Summary:

- PayPal’s valuation is not justified by its fundamentals, with declining margins and slower growth compared to peers.

- The company is facing increasing competition in the payment processing sector, limiting its potential for growth.

- Insider trends and margin deterioration are additional concerns for the company’s future performance, but the core argument is in valuation.

chameleonseye

Dear readers/followers,

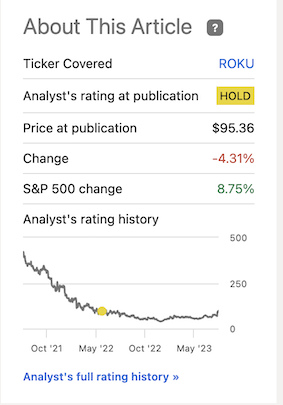

I don’t often write about stocks like this – companies that don’t pay a dividend or companies in the so-called “growth” sectors, as some would argue that PayPal (NASDAQ:PYPL) still is. When I do, my articles are usually of only very limited value to the typical investors in the company. I’m not the typical investor in this business, so I accept this. I would like to point out that the perspective of a valuation investor is not worthless in investments like these, even when they are perceived as “cheap”. So was the case for Roku (ROKU) for instance (Source). Despite having shot back up, my rating in my only Roku article is still relevant – the company remains a market underperformer.

Roku Article RoR (Seeking Alpha)

I don’t have anything, particularly against investing in Growth stocks. In fact, if you’d bought at the price that I considered trough, you’d have made significant RoR. I also have bought companies that do not pay a dividend, most notably Wise (Source), and have seen substantial success with applying traditional valuation methods to these stocks.

Wise Article RoR (Seeking Alpha)

I’m less about disliking a sector, and more about picking the diamonds out of the rough when they are easy and possible to find (i.e being cheap enough.)

It’s what I want you to have in mind when I take a look at Paypal, and consider the stock to not be all that attractive – at all.

PayPal and its appeal

Facilitating payments is a very interesting business. I’m a shareholder of Wise, and looking at investing in Adyen (OTCPK:ADYEY) at the right price so I’m in far from a stranger from this segment.

However, in this article, I’m taking what is going to be a contrarian view here, given the entire slew of positive and bullish articles on the company. My stance also is not exclusively based on recent earnings. Those are only a footnote to me.

I look at the fundamental appeal of a business for the long term at a certain price.

PayPal does two-sided payment processing as a business, primarily. This involves integrating with Merchants, who use and manage their business, while consumers use PayPal for both its financial products and its services and shopping tools.

These tools come in a variety of forms.

- Checkouts, like PayPal payments, Venmo, Pay Later, Paidy, and other solutions.

- Processing Solutions, like PayPal/PayPal Braintree

- Digital wallets both for standard and cryptocurrency, include functions and features like loyalty, deals, and rewards.

- Merchant services, such as risk management, fraud protection, payouts, PayPal Zettle, and other services.

The whole of these services works over 20B global transactions that connect hundreds of millions of so-called active accounts. The Paypal definition of an active account is “an account registered directly with PayPal or a platform access partner that has completed a transaction on our Payments Platform or through our Honey Platform, not including gateway-exclusive transactions, within the past 12 months.” (Source: PayPal 10-Q)

By this definition, I have an active account with PayPal despite not having logged into the thing for over 1.5 years.

The perhaps biggest challenge with PayPal is when I read articles and look at ways the company is valued, that much of the valuation logic and method seems legacy-based.

This is an understandable way to go because PayPal’s legacy facts are very attractive. Back when it IPO’ed, it had a more or less exclusive agreement with eBay (EBAY), which was the origin of its payment business. But eBay severed all ties with PayPal and now uses a competitor, Adyen, for their payment processing. In fact, you could no longer use PayPal on eBay for some time – though it’s back now.

While the company primarily operates as a payment processor, it recognized the necessity of moving into things like Venmo, which is peer-to-peer payments, as well as into more traditional payment processing including digital cards.

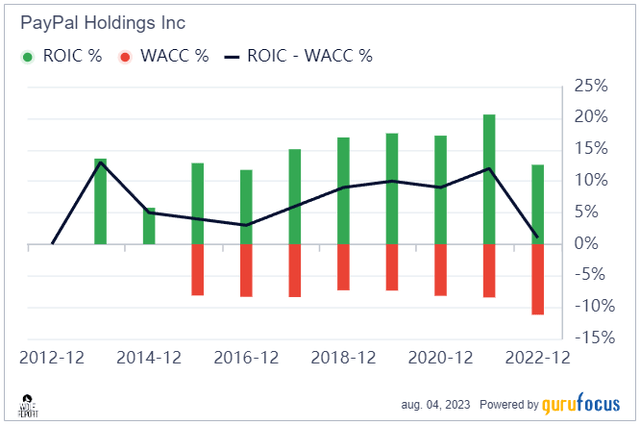

PayPal, on the whole of it, and from a fundamental perspective, looks good. Or, at least, it looks “okay”. It once looked excellent from a profitability perspective, but it no longer does. Not if you look at peers. If you take a look at the company’s profit margins, these are significantly below peers like Visa (V), and Mastercard (MA) where these two score gross of almost 80%, operating margins of above 67%, and net margins of 51% and above (Source: Gurufocus, Visa Margins FY2022). While it’s a tall order to compare PayPal to these, they do operate in the same segment, and PayPal manages not even a fifth of these margins on a net income basis as things stand. Compared to other payment processors like Adyen, we see significantly higher return metrics, where Adyen actually manages to beat PayPal handily in investment capital return metrics, ROIC based on its WACC. While PayPal is profitable, it’s nowhere near the profitability of some of these other peers. And obviously, the company’s WACC has been increasing – as almost all the company’s average cost of capital has been over the past 24 months.

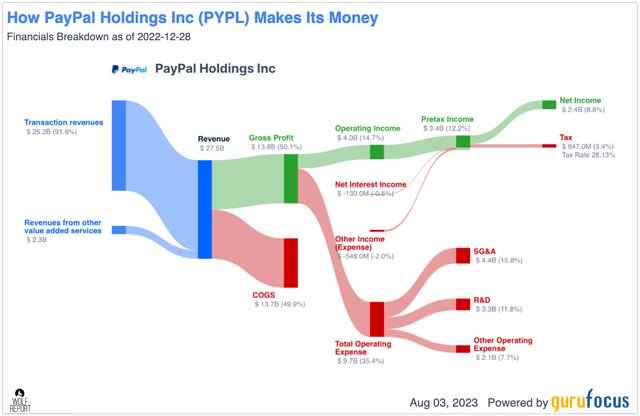

This is a high-level view of how the company makes money, specifically 2022A results.

Paypal revenue/net (GuruFocus)

Nothing about that stands out to me as particularly negative or problematic. This is also key to understanding the bullish portion of the fundamental thesis. That is, that the valuation decline is not justified by the company’s fundamentals.

To some extent, this is true. The company is obviously a business that makes money and has a working business model, this being the first requirement for any company that I end up investing money in. PayPal has this, so this is a positive.

I also consider it very unlikely that PayPal, in a swift manner, will move to not being profitable. That’s a long road. The company, despite not being as ubiquitous as they once were, is still one of the largest names, and many consider it a “must” to have a PayPal button to use for payments.

In fact, I would summarize the current negative fundamental trends as being mainly declining margins. Specifically, declining gross and operating margins that have pushed the company into the lower 55-57th percentile on a peer basis (Source: GuruFocus). The company’s other trends are also worsening – I’m talking debt, I’m talking interest coverage, but these remain at such peer-comparative high levels that I don’t consider this necessarily relevant for the larger thesis I’m presenting here.

The main bullish argument seems to be valuation. I’ll get into that later in this article – but I want to stay in Fundamental-town for a while longer.

PayPal did not have good results for 2Q – at least according to the market. While the company did consensus earnings for the quarter, the underlying trends provided the worrying color that bears were looking for. Because the total number of active accounts totaled 431M for June 30th, this marks the second consecutive quarter of decline. The increase in active transactions on a per-account basis was apparently no salve for this.

The bearish case that’s to be made for PayPal is more based in fundamentals – so it’ll have more space in my article here.

The problem with PayPal which I can “confirm” seeing is competition and macro. Payment processing is an ever-changing sector, and I view it as categorically wrong to characterize PayPal as a “growth stock.” PayPal is expected to grow low double digits in terms of adjusted EPS. There is no scenario that I view as realistic where growth-stock type numbers of over 20% EPS increase on an annual basis are possible.

The company’s business is being assailed by multiple entrants and mature companies. We have peers like Stripe, Affirm, and Adyen, many of which have (as I’ve talked to companies), far superior technological solutions to PayPal. PayPal also has an “international” problem. It’s big in the US and in some areas – but not as big in Europe. Same as with other companies, this severely limits the markets that PayPal can grow to.

These trends are affirmed in my view. The company’s payment processing volumes have been growing, in the company’s own results, far less than the growth seen in peers, including Visa and MasterCard. Even extreme legacy processors like Global Payments (GPN) have superior growth rates to PayPal.

This has turned PayPal from a growth stock into a company trying to retain its market.

How does it try to do this?

Buy back shares and cutting costs.

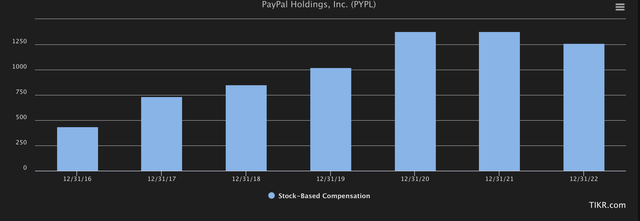

Buying back shares is obviously a working way to maintain margins and EPS growth, in an environment where SBC is climbing. How much is SBC now?

Not as high as in ZIRP, obviously, but that’s no longer where we are either. This is part of the reason why PayPal has to buy back shares, to offset this dilution. The real EPS impact for 2022 alone was over $0.9/share, sending EPS adjusted for SBC down to below $3.3/share for the year. For 2023, I fully expect the EPS post-SBC to climb either close to $4/share or below it.

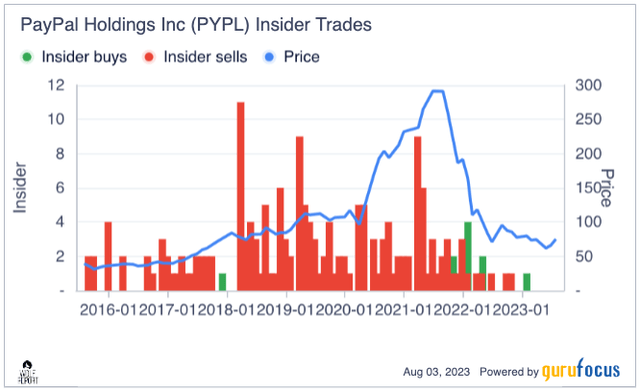

How are insider trends?

Paypal Insider trends (GuruFocus)

Not good, dear readers. Insider trends are not good. I’ll be the first one to say that Insider trends do not make a case for either “BUY” or “SELL” – they can reinforce an existing notion slightly. In this case, I believe it seems clear that even insiders generally do not want to hold onto PayPal shares.

I always have trouble owning a business that insiders do not want to own. The fact that the CEO has sold over 250,000 shares since 2020 does not make this any less negative. There’s also the fact that the CEO is leaving his post.

The bearish view, aside from these small tidbits about SBC and earnings, seems based on further margin deterioration. This year’s operating margins are expected to come in at around 22-23% (Source: S&P Global). Beyond that, they’re expected to drop to 22% in 2025E. And margin deterioration isn’t the only thing – the fact is that peers are growing faster than PayPal. Why should you pay for a company that grows its merchant payment business at single-digit rates when you can pay far less for a company that’s growing it at 14-16%? Adyen’s growth estimate for 2023E is 20%. 35-36% for the years beyond that. That is a growth stock.

Even the current estimates do not call for anything beyond 12-15% EPS growth in 2024-2025, and that’s pre-SBC.

That’s more or less the basic sentiment that the rare PayPal bear seems to be having – and PayPal bears seem rare. As evidenced by the coverage rating balance here on SA, most analysts seem to have a positive view of the stock. I may be shouting into the wind here – that’s fine with me. It’s something I’m used to and actually very comfortable with, given my inclination to being a contrarian investor.

It works for me, even if I at times miss out on great opportunities.

Is PayPal one such great opportunity?

Let’s look at the valuation specifics.

PayPal’s Valuation – not an easy play.

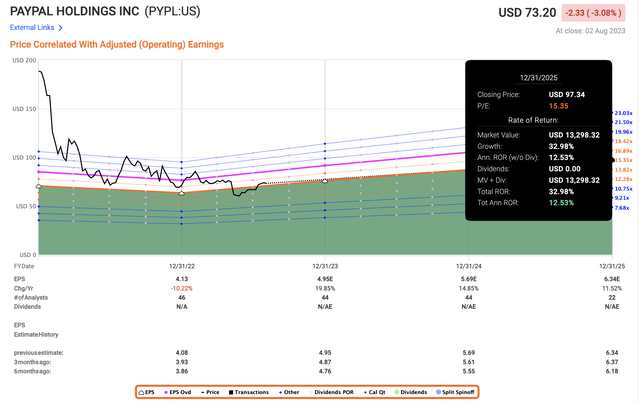

Assuming a relatively stable earnings development in accordance with the forecasted upside and growth, this company based on a 15x P/E valuation, has a double-digit upside.

F.A.S.T graphs Paypal Upside (F.A.S.T graphs)

So, because it has a double-digit upside, it must be a “BUY” for me, right?

No. My preference is for a conservatively adjusted 15%+ annualized or above, inclusive of dividends. And I do like my dividends, which PayPal does not offer me.

You could, of course, estimate the company as being worth more than 15x, and I wouldn’t be able to call you completely wrong on that. I acknowledge that the circumstances for a company’s outperformance on the part of PayPal do exist here.

However, I do not see that the current results and forecast or peer averages justify it.

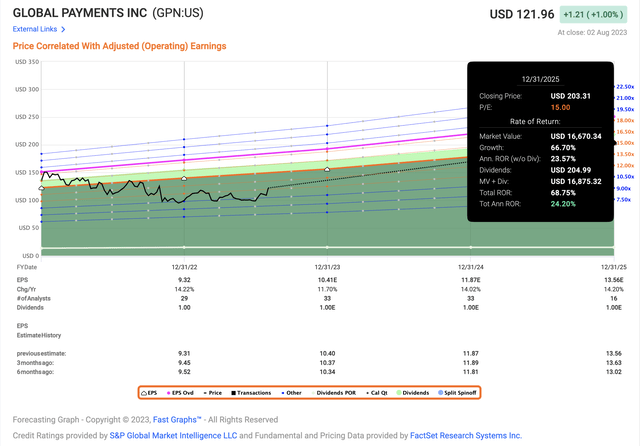

Peers to the company – and I’ll keep mentioning Adyen and GPN here – are forecasting, and reporting substantially higher growth rates and results. This is not an article on GPN, but let me show you what GPL is forecasting and likely to return at an overall multiple of 15x.

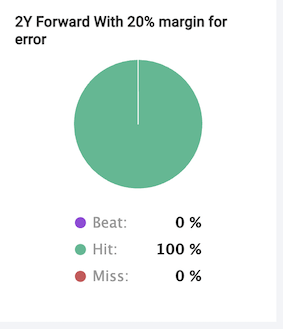

I own GPN. I do not own PYPL. What you see above, aside from the 0.8% yield, is the core reason for this. Forecast accuracy for Paypal, even on the wider 2-year basis comes at a miss ratio of over 35% even with a 20% margin of error.

Would you like to see how likely GPN’s results, based on statistics historically, are to materialize?

GPN forecast accuracy (F.A.S.T graphs/FactSet)

I believe PayPal bulls are committing several fallacies related to cognitive biases. And I want to state here, that I actually get paid for advising on investments for individuals who entrust me in decision-making processes when it comes to their money management. This includes Hot hand fallacies, Gambler’s fallacies, Loss aversion (in the case of long-term investors), Over analysis, and confirmation bias, to name a few.

PayPal was once the premiere choice when it came to payment processing because other competitors doing what this company did were few. That is no longer the case.

The company once commanded a very hefty premium due to what was viewed as impressive growth rates. By hefty premium, I refer to the fact that the company once demanded 56x+ P/E if you wanted shares. But in fact, when you look at earnings growth for the past 9 years, the company has commanded a 17.37% EPS growth rate on average. While that puts the company into the category of “high growth”, I view it wrong equating it with a “growth type” stock.

Wise PLC grew its Earnings by 244% for the 2023 fiscal. They’re slated to grow them by 92% in 2024E. That’s a growth stock in my book. Many investments that I typically cover which have nothing to do with growth-type stock investing have annual EPS growth rates of over 15% but under 20%, like PayPal. Sika AG (OTCPK:SXYAY) on a 5-8 year basis has grown about 16%. And that’s a cyclical specialty chemical company with a 2% yield.

15-19% EPS growth does not make PayPal any sort of special, super-undervalued “growth company”. It’s one in a long line of decently growing businesses, but as we’ve already established, it’s growing far less than its competition.

I’m not seeking to discourage you from PayPal investing if that’s what you believe is best for you. I’m seeking to raise a finger in caution and cause you to perhaps consider what it is exactly that you’re buying. Because as I see it, you’re buying a below-average growing payment processor with a margin, SBC, and management problem.

I won’t hang my hat or focus too long on scandals, such as where PayPal initially told users they would be fined $2,500 if they did something that PayPal essentially disagreed with (Source), or the fact that it’s already admitted over 4,5M accounts were essentially illegitimate/fraudulent (Source), or the fact that customers having service trouble seems relatively common based on anecdotal evidence in talking to customers.

I don’t put much stock on that or devalue the company for this because first, all companies of this size have bad apples or bad elements, and second I’ve used PayPal (when I used it) for over 6 years and I never had any issue with it. Personal experience matters to me – and I actually did have contact with customer support, and despite it not being natively English, my experience was a positive one.

But it’s worth mentioning that PayPal is a company that’s been in hot water before.

S&P Global analysts that follow the company give it a range starting at $60/share and going all the way up to $200/share, with an average of $95/share, which implies a 30.3% upside here. My target of $55/share is therefore significantly lower than even the lowest official analyst target – and that is from 41 analysts, 33 of which are at “BUY” or an equivalent outperform.

If I end up being right, as I’ve shown you initially in the article, it wouldn’t be the first time where a price target I’ve set at seemingly impossible lows materializes as true. Doubt me?

Check out my coverage of Netherlands Prosus N.V (OTCPK:PROSY), and you’ll find how profits there, based on extremely conservative analysis would be possible if you followed my targets.

I want to be clear in saying that I do think I can be wrong in the short and medium term. The company may rise on sentiment alone. But I do not view the company as being worth what it is currently being traded at.

Based on the information coming out of the reports, I would be interested in buying PYPL below $60/share, and in fact, I would be cautious and probably go for a cheap GPN even then. The upside is better, the company is far safer, and I’ll make more returns if my conservative thesis materializes.

Questions?

Let me know!

Thesis

- Paypal is not an undervalued growth stock. I believe it’s close to fairly-valued payment processing stock. I view the bullish side of the argumentation as somewhat hollow, based too much on the historical and legacy positives of a company that we need to recognize as being very mature and facing increasing competition in a very tricky overall market.

- While I won’t call Paypal massively overvalued here, I also, based on the risks that I see, won’t call it “cheap” here, despite A-credit a low debt and what are undeniably attractive qualities.

- I believe the warning signs of a company in deterioration are there. Rising SBC, rising costs, C-suite volatility, margin compression, growth rate problems, and increasing competition, all spells “problems” for me. In a market where we can get 5% risk-free, this is not an investment that I view as favorable making from a Risk/reward ratio.

- I may be interested at a trough of $55/share, representing close to a 10-12.5x normalized P/E depending on where you look at it. But for now, I view peers like Adyen or Globa Payments as superior players and investments.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Paypal is a “HOLD” to me – and i wouldn’t buy it here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GPN, ADYEY, WIZEY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.