Summary:

- Apple reported better-than-expected third-quarter results, with growth acceleration in the Americas, Europe, and China, and strong performance in Services.

- Total revenues declined by 1.4%, as 8% growth in Services was offset by a 4.4% decline in Products. FX-neutral revenues were slightly positive.

- Gross margins came in at 44.5%, another all-time record, and are expected to grow further in the fourth quarter.

- While the market is focused on short-term cyclicality in product sales, I view Apple’s ecosystem as stronger than ever.

- I expect Apple will significantly exceed expectations and see growth materially improve in FY24. Thus, I reiterate a Buy rating with a price target of $203 per share.

Yongyuan Dai/iStock Unreleased via Getty Images

Apple Inc. (NASDAQ:AAPL) reported third-quarter results that exceeded expectations. Revenues totaled $81.8 billion, compared to an expected $81.7 billion, and EPS came in at $1.26, compared to the expected $1.19, as gross margins reached another all-time high of 44.5%. Specifically, Services revenues crushed expectations, coming in at $21.2 billion vs. the $20.7 billion estimates.

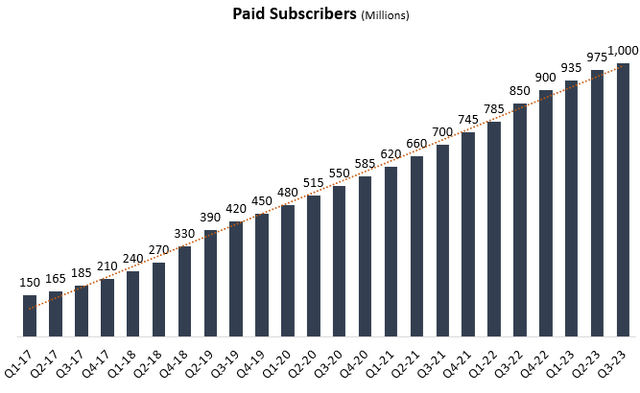

As I expected, Apple surpassed the 1 billion paid subscribers threshold, and the company’s focus on emerging markets continues to bear fruit, with notable June quarter records in China and India.

While investors are focused on cyclical product sales, it’s becoming more and more clear that Apple’s Services segment has the potential to become one of the largest software-based businesses in the world, as it is set to surpass $100B in annual sales in FY24.

I expect an extraordinary year for Apple’s products in FY24 and estimate Services will continue to impress. Thus, I reiterate a Buy rating and raise my price target to $203 per share.

Background

In April, I published Apple: The Ecosystem And The Largest Subscription Company In The World and began my coverage of the company with a Buy rating. I described my investment thesis in-depth and explained Apple’s ecosystem strategy, operations, revenue streams, and business model, as well as the company’s major risks, main growth prospects, and long shots.

In May, I wrote a follow-up after Apple’s second-quarter results, analyzing its 1 Billion Paying Subscribers And Emerging Markets Focus. I focused on the value of the Services segment and Apple’s major growth drivers, as well as reiterated a Buy rating.

After third-quarter results that exceeded expectations but sent the stock into a ~5.0% selloff, it’s the appropriate time to revisit the investment thesis and analyze how the fundamental drivers of Apple’s ecosystem fared in the last quarter. Then, we’ll discuss our expectations for FY24, and update our financial model and projections accordingly.

Third Quarter Financial Review

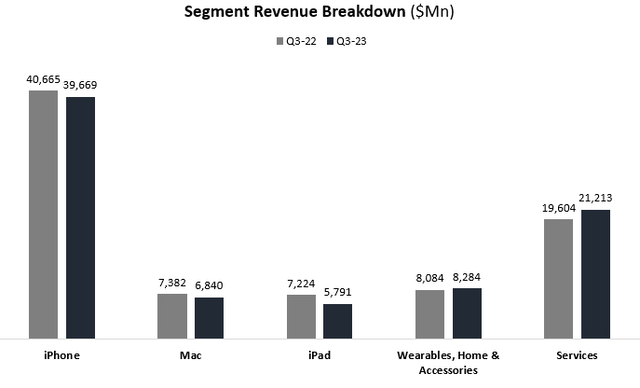

Apple reported consolidated revenues of $81.8 billion, a 1.4% decline Y/Y and an insignificant beat over consensus estimates. iPhone revenues amounted to $39.7 billion, down 2.5% Y/Y, and $240 million below expectations. Mac revenues totaled $6.8 billion, down 7.3% Y/Y, and $220 million ahead of expectations. iPad sales were $5.8 billion, down 19.8% Y/Y, and $620 million below estimates. Sales of Wearables, Home & Accessories were $8.3 billion, up 2.5% Y/Y, and $111 million below expectations. Lastly, Services revenue was $21.2 billion, up 8% Y/Y, and $445 million above expectations.

Revenues were affected by a 4% F/X headwind. On a constant currency basis, iPhone sales grew year-over-year, and Services were up double-digits.

Created by the author based on data from Apple financial reports.

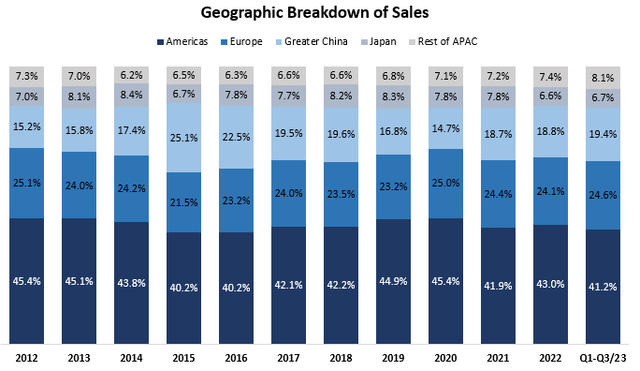

Geographically, growth accelerated in the Americas, Europe, and Greater China, whereas it decelerated in the Rest of APAC and Japan. Management noted June Quarter revenue records in the Europe and Greater China segments, as well as in specific countries including India, Indonesia, Mexico, Poland, Saudi Arabia, Turkey, UAE, France, Netherlands, Austria, and the Philippines.

Created and calculated by the author based on data from Apple financial reports.

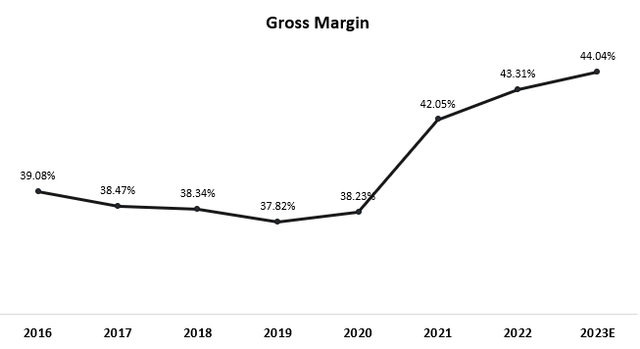

In terms of profitability, after it set its previous record in the last quarter with 44.3%, Apple achieved a new gross margin record of 44.5%, driven by cost savings and a favorable mix toward Services. Apple continues to operate an industry-leading supply chain, which allowed the company to purchase materials and inventories at opportune costs. The combination of these cost savings and Services becoming more than 25% of total sales (an all-time high as well), resulted in the new record, and management expects a similar number in the fourth quarter.

Created and calculated by the author based on data from Apple financial reports; Estimated gross margin for 2023 is based on management’s guidance.

Looking at capital allocation and balance sheet, Apple finished the quarter at a net cash position of $57 billion, after it returned $24 billion to shareholders through dividends and buybacks. The company is maintaining its goal to achieve cash neutrality over time, which means a whole lot of buybacks in the foreseeable future, as the company generates over $25 billion in free cash flow every quarter, on top of the current $57 billion cushion.

Revisiting The Investment Thesis

In my previous article, I wrote the following about Apple’s ecosystem business model:

Apple’s ecosystem business model is quite simple. Usually, a customer first engages with Apple through an iPhone. Then, as every other piece of hardware the company offers is seamlessly integrated with the iPhone, the customer will most likely elect an Apple product rather than a competitor’s substitute offering, despite Apple’s products being typically more expensive. The customer will elect to do so not only because of the individual quality of the product by itself but also due to the value of integration between all of the customer’s Apple products.

In addition to the hardware, the customer will most likely choose to use Apple’s services, as they are the most convenient option and sometimes the only option when using Apple’s hardware.

Ignore Short-Term Noise

In my view, the strength of the ecosystem is the one and only question investors should focus on.

While there’s a lot of noise about lower iPhone sales, declining iPad volume, and other weak points in the report, it’s important to differentiate between short-term triggers and Apple’s long-term intrinsic value drivers. Short-term swings, especially in a company like Apple, could be a result of multiple reasons.

First, its relatively high P/E ratio is always an easy target for bears. Second, the nature of Apple’s core product business is cyclical, and at its current size, cyclical swings are unavoidable.

High-quality consumer electronics are products with long life spans. For instance, I’ve been using the same AirPods for over three years, the same Apple Watch for two years, and I have my iPhone 11 for nearly four years now. All of these products are essential to me, I use them every single day, and I feel no need to upgrade them.

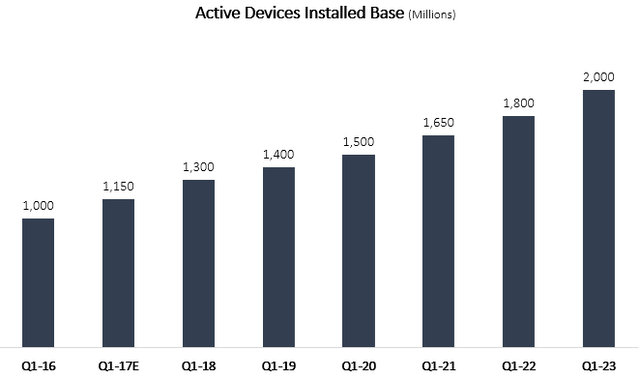

And like me, Apple’s installed base which spans over 2 billion devices is seeing longer and longer upgrade cycles. Typically, when Apple comes out with a huge update or if the economy is booming, people will be more inclined to upgrade quicker, and that happens every two or three years. However, at its current size of over $300B in annual revenues, we cannot expect linear growth in Apple’s Product business, and we shouldn’t.

Lastly, Apple is such a popular company, it is commonly used by people in the financial industry to make a name for themselves. Journalists will publish any small rumor about a minor problem in some manufacturing facility, and analysts will always try to give their bold bear take. Investors are always prone to a panic sell in response to some kind of a bad headline, and with Apple, there are plenty of those on a daily basis.

Focus On Intrinsic Value Drivers

I believe the strength of Apple’s ecosystem can be measured through two main metrics – Active Devices Installed Base, and Paid Subscribers.

Created by the author based on management remarks in Apple’s earning calls 2016-2023.

Active Devices Installed Base reached an all-time high in the third quarter, but we didn’t get a specific number update from management (they typically provide it in the first quarter of Apple’s fiscal year).

Our installed base reached an all-time high across all geographic segments, driven by a June quarter record for iPhone switchers and high new-to rates in Mac, iPad and Watch, coupled with very high levels of customer satisfaction and loyalty.

– Luca Maestri, CFO, Apple’s Q3-23 Earnings Call

The installed base of over 2 billion devices continues to grow sequentially, with nearly half of Mac buyers being new, over half of iPad buyers being new, and about 2/3 of Watch buyers being new. In addition, the company continues to gain share with iPhone, with a record number of switchers, and market share gains in several emerging markets, including India and China.

Created by the author based on management remarks in Apple’s earning calls 2016-2023

Paid Subscribers gained an additional 25 million during the quarter and reached over 1 billion, up 17.6% Y/Y. Subscriber growth reflects the strength of Apple’s Services business, which should remain resilient and see high-single digits growth for the foreseeable future.

Just a few days ago, the company announced it reached over $10 billion in deposits to Apple Card’s Savings accounts, and it set an all-time revenue record across almost every service category.

We set records really across the board. We had all-time records in cloud, in video, in AppleCare, in payments and June quarter records in App Store, advertising and Music. So we saw improvement in all our Services categories. We think the situation will continue to improve as we go through September. And that’s very positive because not only good for the financial results, but obviously, it shows a high level of engagement of our customers in the ecosystem, which is very important for us. And it’s really the sum of all the things that I mentioned in my prepared remarks. It goes from the fact that our installed base continues to grow, so we’ve got a larger pool of customers, to the fact that our customers are more engaged as we have more transacting accounts and paid accounts on the ecosystem. And the subscriptions business is very healthy with growth of 150 million paid subscriptions just in the last 12 months. It’s almost double to what we had 3 years ago.

– Luca Maestri, CFO, Apple’s Q3-23 Earnings Call

There’s a quote from Apple’s CFO reaffirming our investment thesis in a few sentences. Services are growing sequentially and shall continue to do so. The performance represents high engagement in the ecosystem, which isn’t slowing down.

So yes, product sales could be cyclical, but Apple customers are not leaving the ecosystem any time soon. While they might skip a certain version of the iPhone, they will continue to pay for services and they probably won’t switch to a Samsung Galaxy (OTCPK:SSNLF), and that’s what will really determine value in the long term.

The Setup For An Extraordinary FY24

After the post-earnings selloff, Apple is trading at a ~27x multiple over NTM earnings, adjusted for net cash. Based on current consensus estimates, analysts expect FY24 revenue growth of 6.4%, and EPS growth of 8.5%.

In my opinion, the upside in FY24 will come from a combination of significantly exceeding expectations and a multiple expansion closer to the 29-30 range.

Beginning with exceeding expectations, I expect Apple will reach sales of over $410 billion in FY24, as Services surpass $100 billion in annual sales, and Products see a material recovery. Some of the leaked innovations of the new iPhone 15 seem to me like the kind of upgrades that draw increased demand, and with a convenient comparison to FY23, I expect growth acceleration in iPhone. Furthermore, the trough in Macs and iPads is also probably behind us, and I expect positive revenue growth in both of those categories in FY24.

In terms of profitability, current estimates put Apple’s profit margin at 25.3%, which is in line with FY22 and FY23. In my view, margins in FY24 will come closer to 26.0% (specifically, I expect 25.7%), as gross margins reach new highs, F/X headwinds ease, and the company enjoys operational leverage from higher product sales.

Overall, I believe that Apple’s results in FY24 aren’t priced in. With much easier comparisons and continued strength in the ecosystem, I expect significant growth acceleration, and we know that historically the best time to buy Apple is when investors are panicking over its future growth.

Updated Valuation

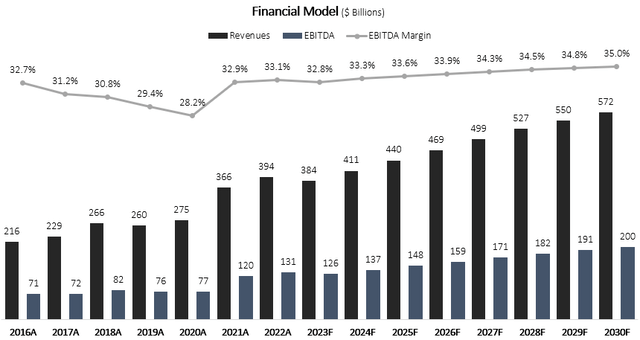

I used a discounted cash flow methodology to evaluate Apple’s fair value. I still forecast Apple will grow revenues at a 5.9% CAGR between 2023-2030, based on steady growth in the company’s core operations, and accelerated growth in emerging markets and Services.

I reiterated my long-term EBITDA margins projection for an incremental increase to 35.0% in 2030, as the Services portion of total revenues continues to grow. I find this projection conservative, as the company achieved a 33.1% EBITDA margin in 2022, a year in which it had a 43.3% gross margin, which is 1.7% below management’s guidance for 2023. Thus, I believe the company is already capable of a margin that is around 34.8%, without the effect of operational leverage and better mix.

Overall, my assumptions result in EBITDA growth in excess of revenue growth, reflecting operational leverage and a better mix.

Created and calculated by the author based on data from Apple’s financial reports and the author’s projections

Taking a WACC of 7.2%, I estimate Apple’s fair value at $203 per share, which represents 11.8% upside compared to the market price at the time of writing.

Conclusion

Apple’s unstoppable ecosystem continued to gain strength in Q3-23, with over 2 billion active devices, above 1 billion active iPhones, and 1 billion paid subscribers. However, the stock experienced a sharp selloff as investors focus on the company’s short-term struggles, which are demonstrated by the revenue decline.

Historically, the right time to buy Apple was when investors were panicking about its future growth potential or lack thereof. While the stock is still one of the best performers in the market in 2023 with over 45% returns, I believe the recent selloff provides a buying opportunity.

I expect an extraordinary FY24 for Apple, with easier comparisons and lower expectations. Thus, I reiterate a Buy rating and raise my price target to $203 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.