Workspace’s success driven by the seat and average revenue per seat growth. Lastly, Alphabet’s focus on growth in Search and Cloud services positions the company favorably, with a $118 billion cash and marketable securities reserve.

GOOG 10-Q Q2 2023

Unleashing The Power Of AI: Alphabet’s Remarkable Progress In Q2

Alphabet showcased significant progress this quarter, driven by various events such as I/O, Brandcast, and Google Marketing Live. The company is eagerly looking forward to Cloud Next in August. The positive momentum is evident in strong Search, YouTube, and Cloud performances focusing on long-term value creation. Additionally, Alphabet actively strives to enhance operational efficiency to fund investments in key priorities.

One of their notable achievements is their leadership in AI. Alphabet has been an AI-first company for seven years and continues to make AI accessible and helpful to everyone. Advancements in large language models, like PaLM 2 and Gemini, enable the incorporation of AI into various products, including the iconic Search. During this quarter, the company unveiled the Search Generative Experience (SGE), which utilizes generative AI to make Search more natural and intuitive. Early user feedback has been highly positive, as SGE improves the current search experience and enables the discovery of entirely new types of queries.

Interestingly, The use of generative AI also extends to advertising, allowing Alphabet to serve ads relevant to users’ commercial queries more effectively. Advertisers gain better opportunities to reach their target audiences by testing and refining placements and formats.

Another area where AI is being leveraged is to boost user creativity and productivity. Bard, an experiment in conversational AI, has been evolving and expanding its capabilities since its launch. Google Lens integration with Bard has been well received, allowing users to turn images into code and perform various tasks. Additionally, Duet AI in Google Cloud and Workspace enhances collaboration with AI, offering coding, writing, data analysis, and more benefits.

Similarly, Alphabet also focuses on enabling others to innovate with AI by providing high-performance infrastructure through Google Cloud for a range of generative AI models. Thousands of customers and partners are utilizing this infrastructure to transform their businesses.

Finally, responsibility for developing and deploying AI technology is crucial for Alphabet. The company has committed to responsible practices and signed joint agreements with other leading AI companies at the White House. They are sharpening their focus, investing responsibly, and finding cost-effective areas of operation, especially in data center machine efficiency. The company has made progress in slowing expense growth and hiring pace while reallocating teams to align with higher-priority efforts.

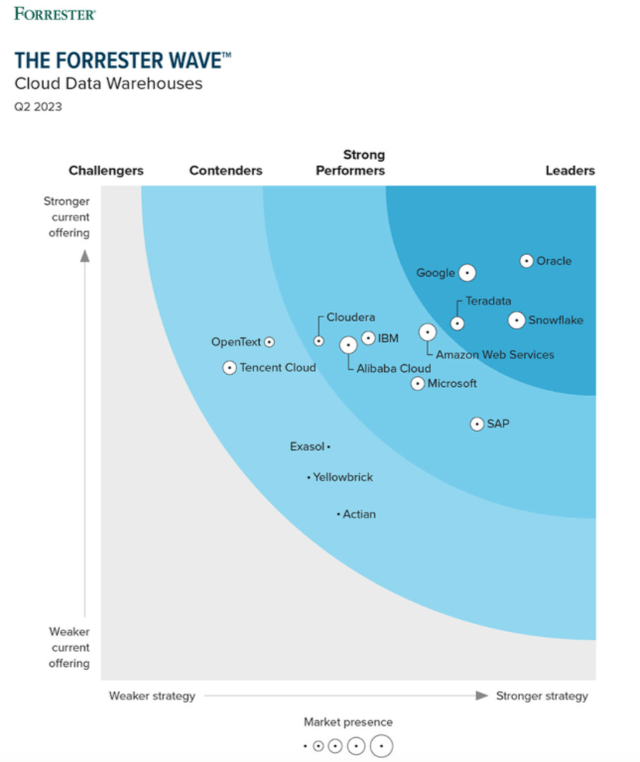

Google Cloud: Pioneering AI-Optimized Infrastructure

Google Cloud has a progressive future with strong revenue and customer base growth. In Q2, the company achieved impressive results, with revenue reaching $8 billion, a 28% increase compared to the previous period. Operating profit also saw a notable rise, reaching $395 million.

One of Google Cloud’s key strengths lies in its AI-optimized infrastructure, which has positioned the company as a leading platform for training and serving generative AI models. More than 70% of next-gen AI unicorns are Google Cloud customers, including prominent companies like Cohere, Jasper, and Typeface, demonstrating the company’s appeal to top players in the AI industry.

teradata.com

Further, the company’s offering of a wide range of AI supercomputers is another competitive advantage. By providing customers with options such as Google TPUs and advanced NVIDIA GPUs and recently introducing the A3 AI supercomputers powered by NVIDIA’s H100, Google Cloud delivers exceptional price performance, as demonstrated by AppLovin’s nearly 2-times better price performance compared to industry alternatives.

Moreover, Google Cloud’s new generative AI offerings have expanded its total addressable market and attracted new customers. The demand for more than 80 models, including third-party and popular open-source models, in the Vertex, Search, and Conversational AI platforms has grown significantly, with some customers experiencing more than 15 times the growth from April to June. Notable examples include Priceline, Carrefour, and Capgemini, each utilizing generative AI to improve various aspects of their businesses.

Also the company’s AI capabilities also play a crucial role in driving customer adoption of its core products. By integrating AI throughout its portfolio, Google Cloud has attracted customers like Pfizer, who have turned to the platform to transform their security operations. The integration of AI with Chronicle Security’s operations suite with Mandiant has led to a 35% increase in incident response engagements in the first half of 2023 compared to the same period in the previous year.

Finally, Google Cloud’s AI capabilities have expanded its partner ecosystem, with hundreds of ISVs and SaaS providers, including Box, Salesforce, and Snorkel, and major consulting firms like Accenture and Deloitte. These partners have collectively committed to training over 150,000 people on Google Cloud generative AI, further solidifying the company’s position in the market.

YouTube’s Success Story

Alphabet has been experiencing significant growth in its YouTube division. For the 12 months ending in March, YouTube’s revenues reached almost $40 billion, demonstrating a robust financial performance. The platform has successfully attracted audiences and increased user engagement, with YouTube Shorts now being watched by over two billion logged-in users monthly, up from 1.5 billion a year ago.

Notably, the ‘living room’ has been the fastest-growing screen in terms of watch time, and the platform is reaching more than 150 million people on connected TV screens in the U.S., showing momentum in international growth as well. Further, YouTube’s subscription offerings have also shown strong growth, with over 80 million YouTube Music and Premium subscribers announced last year. The company is trying to enhance its multi-format strategy further to drive long-term growth, focusing on enabling creators to thrive on the platform and expanding monetization opportunities.

GOOG 10-Q Q2 2023

Two focus areas for YouTube’s growth are Shorts and Connected TV (CTV). Shorts, a short-form video format, has seen positive momentum in watch time and monetization. YouTube has introduced ads on Shorts to support direct response campaigns and is testing brand advertisers’ engagement and awareness campaigns, which have shown promising results.

On the other hand, the Connected TV space has seen substantial engagement from viewers, leading to increased ROI for advertisers. YouTube has introduced new ad offerings for streaming, including 30-second unskippable ads on YouTube Select, targeting the TV screen, and exploring new pause experiences for brands to capitalize on viewers’ moments of pause.

Consequently, YouTube’s overall performance has been impressive, as measurement partners such as Nielsen, TransUnion, and Ipsos MMA indicate that YouTube delivers a higher ROI than TV and other online video platforms on average. The success story of The Hershey Company exemplifies this, as YouTube’s advanced audience capabilities and AI-powered formats have significantly increased ROI from 2018 to 2023.

Lastly, Alphabet has expanded its partnership with Warner Bros. Discovery, Inc. (WBD) across the Android ecosystem, focusing on Google TV and new surfaces. The deal also includes a bundle for Max NFL Sunday Ticket on YouTube TV, highlighting the company’s commitment to providing high-quality content and experiences to its customers.

Revolutionizing User Experience & Retail Success

Alphabet’s Pixel devices, including the new Pixel Fold, Pixel Tablet, and Pixel 7A, have gained strong sales momentum. This indicates positive consumer reception and the potential for further growth in the hardware segment. Integrating generative AI in Android 14 to personalize Android phones could enhance the user experience, potentially driving higher device adoption and engagement.

Additionally, Alphabet’s emphasis on Google AI in its advertising products is evident, with nearly 80% of advertisers already utilizing AI-powered search ads. The introduction of AI-based keyword prioritization, asset creation flow, and conversational experiences in Google Ads aims to assist advertisers in setting up campaigns faster and creating high-quality ads that resonate with users. Utilizing generative AI to create relevant assets for customer queries demonstrates a commitment to enhancing ad relevance and performance.

Notably, retail remains a key focus area for Alphabet, with profitability and efficient growth priorities. As demonstrated by Ace Hardware’s significant revenue growth, solutions like Performance Max (PMax) have contributed to retailers’ bottom-line value. The introduction of AI-powered virtual try-on tools and the product studio aims to enhance the online shopping experience, potentially driving higher impressions and clicks for products with engaging visual content.

Likewise, the growth of businesses using the Merchant Center has doubled in the past two years, indicating its importance for merchants. The simplification of Merchant Center through automation and consolidated performance insights is expected to facilitate business growth further and improve user experiences.

Pixel Fold

Technical Insights: Key Entry Points

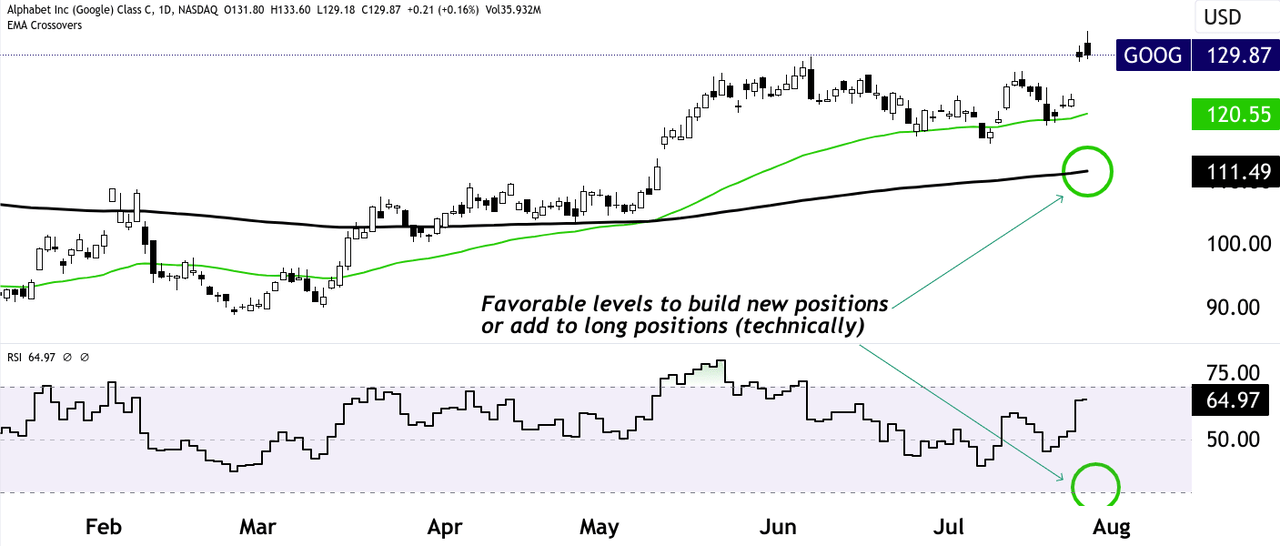

Looking at Alphabet’s price chart, it is evident that the stock is trading at the highs of 2023. Thus, investors who are looking to build a position in the stock can consider the 200-day Exponential Moving Average (EMA) (black line) as the key level to enter a long position. Technically, the Relative Strength Index (RSI) can be observed with a 200-day EMA to solidify the confidence. A trade entered when the RSI is below or near 30 may serve as an ideal entry point, given the current bullish momentum of Alphabet’s market valuation.

tradingview.com

Takeaway

In conclusion, Alphabet’s Q2 2023 results showcase impressive revenue growth, driven by Search, Cloud services, and YouTube’s expansion. The company’s AI advancements, such as generative AI models and AI-powered ads, have contributed to its positive momentum. Google Cloud’s AI-optimized infrastructure attracts top AI companies, while YouTube Shorts and Connected TV drive further expansion.

The hardware segment, including Pixel devices, gains strong sales momentum. Alphabet’s focus on AI and innovation signifies its forward-looking approach that ensures continued growth and value creation for shareholders. Overall, the Q2 2023 earnings solidify the bullish stance on Alphabet’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.