Summary:

- PepsiCo’s revenue mix is evolving positively, with potential for higher margins in the food segment.

- Good capital allocation and return to shareholders through dividends and share repurchases.

- Valuation is a challenge, but the company’s strong management and growth prospects make it a hold.

Editor’s note: Seeking Alpha is proud to welcome Miguel Daban as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

PepsiCo (NASDAQ:PEP) is one of the most well-known brands in the world. The business model and its management have proven to be outstanding throughout the past five decades and growth opportunities are still ahead. I consider PepsiCo a strong pillar for any long-term portfolio, but it trades at demanding prices.

Source: 2022 Consumer Analyst Group of New York Conference.

Business Model

PepsiCo is a conglomerate of brands that operates in the snack and non-alcoholic beverage markets. Founded in 1919, PepsiCo has proven to be resilient through the years and could be a solid anchor of any portfolio, as long as it is purchased at a fair price.

PepsiCo is the world’s biggest player in the snack food category, thanks to well-known brands such as Cheetos, Lay’s, or Doritos, and the second biggest player in non-alcoholic drinks, just behind Coca-Cola (slide 4).

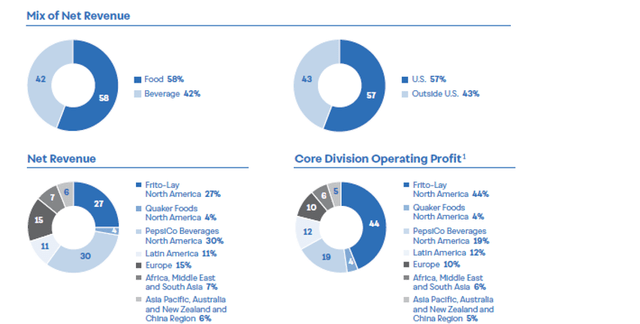

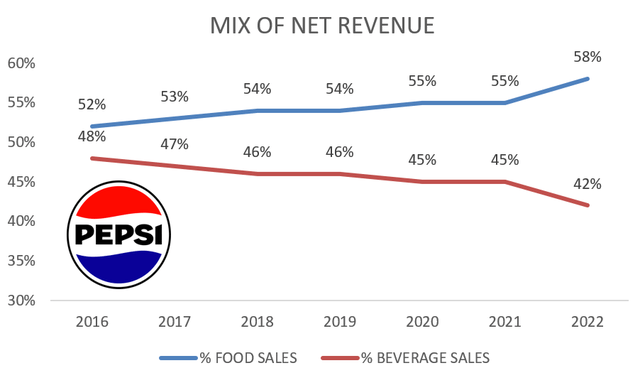

It is an easy-to-understand business. Its revenue is divided between food (58%) and beverages (42%). And its geographic share is divided between the US (57%) and outside the US (43%). PepsiCo also separates its business segments by type of product and geography.

What we can see in the image above is that the “Frito-Lay” segment has higher margins than “PepsiCo Beverages”. This could be explained by aluminum costs (higher than plastic) and the ease of transporting the snacks (less heavy and less prominent). The good point in the thesis is that food segment is gaining share in the revenue mix, so it should translate into higher margins over time. As management said in the annual conference call, the “Frito Lays” segment is its higher margin one, and it grew at an 18% annual growth rate in 2022. I do not expect this pace of growth for many years, but I am pretty sure that food sales will be even more important in the years to come.

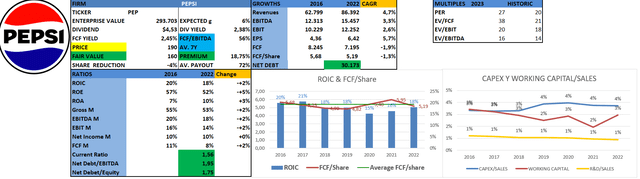

Source: Author’s calculation based on data from Seeking Alpha

Unlike Monster (MNST) (and like KO), PepsiCo is vertically integrated, which is why it owns the bottling plants, transportation fleet, manufacturing centers, etc. Despite being more capital-intensive, this also represents an important competitive advantage, plus you can compete with other emerging brands and take advantage. Later, I will talk about the partnership with functional beverage brand Celsius (CELH).

Thanks to its massive scale, PepsiCo has a wide range of suppliers and customers, with Walmart being the biggest client with 14% of the revenues. Although, thanks to its long-term partnership and the importance of PepsiCo products for a supermarket like Walmart, I do not see this as a risk.

Market Prospects

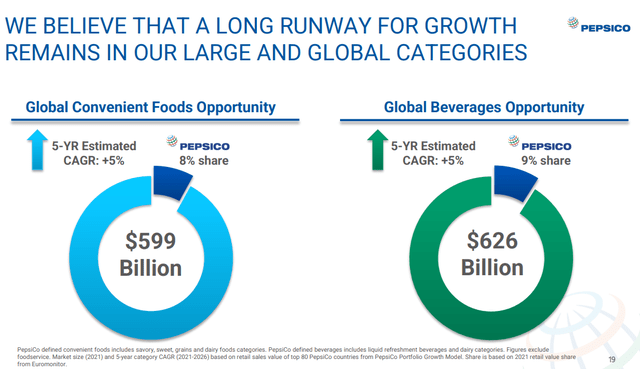

PepsiCo does not operate in a high-growth market. The average growth of the market, according to the company, will be between 4% and 5%. Its market share in both segments is not that significant (8%-9%), so thanks to its scale, R&D budget (over $20 billion in 2022), and top-tier brands, I think it will be able to capture market share and grow at a faster pace. And I am not taking into account the positive optionality that M&A could have.

Source: 2023 Consumer Analyst Group of New York Conference.

Competitive Advantages

Brand power.

Economies of scale increases the barriers of disruption, as PepsiCo is able to invest huge amount of capital in physical assets, marketing or R&D.

Skillful management and good capital allocation.

Capital Allocation

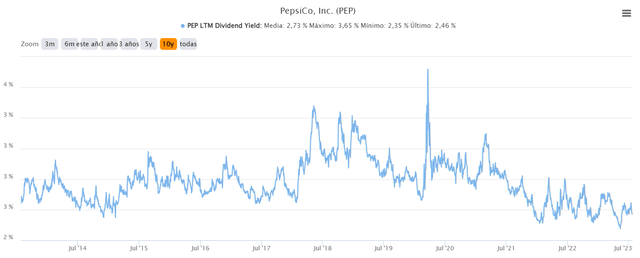

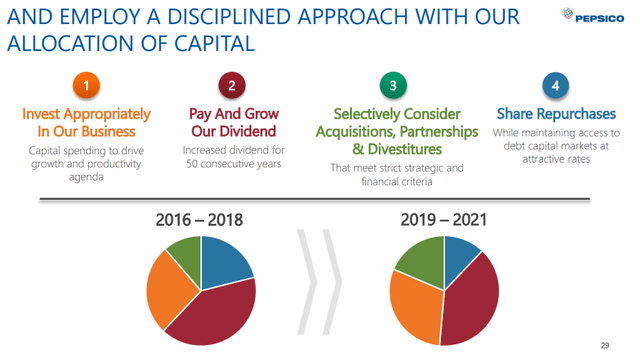

Pepsi’s capital allocation has been superb in order to alleviate a lack of growth. They are efficient in identifying when the stock is overpriced, so they should decrease share repurchases and increase dividends, as they have been doing since 2019. PepsiCo is a Dividend King, since it has been increasing the dividend for 51 consecutive years. It has an average payout of 71% and grants a yield of 2.38%, so it could be an attractive option for dividend enthusiasts.

Source: 2022 Consumer Analys Group of New York Conference.

Celsius Partnership, A Positive Catalyst

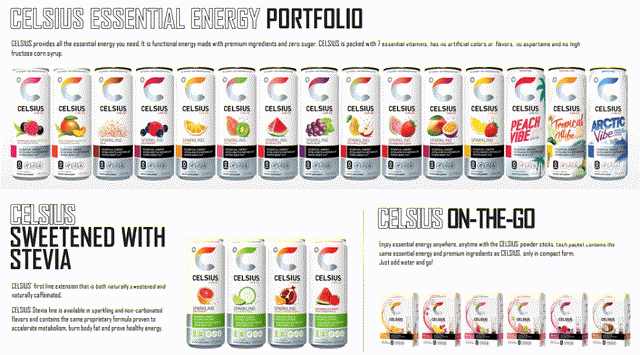

They are also quite good at making M&A, as they have proved with the 8.5% participation in the functional beverage company, Celsius in the year 2022. This way, PepsiCo becomes the largest shareholder of the company by buying Celsius preferred stock at a price of $75 (CELH now trades at $147) and will be in charge of its distribution. It is the same movement that Coca-Cola did with Monster back in 2012. This way, PepsiCo is gaining exposure in a fast growing market, with a company that is growing in sales at rates greater than 100% each semester and fixing the poor execution that they carried out with Rockstar.

Source: Celsius May 2022 Investor Presentation

Good Management With Great Alignment

Pepsi’s management team is one of the best points of the thesis, as they are achieving great results and creating new sources of growth in a pretty mature company.

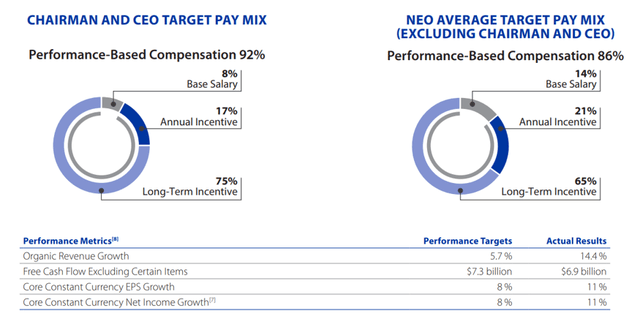

PepsiCo’s CEO is Ramón Laguarta, appointed in October 2018, although he has been in the company since 1996. His total annual compensation is $28.4 million, comprised of 8% base salary, 17% target salary annually, based on: organic sales growth, FCF, EPS, and Net Income. The remaining 75% of long-term incentives, are based on: EPS growth, ROIC and total return to shareholders. He directly owns 0.03% of the company’s shares, worth $72.0 million. The metric incentives are unbeatable, but the performance targets seem a bit low compared to the latest achievements of the company.

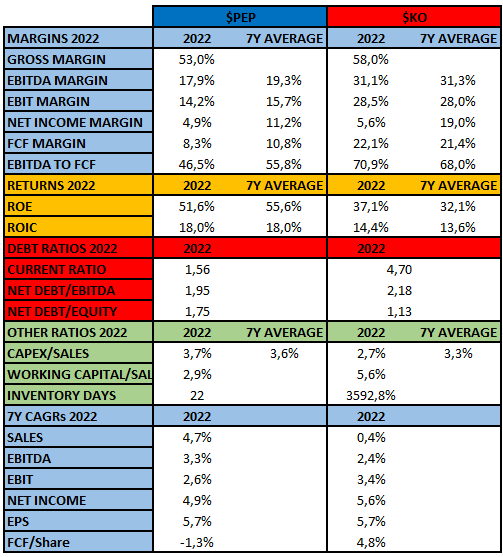

Competition

I have prepared the next table with data extracted from Tikr, so a comparison against Coca-Cola can be made at first sight. But if I have to come to some conclusions, they would be that PepsiCo is better in many ways. They have a more diversified product portfolio, higher growth prospects, less debt, a higher ROIC, and more reinvestment possibilities. For me, there is a clear winner.

Source: Author’s representation

Financials

In this image, all the financials of the company and their evolution over the past 7 years are displayed. All of the metrics showed poor performance; many of them even decreased in comparison to 2016. Some important metrics are CAPEX (4% of sales), but as we have mentioned before, a capital-intensive business increases barriers to entry. If PepsiCo would be like Monster (which does not own bottler facilities), I think its ROIC would be much more similar to the later one (around 25%).

Source: Author’s representation

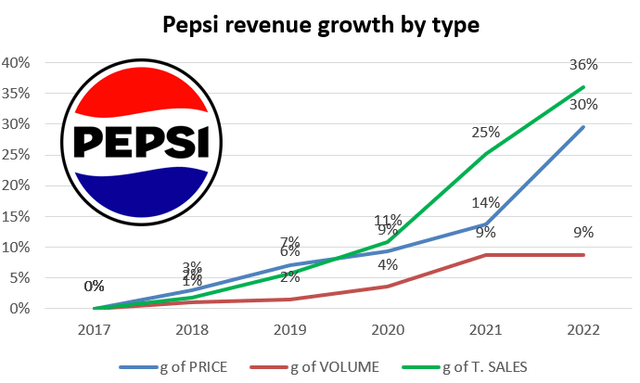

I would like to make a comment on the growth of the top line. Lately, the sales mix has been led by an increase in prices. In cumulative terms, during the last 5 years, the price has increased by 30% compared to the 9% that the volume has done. Highlight the incredible rise of 14% in 2022, with no growth in volume in the same year. From my point of view, with the size of the company and the stage at which it is already, double-digit growth in the top line is not required. After the aggressive price increase this year and seeing the volume decrease in Q1, I assume that they will return to the path of annual price increases between 2%-4% and see if the volume can continue the growth path of 2%-3%, as they had done until 2022. We have to take into account that the switching costs of these products are non-existent, so in the moment that brand power no longer justifies a higher price than the competition’s similar products, Pepsi’s value proposition will break and its terminal value will be affected. They have to be careful and return to a more sustainable growth model that impacts volume less and makes it last longer over time.

Source: Author’s calculation based on data from Seeking Alpha

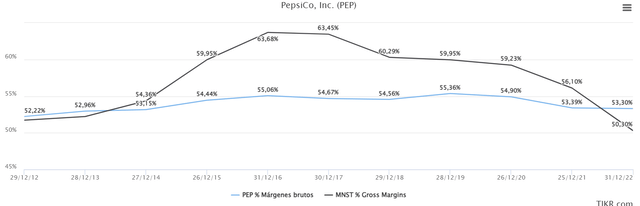

There is another factor to take into account when we invest in PepsiCo. PepsiCo’s product demand is not cyclical; what is more exposed to economic cycles are their costs. This is because these kinds of companies are affected by aluminum prices, fuel costs, and fleet costs. So what we have been seeing these past years is a contraction in their gross margins. Once the inflation is over, margins should come back to normal levels (if not more thanks to the price hikes), so there is another positive optionality.

Valuation

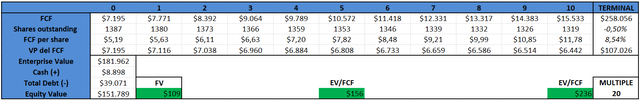

Valuation is probably the worst part of the thesis. As we have seen in the financial part, PepsiCo’s CAGRs in all of its growth metrics are not stellar, and despite this, the company has returned 84% (dividends included) to its shareholders in the past 5 years. Therefore, the main growth driver of the stock price has been multiple expansions. For me, a fair value for PepsiCo, due to its expected growth and the part of the business cycle in which the company is, would be 20x-22x times the PE multiple at most. According to my projected 2023 EPS of $7.93, this would give us a fair value of around $160-$170. But this assumptions are based on net income, which is not personally my favorite profitability metric. So, I will perform a DCF model.

If we take a look at a DCF model, taking into account the following assumptions: WACC 9.2%, TGR 3% and expected FCF growth of 8% (thanks to a 6% revenue growth, but benefited from a margin expansion thanks to the higher revenue share of the food segment) I get a fair value of $109 per share. The main difference between this method and the previous one is that in a DCF model, the debt is taken into account, so indebted firms, such as PepsiCo, suffer more.

Source: Author’s representation

One last valuation metric could be dividend yield. The past 10-year average has been 2.73%, and now is standing at around 2.5%, so may not be that much overvalued using this method. A dividend yield of 3% could be a good addition point.

Other Important Graphs

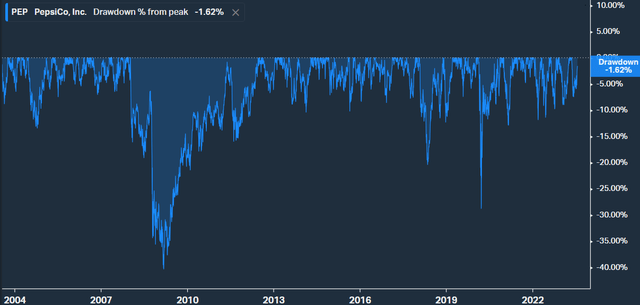

PepsiCo almost never has strong corrections. In the last 20 years, it has exceeded a 15% decline on three occasions. In the 2008 crisis, it fell by 40%, in the COVID, by 30%; and in general, once it goes beyond -10%, it does not usually last long. You could even make a DCA system where you buy every time, it falls below 10%. It’s a defensive anchor to keep in mind, but this makes it difficult for it to drop at more reasonable prices to get attractive IRRs.

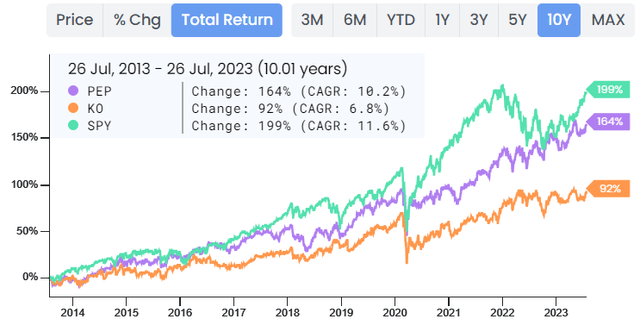

Its past 10 years’ total return has been superior to the S&P 500 and more than double the one of KO.

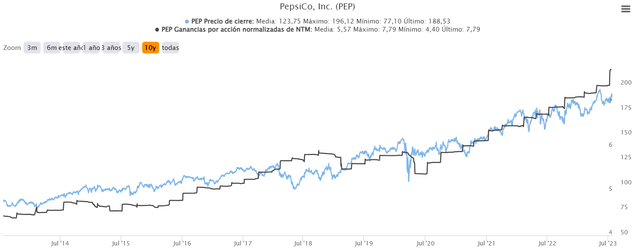

There is also a high correlation between EPS and share price, supporting the idea defended by Peter Seilern or Francois Rochon.

Risks

I considered PepsiCo a risk-free investment, but there will be some factors that we should track in order to identify any kind of problem that may put its terminal value at risk. Higher taxes on sugary drinks and snacks can erode a company’s margins.

Health departments in many countries are constantly reviewing the tax rates applied to sugary products. In order to discourage demand and collect more, these types of products are susceptible to higher taxes, which may harm the economic interests of PepsiCo and its investors.

As we have seen, one of PepsiCo’s capital allocation strategies is usually the acquisition of new businesses. In the event that they overpay or do not create the expected positive synergies, it will be a destruction of shareholder value and trust in management may be lost.

As we have seen, the pairing of volume and price growth has not grown at the same time. There is a risk that PepsiCo products end up being too expensive compared to the value they provide to the customer and their demand ends up negatively affected.

PepsiCo’s high exposure to raw material prices can cause its production costs to skyrocket, as we already saw in 2021. Without being a cyclical company on the demand side, it does have much more exposure on the cost side.

Conclusion

PepsiCo is a company that I personally like a lot (even though I do not hold a position yet). Its growth prospects look good, the management is competent and well aligned with shareholders, the ROIC is high, and the company still has many reinvestment opportunities. From my point of view, it is a compounding machine with the peculiarity of being a dividend king as well.

What prevents me from owning it is its valuation. I am personally looking for a price around $150, so I would rate PepsiCo as a hold and not a sell due to its small drawdowns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.