Summary:

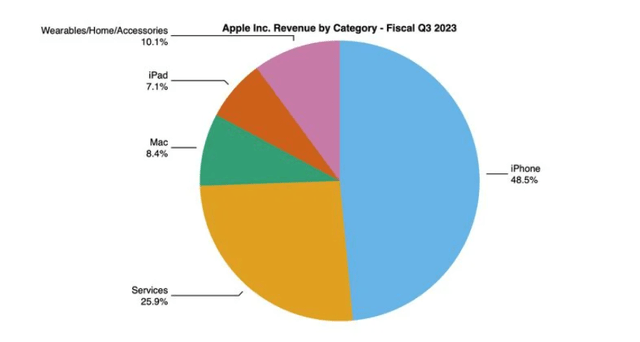

- Apple’s earnings report showed weakness in hardware but strength in services.

- Services segment saw record sales and beat estimates, growing 8% YoY.

- Despite hardware weakness, there are compelling reasons to buy Apple stock, including optimism for the coming iPhone 15 cycle.

- Apple’s quiet strategy on AI is likely contingent on the Services segment, which saw record strength and is now more than half of iPhone revenue.

P_Wei

Apple (NASDAQ:AAPL) reported highly anticipated earnings after the bell yesterday, Thursday, August 3rd. The report was a mixed bag that showed weakness in Hardware, offset by strength in services.

Any price weakness in this report is a significant buying opportunity for a simple reason. While Hardware (iPhone, iPad, Mac, etc..) drives Apple’s revenue, the positive story on Services has driven its multiple expansion over the past few years.

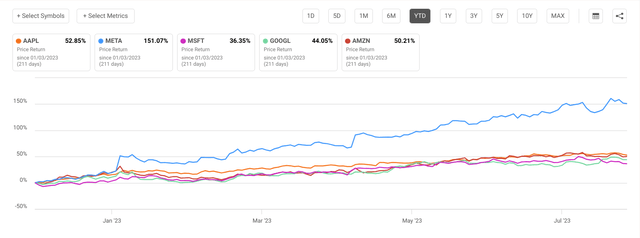

Apple has had quite an eventful year. It hit 52-week lows in January after protests rocked China and an unprecedented worker riot occurred at its massive iPhone production facility. This event caused the market cap to dip below $2 trillion. Read my previous coverage on Apple here.

After the company navigated the China issue with incredible poise, the firm’s value started recovering as AI enthusiasm gripped the market and Big Tech took off. Within only six months, the firm was over $3 trillion.

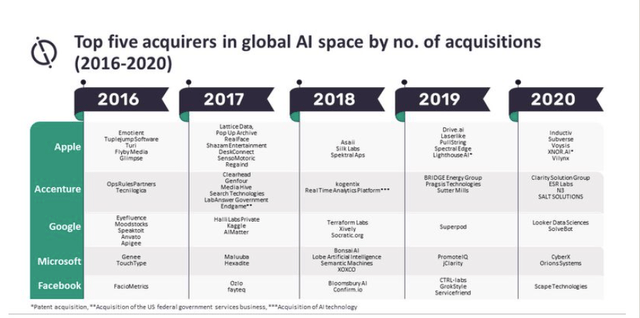

Remember that Apple traded below 20 times earnings for many of the 2010s, and the story of Services Growth was critical to the multiple breaking out of the ranges before COVID. The other thing about Apple’s Services segment is that its prodigious size and the reams of valuable data it generates will likely be the cornerstone of Cupertino’s crystallizing artificial intelligence strategy. For now, Mr. Cook and his C-Suite are happy walking lightly and carrying a big stick.

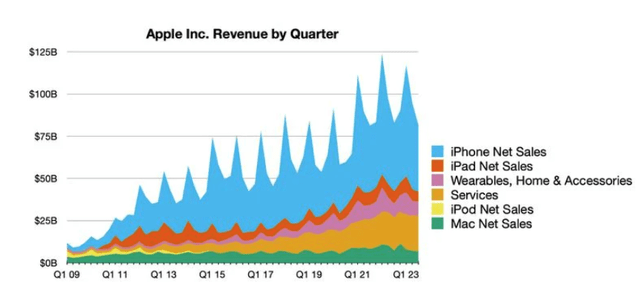

Services had a blockbuster quarter with record sales and over 50% iPhone revenue, an unimaginable feat years ago. Of course, this achievement was somewhat overshadowed by the third straight decline in sales and weakness in hardware segments.

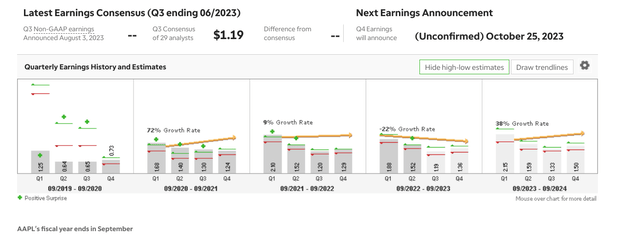

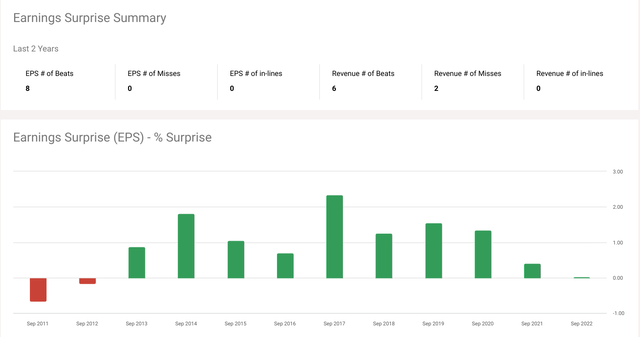

However, it’s important to remember the cyclicality of Apple’s hardware business. And as you can see above, we are likely in or very close to the trough in the cycle. There are many reasons to be optimistic about Apple’s moonshot projects, from Project Titan to the exciting One thing that was also evident in this quarter was a significant rise in R&D spending YoY.

Our recent Asia supply chain checks give us further incremental confidence that this upcoming iPhone 15 product cycle could be another trophy case moment for Cupertino kicking off this fall with expected units and ASPs [average selling prices] that could yet another easily surpass current Street expectations. -Wedush Securities Analyst Dan Ives

So, really, given this backdrop, any price weakness is a gift mainly since there’s much reason to be optimistic about the coming iPhone 15 cycle. Apple is a BUY, even though some seasonal weakness in August could be felt. I firmly believe any near-term price weakness is an opportunity to accumulate, given the positive expectations for fiscal 24.

As you can see, the weakness in Hardware is consistent with an expected earnings trough. Part of this relative weakness is still a COVID hangover and the associated curtailed demand after the unprecedented COVID binge global consumers had on all things Apple. However, if you look at the projected growth rate for the next fiscal year, you can see much to be excited about for shareholders with a medium to long-term horizon on Apple’s stock.

Apple’s Second Quarter Earnings Show Latent Strength

There is a moment that occurs in the wake of an earnings release when the immediate momentum of the price is unclear. The numbers get released, and the crowd responds moments later. There is a precious moment of uncertainty between those two events occurring.

Often the crowd’s response is wrong initially. Maybe a beat is walked back by tepid guidance or a miss reversed by positive guidance. An earnings pop or crash is often reversed when the market opens the next day or maybe a few days later.

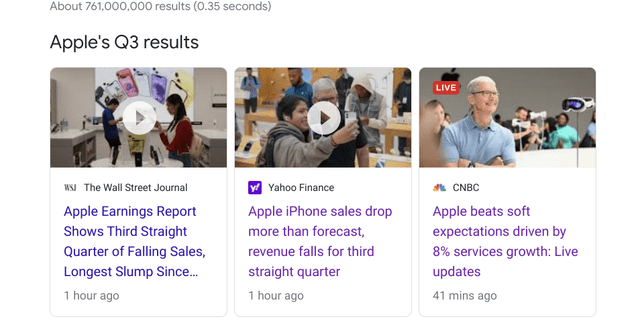

You can see what happened today; after the initial beat on services, the temperature on the report was favorable, as you can see in the CNBC article headline on the right, compared to the two headlines on the left, written 20 minutes later.

The firm’s services beat quickly became the most extended sales slump since 2016. Both items in the headlines are simultaneously correct. However, very few companies on Earth are as good at working the crowd as Apple. This firm knows how to capture the imagination of shareholders and consumers, and the fact that the firm is heavily invested should suggest more dazzling is ahead for shareholders.

Despite the muffled reaction and after-hours sell-off of around 2%, there were a lot of bright spots in the earnings report:

- The Services segment saw record sales and beat estimates, growing 8% YoY. Subscriptions have doubled in three years.

- Services growth is also accelerating; it grew significantly faster than the rate last quarter.

- The firm beat expectations on gross margins. Also, its hesitance to lay off workers may resonate among Silicon Valley’s top talent.

- Apple saw robust smartphone sales in emerging markets (including China, despite economic weakness)

- The firm continues to make measurable progress in diversifying its concentrated manufacturing footprint out of China.

- Tim Cook commented that the firm has been researching Generative AI for years.

Overall, the hardware weakness is somewhat concerning. However, the firm’s seasoned CFO thought this would improve somewhat in the next quarter, although revenue would likely be down. I’m not worried about the weakness in Hardware, and I think buying before the inevitable upswing is the right move. Building economic strength suggests it may be possible for Apple to outperform expectations next quarter.

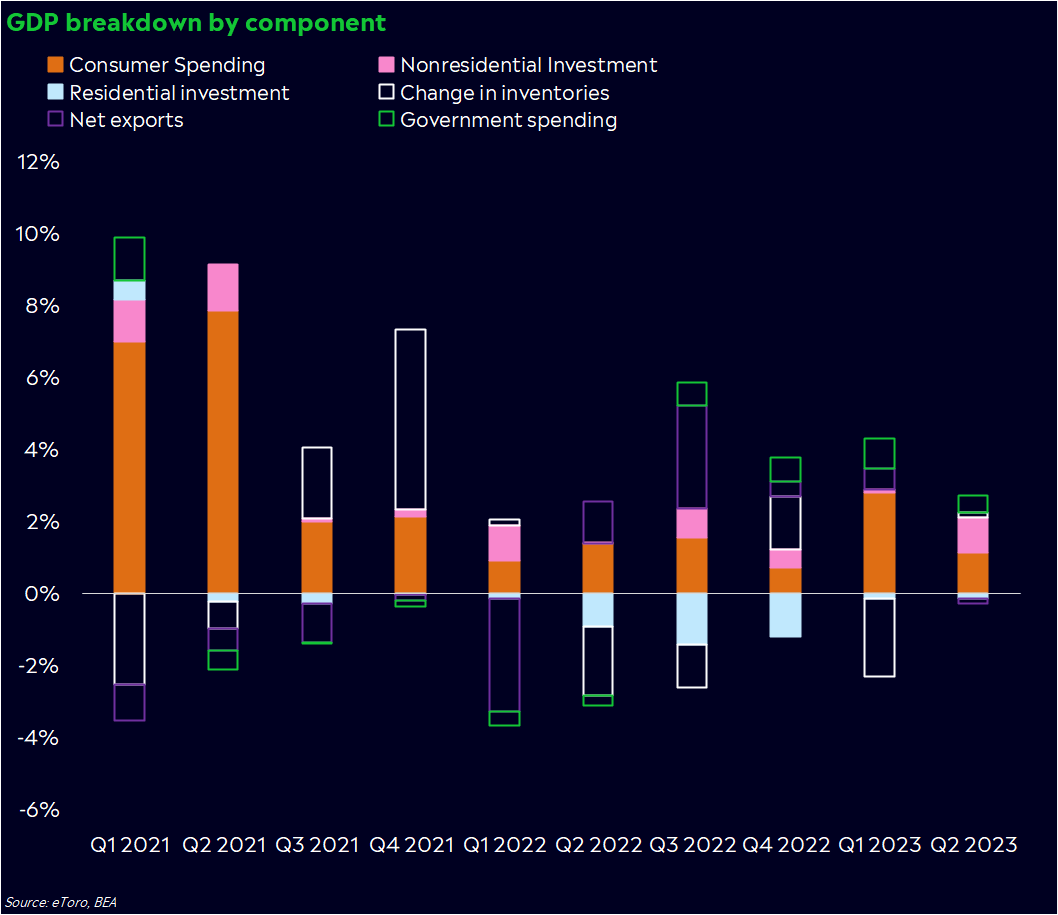

EToro

My money is on us seeing a $4 trillion Apple market cap within a year. Still, after such an incredible YTD run, many risks could curtail the advance of the world’s most extensive stock.

Risks and Where I Could Be Wrong

Apple is a massive company that will inevitably be tied to economic activity. There have been building expectations of a recession that has yet to manifest over the past year. Apple’s fortunes, particularly its most significant hardware segments, will be tied directly to economic activity, despite the burgeoning services segment reducing cyclicality.

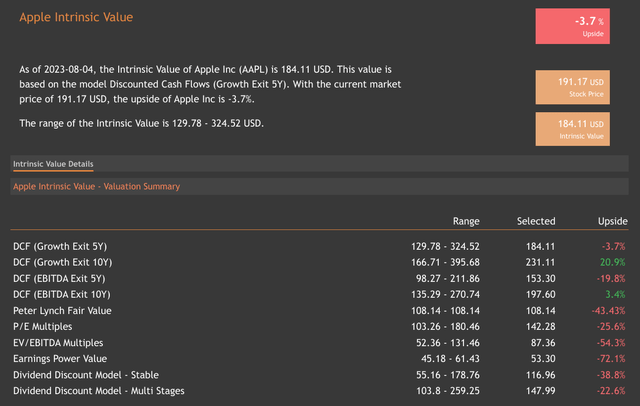

So, I would say that my BUY on Apple is mainly contingent on the US economy achieving a soft landing, which I view as increasingly likely. However, if the Bears are correct about an imminent recession or an unforeseen exogenous shock triggering one, it would be difficult for Apple to continue price gains given its stretched valuation. Any of the following risks could result in adverse severe price action for the world’s most extensive stock.

- Monetary policy lag and QT cause a rapid reversal of economic conditions.

- Debt-strapped companies start to buckle under the weight of higher rates, causing higher unemployment than predicted by the SEP.

- Inflation returns.

- Fed policy error.

- Escalation of geopolitical tensions.

Of all the risks to Apple, I’d say the primary one is valuation risk in a market stalked by potentially ominous catalysts. Still, for the world’s most extensive stock with the most valuable brand, being intrinsically undervalued with a few DCF methodologies shows the valuation picture isn’t as bad as recent highs might suggest.

The second most serious risk to Apple is its concentration in China. During rising geopolitical risks and increasingly intense Great Power Competition, Apple’s gem of low costs has become somewhat of an albatross. However, in the near term, China’s economic weakness suggests it will continue prioritizing one of the party’s most important economic relationships as it did when it bused in Army workers to work the iPhone factories. The firm has taken concrete action to mitigate this risk.

Conclusion

Apple is known for triumphing in the face of the unexpected and long odds. It was initially one of the quintessential American challenger brands and has utterly changed the face of commerce and the human experience. The firm’s current CEO, Tim Cook, is one of the world’s best operators. His Spartan operations management and dedication to shareholders should help you sleep soundly at night.

Any way you cut it, he has led Apple admirably through the pandemic, and it redefined the stock as not only one of the premier ways to access growth but also safety. While the recent earnings report was a mixed bag, if you understand the history of Apple’s product and R&D cycles, there are compelling reasons to buy the stock despite the fantastic performance this year.

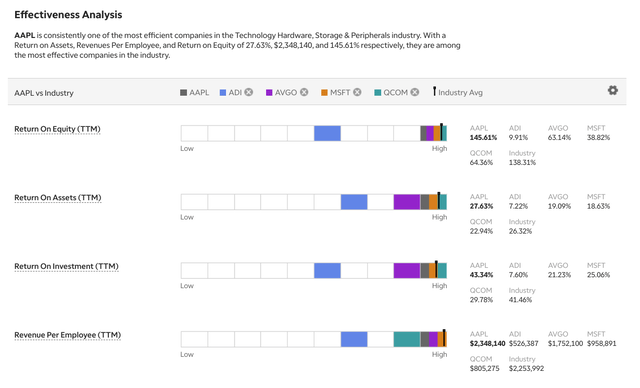

The firm has begun transitioning to a post-COVID reality where the considerable investments and continued financial effectiveness will continue rewarding long-term shareholders. Apple’s Services ecosystem was already a success story before the recent fascination with AI.

However, when you think of what the new technological revolution can do when paired with Apple’s existing strengths and products, it’s easy to imagine that the best is yet to come for Cupertino and the multiple generations of consumers the firm has dazzled with its perpetual thoughtfulness. Those who mistake Apple’s relative silence on AI for weakness haven’t been paying close enough attention.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.