Summary:

- Apple stock’s significant overvaluation returned to haunt its recent late buyers, sending AAPL back toward its early June lows.

- I had already cautioned AAPL holders in early July that a “violent” selloff must be anticipated, as its overvaluation is not justified, even as it reached new highs in July.

- CEO Tim Cook and his team didn’t give the highly optimistic outlook the market was likely looking for, sending weak holders fleeing as early dip buyers took profit.

- I explain why AAPL stock remains a Sell at the current levels. However, there’s no need to cut full exposure. Taking some profits and rebalancing is still an appropriate strategy.

- I discuss the critical levels for investors to watch. Read on to assess whether you think my Sell rating is appropriate.

Scott Olson

Apple Inc. (NASDAQ:AAPL) investors who recently added to its late July and August highs got what they deserved as AAPL’s expensive valuation returned to haunt them. Accordingly, AAPL fell to lows last seen in early June, dropping more than 8% from its mid-July highs.

Despite that, AAPL’s valuation is still perched at dangerously high levels, as sellers cut exposure against over-optimistic late buyers over the past few weeks.

Last week’s steep decline came against the run of play, as AAPL underperformed the S&P 500 (SPX) (SPY). However, AAPL remains well above its early January 2023 bottom, suggesting early dip buyers have little to worry about. While CEO Tim Cook and his team didn’t disappoint, investors were likely expecting more from Apple’s September 2023 (fiscal fourth quarter) guidance.

After all, Apple entered into its FQ3 earnings release last week on the back of significant optimism, suggesting investors weren’t prepared for anything less than a highly positive outlook. I also cautioned AAPL holders in my early July update as I downgraded AAPL to a Sell/Bearish/Market Underperform rating. I reminded investors that “historically, AAPL struggled when its forward EBITDA multiples reached the two standard deviation zone over its 10Y average.” I added that the last time AAPL reached those levels in late 2021, we “saw a violent rotation that saw AAPL decline nearly 30% toward its June 2022 lows.”

Therefore, I believe such a prospect likely dominated sentiments last week, as weak late buyers were probably spooked into the selloff. Moreover, based on my price action analysis, AAPL has not experienced such a steep decline since late last year. As such, the “calm and collected” rally from AAPL’s January 2023 bottom could have surprised these late buyers, sending them scurrying for cover and “fleeing to the hills.”

Notwithstanding last week’s selloff, I must highlight that I don’t expect AAPL to fall back toward its January 2023 levels. Therefore, my assessment suggests that AAPL should maintain its long-term uptrend bias. Despite that, I expect further downside volatility if AAPL fails to regain control of its $185 resistance level, which could encourage more dip buyers to take profit, intensifying its selling pressure.

But why not fall back toward January lows? Here’s why. The market has likely anticipated a solid September 2023 quarter (recall that the market is forward-looking). However, the over-optimism was misplaced as CFO Luca Maestri guided to an FQ4 (September quarter), anticipating “year-over-year revenue performance to be similar to the June quarter.” Notably, Apple’s macro outlook of “assuming the macroeconomic outlook remains stable” seems more positive than its May FQ2’23 earnings call. Maestri was more cautious back then, as he annotated his guidance was predicated on Apple’s assumption that “the macroeconomic outlook does not worsen.”

As such, I assessed that Apple seems cautiously optimistic about more constructive macro prospects that should undergird more robust consumer spending from its September quarter onward. While Apple anticipates Mac and iPad to suffer from tough comps, it expects “iPhone and Services year-over-year performance to accelerate from the June quarter.”

Cook also added commentary that he’s confident that the US telcos would continue to offer “promotions to encourage phone upgrades,” with the promotional campaigns expected to “continue into the December timeframe, which is the peak quarter for iPhone sales.” As such, I believe Apple is optimistic about its relatively weak US market performance bottoming out in the June quarter as Apple ramps up the pace for the launch of its iPhone 15 series.

With that in mind, AAPL buyers must still be cautious about buying its recent pullback at the current levels. Yes, I know Apple’s Services segment has continued to post remarkably resilient growth despite the hardware headwinds.

As such, I expect Apple’s near- and medium-term growth drivers to emanate from its ability to improve its Services mix while building up its long-term presence in India. It’s hard to go against Apple’s remarkable execution in the long run. However, the steep selloff last week suggests that AAPL isn’t a buy at any price, and it makes sense to leverage over-optimistic late buyers to cut exposure and rebalance the portfolio.

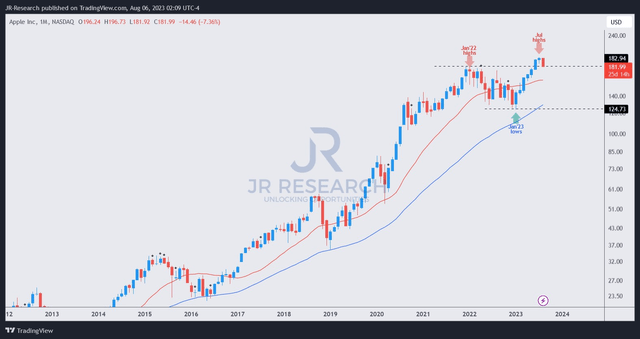

AAPL price chart (weekly) (TradingView)

AAPL surged past its previous January 2022 highs in June 2023, posting its all-time highs in July. However, this week’s selloff has taken AAPL back toward its June levels, with most of the gains in June lost for now.

However, it’s important to note that the above chart is AAPL’s long-term chart, with price action validation only possible by the end of August 2023. In other words, we still have some time to go as AAPL buyers attempt to hold on to the $185 breakout level.

Failing which, I assess the next critical support zone at the $170 level, closer to the $175 per share that AAPL averaged for its buyback program in Q2.

For now, I believe my Sell thesis remains appropriate, even though the appeal is less attractive than in late July. I’m not asking AAPL holders to sell everything; it’s not necessary. However, cutting some overvalued exposure and rebalancing is sound portfolio discipline. As such, it makes sense to consider doing so at the current levels, as selling pressure could intensify if AAPL fails to defend the $185 breakout zone.

Rating: Maintain Sell. Please note that a Sell rating is equivalent to a Bearish or Market Underperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!