Summary:

- GOOG continues to demonstrate its search engine moat and Cloud high growth cadence, while similarly taking advantage of the returning ad-spending.

- Thanks to the ongoing SAG-AFTRA/ WGA strikes, YouTube has also recorded accelerating TV advertising revenues, significantly aided by the sustained cord cutting and new unskippable 30-second ads.

- Taking a leaf out of Elon Musk’s playbook has paid of extremely well, with GOOG’s top-line expansion expected to accelerate ahead of expense growth through 2024.

- This is on top of the founders’ renewed enthusiasm over the GenerativeAI, thanks to the perceived threat from ChatGPT and the subsequent “Code Red” situation.

- Despite the brilliant recovery thus far, we believe GOOG’s rally still have legs, with a long-term price target of $192.84.

mgstudyo

The GOOG Investment Thesis Remains Robust, With Great Upside Potential

We previously covered Alphabet (NASDAQ:NASDAQ:GOOG) (NASDAQ:NASDAQ:GOOGL) in May 2023, assuring investors of its moat, since previous data indicated Google Search’s leading market share at 92.64% by June 2023, with competitors still lagging behind.

Thanks to the management’s project rationalization and cost optimization, the company might also achieve improved efficiencies moving forward, a move that we had similarly witnessed with META (META), a fellow advertising/ social media giant.

For now, GOOG’s prospects seem bright indeed, with FQ2’23 double beats at revenues of $74.6B (+6.9% QoQ/ +7.1% YoY) and GAAP EPS of $1.44 (+23% QoQ/ +19.1% YoY), returning to its profitable execution.

It appears that the cost optimizations have worked tremendously as well, due to the expanding gross margins of 57.2% (+1.1 points QoQ/ +0.4 YoY) and moderated operating expenses of $20.84B (-4.2% QoQ/ +3.5% YoY) by the latest quarter, compared to its FQ4’22 numbers of 53.5% and $22.54B, respectively.

With GOOG’s current operating margins of 29.3% (+4.3 points QoQ/ +1.4 YoY) already nearing its hyper-pandemic peak of 32.3% in FQ3’21, we are not surprised by the improvements in its FQ2’23 EPS profitability, aided by the reduced share count to 12.76B (-0.4% QoQ/ -3.5% YoY).

It appears that taking a leaf out of Elon Musk’s playbook has paid off well, as seen with Twitter’s drastic headcount reduction from over 7.5K employees to around 1.3K by early 2023. Sundar Pichai, the CEO of GOOG, has recently iterated the same approach, with the top-line expansion expected to accelerate ahead of expense growth through 2024:

To take advantage of the AI opportunities ahead, we have been sharpening our focus as a company, investing responsibly with great discipline and finding areas where we can operate more cost effectively… Overall, we are actively moving people to higher priority activities within the Company, and we continue to optimize our real estate footprint for current and future needs. (Seeking Alpha)

Sentiments around GOOG’s moat in the search engine segment have also improved, since its Google Search records expanding revenues to $42.62B (+5.6% QoQ/ +4.7% YoY) by the latest quarter.

This suggests that its leading market share is not easily challenged by Microsoft’s (MSFT) Bing and OpenAI’s ChatGPT after all, despite all of the generative AI hype since November 2022.

Combined with the recovering ad-spend market, as similarly highlighted by META’s FQ3’23 revenues guidance of $33.25B (+3.9% QoQ/ +19.9% YoY), we believe GOOG’s rally still have legs, despite the rally of +57.8% since the November 2022 bottom.

This development may be aided by the ongoing SAG-AFTRA/ WGA strikes, since TV ad buyers have recently flocked to YouTube ads, as reflected by the accelerating revenue growth to $7.66B (+14.4% QoQ/ +4.3% YoY) by the latest quarter.

With nearly 20% of connected TV spend diverted to GOOG amidst the uncertainty, we may see its advertising revenues further expand in FQ3’23, aided by the sustained cord cutting during the pandemic, with nearly “45% of YouTube viewing in the US already taking place on TV screens.”

This is on top of the introduction of NFL live sports from September 2023 onwards and the new unskippable 30-second ads for its TV app, in an attempt to take over the traditional TV’s advertisement segment.

In the meantime, the GOOG management has also highlighted intensified monetization effort through AI tools, potentially boosting its competitive edge/ moat over its advertising, search engine, and AI peers.

Much of this is naturally attributed to the founders’ renewed enthusiasm over the Generative AI, thanks to the perceived threat from ChatGPT and the subsequent “Code Red” situation, despite their supposed retirement since 2019.

Thanks to the team’s frenetic efforts, GOOG is already planning to launch their multimodal Large Language Models such as PaLM 2 and Gemini by H2’23, supposedly as a rival to OpenAI’s GTP-4 model.

Given its inhouse research/ AI capabilities, the cofounders’ increased involvement, and the merged capabilities of the combined Google DeepMind, we believe the company may be able to defend and expand its moat during this rapidly transforming period.

This is on top of the management projecting generative AI to further expand its Total Addressable Market as the macroeconomic outlook picks up henceforth.

FQ2’23 already saw Google Cloud reporting excellent growth in revenues to $8.03B (+7.7% QoQ/ +37.9% YoY), while sustaining its positive operating margin of 4.9% (+2.4 points QoQ/ +14.3 YoY), thanks to the expanding consumer base including “more than 70% of gen AI unicorns.”

With a tremendous 15x fold QoQ expansion in its generative AI customer base in the latest quarter and increased upsell/ cross-sell of its AI-powered products, we may see GOOG cloud segment’s top/ bottom line grow moving forward, aided by the relative nascency of the market.

So, Is GOOG Stock A Buy, Sell, or Hold?

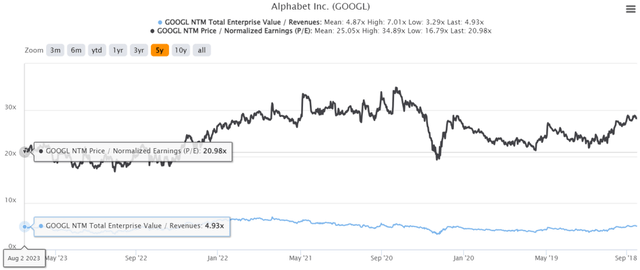

GOOG 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

For now, GOOG’s valuations remain moderate at NTM EV/ Revenues of 4.93x and NTM P/E of 20.98x, compared to its 3Y pre-pandemic mean of 4.63x and 25.11x, respectively. Based on the NTM valuations and the market analysts’ FY2025 adj EPS projection of $7.68, we still project a long-term price target of $161.12, if not $192.84 based on the pre-pandemic valuations.

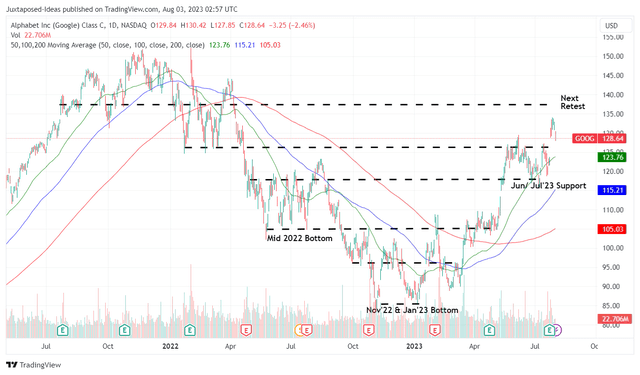

GOOG 2Y Stock Price

Trading View

Due to the excellent upside potential from current levels, we continue to rate the GOOG stock as a Buy. For now, this buy rating does not come with a specific entry point recommendation, since it depends on individual investor’s dollar cost averages.

With the bull market appearing to have taken hold and the Fed offering dovish commentary in the recent FOMC meeting, there is no harm in adding this compounder during any dips, for so long that the portfolio allocation remains prudent.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.