Summary:

- We remain sell-rated on Intel Corporation; we think cloud customers’ wallet-share shift to A.I. acceleration rather than compute will present significant challenges to its data center business in 2024.

- We now believe the stock has priced in PC Client recovery, moderating share loss to AMD.

- We believe the current macro uncertainty will continue to weigh on consumer and enterprise spend.

- While we believe INTC can become a competitive foundry in the advanced process, material revenues may take longer to realize as the foundry industry remains in over-capacity mode.

- We recommend investors explore exit points as we believe the risk-reward profile for the stock has now become less favorable.

David Silverman

We maintain our sell rating on Intel Corporation (NASDAQ:INTC). The company just announced Q2 2023 earning results; we believe the stock has captured and factored in the PC Client recovery, moderating share loss to Advanced Micro Devices, Inc. (AMD) in PC and Server markets and investor confidence in the on-track execution of its process roadmap of 5 nodes in 4 years. Our sell rating is based on our belief that the company’s 2024 data center business will be meaningfully challenged as cloud customers’ wallet share favors A.I. acceleration over compute.

Additionally, while we believe INTC can become a competitive foundry in the advanced process, we think material revenues may take longer to realize as the foundry industry remains in over-capacity mode. We recommend investors explore exit points out of the stock at current levels, as we see a less favorable risk-reward profile for INTC over the next nine to twelve months.

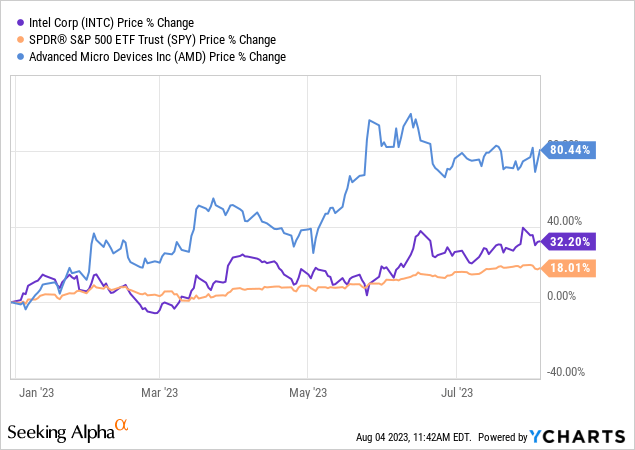

The stock is up 31% YTD, outperforming the S&P 500 (SP500) by 14%. We downgraded the stock in early June based on the expectation that the A.I. boom will hurt CPU sales as the bulk of the 2023 cloud capex prioritizes A.I. server spending over compute servers; noting, A.I. server ASP is more than 10-15x higher than that of a compute server and requires a lower CPU to GPU ratio. We continue to expect INTC’s data center business to see near-term headwinds due to the softer cloud spending on compute, and we don’t expect INTC to see meaningful A.I. revenue growth in the near-term.

The following graph outlines INTC’s performance against AMD and the S&P 500, YTD.

SeekingAlpha

Three positives priced in & a negative on the way

INTC reported revenue of $12.9B, down 15.7% Y/Y but up 10.5% sequentially, and Non-GAAP EPS of $0.13; the stock rose more than 7.5% in extended trading in response. This quarter, the company experienced QoQ rebound in its two core segments: Client Computing Group or CCG and Data Center & AI or DCAI, plus management reaffirmed to investors that it’s on track for its process roadmap of five nodes in four years. We now believe the following has been priced into the stock:

- PC client recovery post customers’ over-inventory destocking: CCG revenue declined 12% Y/Y but rebounded 18% sequentially to $6.8B this quarter, exceeding expectations as customers refilled inventory ahead of back-to-school seasonal demand. The rebound QoQ highlights that the PC slump is easing, but now the sequential growth trajectory must be maintained. We think the PC rebound has been factored in.

- Moderating share loss to AMD in the PC and Servers markets: Our expectations of INTC moderating share gain to AMD in PC and Server markets have been reflected in FY23 earnings so far, this quarter included. In 2Q23, AMD’s Client net revenue dropped 54% Y/Y to $2,152M but grew sequentially by 35%; meanwhile, INTC’s Client Computing Group revenue dropped 12% Y/Y to $6.78B and rebounded 18% sequentially. Additionally, in the data center market, we’re seeing AMD share gain against INTC stall. AMD reported data center sales rebounded 2% sequentially to $1.32B, down 11% Y/Y, while INTC reported DCAI sales up 8% sequentially and down 15% Y/Y to $4.04B.

- On-track execution of its process roadmap of 5 nodes in 4 years: Management emphasized on the earnings call that INTC “remain[s] on track to 5 nodes in 4 years and to regain transistor performance and power performance leadership by 2025.” We believe investor confidence in INTC’s process roadmap has also been priced into the stock.

Our sell-rating is driven by our belief that INTC’s data center business, accounting for roughly 31% of total sales, will be under pressure as cloud customers shift wallet-share focus to A.I. accelerators rather than compute. Management touched on this concern briefly on the Intel Corporation Q2 2023 Earnings Call Transcript, noting:

“server CPU inventory digestion persisting in the second half, additionally, impacted by the near-term wallet share focus on AI accelerators rather than general purpose compute in the cloud.”

Additionally, we continue to expect the A.I. boom will harm CPU sales during the back end of the year; management expects “Q3 server CPUs to modestly decline sequentially.” We see further downside risk for INTC’s data center business in 2024 and recommend investors explore favorable exit points out of the stock at current levels with the positives priced in.

Valuation

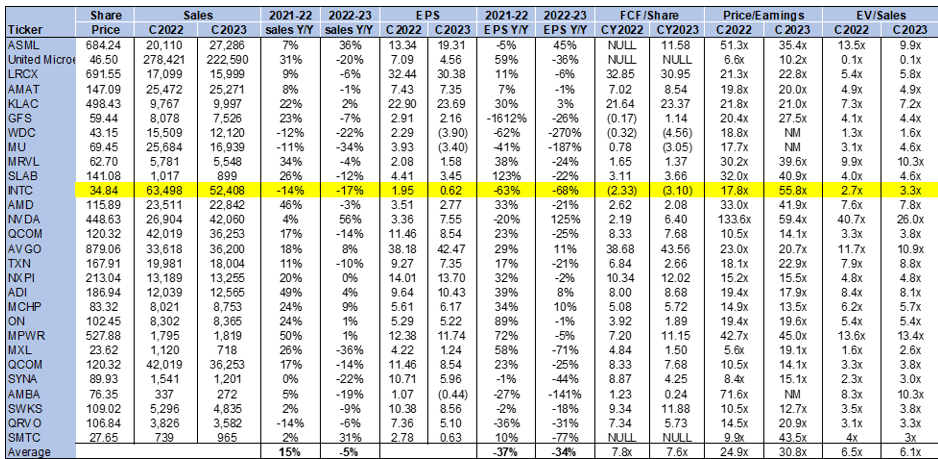

INTC is trading well above the peer group average on a P/E metric at 55.8x C2023 EPS $0.62 compared to the peer group average of 30.8x. The stock is trading at 3.3x EV/C2023 Sales versus the peer group average of 6.1x. We see downside for the stock in the near term and believe the stock has captured the expectation of recovery. Hence, we recommend investors explore favorable exit points out of the stock at current levels.

The following chart outlines INTC stock valuation against the peer group.

TSP

Word on Wall Street

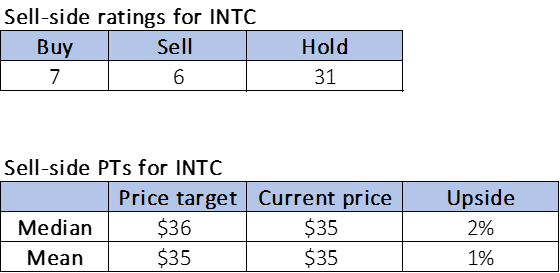

Wall Street is bearish on the stock, leaning toward a hold rating. Of the 44 analysts covering the stock, seven are buy-rated, six are sell-rated, and the remaining are hold-rated. The stock is currently priced at $35 per share. The median sell-side price target is $36, while the mean is $35 for a potential 1-2% upside.

The following charts outline INTC’s sell-side ratings and price-targets.

TSP

What to do with the stock

We continue to be sell-rated on Intel Corporation. We think the positives of the recovery have been priced into the stock. We see the downside ahead for INTC’s data center business in 2024 due to increased cloud customer focus on A.I. accelerators and recommend investors explore favorable entry points out of the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you’ll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.