Summary:

- PayPal Holdings, Inc.’s stock experienced a sharp decline after its Q2 earnings report, presenting a potential opportunity for long-term investors.

- The company’s revenue has remained consistent and is currently trading at just 2.4 times its trailing twelve months’ revenue.

- Despite the market’s reaction, PayPal’s Q2 results were not a disaster, with revenue surpassing expectations and total payment volume reaching a new high.

- PayPal stock remains attractive for those who can withstand medium-term pain.

JasonDoiy

PayPal Holdings, Inc. (NASDAQ:PYPL) stock was just beginning to break out of its nearly two-year slump before the company’s recent Q2 report sent the stock sharply lower. In my last review of PayPal, I rated the stock a “Buy” citing extreme undervaluation on both fundamental and technical sides. Since then, the stock went up more than 15% compared to the market’s 9%, before cratering 12% post-earnings.

Does that present an opportunity for long-term investors once again? I believe so and present a few reasons to back up my claim. Let us get into the details.

Still As Cheap As Never

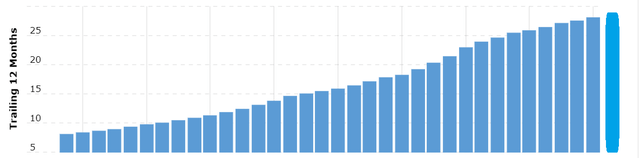

In my previous PayPal review, I brought up the fact that despite the stock’s monumental struggles in the last 2 years, the company’s ability to sell has largely remained unaffected and even grew a little when looking at revenue over any trailing twelve months [TTM] period. With the $7.29 billion reported in Q2, this streak is still intact, as the new TTM revenue of $28.55 billion tops the $28.07 billion in the previous rolling TTM period.

PYPL TTM Revenue (Macrotrends.net)

This reeks of consistency and also means that the company is right now trading at just 2.4 times trailing twelve months’ revenue. Although the companies are drastically different in their importance to the World at large, Apple, Inc. (AAPL) is trading at nearly 8 times 2022’s revenue. The mega-cap tech stock that I believe is the most underappreciated right now, Alphabet, Inc. (GOOG) is trading at nearly 6 times 2022 revenue. You get the picture.

Q2 Wasn’t A Disaster

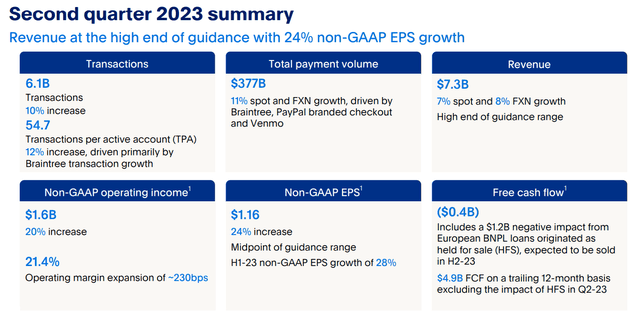

Looking at the market’s reaction, you would think PayPal had a disaster of a quarter, but that is far from the truth.

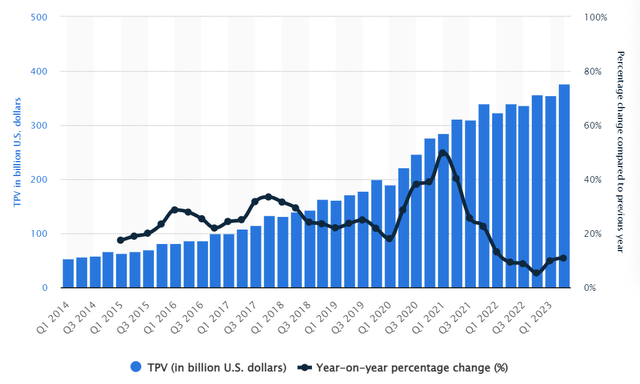

- Revenue still topped consensus of $7.27 billion by 0.30%, backed by total payment volume [TPV] of $377 billion.

- And just like the revenue being on a perennial upward trajectory, PayPal’s TPV is on an overall long-term uptrend as well as $377 billion is the highest as shown in the chart below.

- PayPal also reaffirmed FY 2023’s EPS guidance at $4.95/share, which gives the stock a forward multiple of just about 13. If longer-term estimates hold true, the stock is a trading at a very attractive Price-Earnings/Growth [PEG] of 0.75.

- Venmo was called out in the company’s earnings release a few times, including a TPV increase of 8%. The company is actively rolling out additional products and features targeting teens (safely) and merchants with contactless options.

- This is not directly related to Q2 results, but recently, the PayPal CEO got on the AI bandwagon by touting that one of his divisions is already more productive by 30% due to AI’s impact. As the company struggles on margin, any further operational efficiency will only help improve the bottom line.

PYPL Q2 2023 (investor.pypl.com) PYPL TPV (statista.com)

The Buyback Impact

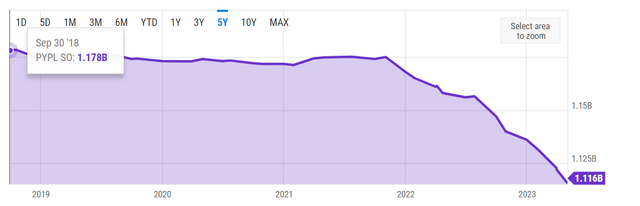

The company announced a while ago and also reaffirmed in its earnings release that it plans to spend about $5 billion in FY 2023 towards share buyback. Although we are halfway through the FY with this report, for ease of calculation, let us assume the full buyback amount is in the kitty. And for the record, I fully expect PayPal to announce further buybacks after the current authorization ends. The company has been under activist pressure in the past to utilize the pullback in price by retiring shares.

- Current EPS Guidance: $4.95/share

- Total shares outstanding: 1.116 billion

- Authorized buyback balance: $5 billion

- Although the stock appears to remain on a long-term downtrend, let’s assume the average buyback price to be $80, which is the midpoint of the current 52-week range between $58 and $103.

- Total number of shares that can be retired spending $5 billion at $80: 62.50 million

- New EPS post the buyback scenario above: $5.23, a near 6% jump.

PYPL Shares Outstanding (YCharts.com)

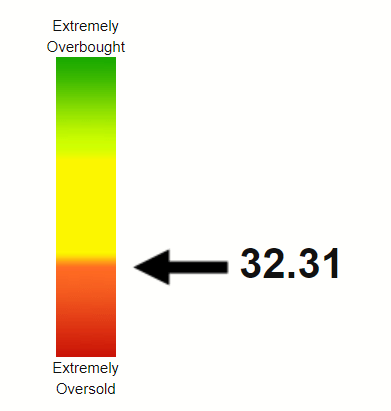

Technically Oversold

PayPal stock’s Relative Strength Index (“RSI”) is now in the extremely oversold region, as shown below. With the market appearing shaky over the last few days and general long-term weakness of FinTech stocks, I expect PayPal’s stock to be under pressure over the next few weeks, making the case for a relief rally at the slightest hint of fundamental recovery.

PYPL RSI (stockrsi.com)

Conclusion

My bullish stance on PayPal stock here is not to say there are no issues with the company. At the macro level, FinTech in general is down in the dumps, and with many big players like Apple and Alphabet offering payment services in some shape or form, competition is aplenty. PayPal specifically has a lot of issues to overcome as well including operating margin pressure, fall in active accounts, and deteriorating loan segment.

However, the fact that it has one of the most trusted two-sided network (in its own words and in reality, too) should mean something in the longer term despite short-to-medium term headwinds. I fully expect PayPal to have a Meta Platforms, Inc. (META) type of resurgence at some point, where the market wakes up to the combination of stock undervaluation and company’s stickiness.

I remain long PayPal stock and I am seriously evaluating adding more shares in the $60s.

PYPL Brand (investor.pypl.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOG, META, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.